A daily market update from Fundstrat — what you need to know ahead of opening bell

“We must build dikes of courage to hold back the flood of fear.” ~ Martin Luther King, Jr.

Overnight

Pension funds are pulling $325 billion from stocks, some turn to bonds or private markets after major indexes’ run to records (WSJ)

BBC analysis concludes that Russia’s military death toll from its invasion of Ukraine has surpassed the 50,000 mark. (BBC)

Vietnam has reportedly launched a $24 billion bailout of Saigon Commercial Bank, endangered by embezzlement by disgraced property tycoon Truong My Lan. (RT)

Norway’s sovereign wealth fund, world’s largest, posts $110 billion in first-quarter profit as tech stocks surge (CNBC)

Mike Johnson Defies GOP Critics, Setting Up Ukraine-Israel Aid Showdown (WSJ)

Senate rejects impeachment articles against Mayorkas (AP)

Tesla asks shareholders to approve Texas move and restore Elon Musk’s $56B pay (Ars Technica)

US Dept. of Transportation watchdog is auditing the FAA’s oversight of Boeing (Semafor)

Shares of ASML sank after disappointing net bookings, but the company forecasts a 2H rebound (FT)

Climate change may cost $38 trillion a year by 2049, study says (Axios)

Jane Street made $4.4B in trading revenue in Q1 (FT)

TSMC beats first-quarter revenue and profit expectations on strong AI chip demand (CNBC)

German police arrest suspected Russian spies over bombing plan (FT)

Indonesian volcano eruption forces evacuations, airport closure (RT)

Eli Lilly reported that its weight-loss drug Zepbound showed promises as a treatment for sleep apnea in late-stage clinical trials. (CNBC)

The Supreme Court unanimously ruled that an employee who is forcibly transferred can sue for discrimination even if their employers did not demote them or lower their pay (AP)

Oil prices fall more than 3% as traders discount Iran-Israel war risk. (CNBC)

Mistral, an OpenAI Rival in Europe, in Talks to Raise Capital at a $5 Billion Valuation (The Information)

StubHub, a well-known ticket reseller, is reportedly hoping to go public sometime this summer, eyeing a valuation of $16 billion. (Billboard)

First news

- President Biden announced plans to request a tripling in tariffs on Chinese steel while visiting Pittsburgh.

- Record rainfall in Dubai caused widespread flooding and chaos, even droughts brought an entirely different set of troubles part of Latin America and southern Africa.

- Bountiful wheat harvests around the world are likely to result in eroded profits for American farmers this season.

- A former Boeing engineer appeared before a Senate panel, testifying to purportedly dubious shortcuts that put passenger safety at risk.

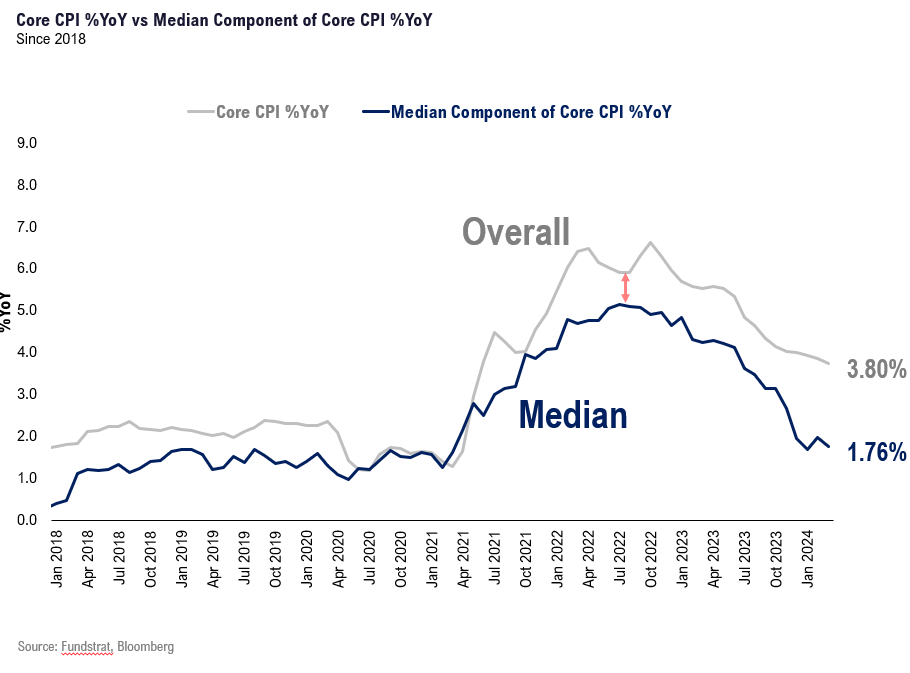

Chart of the Day

MARKET LEVELS

| Overnight |

| S&P Futures +6

point(s) (+0.1%

) overnight range: -0 to +22 point(s) |

| APAC |

| Nikkei +0.31%

Topix +0.54% China SHCOMP +0.09% Hang Seng +0.82% Korea +1.95% Singapore +1.05% Australia +0.48% India -0.72% Taiwan +0.43% |

| Europe |

| Stoxx 50 +0.26%

Stoxx 600 +0.11% FTSE 100 +0.2% DAX -0.03% CAC 40 +0.37% Italy -0.01% IBEX +0.73% |

| FX |

| Dollar Index (DXY) -0.05%

to 105.9 EUR/USD -0.01% to 1.0672 GBP/USD +0.15% to 1.2473 USD/JPY +0.01% to 154.4 USD/CNY +0.01% to 7.2392 USD/CNH +0.08% to 7.2501 USD/CHF -0.19% to 0.9091 USD/CAD -0.12% to 1.3756 AUD/USD +0.12% to 0.6443 |

| Crypto |

| BTC +1.13%

to 61540.36 ETH +1.04% to 3002.88 XRP -0.1% to 0.4902 Cardano +0.34% to 0.4442 Solana -1.42% to 129.97 Avalanche +0.73% to 33.85 Dogecoin -1.57% to 0.1444 Chainlink +0.36% to 13.16 |

| Commodities and Others |

| VIX -0.05%

to 18.2 WTI Crude -0.7% to 82.11 Brent Crude -0.63% to 86.74 Nat Gas +3.21% to 1.77 RBOB Gas -0.72% to 2.709 Heating Oil -1.06% to 2.547 Gold +0.81% to 2380.24 Silver +0.87% to 28.47 Copper +1.76% to 4.416 |

| US Treasuries |

| 1M -6.2bps

to 5.3237% 3M -3.7bps to 5.3641% 6M -1.9bps to 5.339% 12M -1.1bps to 5.13% 2Y -1.0bps to 4.922% 5Y -1.6bps to 4.5989% 7Y -1.6bps to 4.5887% 10Y -1.6bps to 4.5711% 20Y -1.5bps to 4.8073% 30Y -1.2bps to 4.6878% |

| UST Term Structure |

| 2Y-3

M Spread narrowed 1.2bps to -49.2

bps 10Y-2 Y Spread narrowed 0.6bps to -35.3 bps 30Y-10 Y Spread widened 0.4bps to 11.5 bps |

| Yesterday's Recap |

| SPX -0.58%

SPX Eq Wt -0.21% NASDAQ 100 -1.24% NASDAQ Comp -1.15% Russell Midcap -0.47% R2k -0.99% R1k Value -0.21% R1k Growth -0.9% R2k Value -0.78% R2k Growth -1.2% FANG+ -1.29% Semis -3.08% Software -0.79% Biotech -1.12% Regional Banks +0.17% SPX GICS1 Sorted: Utes +2.08% Cons Staples +0.45% Materials +0.21% Fin +0.2% Comm Srvcs -0.12% Healthcare -0.18% Energy -0.34% Indu -0.57% Cons Disc -0.57% SPX -0.58% REITs -0.8% Tech -1.71% |

| USD HY OaS |

| All Sectors +6.6bp

to 373bp All Sectors ex-Energy +6.5bp to 357bp Cons Disc +6.3bp to 308bp Indu +6.7bp to 263bp Tech +7.5bp to 467bp Comm Srvcs +4.3bp to 642bp Materials +9.7bp to 326bp Energy +7.3bp to 289bp Fin Snr +6.6bp to 338bp Fin Sub +4.5bp to 244bp Cons Staples +5.8bp to 326bp Healthcare +7.1bp to 427bp Utes +6.6bp to 233bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 4/18 | 10AM | Mar Existing Home Sales | 4.2 | 4.38 |

| 4/18 | 10AM | Mar Existing Home Sales m/m | -4.11 | 9.5 |

| 4/23 | 9:45AM | Apr P S&P Manu PMI | n/a | 51.9 |

| 4/23 | 9:45AM | Apr P S&P Srvcs PMI | n/a | 51.7 |

| 4/23 | 10AM | Mar New Home Sales | 675.0 | 662.0 |

| 4/23 | 10AM | Mar New Home Sales m/m | 2.0 | -0.3 |

| 4/24 | 8:30AM | Mar P Durable Gds Orders | 2.5 | 1.3 |

MORNING INSIGHT

Good morning!

While this selloff, over the past few weeks, has been painful, it is creating some attractive entry points. We normally like to buy dips, but the surge in the VIX is acting as a short-term headwind and prompting de-leveraging. So we want to be extra careful in the short-term.

Our view for the rest of the year remains constructive.

Click HERE for more.

TECHNICAL

- US Equities look to be nearing a low based on Structure, breadth, momentum, and cycles.

- Breadth gauges like McClellan Oscillator have fallen to the lowest levels since March 2023.

- Percentage of SPX names above their respective 20-day moving average has reached Single Digits.

- The period between Thursday and next Monday should be important in providing a low to stock indices and potentially Treasuries.

Click HERE for more.

CRYPTO

The recent market drawdown, driven by geopolitical tension, tax-related selling, and surges in real yields, has altered our view on the immediate-term risk/reward (measured in weeks), necessitating a more deliberate approach to the market.

Over the intermediate/long-term, this recent weakness will prove to be a great buying opportunity. However, given near-term uncertainties, we recommend increasing the proportion of BTC relative to altcoins, anticipating a rise in BTC dominance. Additionally, we advise reallocating a portion of our underperforming altcoins into stablecoins.

Click HERE for more.

FIRST NEWS

Blue Steel. Campaigning in the swing state of Pennsylvania, President Biden announced his intention to ask U.S. Trade Representative Katherine Tai to triple current Trump-era tariffs on Chinese steel — currently averaging around 7.9% – and aluminum. Observers immediately seized on the obvious political motivation. Steelmaking no longer has its historical dominance in the economy of Western Pennsylvania, but Biden’s announcement came as he was due to address the United Steelworkers union in Pittsburgh – which is still called “the Steel City” for a reason. (The union endorsed Biden in March.)

Biden and his staff, of course, are framing the stance as good for the economy and the nation. Dr. Jared Bernstein, head of the White House Council of Economic Advisers, described domestic steelmaking as “one of our most critical sectors — what the president calls the backbone of the American economy, the bedrock of our national security.” Some suggested that the proposed tariffs and higher steel prices could contribute to higher manufacturing costs, and thus, higher inflation, but Dr. Bernstein disagreed. “This is a targeted intervention that shouldn’t have much impact at all on inflation.”

Biden’s proposal is consistent with recent policies regarding steel and China. He has publicly voiced opposition to the proposed $14.9 billion acquisition of U.S. Steel by Japan’s Nippon Steel, and he repeated his opposition in vowing to block the deal in a speech to the steelworkers union on Wednesday. He and his advisers have also criticized China for what National Economic Council Director Lael Brainard described as China’s “policy-driven overcapacity” in steel and other manufactured products. (Reuters)

Not just a dry heat. Dubai, located in the middle of the desert, was not built with the expectation of heavy rainfalls. So the city was understandably taken by surprise after the UAE saw its heaviest rainfall on record, with some areas receiving as much as 10 inches of rain in a 24-hour period – more than double the city’s average annual rainfall.

Dubai’s streets, not constructed with a surfeit of drainage capacity, flooded, with water rushing into shopping malls and homes. Flights were canceled at Dubai International (the second-busiest airport in the world after Atlanta’s Hartsfield-Jackson), and schools were closed as the entire region – including Oman and southeastern Iran grappled with unusually wet weather.

UAE officials denied speculation that the rains had been caused by cloud-seeding, a practice in which the country routinely engages. Instead, climate experts attributed the unusual strength of the storm to climate change, with warmer temperatures causing the air to store and release more moisture.

If Dubai got more water than it can handle, some countries in Latin America have the opposite problem. Ecuador has begun rationing electricity in major cities like Quito in response to a drought depleting reservoirs and limiting output at hydroelectric plants, which produce about 75% of the country’s power. Meanwhile in Bogota, Colombia, about 685 miles northeast of Quito along the Pacific Coast, the city’s reservoirs are at their lowest in 40 years, forcing authorities to implement 24-hour water shutoffs to neighborhoods on a rotating basis and urging residents to curtail bathing. (CNBC, Yahoo! News, AP, Guardian)

Amber waves. Water isn’t the only thing that is simultaneously in oversupply and undersupply, depending on geography. Amidst a drought in Southern Africa that could turn out to be one of the word in decades, grain crops have failed en masse in Zimbabwe, Zambia, Mozambique, and Malawi, leading to fears of a potential famine. The World Food Program estimated that 13.6 million people are currently experiencing crisis levels of food insecurity in the region.

Here in the United States, however, wheat farmers are facing a problem of a very different sort. Winter wheat farmers are anticipating one of their best crops in years, but similarly plentiful harvests from the Black Sea and from Europe have caused global wheat prices to plummet, meaning that those bountiful American wheat harvests might end up leading to loss-making season nonetheless. (BBC, RT)

“Not going”? Concerns about the safety of Boeing aircraft (or perhaps lack thereof) took center stage on Capitol hill as whistleblower Sam Salehpour, formerly an engineer at Boeing, testified before the Senate Homeland Security and Governmental Affairs Committee’s investigations subcommittee. Perhaps unconsciously alluding to the jeer “If it’s Boeing, I’m not going” that arose after Boeing 737s crashed in 2018 and 2019, Salehpour told reporters before the hearing he would not trust the safety of his own family to a Boeing 787.

Salehpour asserted that Boeing is taking shortcuts that would compromise safety and durability – shortcuts that purportedly include having workers jump up and down on pieces of the fuselage to make the misaligned parts fit, thus sometimes creating gaps larger than the 0.005-inch maximum (roughly the thickness of a single strand of human hair) set by the company. He asserted that “at 35,000 feet, details that are the size of a human hair can be a matter of life and death.”

Boeing had previously said that its 0.005-inch standard was “hyper-conservative” and that exceeding that limit would not compromise safety. (Vox)

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In c8d105-4c006e-6639cc-f19309-510c05

Already have an account? Sign In c8d105-4c006e-6639cc-f19309-510c05