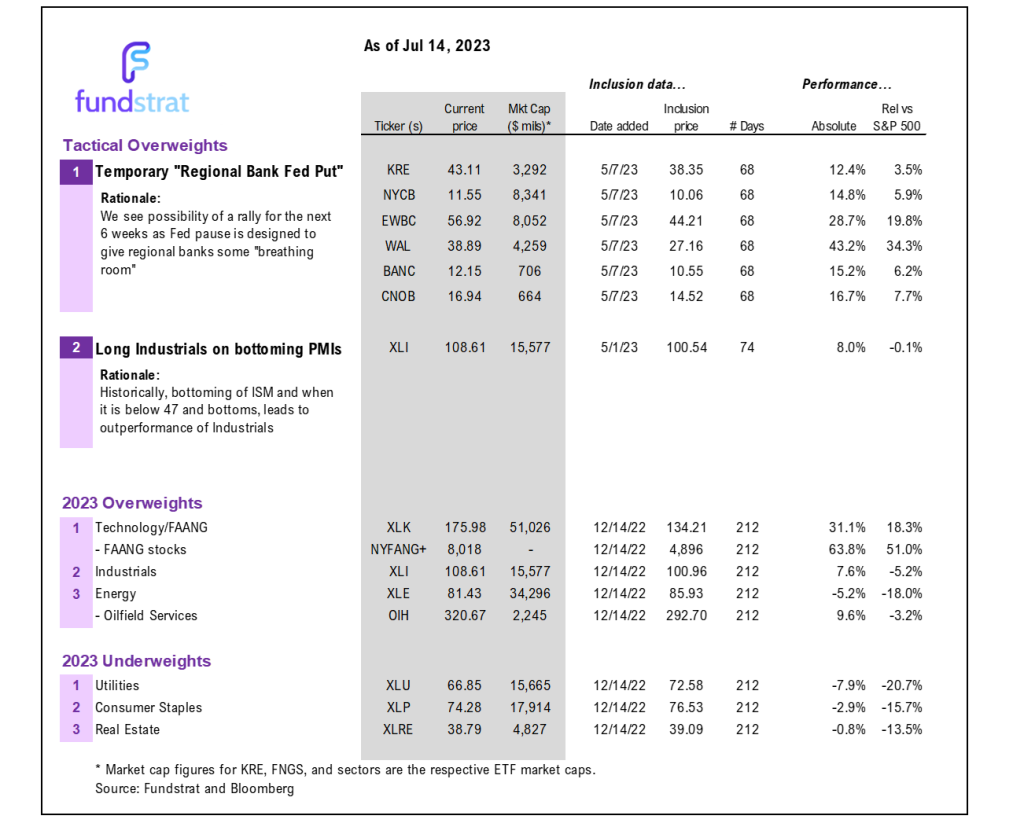

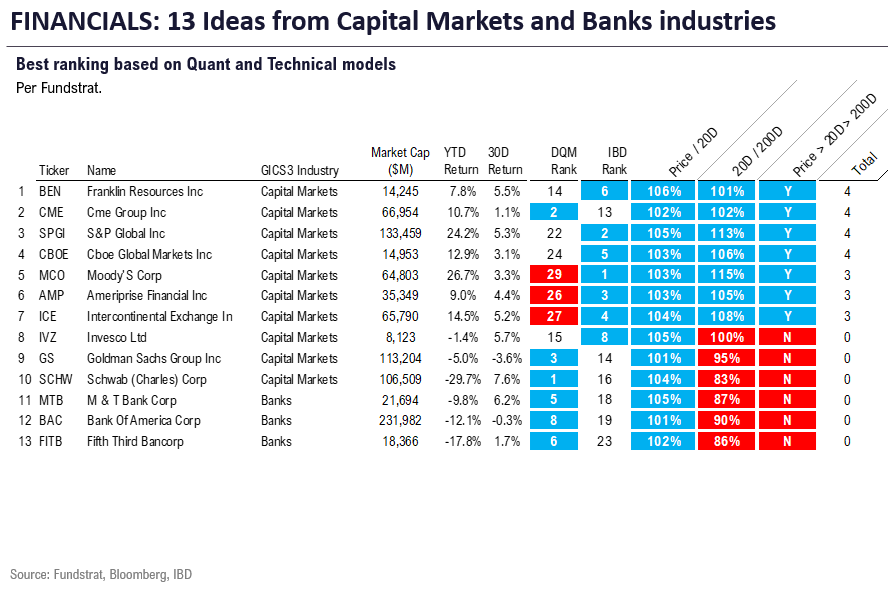

Market focus shifts to 2Q23, which should be overall solid given weaker USD. Financials focus, representing 27 of 61 reporting this week. 13 Financial stocks that could gain next few weeks

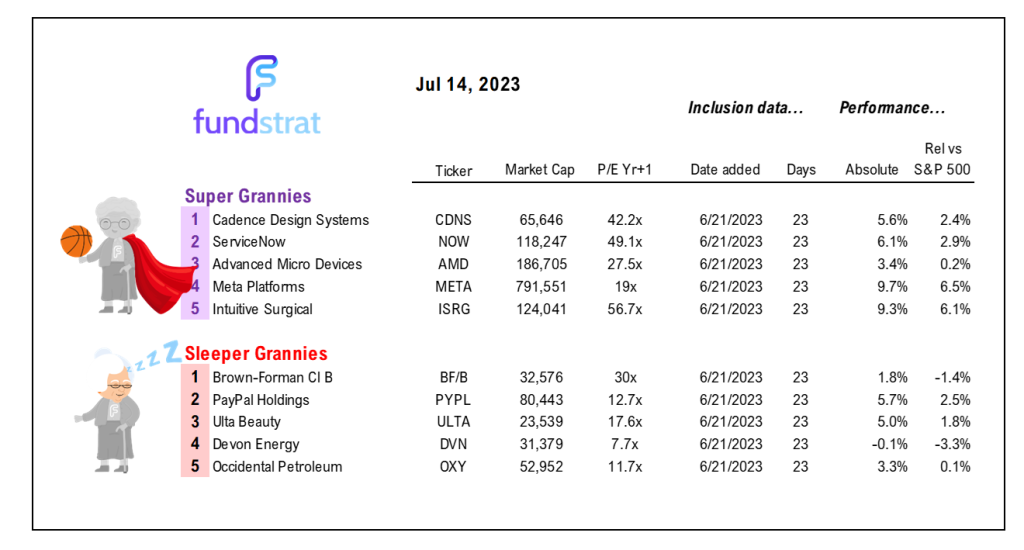

NEW: Section (above) added identifying Key Recommendations and Super Grannies

________________________________________________

The next key macro event is the FOMC meeting two weeks away. So markets will direct attention to 2Q23 EPS season. Financials are 27 of 61 reporting this week, and we think this group could benefit from results. We highlight 13 stocks. Please click below to view (Duration: 5:28).

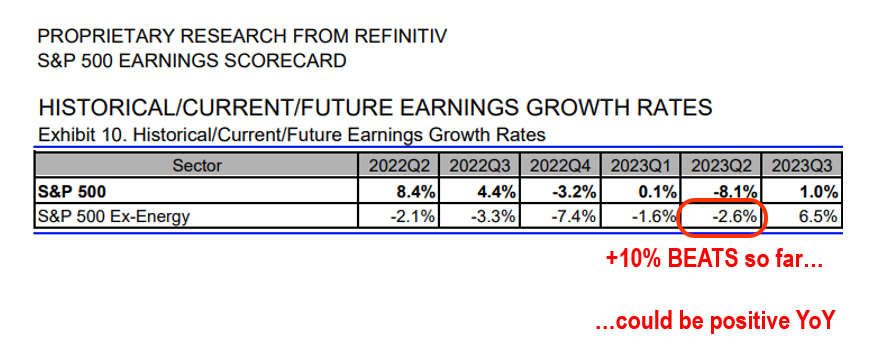

Last week was a big macro week, with key inflation data from CPI and PPI but the next key macro event will be the July FOMC meeting, which is two weeks away. Thus, the market will shift focus to 2Q23 earnings, which is already underway. We expect this to be overall “better than expected” and overall EPS growth YoY ex-Energy is expected to be positive.

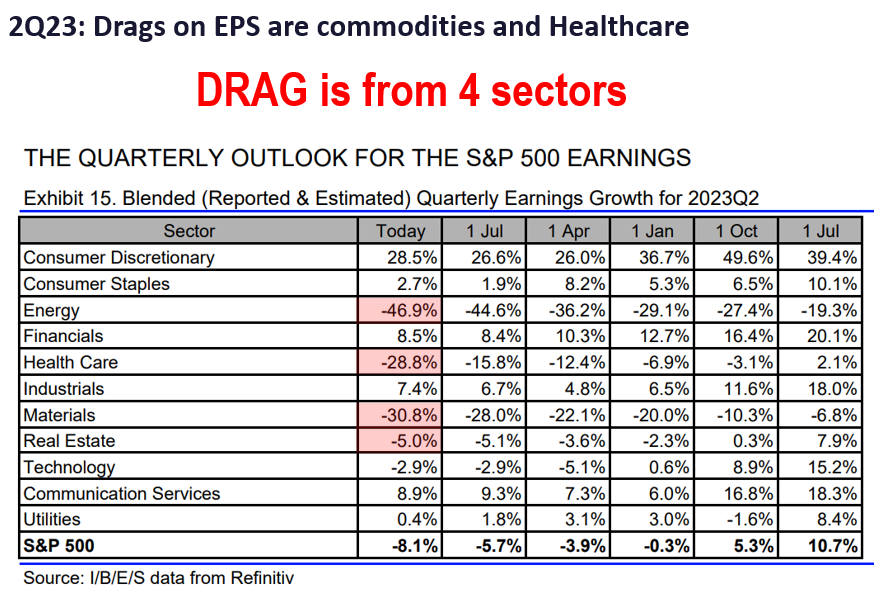

- Bottoms-up consensus is looking for EPS to be down 8.1% YoY. This sounds terrible at first glance, but this negative YoY is due to 4 sectors:

– Energy -47%

– Materials -31%

– Healthcare -29%

– Real Estate -5% - In fact, Cyclical sectors are showing pretty solid YoY growth rates:

– Discretionary +29%

– Comm Services +9%

– Financials +9%

– Industrials +7%

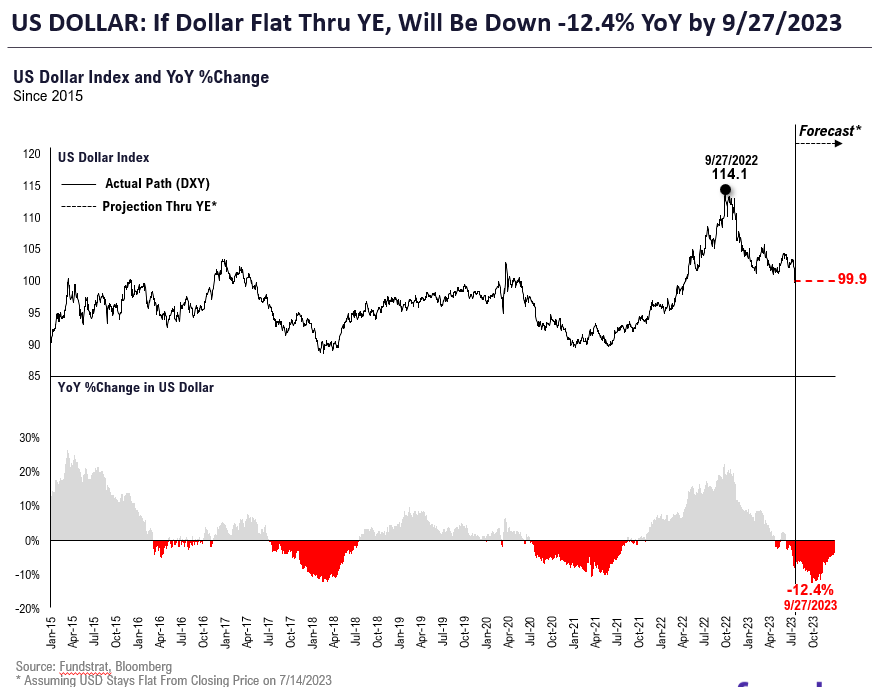

– Technology -3% <– Ok, eh - One source of upside to 2Q23 will be weaker USD, down -8% YoY and should become closer to -10% to -12% YoY for 3Q23. Recall, the surge in USD in 2022 subtracted 5%-7% from EPS results, so this payback should boost results for the next 2-3 quarters. Overall, 2Q23 will likely be the worst of the EPS comparisons (YoY) and we expect earnings to start comparing favorably next quarter.

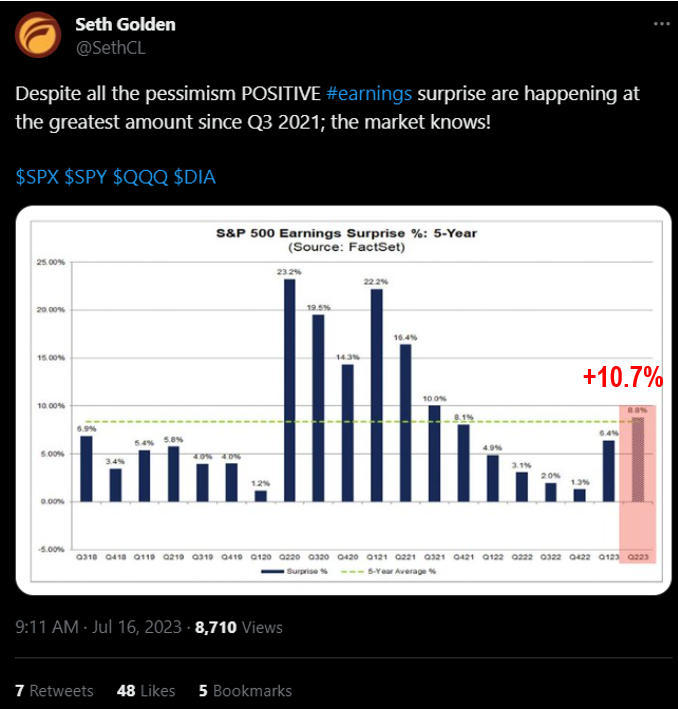

- Only 30 (of 503) S&P 500 reported results so far, but it has been positive.

– 80% are beating results

– overall “beat factor” is +10.7%

– that is the highest since 2021 and that was during the pandemic surge

– the negative/positive preannouncements ratio is 1.6, the best in 4 quarters - Of the 61 companies reporting this coming week, 27 are financials. In other words, banks and financial services will dominate earnings results this week

- Our overall takeaway is that earnings comparisons will start to get easier in the next few quarters due to weaker USD, easier year ago EPS and stabilizing demand (ISM). But this is our best guess and the key will be commentary from CEOs on such an outlook.

BOTTOM LINE: Cyclicals seem the best bet into earnings season, particularly Financials

The S&P 500 closed above 4,505. This is a key level as it represents a Fibonacci 76.4% retracement of the entire 2022 decline from 4,818 to 3,491. And we think this is shattering the thesis of this being merely a “bear market rally”

- The best opportunities ahead of 2Q23 EPS season, in our view, are the Cyclicals. This is where EPS growth rates are positive YoY. And three groups stand out to us:

– Industrials –> due to weaker USD

– Financials –> managing thru tough comps

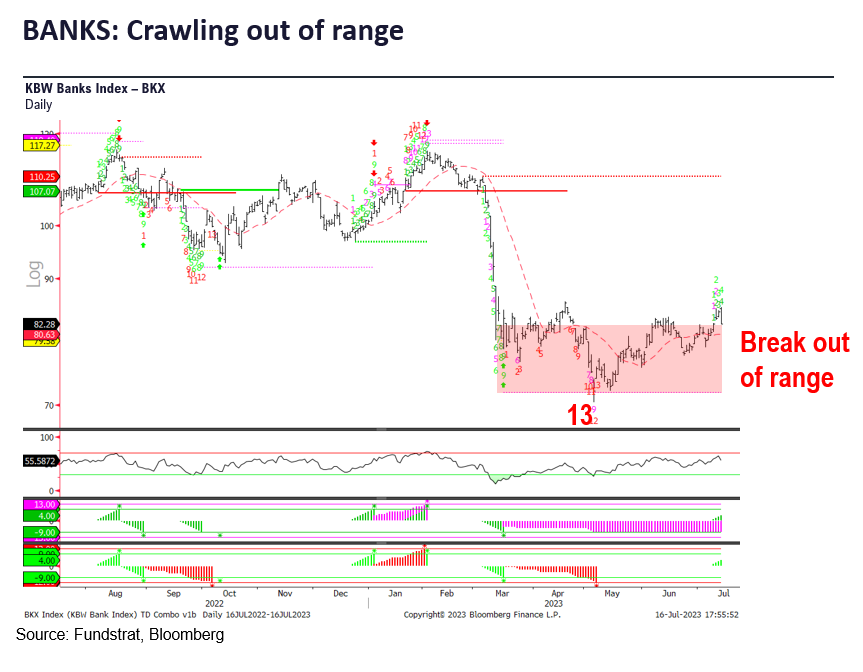

– Technology, as well –> weaker USD - Financials, in particular, seem timely. This group has languished for the better part of 2023 due to the multiple headwinds of:

– Fed higher for longer –> deposit flight + credit risk

– regional bank crisis –> CRE fears and needless “tail risk”

– recession expectations –> credit quality hurt - Thus, as these headwinds diminish somewhat, we expect Financials to outperform.

- We have identified 13 stocks which are Financials and could benefit during earnings season:

– M & T Bank Corp (MTB -0.35% )

– Bank Of America Corp (BAC -0.21% )

– Fifth Third Bancorp (FITB 0.22% )

– Franklin Resources Inc (BEN -0.40% )

– CME Group Inc (CME -0.75% )

– S&P Global Inc (SPGI)

– CBOE Global Markets Inc (CBOE -1.21% )

– Moody’s (MCO 0.25% )

– Ameriprise Financial Inc (AMP -0.22% )

– Intercontinental Exchange In (ICE -0.09% )

– Invesco Ltd (IVZ 1.10% )

– Goldman Sachs Group Inc (GS 1.79% )

– Charles Schwab (SCHW 0.13% )

Some reasons to like banks here

EPS YoY should be bottoming this quarter

Many groups have positive YoY actually…

Beats so far is best since Q3-21 and sort of “early cycle” like

USD is becoming a tailwind

ECONOMIC CALENDAR: FOMC keyin July

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed- 7/17 8:30am July Empire Manufacturing Survey

- 7/18 8:30am July New York Fed Business Activity Survey

- 7/18 10am July NAHB Housing Market Index

- 7/18 Manheim July Mid-Month Used Vehicle Value Index

- 7/20 8:30am July Philly Fed Business Outlook Survey

- 7/25 9am ET May S&P CoreLogic CS home price

- 7/25 10am ET July Conference Board Consumer Confidence

- 7/26 2pm ET July FOMC rates decision

- 7/28 8:30am ET June PCE

- 7/28 10am ET July Final U Mich 1-yr inflation

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

34 Granny Shot Ideas: We performed our quarterly rebalance on 4/26. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– Friday