Our Views

This has been a rough few weeks for equity markets, with the S&P 500 falling 5% from recent highs. Many skeptics are now “top calling” saying the dominant bear trend is resuming. But as our clients know, this is not our take.

- Following several somewhat “hotter” data prints, markets are now moving back into the “higher for longer” camp, and in turn, markets are shifting into risk-off. We think this will prove to be temporary as much of the “hot” inflationary data points stem, in part, from seasonals (Jan issues) and warmer weather (in Jan).

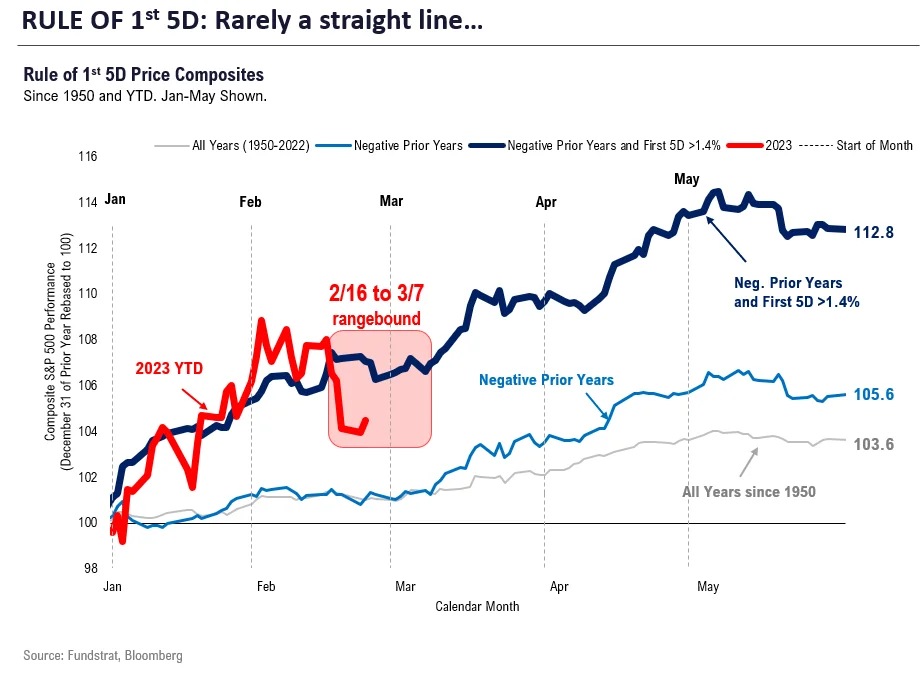

- Stocks have historically consolidated between 2/16 to 3/7 on the heels of strong January gains. So some payback is coming.

Equity markets have become “data reactive,” while the Fed has become “data dependent.” That is, for the past 5 months (since October 2022 lows), investor sentiment and “narratives” have shifted rapidly at each data point, even as the Fed focuses on the larger story arc (which shows inflation slowing.)

The FRB published a study looking at the “demand reallocation shock” of COVID-19. Their study notes that most of the surge in inflation was likely due to pandemic drivers – as much as 3.5% of the rise, or the bulk. What does this mean? Inflation drivers are arguably transitory.

Markets reflexively treat “Fed still set to hike” as a risk-off signal. However, since 1970, of the 14 Fed hiking cycles, only three saw equities fall as the Fed raised rates. The three cycles of “higher Fed funds = falling stocks” were (i) Fed Burns 1973-1974, (ii) Burns 1976-1978 and (iii) Powell 2022-now. Stocks rose during the 11 other Fed hike periods. That means 78% of the time, when the Fed is hiking, stocks are rising. So, a tough Fed doesn’t mean stocks must fall at every hint of an inflation data point.

- SPX pullback has broken its 50% retracement, and the area at 4000-4030 is important. Any failure at holding 4000 would break the 200-day moving average and 61.8% retracement.

- Treasury yields are likely to push higher into next week before stalling and reversing course.

- The U.S. Dollar looks closer to peaking out, and should face resistance near 106 into next week.

- It’s truly important that both U.S. Dollar and rates stop pushing higher for risk assets to turn back up given such a strong negative correlation in both in recent months.

- The S&P 500 continues to struggle as recent economic data releases have caused a dramatic reversal of the dovish Fed hopes that appeared in the first six weeks of the year.

- Based on my research, we are right where we are supposed to be. The main themes that my work has been flagging for quite some time are still relevant, which is the Fed is likely higher for longer, forward profit expectations remain too high, and valuation levels likely need to moderate further.

- My key indicators have not supported the view that a new bull market has begun, but still points to an ongoing bear market that still has unfinished business on the downside.

- Thus, I continue to reiterate that there is considerable risk for equity investors. From a positioning standpoint, I am still recommending having more cash than your norm, a defensive tilt to your sector allocations with some selective offensive secular growth names, and that rallies remain countertrend opportunities to sell into and raise cash, increase downside hedges, or to outright short.

- It was an objectively tough week for the bulls as yields did not roll over as many anticipated, leading to a lack of follow through in the crypto spot market.

- Futures contracts were priced at their highest levels since April of last year, and perp funding rates were at their highest levels since late 2021. Consequently, many traders were caught offsides.

- The market continued to reprice rates higher this week on the back of continued hawkish sentiment from the Fed and relatively hot inflation data. The market is notably no longer pricing in rate cuts for 2023.

- After examining hourly returns, we note that BTC has underperformed during Asian trading sessions in comparison to US trading hours since the start of this year. However, we posit that this does not negate the positive tailwinds that BOJ and PBOC liquidity provide to the crypto market.

- We maintain the asymmetry form here remains to the upside in 1H and that this dip is worth buying. The lack of retreat in crypto prices relative to the increase in yields over the past few weeks is quite impressive. We think this is a function of investor composition, improving global liquidity conditions, and a market for risk assets that has already experienced the worst of the ongoing tightening cycle.

- The January inflation numbers, combined with the release earlier in the week of the minutes from the FOMC meeting on 1/31-2/1, point toward another rate increase when the FOMC meets next month on March 20/21.

- Chair Powell has done a good job of telegraphing policy and not surprising markets, and both his remarks and the February minutes point toward another increase.

- The Fed Chair has made clear that their decisions are data driven, but today it appears all the tea leaves point of another 25bps increase in March.

- The next key date in the debt-ceiling talks will be March 9, when President Biden unveils his federal budget for the 2024 fiscal year (which begins October 1.)

Wall Street Debrief — Weekly Roundup

Key Takeaways

- The S&P 500 closed at 3,970.04, falling 2.7% this week, and the Nasdaq finished the week at 11,394.94, down 3.3% on the week. Bitcoin fell about 5%.

- All told, it was the worst week for the stock market since Dec. 9.

- Though the next few weeks could remain choppy, Tom Lee and Mark Newton remain constructive on equities for the year.

“I haven’t the faintest idea as to whether stocks will be higher or lower a month or a year from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over.”

Warren Buffet, 2008

Good evening:

In recent weeks, many stocks have fallen, spooking investors that maybe 2023’s hot start won’t last. Tom Lee has acknowledged that gains will be limited in the short run into March. But there’s no thesis change to his bullish 2023 outlook: Inflation will cool into the summer. Said Lee this week:

“If you look at the 14 rate cycles that lasted more than 12 months, 11 out of the 14, markets rallied into highs with the hikes. The two exceptions were (under Arthur F. Burns, 1970-78) who was higher in a hurry. Once (Paul) Volcker became fed chair, hikes were associated with higher stock prices. With (Alan) Greenspan, there were five cycles of his raising. Five of five times markets marched higher to all-time highs.

“So, unless Powell is invoking his inner Burns, I think the stock market is going to appreciate data dependence,” Lee added.

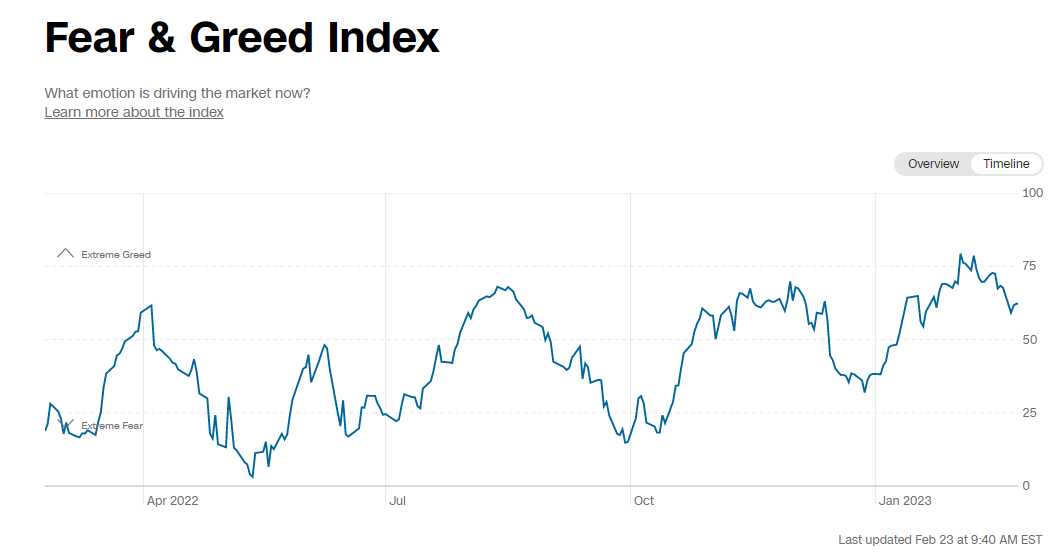

At our weekly research huddle, Mark Newton noted that ever since stronger-than-expected retail sales and CPI numbers, “the narrative changed for the market and everybody said, ‘Well the economy is a lot stronger and the Fed’s going to have to hike for longer.’”Newton, Head of Technical Strategy, noted that the equity put-to-call ratio has reached the year's highest levels, at 0.80. “Fear and Greed has backed off pretty sharply too,” he said. “We were at pretty optimistic levels. Arguably, it's still mid-range, but it's not nearly what it was. There had been a big diversion between overall long-term and short-term sentiments. Short-term sentiment got optimistic earlier in the year. Now that seems to have retreated.”

Newton concluded that from a technical standpoint, the recent softness “really hasn't been all that damaging. Up trends are still very much intact, and we're still above the 200-day moving average today. If you want to have confidence, you wait until we get over 4060. That's going to be a very bullish sign. I think that's going to happen in the next week. A lot of this though, it does depend on rates and the dollar [which touched a seven-week high on Friday] starting to pull back.”

Newton also noted energy stocks should be close to bottoming. “I like energy, I like healthcare,” he said. “Counter-trend trades like energy and healthcare will look much better in the months to come.”

He said sentiment has grown too negative, treasuries should rally, meaning yield should fall and stocks should rally again in March. Ken Xuan, Head of Data Science, concurred. “We are still constructive on the market,” he said. “February was expected to be choppy, especially after strong gains in January.”

Other notes from Newton:

- S&P could reach 4200, maybe even last August’s high of about 4325.

- Weekly momentum and breadth, which refers to how many stocks participate in a given move, is in good shape.

- While many investors anticipate higher rates to drive stocks lower, Newton said: “I like to take the other side of that. Any further pullback that causes sentiment to get even more bearish (will) create a really good opportunity.”

- Other favorites: Technology, semiconductors

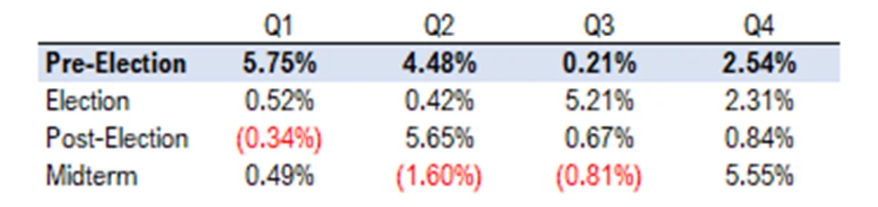

As a reminder, the first half of pre-election years historically is strong.

Elsewhere

The winter has been mercifully mild in Western Europe amidst a natural gas shortage sparked by sanctions against Russia, leading to nearly full stockpiles and falling wholesale gas prices. Worried stakeholders are now looking forward. Many of the tactics EU nations used to prepare for this winter will be unavailable if the war is ongoing next winter.

President Biden has nominated the former CEO of Mastercard, Ajay Banga, to lead the World Bank. If confirmed, Mr. Banga would replace David Malpass, who is resigning after coming under fire for his views on climate change. The India-raised Banga is noted for his in-depth knowledge of the digital economy and the challenges developing economies face.

Sixty-one UK companies and their 2,900 employees have been experimenting with a four-day work week for the past six months, and 56 of them reported that it had worked well enough to justify continuing to experiment with the unorthodox schedule. The study’s sponsors said most participating organizations reported no decline in revenues or productivity.

By the way, we’d like your feedback. How are you enjoying this weekly roundup? We read everything our members send and make every effort to write back. Please email thoughts and suggestions to inquiry@fsinsight.com

Important Events

Est.: 108.5 Prev.: 107.1

Based on a survey of consumer attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates.

Est.: 47.8 Prev.: 47.8

Measures the performance of the manufacturing sector, based on a survey of 600 industrial companies.

Est.: 48.0 Prev.: 47.4

Measures economic activity in the manufacturing sector based on a survey of purchasing and supply executives nationwide.

FS Insight Media

Stock List Performance

| Strategy | YTD | YTD vs S&P 500 | Inception vs S&P 500 | |

|

Granny Shots

|

+7.24%

|

+1.40%

|

+102.99%

|

View

|

|

Sector Allocation

|

+11.75%

|

-4.16%

|

+0.90%

|

View

|

|

Brian’s Dunks

|

Performance available here.

|

|||