Signal From Noise

Research

Signal From Noise

Research

Key Takeaways

- TSLA has been on our Granny Shots list for a while, we are still bullish on the firm and believe that it is going to define the next generation of automobiles. Having a long-term horizon on the name will mitigate some of the stock’s idiosyncratic risks.

- The engineering-first management style of Elon Musk continues to build advantages which seem increasingly insurmountable. Tesla already has competitive margins that are expanding which will likely only continue building as battery costs come down.

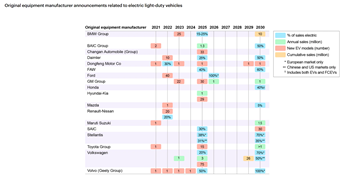

- While we continue to like some legacy automakers and while we believe they have credible expansions plans into EV, they are all following TSLA’s lead. TSLA is a technology company.

- The continued back-breaking pace of innovation and the ability of TSLA to continue its rapid growth in the face of unpredented supply chain disolations makes us think this company’s competitive advantage has really just begun.

- The company continues to make progress in auto production and it continues to boost market-share across geographies. The multiple of the stock implies huge opportunities in batteries, AI and software that differentiate this innovative leader from legacy auto firms.

“Build a sports car, use that money to build an affordable car, use that money to build an even more affordable car. While doing the above, also provide zero emission electric power generation options.” – Elon Musk, From the Secret Tesla Motors Master Plan Just Between You and Me

The business of manufacturing and selling cars is not for the faint of heart. It is almost as difficult as building a commercial space company from scratch. In the early days of the auto industry after Henry Ford revolutionized the sleepy 19th century American economy, there were hundreds of new auto companies hoping to make their mark.

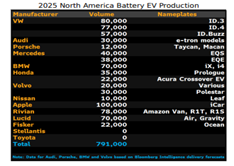

This early market environment slowly gave way to the consolidation of the industry into the Big 3 of Chrysler, General Motors and Ford. Of all the American auto companies that have produced and sold cars, the only two to have never gone bankrupt are Ford and Tesla. The projected levels of production for all the new EV competitors pale in comparison to what Tesla can produce today.

There are a lot of newfangled and flashy electric vehicle companies making headlines for this reason or that reason, even if they have to be rolled down a hill. Sometimes, companies with little more than a concept have eclipsed the market-caps of legacy behemoths that have sprawling manufacturing networks and turn out hundreds of thousands of finished cars a year. Similarly, existing auto manufacturers are tripping over each other to introduce the boldest BEV plans.

So, should you choose a company with an established track record of juggling the simultaneous intense pressures of manufacturing complicated machines and building/maintaining brand value, or a new fangled start-up with all the ideas, but little having been brought to fruition? How about both? Tesla is the best name for gaining exposure to EV. It’s unclear who the ultimate winners in the developing competition to dominate EV and the future of mobility will be, but it’s hard to imagine a world where Tesla isn’t amongst them.

Why Search For The New Tesla When You Can Just Own a Dominant Tesla?

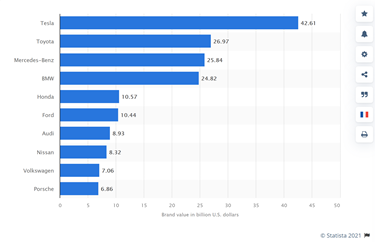

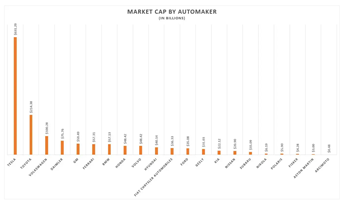

Everybody is looking for the next Tesla. The company’s strides over the last decade make it a perfect middle ground despite a daunting valuation. The company is producing an enormous amount of desirable vehicles, ruthlessly reducing manufacturing costs and maintaining one of the more valuable brands on the planet. Selling Tesla in favor of a less-established name makes little sense to us when what we believe is a long-reign as the world’s most valuable automaker has likely just begun, not least of which because this company is much more than just an automaker, unlike most peers.

We believe their strides in battery technology and the software-centric car experience will define the future of mobility more than any other company in existence today. Growth on existing business is more real than for companies who’ve never produced and sold a vehicle. We don’t see serious competition until Apple’s proposed vehicle comes online in 3 or 4 years. We would venture to say there’s lots of market-share gains for TSLA between now and then. Having the most valuable auto brand in the world is nothing to snuff at and something that this company will easily be able to capitalize on.

We’ll give you a piece of advice, just buy Tesla for exposure to the burgeoning EV industry. Their problems and headline risk will be trumped by their state-of-the-art manufacturing capacity, engineering-forward culture and their long-term strategy which has been remarkably consistent (see introductory quote from 2006).

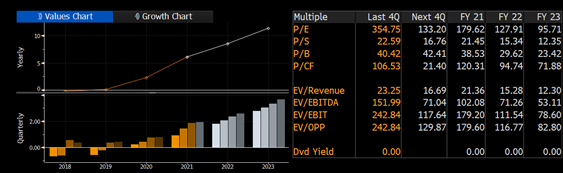

Tesla is more than an automobile manufacturer, which is clear when looking at relative valuation. Listen to Professor Price, don’t lecture him! The speculative nature of the stock that lured many opportunistic bears into bankruptcy is long-gone. When it comes to building and selling cars, a working assembly line is a lot more important than how your designs test with consumers. This company produces hundreds of thousands of cars a year and will likely also soon have the world’s best-selling model. The Model 3 has already taken that mantle in Europe.

In a 2012 Presidential debate, then candidate Mitt Romney called Tesla a perfect example of the government picking “losers” when it allocates public funds. Mr. Romney probably got off way cheaper than most of the folks who have doubted Tesla and put their money where their mouth was!

Today, the idea that Tesla is a ‘loser’ company is laughable. However, there is still a lot of alpha in the stock because many blocks of institutional investors may view it with a wary eye. In our estimation, the age of its dominance has just begun and there’s plenty of upside left for those who want to get in now. Always be aware of risks, but its’ likely early days for this company.

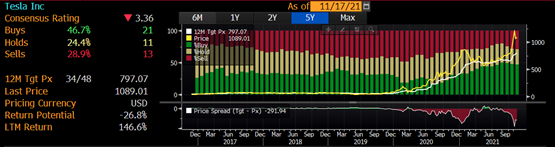

This column focuses on endurable competitive advantage and that’s exactly what this company has. It is now the most valuable auto manufacturer in the world by far, a distinction we do not see the company losing anytime soon. The sell-side is warming up too and slowly it is becoming obvious to the world that this company is not a meme stock anymore, despite being the first to hold that title.

There’s never a shortage of Tesla bears or of controversy surrounding the eclectic founder of the company. Most recently, the Tesla founder drew the ire of investors by making large stock sales. He has a tendency for public spectacle only matched by his managerial prowess. If you think Elon Musk is simply too much to handle, then we’d urge you to try building a rocket that lands itself to see how you do. Any temporary downside he brings is mitigated by his once-in-a-generation visionary status.

Why Tesla Is a Granny Shot

Tesla has been on our famous Granny Shots stock list since its’ inception. We select names on this list when they conform with at least two of six themes. We have three strategic themes, The Rise of AI/Automation and the Economic Rise of Millennials are why we selected this name well before it had the notoriety and debate about valuation that exists today. We still like it. Own it, don’t trade it!

When we select stocks for strategic themes, we expect the benefits to play out over a three-to-five-year period. We believe this is definitely true for Tesla and despite the controversial nature of the stock and a high level of price volatility relative to some names on the list, we believe if you hold the stock over this time period you will likely see significant capital appreciation given the pace of the company’s strides.

Our Head of Research, Tom Lee, has long used demographic research as a central part of his analysis. One of the reasons we like this stock is that millennials, who are now entering their prime earning and spending years, are ridiculously fond of this company’s product and brand. We believe that Tesla is becoming far more than a mere OEM, it is a hybrid auto-technology company building a valuable network of interconnected products that will only grow in value over time. The race to imitate its more software-centric approach to cars by legacy competitors speaks volumes about the viability of this strategy.

Another major trend you have to look under the proverbial hood to notice is this. While most OEM’s are rapidly trying to reduce low-margin, mass-market models for higher-margin premium models, Tesla is doing the opposite. So, while it already has superior margins to most competitors, it is also simultaneously making the push into the mass-market it envisioned since the beginning. The other companies are responding to the tempo Tesla is setting. This should bode well for the company’s market share.

What You’re Getting For The Premium

If you’re constrained by the logic that has resulted in so many Tesla shorts losing their shorts, that Tesla should be valued in an analogous fashion to GM and Ford, then we probably aren’t going to convince you of why you should buy this company. It’s certainly not for everyone and if you’re obsessed with Ben Graham then this one is not for you.

Nonetheless, you’re getting a lot of growth and growth has a premium in today’s world. The company is projected to grow its revenue from 2021 to 2022 at over 60%. It will also likely produce more than a million cars next year, which means it is eroding one of the only advantages legacy OEMs have left!

Supply chain worries have been affecting all auto manufacturers, but given Tesla’s pro-active management and manufacturing obsessiveness, it has clearly managed these issues better than peers particularly with regard to semi-conductors. The company also had its best margins since the Model 3 was released in Q3 and the progress on growth and production are even more impressive in the face of supply-chain headwinds.

Here’s another thing. Tesla will be doing a lot more than selling cars in the future. It’s super-charging stations means it will be central to future EV infrastructure completely outside of its auto sales. In general, the company’s power storage technology, where it continues to make leading edge strides, is also a hugely untapped market.

However, having a company with a technology company culture pays dividends in multiple ways. The company found out auto insurance costs are a huge proportion of monthly auto-spend, so it decided to use its ample data and can-do culture to explore its own insurance product. Efforts have so far proven very promising and show that with a culture like Tesla, opportunities for growth can seemingly spring out of thin air.

Risks And Where We Could Be Wrong

The biggest risk is clearly the excessive valuation of the stock. If competitors do make more progress against Tesla’s current position, than we currently view as likely, then it certainly could come down hard and fast. However, we see the persistent progress and growth as building upon previous strides. Every car the company produces and sells is making the downside less than exists with the more speculative EV plays. The company is just getting to productive parity with the big guys, and we think this is when the magic will really start to happen in terms of competitive advantage.

As the benefits of the company’s increasing scale and capacity make themselves known and new growth initiatives play out, we see it more likely that the company’s new found market-cap dominance remains an enduring reality instead of a temporary blip. The headline risk associated with Elon Musk’s sometimes public and counterproductive actions are sometimes unfortunate, but probably a very minor consideration if you stretch your investment horizon.

There have been recent legal concerns that could prove problematic; however, the company is usually on top of these items and we don’t see this as a major headwind. In terms of competition, not only does everything have to go right for competitors to erode the considerable lead that Tesla has built, but a lot also has to go wrong with Tesla. One big risk is the if the Fully-Self Driving software doesn’t make as much progress as is expected.

The race to the first commercially available self-driving vehicle is on, and we expect Tesla to win it. If another company establishes dominance in this area, that could be a major headwind to Tesla and may compromise the economics of its’ aggressive R&D investments. All and all, we think the equation for gaining market share is in place and that this provides some potential upside to the stock particularly as competition reduces reliance on low-margin, high-volume models.

Tesla has recently gotten low reliability scores. It does have a dearth of servicing capacity compared to legacy competitors. However, it is rushing to fill this gap. We’d still say its sales model is still superior to the vast networks of middlemen and lending arms required to generate sales for legacy autos. The credit operations of the older guys tend to become an albatross around the neck later in the cycle.

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In e50ec1-d27c0b-aeb534-02bfaa-069dbf

Already have an account? Sign In e50ec1-d27c0b-aeb534-02bfaa-069dbf