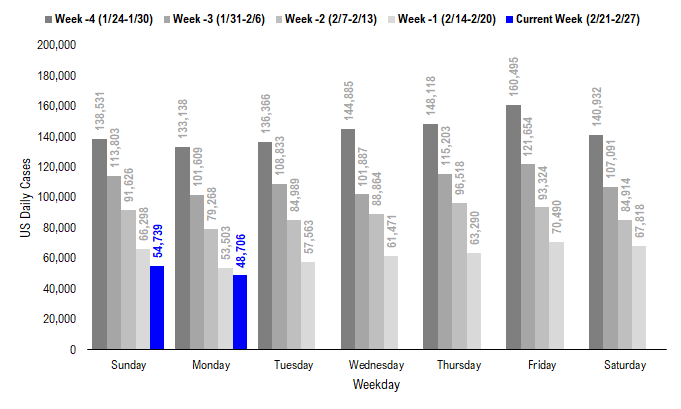

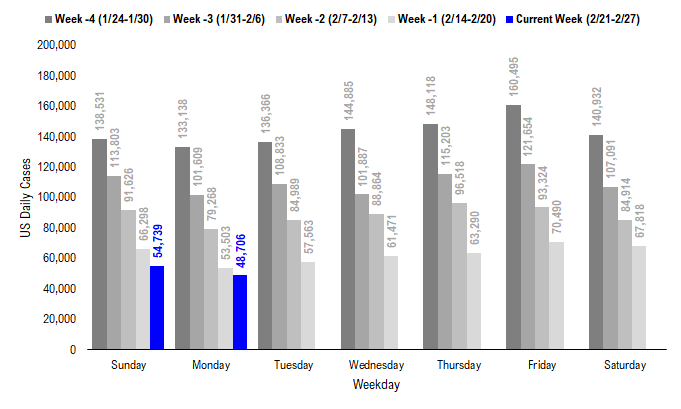

COVID-19 UPDATE: Achievement unlocked --> daily cases 48,706 on Monday (sub-50k!!!!). Epicenter 37% of S&P 500 market cap but 45% of revs, soon to be >50%

Click HERE to access the FSInsight COVID-19 Daily Chartbook.

We are shifting to a 4-day a week publication schedule:

- Monday

- Tuesday

- Wednesday

- SKIP THURSDAY

- Friday

STRATEGY: Epicenter is 37% of market cap but soon to be >50% of revs

Achievement unlocked –> sub-50K cases

The most positive development on COVID-19 is that daily cases fell below 50,000. This is a sizable drop from the nearly 300,000 cases per day seen at the start of the year. Thus, the trend is a sustained and meaningful drop in cases.

– at this pace, daily cases could be sub-25,000 sometime in March

– the pace of improvements is slowing somewhat, so progress will be dependent on the “boost” from vaccinations.

Source: COVID-19 Tracking Project and Fundstrat

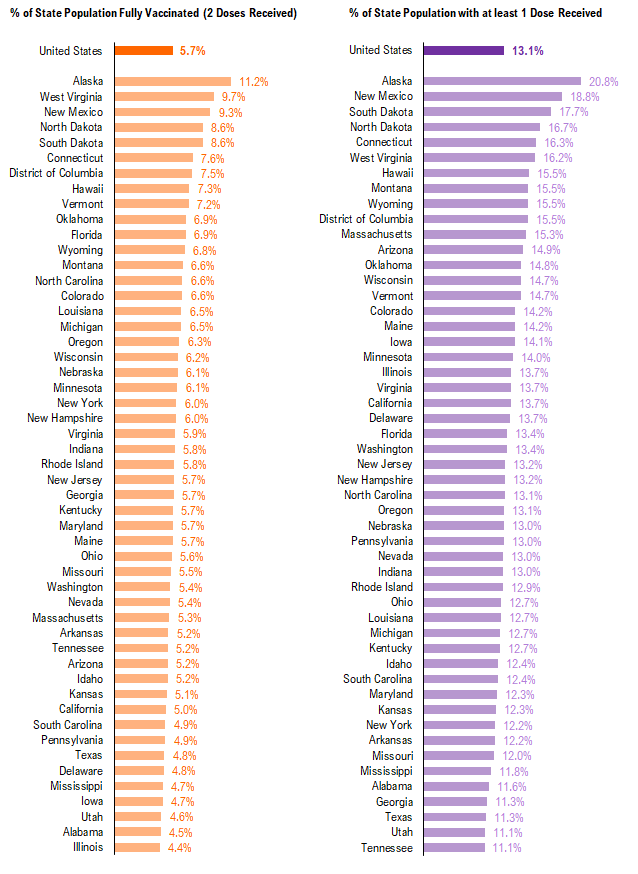

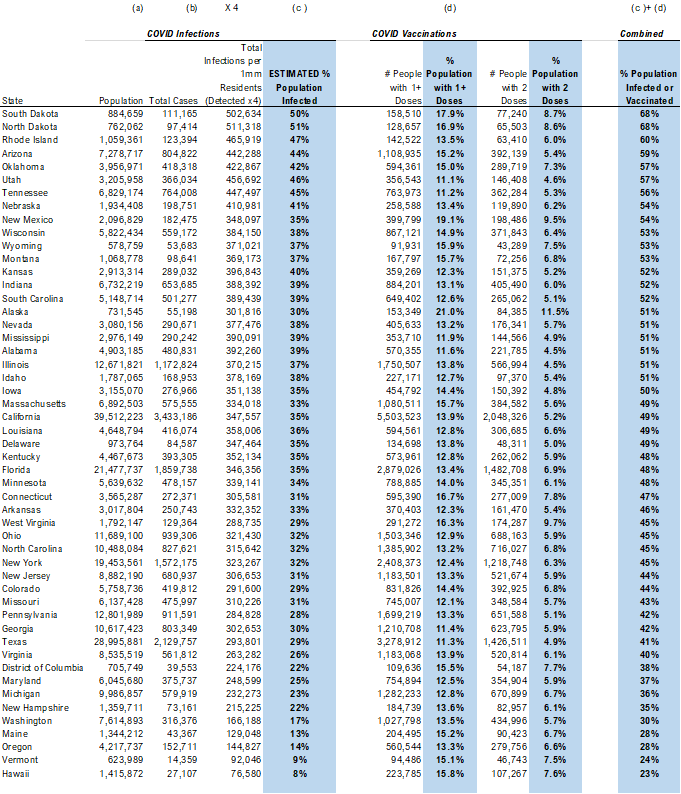

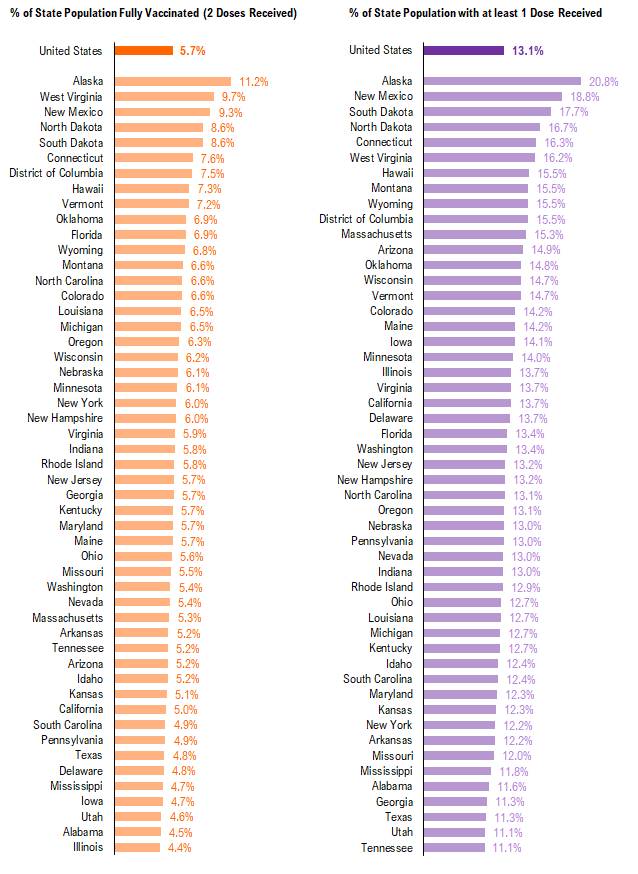

And as shown below, about 6% of Americans have received two doses of a vaccine. And only Alaska has given its >20% residents at least one dose. This figure is cumulatively rising, thus, the benefit from this should strengthen in the coming weeks.

– hopefully, this allows cases to steadily decline and be sub-25k in March

Source: CDC, COVID-19 Tracking Project and Fundstrat

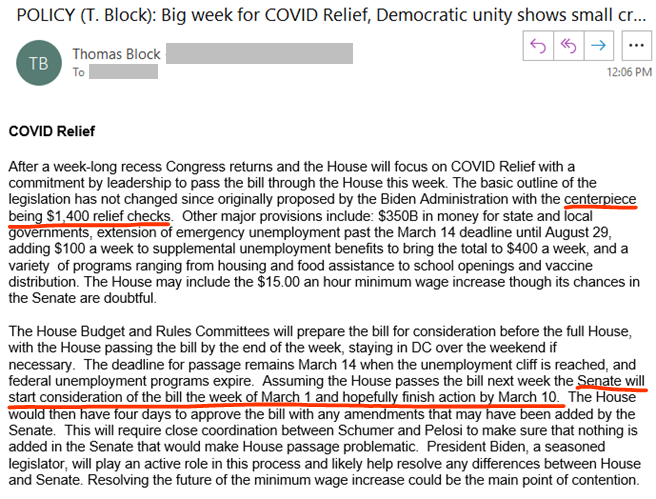

Washington in Focus: Fed testimony starts Tuesday, COVID-19 relief going through House

Washington is in focus this week. Fed Chair Powell is doing his semi-annual testimony. And as our Policy Strategist, Tom Block, noted, Powell is known to stick to the script. And this script is the Fed is not going to counter any efforts by Washington to bring economic aid to the economy. Hence, while the bond market might be nervous about rates, equity investors should keep in mind the Fed prefers flat to rising asset prices — hence, generally supportive of stocks. And it does not pay to “fight the Fed.”

Regarding the stimulus, the House is working on passing the bill and it will be sizable (see below). And Tom Block reminds us the Senate is expected to take up a version of the bill in the first week of March. So for the next few weeks, Washington relief progress remains in the headlines.

Source: Fundstrat

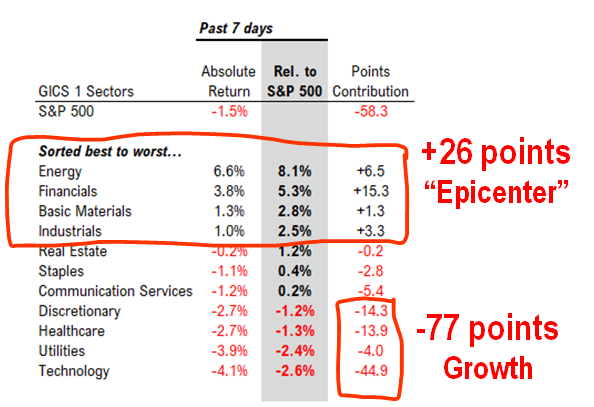

STRATEGY: The rotation into “Epicenter” is shredding Growth stocks…

The “violent rotation” from Growth/Defensives into Epicenter continues. This is something we had talked about the better part of the last 6 months — the rotation from Growth/Defensives and Epicenter/Cyclicals would be violent, because of the abrupt shift in the thesis.

In the past week:

– the S&P 500 has fallen 1.5%

– Technology/Healthcare down -3% to -4%

– subtracting -77 points from S&P 500

– Epicenter sectors +1% to +7% (Energy is best)

– adding +26 points

Not only is this move violent, but the gains in Epicenter are not enough to offset the losses from Growth.

Source: Fundstrat and Bloomberg

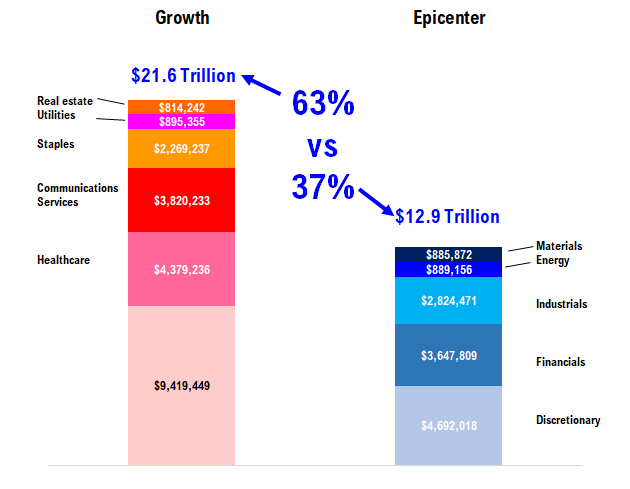

STRATEGY: There is not enough “Epicenter” market cap to go around…37% vs 63%

There are several reasons this rotation is violent, and I will list a few of the reasons below:

– Growth stocks are owned based upon steady growth –> Epicenter nope

– Growth stocks are owned for positive EPS beats –> Epicenter, might happen

– Growth stocks are “good narrative” stocks –> Epicenter stocks are “we did not die, so we live”

but there is a bigger factor as well…

– Growth is $21.6T, or 63% of the S&P 500 Index

– Epicenter is only 37%

– Epicenter was 24% when we first started to write about it…

So there is simply not enough Epicenter market cap to go around.

Source: Fundstrat and Bloomberg

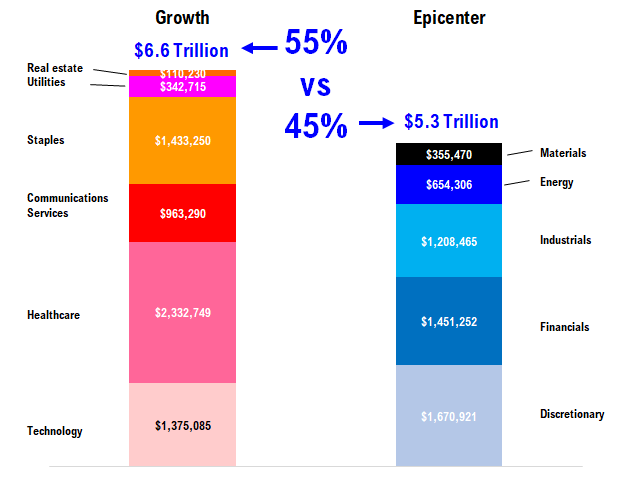

But before you roll your eyes, and say, well, Epicenter companies are just junky cyclicals. So, they might rise 20%, and then what?

– Epicenter revs are $5.3T, or 45% (of the overall index)

– Growth is $6.6T, or 55%

So, in an economy re-opening, +7% GDP world, the 45% of Epicenter revenues are going to surge.

– Epicenter 2022 share of revenues might be >50%

In that scenario, shouldn’t Epicenter share of market cap be >50%?

– Moving from 37% to 50% is a 50% gain in Epicenter stocks

This suggests plenty of upside in Epicenter still.

Source: Fundstrat and Bloomberg

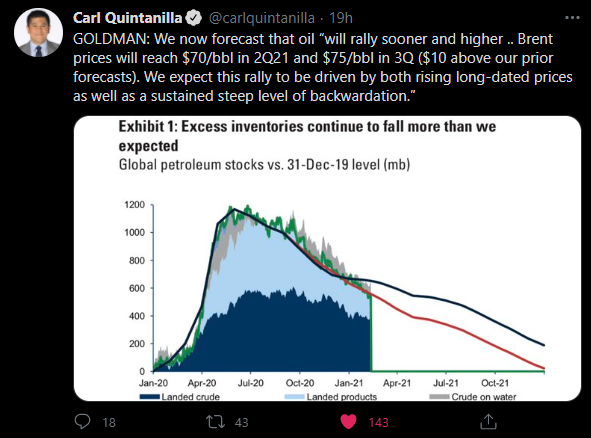

STRATEGY: Energy is the Epicenter of the Epicenter…

Energy is the epicenter of the Epicenter trade. Sure, I understand it was not a storefront or business forced to shut down. But Energy was a wobbly sector before the pandemic. And it was absolutely crushed as credit risk soared. So this was like the weakest link in the cyclical complex.

Energy has also been abandoned by institutional investors. It is a blight on people’s track record. And it is a sector that is viewed with no future. So why bother?

But now, the outlook for oil is surprisingly robust. Look at Goldman’s forecast below.

– Goldman sees $70 oil in 2Q2021 and $75 in 3Q2021

– forecast is $10 per barrel higher than before

Source: Twitter

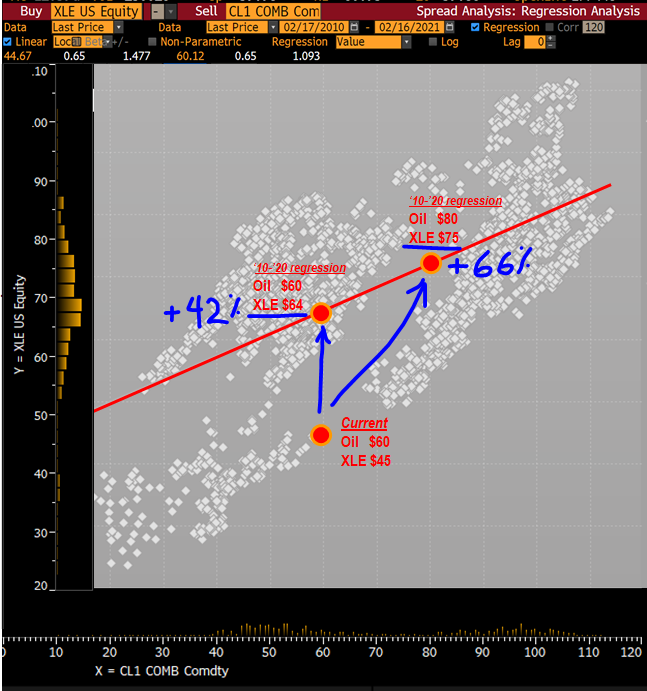

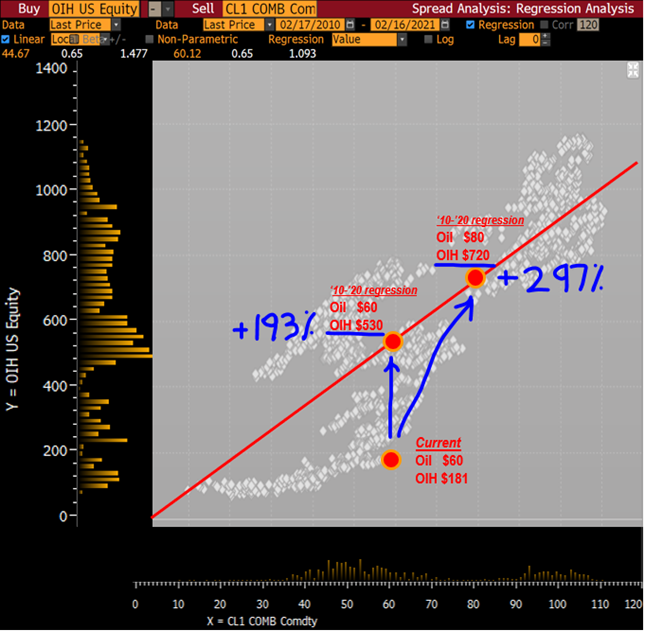

Take those oil prices… and think about the correlation of oil to XLE and OIH…

We want to again look at the comparative relationship between oil and energy stocks, using the scatter below (Bloomberg regression function). We published these a few weeks ago, and want to highlight them again.

Based on the price relationships since 2009….

Price of oil….

$60 $80

XLE (fair value) $64 $75

% upside 42% 66%

OIH (fair value) $530 $720

% upside 193% 297%

See that? Massive massive upside to Energy stocks. There is even bigger upside to the oilfield services (OIH ETF as a proxy). So the interesting takeaway is that Energy stocks still seem to have comparative upside given the sizable move in crude oil prices.

Source: Fundstrat and Bloomberg

Source: Fundstrat and Bloomberg

By the way, other sellside firms are getting constructive on Energy as well. See this from RBC Capital Markets.

Source: RBC Capital Markets

STRATEGY: 7 reasons stocks are “buy the dip” even as the bond market is on “edge” with Fed Chair Powell set to speak…

The larger story arc, in our view, is that equities have multiple positive supports and this constructive backdrop likely prevents a larger risk-off spillover. In fact, this past week is evidence of this. Despite the surge in the VIX and the rollover of technology stocks, the indices actually were flat and Epicenter stocks were positive.

More specifically, we see 7 positive supports for stocks in the near-term:

1. Washington is moving forward with passing a large fiscal relief package, and Treasury Sec. Yellen has made a forceful case for it

2. Fed has been vocal in policy stance (last week’s minutes affirmed) and Fed is patient

3. US economy is re-opening and economic momentum is strong — so strong, JPMorgan’s Chief Economist, Bruce Kasman, says US V-shape recovery will soon surpass China. Wow.

4. There remains a substantial perception gap between policymakers/media and COVID-19 realized data, and a closing of this gap is positive for risk assets.

5. Millennials are steadily allocating assets toward equities, and the surge in retail brokerage account openings is evidence of this.

6. Bonds are becoming less attractive total return vehicles as inflationary expectation are increasing, boosting the attractiveness of equities

7. VIX is steadily declining, and as we pointed out in our 2021 Outlook, periods of declining volatility historically lead to big equity gains, particularly for cyclicals.

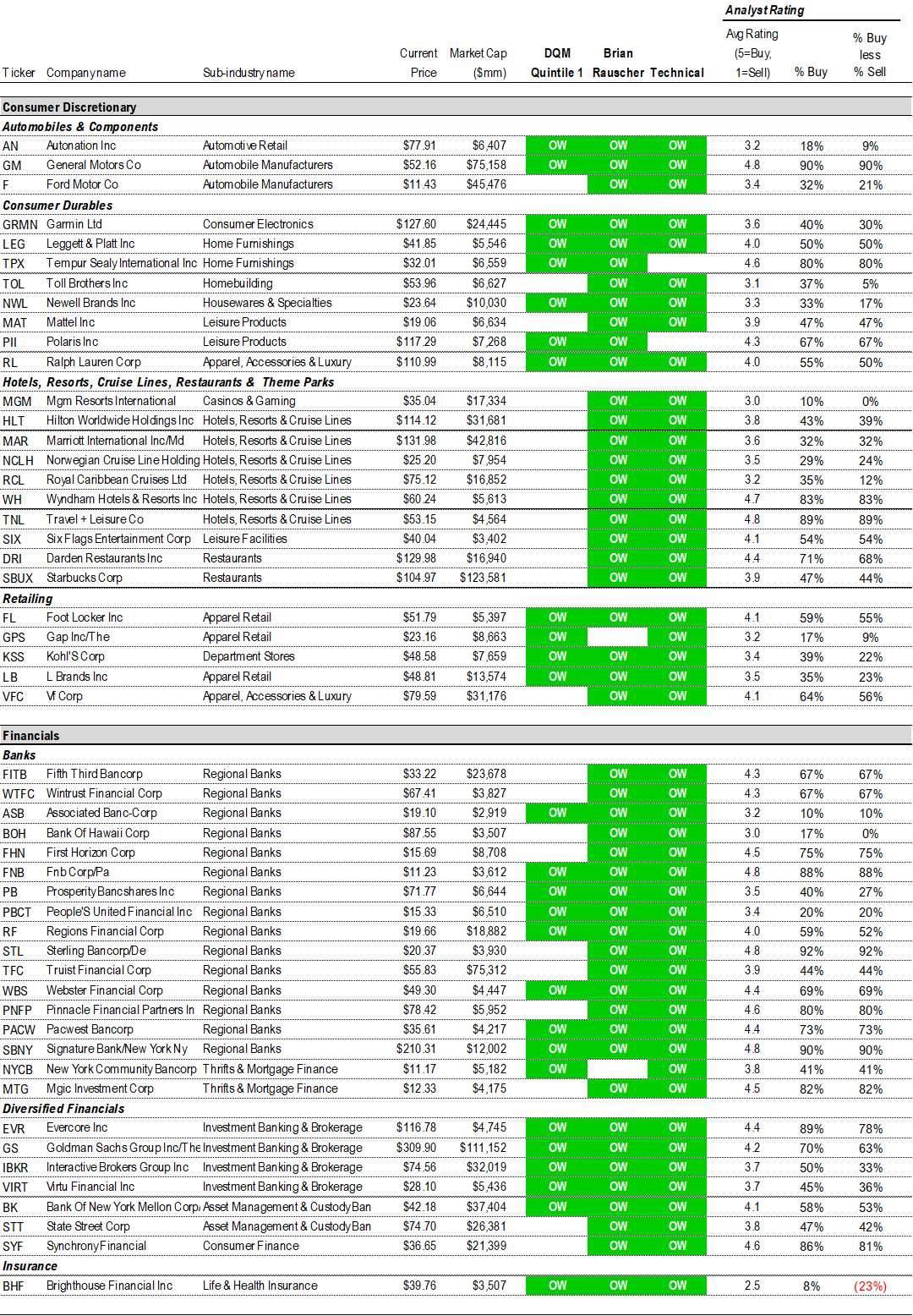

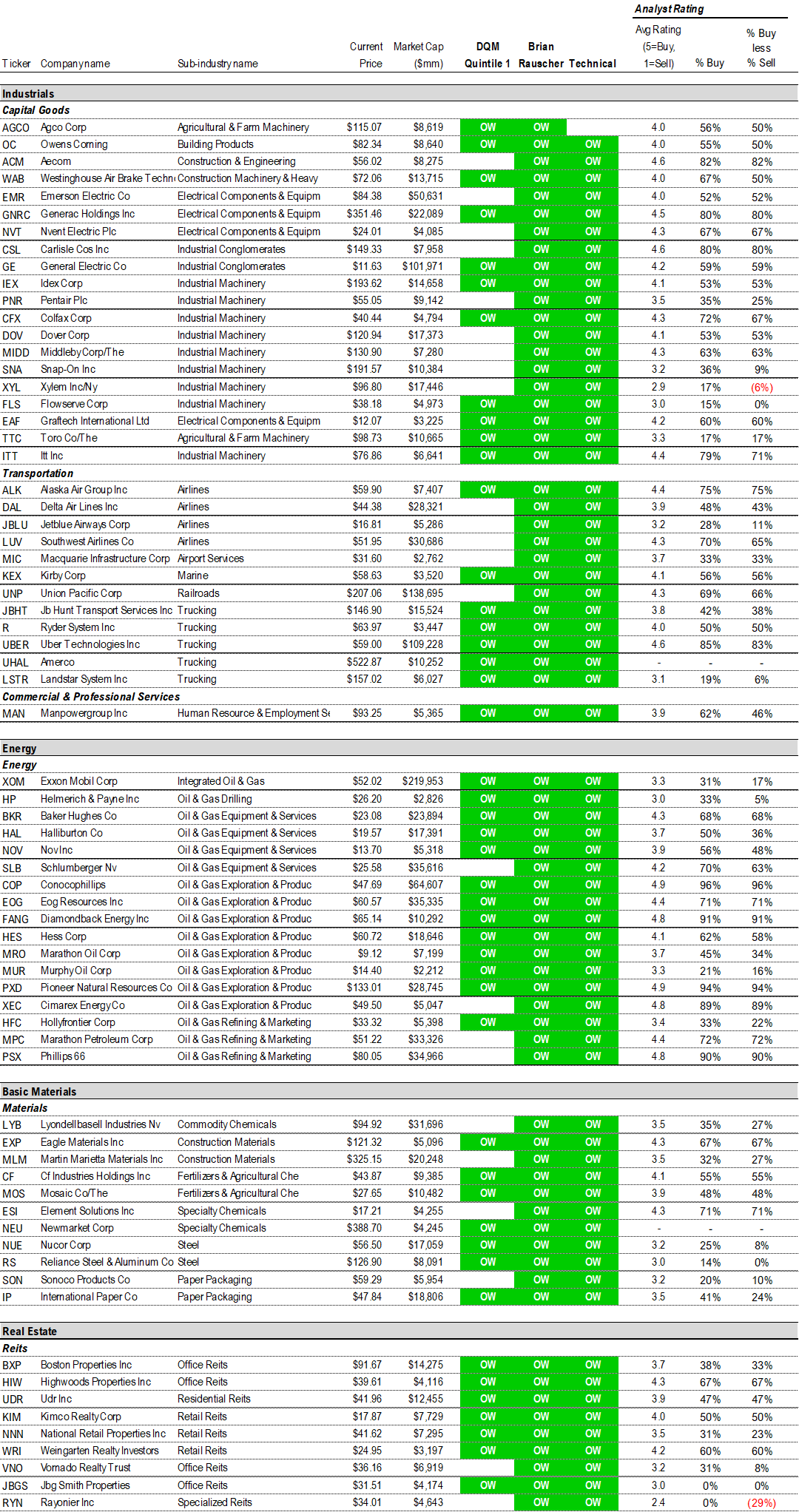

STRATEGY: Epicenter Trifecta List 121 stocks(*)

The case for being Cyclically-tilted is strengthening:

– Vaccine rollout set to accelerate

– US cases collapsing

– US economy set to re-open

– US corporates reset cost structures = strong operating leverage

– US credit markets strong = cost of capital falling

Below is our updated “Trifecta” epicenter stock list. These are the stocks which were hit the hardest by the pandemic and have the greatest operating leverage to a re-opening. And we like the earnings upside in these stocks, because of the massive cost reset. The stocks are based on positive views coming from the trifecta of: (i) Quant (tireless Ken), (ii) Global Portfolio Strategy (Brian Rauscher, aka Rocky) and (iii) Technicals.

Consumer Discretionary:

AN, GM, F, GRMN, LEG, TPX, TOL, NWL, MAT, PII, RL, MGM, HLT, MAR, NCLH, RCL, WH, TNL, SIX, DRI, SBUX, FL, GPS, KSS, LB, VFC

Financials:

FITB, WTFC, ASB, BOH, FHN, FNB, PB, PBCT, RF, STL, TFC, WBS, PNFP, PACW, SBNY, NYCB, MTG, EVR, GS, IBKR, VIRT, BK, STT, SYF, BHF

Industrials:

AGCO, OC, ACM, WAB, EMR, GNRC, NVT, CSL, GE, IEX, PNR, CFX, DOV, MIDD, SNA, XYL, FLS, EAF, TTC, ITT, ALK, DAL, JBLU, LUV, MIC, KEX, UNP, JBHT, R, UBER, UHAL, LSTR, MAN

Energy:

XOM, HP, BKR, HAL, NOV, SLB, COP, EOG, FANG, HES, MRO, MUR, PXD, XEC, HFC, MPC, PSX

Basic Materials:

LYB, EXP, MLM, CF, MOS, ESI, NEU, NUE, RS, SON, IP

Real Estate:

BXP, HIW, UDR, KIM, NNN, WRI, VNO, JBGS, RYN

Source: Fundstrat, Bloomberg

(*) Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

ADDENDUM: We are attaching the stock lists for our 3 portfolios:

We get several requests to give the updated list for our stock portfolios. We are including the links here:

– Granny Shots –> core stocks, based on 6 thematic/tactical portfolios

– Trifecta epicenter –> based on the convergence of Quant (tireless Ken), Rauscher (Global strategy), Technicals

– Violence in USA –> companies that are involved in some aspect of home or personal security. We are not “recommending” these stocks, but rather, bringing these stocks to your attention.

Granny Shots:

Full stock list here –> Click here

Tickers: AAPL, CSCO, INTC, MXIM, NVDA, EBAY, KLAC, GRMN, GOOG, MNST, MSFT, AMZN, QCOM, TSLA, PYPL, AXP, BF/B, PM, XLNX, TGT, PG, XOM, VLO, GL, RF, ATVI, BBY, GE, AMAT, LRCX, MU, HPQ

Trifecta Epicenter (*):

Full stock list here –> Click here

Tickers: AN, GM, F, GRMN, LEG, TPX, TOL, NWL, MAT, PII, RL, MGM, HLT, MAR, NCLH, RCL, WH, TNL, SIX, DRI, SBUX, FL, GPS, KSS, LB, VFC, FITB, WTFC, ASB, BOH, FHN, FNB, PB, PBCT, RF, STL, TFC, WBS, PNFP, PACW, SBNY, NYCB, MTG, EVR, GS, IBKR, VIRT, BK, STT, SYF, BHF, AGCO, OC, ACM, WAB, EMR, GNRC, NVT, CSL, GE, IEX, PNR, CFX, DOV, MIDD, SNA, XYL, FLS, EAF, TTC, ITT, ALK, DAL, JBLU, LUV, MIC, KEX, UNP, JBHT, R, UBER, UHAL, LSTR, MAN, XOM, HP, BKR, HAL, NOV, SLB, COP, EOG, FANG, HES, MRO, MUR, PXD, XEC, HFC, MPC, PSX, LYB, EXP, MLM, CF, MOS, ESI, NEU, NUE, RS, SON, IP, BXP, HIW, UDR, KIM, NNN, WRI, VNO, JBGS, RYN

Violence in USA:

Full stock list here –> Click here

(*) Please note that the stocks rated OW on this list meet the requirements of our investment theme as of the publication date. We do not monitor this list day by day. A stock taken off this list means it no longer meets our investment criteria, but not necessarily that it is neutral rated or should be sold. Please consult your financial advisor to discuss your risk tolerance and other factors that characterize your unique investment profile.

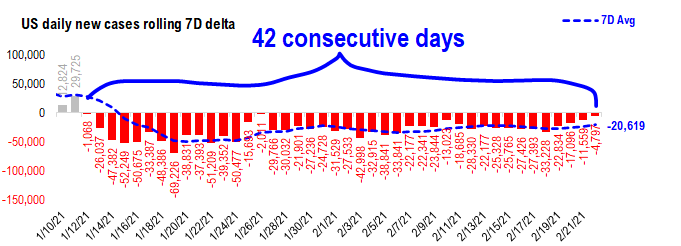

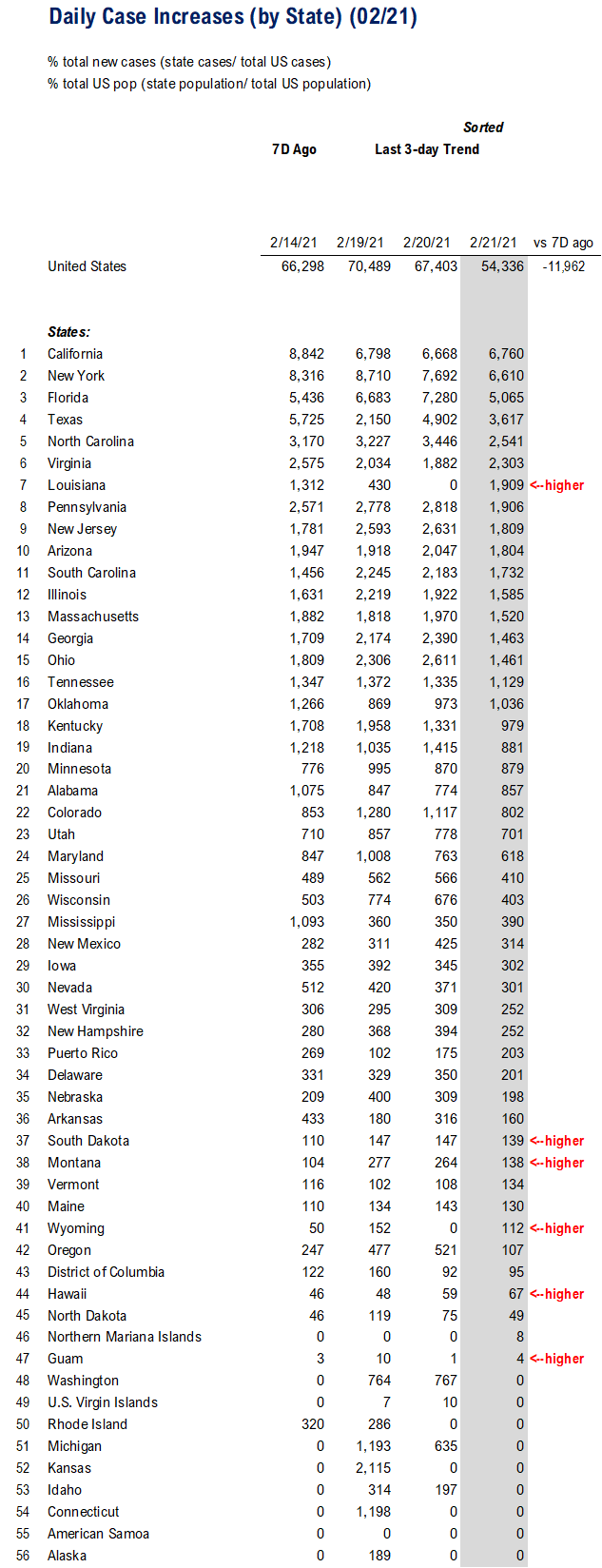

POINT 1: Daily COVID-19 cases 48,706, -4,797 vs 7D ago… daily cases fall below 50,000 first time since Oct. 13

_____________________________

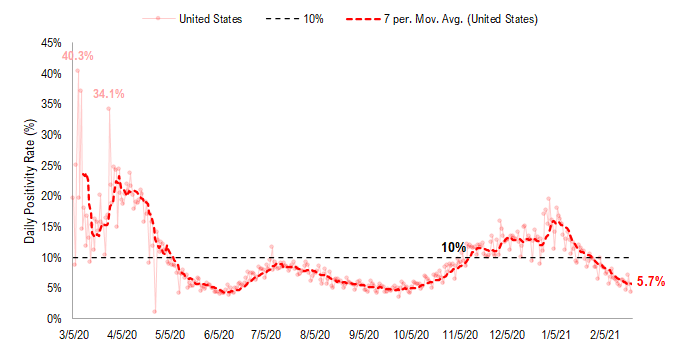

Current Trends — COVID-19 cases:

– Daily cases 48,706 vs 53,503 7D ago, down -4,797

– 7D positivity rate 5.7% vs 6.4% 7D ago

– Hospitalized patients 55,403, down -15% vs 7D ago

– Daily deaths 1,893, down -22% vs 7D ago

_____________________________

The latest COVID-19 daily cases came in at 48,706, down 4,797 vs 7D ago.

– US cases fall below 50,000 first time since Wave 3

– COVID-19 cases have declined (vs 7D ago) for 42 consecutive days

Source: COVID-19 Tracking Project and Fundstrat

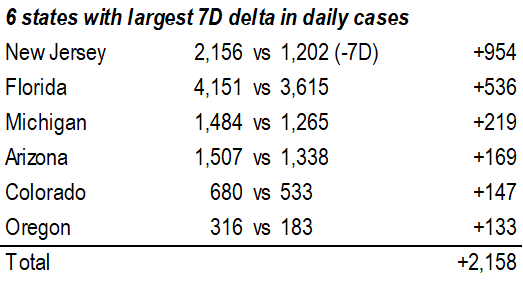

Daily cases are falling by ~25,000 vs 7D ago (7D delta, see below)… Wow

The 7D delta has turned negative for the past 42 days consecutively. This is impressive and the rate of change is accelerating to the downside.

– this is contributing to the sense that this receding of cases is a much faster retreat than seen in the past few months

Source: COVID-19 Tracking and Fundstrat

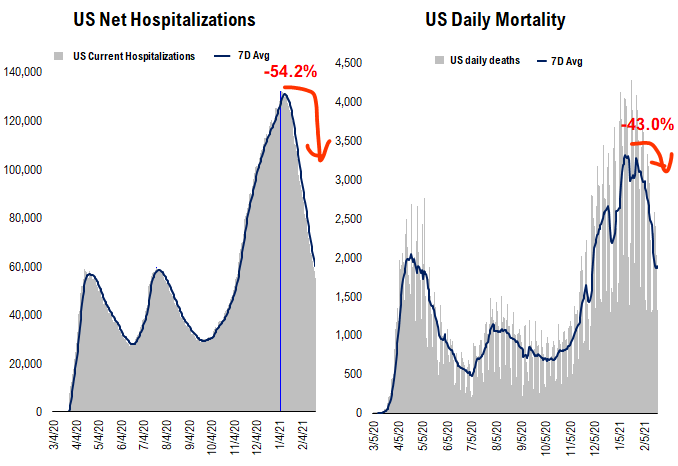

US hospitalization still rolling over … and even US deaths seem to be rolling over…

Below we show the aggregate patients who are currently hospitalized due to COVID. It certainly seems to be rolling over = good sign.

Source: COVID Tracking Project and Fundstrat

Source: COVID Tracking Project and Fundstrat

Source: COVID-19 Tracking and Fundstrat

Source: COVID-19 Tracking and Fundstrat

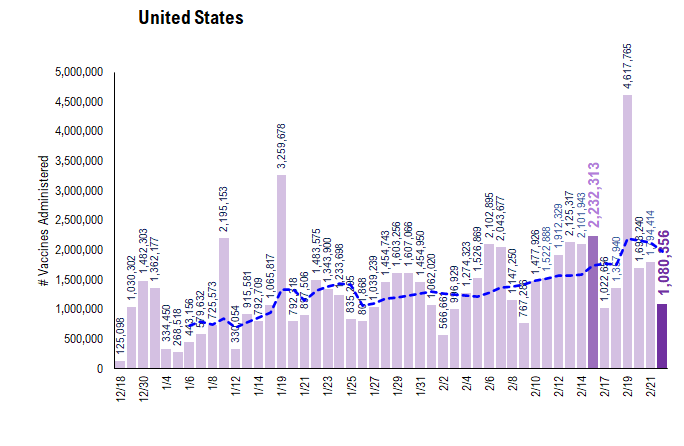

POINT 2: VACCINE: Pace vaccinations kind of stalling… 1.9mm vs 1.6mm (7D avgs)

_____________________________

Current Trends — Vaccinations:

Vaccinations ramping steadily

– avg 1.9 million this past week vs 1.6 million last week

– overall, 5.8% have 2-doses, 13.2% 1-dose

_____________________________

Vaccination frontier update –> only ND + SD + RI > 60% combined penetration (vaccines + infections)

Below we sorted the states by the combined penetration (vaccinations + infections). As we commented in the past, the key figure is the combined value >60%, which is presumably near herd immunity. That is, the combined value of infections + vaccinations as % population > 60%.

– Currently, only ND + SD + RI are at this level

– nearly half of the states are approaching this, such as UT, AZ, TN, OK at >55%

– So slowly, the US is getting to that threshold of presumable herd immunity

Source: CDC, COVID Tracking Project and Fundstrat

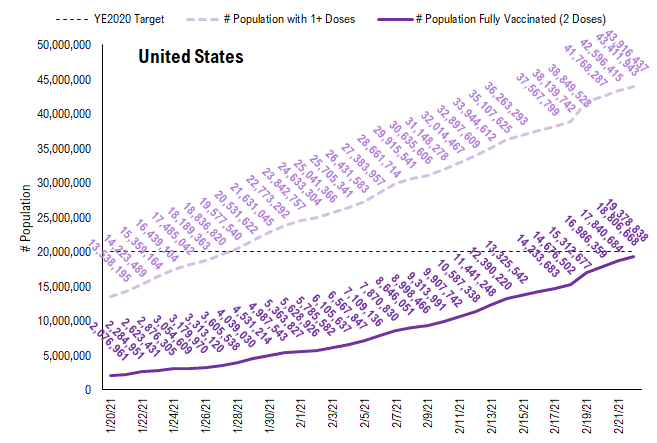

There was a total of 1,080,356 doses administered. The stats 7D ago was distorted due to President’s Day. Hence the data is not really comparable. However, the pace overall is steadily rising, as evidenced by the 7D moving average (see blue line).

Source: CDC, COVID-19 Tracking Project and Fundstrat

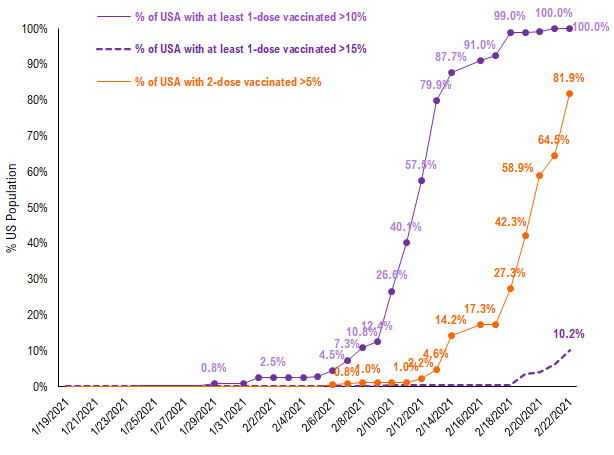

~10% of the US has seen 1-dose penetration >15%… still not wide geography

To better illustrate the actual footprint of the US vaccination effort, we have a time series showing the percent of the US with 2-doses covering at least 5% of its residents, displayed as the orange line on the chart. This figure is 82% (orange line). That means, while 5.8% of the US overall has received 2 doses, 82% of US states has US citizens with >5%.

– While all US states have seen vaccine penetration >10%, only 10% of them have seen 1 dose penetration >15%. Not a lot of geography.

– Now 82% of the US has at least 5% of its residents with the full 2 doses

– This is still a small figure (5% of residents with 2 doses) but this figure is rising sharply now

– the takeaway is the vaccination efforts are unlikely to be having much of an effect on case figures, currently

Source: CDC, COVID-19 Tracking Project and Fundstrat

This is the state by state data below, showing information for states with one dose and for those with two doses.

Source: CDC, COVID-19 Tracking Project and Fundstrat

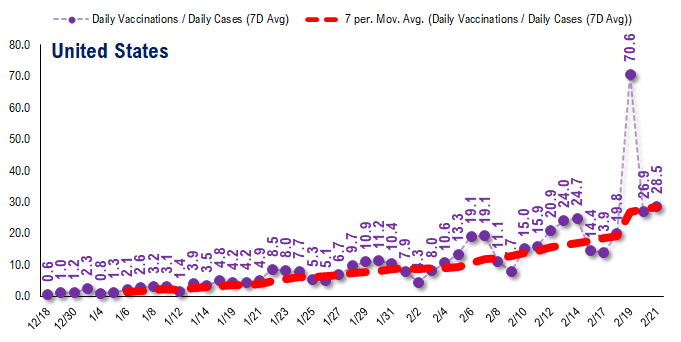

The ratio of vaccinations/ daily confirmed cases is generally trending higher (red line is 7D moving avg) and this is the most encouraging statistic.

– the 7D moving average is about ~25 for the past few days

– this means 25 vaccines dosed for every 1 confirmed case

This figure is rising nicely and likely surges in the coming weeks

Source: CDC, COVID-19 Tracking Project and Fundstrat

In total, about 44 million Americans have received at least 1 dose of a vaccine. This is a good pace and as we noted previously, implies 30% of the population by April.

Source: CDC and Fundstrat