Stocks’ Continued Strength Bodes Well For 2nd Half

Our Views

Earlier this week, I was speaking with the Director of Research of a major hedge fund (based in CT) and this person told me of their frustration of missing most of the 15% gain in equities YTD. They view the rise as almost entirely attributable to the market liquidity, as their business cycle indicators told them stocks should be down big in 2023.

This is a widely held view. I have previously mentioned that I believe the key story arc is the Fed is fighting an inflation war. Thus, this is not a classic Fed cycle where the Fed only pivots when something breaks. In this inflation war, the Fed can stop when inflation has “broken enough.”

Remember that Volcker ended the inflation war on Oct 5, 1982 (his first ever utterance of ending the war, made in a speech). Here are the inflation stats from Oct 1982 (Sept):

- Headline CPI 3.7% YoY

- Core CPI 4.5% YoY

See the point? The Fed can end this inflation war (aka pivot) when the collective public believes inflation is broken. I don’t know when this moment will arrive. Will it be when shelter/rent prices finally tank in CPI? Maybe. Actually, that is my best guess. That will be sometime in 2023, I expect.

The stock market is beginning to adapt to this view. This, in our view, explains much of the surge in stocks YTD. It also helps that EPS estimates are finally starting to creep higher. In fact, 2Q23 EPS is expected to be +0.1% ex-Energy. The regional PMIs and ISM also seem to be bottoming, so this makes sense. EPS growth finally curling up:

- 4Q22 S&P 500 ex-Energy -7.1%

- 1Q23 -1.7%

- 2Q23 +0.1%

This is the first positive YoY EPS growth (ex-Energy) since 1Q22. And it also shows the low in EPS growth rates was 4Q22 — which is also when the S&P 500 bottomed, in our view.

This is an argument for market breadth to start expanding. In our view, the Fed FOMC rate decision and press conference (yesterday) was essentially a “green light” for financial conditions to ease and for business CEOs to breathe easier – thus, we see these are conditions to allow a greater number of stocks to outperform, beyond FAANG.

- SPX is up against channel high, but pullback will likely prove minimal, for now. Run-up into late June/early July is expected.

- Weekly SPX cycle presented in January Annual Outlook suggested May 2023 bottom before turning back higher for a bullish 2H 2023. When viewing this forecast it is important to note that in equal-weighted terms, SPX was negative for three of the five months before June got underway. Based on my weekly cycle composite work, I suspect that the May bottom occurred on schedule

- Near-term breadth has reached levels near prior highs, but still early to call a peak. I feel that a minor stalling out “could” happen next week, but should prove short-lived and this could rise to even higher levels into July.

- The NDX was the winner for the week, being up 3.8%, and the S&P 500 cap-weighted Tech sector was atop the leaderboard by a wide margin, posting a 4.4% rise. On an intra-sector basis, INTC -0.59% , ORCL 1.10% , HPE -0.17% , NVDA -1.98% . GLW 0.37% , and ADBE 0.11% were all up over 9%.

- The cap-weighted S&P 500 also continued to power higher despite a hawkish tone from the FOMC meeting midweek. The index continued to outperform both the equal-weighted S&P 500 and the Russell 2000, which only posted gains of 2.4% and 0.48%, respectively.

- Thus, the divergences continue between the Magnificent 7, Tech/AI related and the broader equity market, and my work continues to signal that they will persist, especially against more Cyclically related areas notwithstanding tactical relative pullbacks.

- On the macro front, my view remains little changed. As core inflation remains well above the Fed’s target and has not improved much over the past six months, the labor market is showing cracks but remains resilient, the profits of cyclical related areas still look to be high and at risk, and the weakest economic quarters are still likely in front of us. So, there are still several key risks that are still lingering about and should keep investors alert.

- Be on the lookout for an update to my Dunks stock list early next week.

- In response to SEC lawsuits, our strategy to decrease stablecoin allocations to 10% and lower altcoin allocations from 17.5% to 7.5% proved beneficial as altcoins faced significant losses. The current crypto market shows striking divergence, with ETH and BTC dominance at its highest since April 2021.

- The Hinman emails released this week highlight historical inconsistencies within the SEC and suggest that there is an acknowledged gap in regulations as it pertains to crypto. This could serve as a regulatory tailwind.

- Despite equity markets’ surge and crypto’s struggle, Bitcoin’s fundamental link to global liquidity remains intact, shown by its tight correlation with gold and inverse relation with the dollar. With potential weakness in the dollar, this could favor Bitcoin. Our Head of Technical Strategy predicts a technical decline in the US Dollar index, providing potential uplift to emerging markets.

- Recent decoupling of Bitcoin and domestic net liquidity could be due to the lessened impact of US macro factors on Bitcoin amid regulatory pressures or delayed crypto market response to increased market participation. Central bank activities suggest global macro factors may be more influential. Planned stimulus by the PBOC and BOJ, combined with potential Fed pause, could ease global liquidity conditions.

- Core Strategy – Despite the challenging price action and an apparent decoupling from equities, bitcoin’s correlations with gold, the dollar, and global liquidity remain intact. We think most of the damage is done and believe it is right to stay mostly allocated to majors with small allocations to alts as call options on regulatory victories. We see a near-term decline in the dollar and concurrent monetary easing from global central banks to serve as macro tailwinds for BTC and ETH. As we approach bitcoin’s 200-day moving average, we may look to put more capital to work.

- Secretary of State Blinken travels to China months after the spy-balloon incident disrupted earlier plans for his visit to the so-called Middle Kingdom.

- House begins the messy process of writing the federal budget for the next fiscal year, which begins October 1, with more conservative Republicans pushing for spending cuts.

- Conflicting priorities between conservative and moderate Republicans, as well as Democrats, point to the risk of a government shutdown on October 1.

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 continues to march higher in 2023, closing at 4,409.59. It rose 2.58% for the week and is up 14.85% YTD. The Nasdaq climbed 3.25% to 13,689.57 this week (+30.79% YTD), and bitcoin edged higher about 1.64% at $26,351.50.

- It was the fifth straight positive week for the S&P 500, and the index’s best week since March. The Nasdaq also saw its best week since March, up eight weeks in a row.

- A pause from the Fed, along with further evidence of cooling inflation, helped markets rally despite hawkish signals coming from Wednesday’s FOMC meeting.

"An investment in knowledge pays the best interest." — Benjamin Franklin

Good evening:

For months, our Tom Lee has said inflation would fall throughout 2023 and the Federal Reserve would take its foot off the gas. Markets, which are forward-looking, recognized both themes in the first half. In our view, this week functioned as more confirmation of what Lee has been calling since stocks bottomed last October. Don’t look now, but the tech-heavy Nasdaq – technology has been Lee’s top pick all year – is up nearly 31% year-to-date.

Fed week began with inflation data coming in softer than expected, declining for the 11th straight month. Lee and his team looked closely at the data and concluded that the details were better than the headline core figure alone might suggest – and better than expected. With the bulk of core CPI driven by components that use lagging data (specifically, shelter and used cars), Lee concluded that the CPI number “is reflecting inflation pressures that have been gone for some time. Thus, forward inflation is tracking lower.”

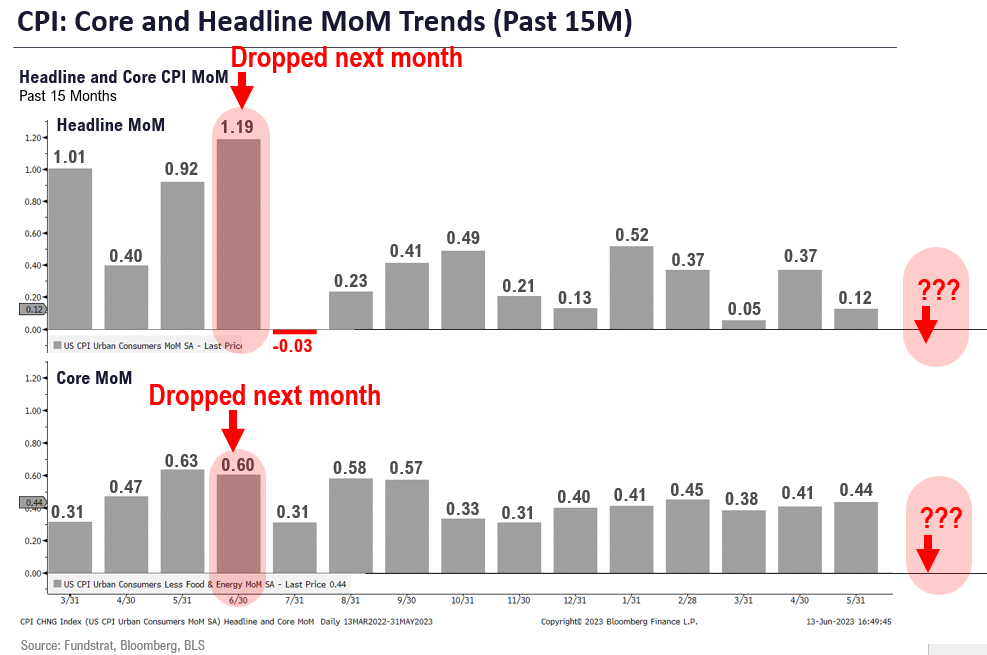

Next month, we expect the 41-year-high CPI reading from back in June 2022 (+1.2% MoM) will result in a significant drop in June 2023 CPI YoY, which could fall to as low as 3.0% vs. May 2023 4.1% YoY. This is illustrated in our Chart of the Week:

Headline inflation is what matters to the public and thus, the White House, and this expected 3.0% reading is what investors will see against a Fed funds of 5.25% now. In our view, this would strengthen the case for a July pause.

Looking ahead, Lee continues to be constructive, viewing the FOMC decision and subsequent press conference as a “green light” for financial conditions to ease, business confidence to improve, and thus, for a greater number of stocks to outperform beyond FAANG. Plus, strong first halves tend to lead to continued strength for the rest of the year, with 2013 (+29.60%) and 2019 (+28.88%) as the most recent examples.

Here are other highlights from Lee this week:

Expansion, not recession possible: Instead of a recession unfolding, it looks like the economy is slipping into an expansion, and that’s because we don’t have a commodity shock. We have businesses that de-stocked starting to restock, and we have things like employment, you know, the tightness kind of cooling off.

Valuations for giants like Apple and Nvidia are OK: As Peter Lynch would say, you don't want to be valuation-sensitive when you buy great companies. There isn't really another Apple out there or another Nvidia. As long as they're central to what's happening, especially AI or the consumer, I don't know if you want to say rate hikes will kill their stories.

Short-term weakness is possible: I think earnings have bottomed...but I think investors need to be wary that nothing goes straight up. There is a chance, of course, a window where there could be a tactical pullback. I think that's a dip (to) buy rather than thinking it's a top.

On the swing from bearish to FOMO: I think these are conditions for profits to actually outperform and at a time when investor positioning is so offside, it’s really been very obvious people have been really cautious. I think they’ve not turned from being bearish to having a bit of FOMO.

Staying risk-on: Our view is that you want to be risk-on this year. We do think we're largely through the worst of this tightening cycle, inflationary pressures are easing pretty quickly, and this is going to set the pathway for earnings to outperform.

Why stocks aren’t overextended: I don’t think stocks are over-extended. I think the FAANGs did the heavy lifting, and I think if we’re slipping into an expansion, a lot of other groups are going to participate.

Notes from our Weekly Huddle

Brian Rauscher, our Head of Global Portfolio Strategy and Asset Allocation, said he’s gradually starting to like more individual names in the market, though he still doesn’t see broad-based opportunities. “I think this has become a year of stock picking, where being in the right stocks – as opposed to just the right areas – would probably pay off,” he suggested.

That’s in contrast to both Lee and Head of Technical Strategy Mark Newton, who have seen improved breadth in recent weeks. At our weekly research huddle, Newton said, “We’ve seen a nice broadening out of this rally in recent weeks, which formerly was largely led by just large-cap tech. It’s now expanded to financials and industrials and discretionary. So that's been a good sign.” The broadening can also be seen in the various indices: “It's nice to see all these indices start to move up together as opposed to it just being a technology rally.”

Newton said, “We've seen a big move in the S&P. The trend has gotten parabolic, and there's a lot of momentum behind this. So it's very difficult to sell until there's really some evidence that markets are starting to peak, and I really do not see that right now. We've just gone straight up and that's obviously a very good thing. I expected markets can rally into about the latter part of June, early July. And then we should get a peak and a pullback.”

Despite the improved market breadth, Newton still likes the sector that has outperformed all year – technology. “I still think tech works really well. A lot of the large-cap technology stocks still look excellent.”

Newton’s views on asset classes outside of U.S. stocks

- European markets: “[ECB President Christine] Lagarde was speaking on Thursday and she was very firm. They’re going to continue hike, hike, hike. So the dollar is really starting to fall apart because the US is sort of wavering as to potentially being at a level where it might pivot, whereas the ECB is not. That's really interesting and has some good implications for European markets.”

- Emerging markets: “Emerging markets are enjoying a very nice breakout that happened about two weeks ago. So this is a really good risk-reward. For owning emerging markets as the dollar rolls over, I think that's going to fuel this trade. I like emerging markets here as one of my top calls.”

- China: “China actually has been coming back in a big way. The PBOC [People’s Bank of China] cut rates, and it's really fueling this thinking that they're going to add stimulus because they really want to catch up. Their whole COVID policy really had some damaging effects on the economy and Xi [Jinping] is really going to try to get the Chinese economy back. So I like China a lot.”

- Copper: “The other thing I like a lot is copper. The commercials have been buying like crazy. If China starts to add stimulus that's really going to eat copper. FCX 4.36% is a way you can participate in that, or perhaps COPX 4.68% , which is the copper ETF.”

Elsewhere

A potential supply-chain crisis has been averted after dock workers reached an agreement with the operators of West Coast ports. With the help of acting Secretary of Labor Julie Su, the International Longshore and Warehouse Union and the Pacific Maritime Association on Wednesday reached a deal that covers employees at all 29 West Coast ports for six years. One immediate benefit of the agreement is that workers will halt a 14-day work slowdown and stoppage that had ports operating at 70% capacity.

China’s central bank cut several rates in an effort to stimulate the country’s economy. Earlier in the week, the People’s Bank of China lowered its 7-day reverse repo rate, the first time it has done so since August 2022. On Thursday, the PBOC followed up with a 10 bp cut to 2.65% on a one-year medium-term lending facility loan to various financial institutions.

Global food prices will likely rise amidst a worldwide decline in food security due to last week’s destruction of the Nova Kakhovka dam, according to United Nations aid chief Martin Griffiths. “This is a breadbasket - that whole area going down towards the Black Sea and Crimea is a breadbasket not only for Ukraine but also for the world,” he pointed out. Ukraine and Russia have each accused the other of deliberately setting off explosions on the dam, which is in Russia-controlled territory. The destruction has also jeopardized clean drinking water for 700,000 people.

The ECB hiked rates by 25bp a day after FOMC day, to 3.5%. The hike in rates to their highest level since 2001 comes despite inflation that is declining – though still high, at 6.1%.

The European Parliament has advanced a landmark Artificial Intelligence Act, the first major legislation regulating Artificial Intelligence and signaling the EU’s desire to lead the global discussion on the issue. The act – 100 pages, 85 articles – includes a ban on the use of “subliminal techniques” to manipulate people, strict rules on AI-powered biometric surveillance, transparency in the use of copyrighted material for AI training, and more.

Solar power was successfully harvested from space and beamed to an earthbound receiver for the first time this week, proof of concept from a satellite prototype launched by the Space Solar Power Project at the California Institute of Technology. The satellite was launched into space on a SpaceX rocket in January and came online Monday, successfully using an array of solar panels to generate electricity and a microwave-based array to send it to the roof of the Gordon and Betty Moore Laboratory of Engineering on Caltech's Pasadena campus – with minimal power loss.

And finally: It’s Beyoncé’s fault, according to some Swedish economists seeking an explanation for the country’s higher-than-expected 9.7% inflation in May. The theory is that the singer’s tour appearances in Sweden sparked such increased demand for hotels, restaurants, and other tourist-related goods and services that the resulting price increases affected inflation statistics.

“Your heart's desire is to be told some mystery. The mystery is that there is no mystery.” ~ Cormac McCarthy (1933 - 2023)

Notice to all readers: U.S. markets and Fundstrat offices will be closed on Monday, June 19, 2023, in observance of Juneteenth. We will resume our regular publishing schedule the following day.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

Est.: 51 Prev.: 50

A gauge of the sales conditions in the national housing market, based on a monthly survey of home builders.

Est.: 258K Prev.: 262K

A statistic measuring the number of new claims for unemployment insurance benefits around the U.S. in the previous week.

Est.: 48.5 Prev.: 48.4

A measure of U.S. manufacturing activity based on questionnaires sent to the purchasing managers of around 800 manufacturers.

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+13.00%

|

+1.82%

|

+109.14%

|

View

|

|

Sector Allocation

|

+11.75%

|

-4.16%

|

+0.90%

|

View

|

|

Brian’s Dunks

|

Performance available here.

|

|||