The primary macroeconomic event impacting markets this week was the release of the latest Consumer Price Index (CPI) reading. As we began the week, Fundstrat Head of Research Tom Lee told us that anecdotally, based on his conversations with clients, RIAs, and investors at various industry events, uncertainty seemed to be pervasive, with both “nervous bulls” and “angry bears”.

Yields are up – the 10-year has risen to its highest level in months (4.295% as of Friday afternoon). Yet as Head of Technical Strategy Mark Newton had noted in past weeks, the traditional correlation between stocks and yields has not been in evidence recently – stocks have risen alongside yields. To Lee, this is a sign of market strength. Yet, Lee continues to urge caution as long as the timeframe for the Federal Reserve’s anticipated rate cuts remains unclear, amplifying nervousness and uncertainty.

They were certainly in evidence on Tuesday, when CPI came in hot versus consensus – the January reading showed inflation continuing to decline, but not as quickly as the Street had expected. Many – economists, pundits, and investors – suggested that this could cause the Fed to delay rate cuts, and the day ended with the S&P 500 down about 2%. Lee responded, “In our view, this is an over-reaction to a singular CPI print. Markets might panic, the Fed might hesitate, but if you peel the onion, [this CPI print] is not that bad.””

He was not alone. During a speech the next day at the Council on Foreign Relations, Chicago Fed President Austan Goolsbee said, “Let’s not get too flipped out,” later urging observers not to get “amped up when you get one month of CPI that was higher than you expected it to be.” Consistent with the assessments Lee has been making for months, Goolsbee stressed that “it’s totally clear that inflation is coming down […] We can still be on the path [to the Fed’s target inflation of 2%] even if we have some increases and some ups and downs.”

But what does that mean for equity investors? Was the hot CPI print the catalyst to mark a short-term top? “We don’t think so,” Lee said. “Near-term peaks are usually marked by a sell-off on good news,” he said, “and that’s not what happened on Tuesday.” And on Friday, when PPI came in hot, stocks barely slipped. Based on this, “we think stocks have upside in the near-term,” he told us.

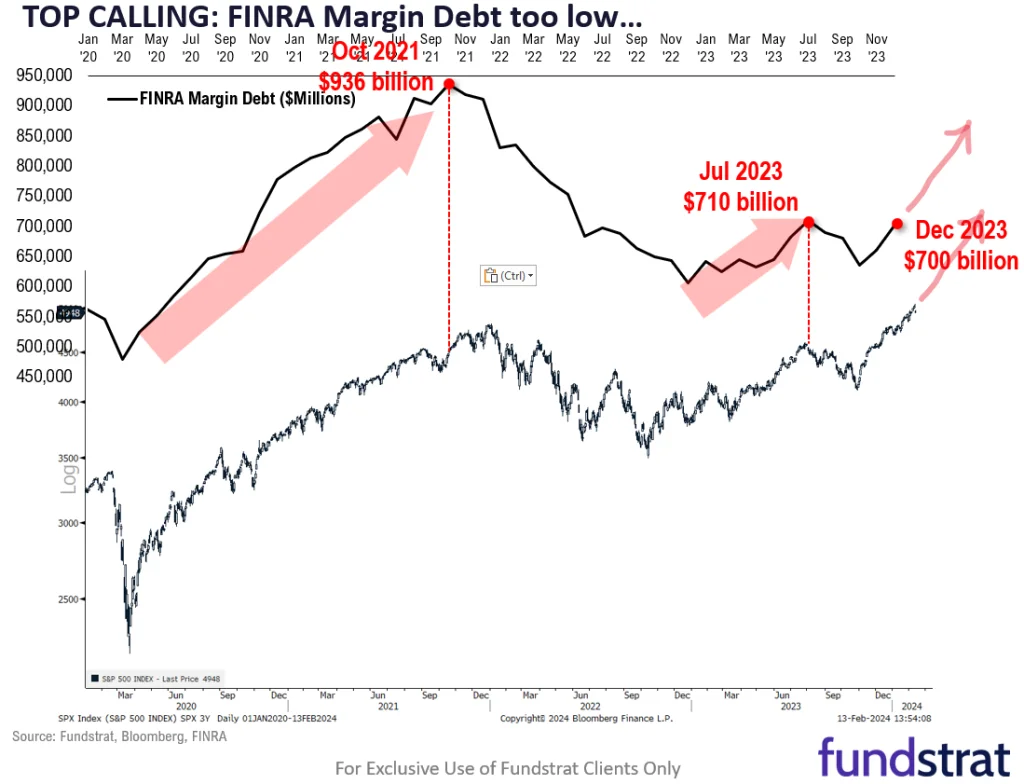

Chart of the Week

Commenting on speculation that markets have peaked, Lee observed that peaks usually happen after buying power is exhausted. The July 2023 top was preceded by a peak in margin debt, and current margin debt is still below those levels, as shown in our Chart of the Week. “These levels need to surge to mark a near-term top,” Lee said.

Recent ⚡ FlashInsights

[fsi-flash-insights]

FSI Video: Weekly Highlight

Key incoming data

2/13 8:30am ET January CPIMixed2/14 PPI RevisionsTame2/15 8:30am ET February Empire Manufacturing SurveySoft2/15 8:30am ET February Philly Fed Business Outlook SurveyHot2/15 8:30am ET January Retail Sales DataTame2/15 10am EST February NAHB Housing Market IndexHot2/16 8:30am ET January PPIHot2/16 8:30am ET February New York Fed Business Activity SurveySoft2/16 10am ET U. Mich. Sentiment and Inflation Expectation February PrelimTame- 2/19 9am ET Manheim Used Vehicle Index February Mid-Month

- 2/21 2pm ET January FOMC Meeting Minutes

- 2/22 9:45am ET S&P Global PMI February Prelim

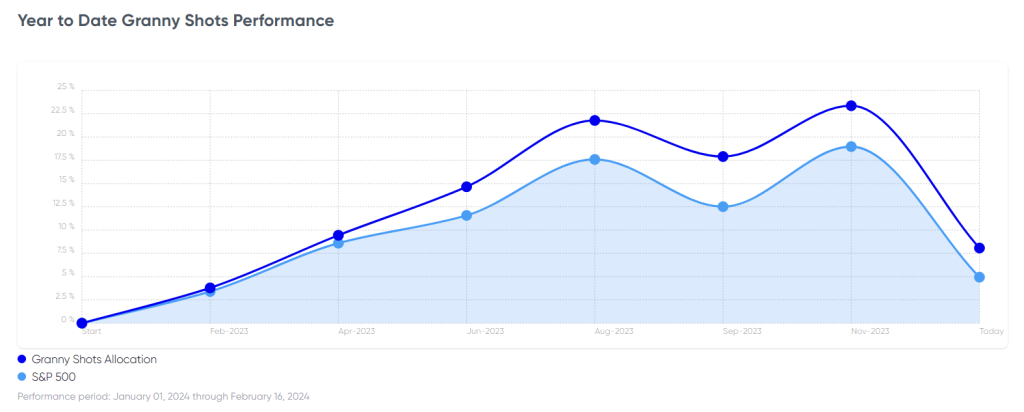

Stock List Performance

In the News

[fsi-in-the-news]

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 749de8-0fcbc9-3e0d07-3b197b-4a7a0c

Already have an account? Sign In 749de8-0fcbc9-3e0d07-3b197b-4a7a0c