Please CLICK HERE to download the December sector allocation report in PDF format.

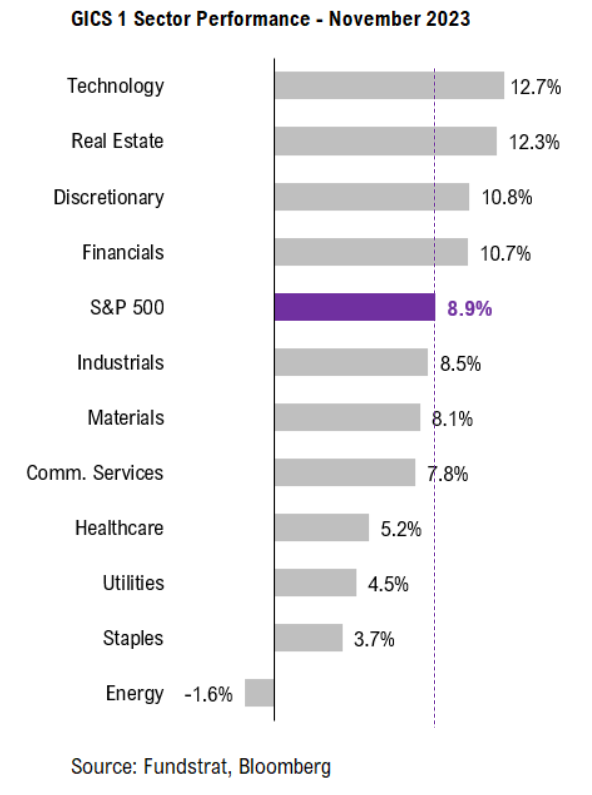

After experiencing three consecutive months of decline in August, September, and October, the market sharply rebounded in November by 8.9 percentage points. This marked the best monthly performance of 2023, not only erasing the losses from August to October but also reaching the highest closing price of the year on the first trading day of December.

Sector-wide, the cyclical sectors generally led during the rebound. Technology, Consumer Discretionary, Financials were up by 12.7%, 10.8%, and 10.7%, respectively. Real Estate also performed well, increasing by 12.3%, only second to the leading technology sector. On the laggard side, Energy was the only sector that declined in November. Apart from Energy, defensive sectors generally trailed others, with Healthcare, Utilities, and Consumer Staples “only” increasing by 5.2%, 4.5%, and 3.7%, respectively.

November Market Performance

Sorted by Best to Worst

Sector ETF Allocation

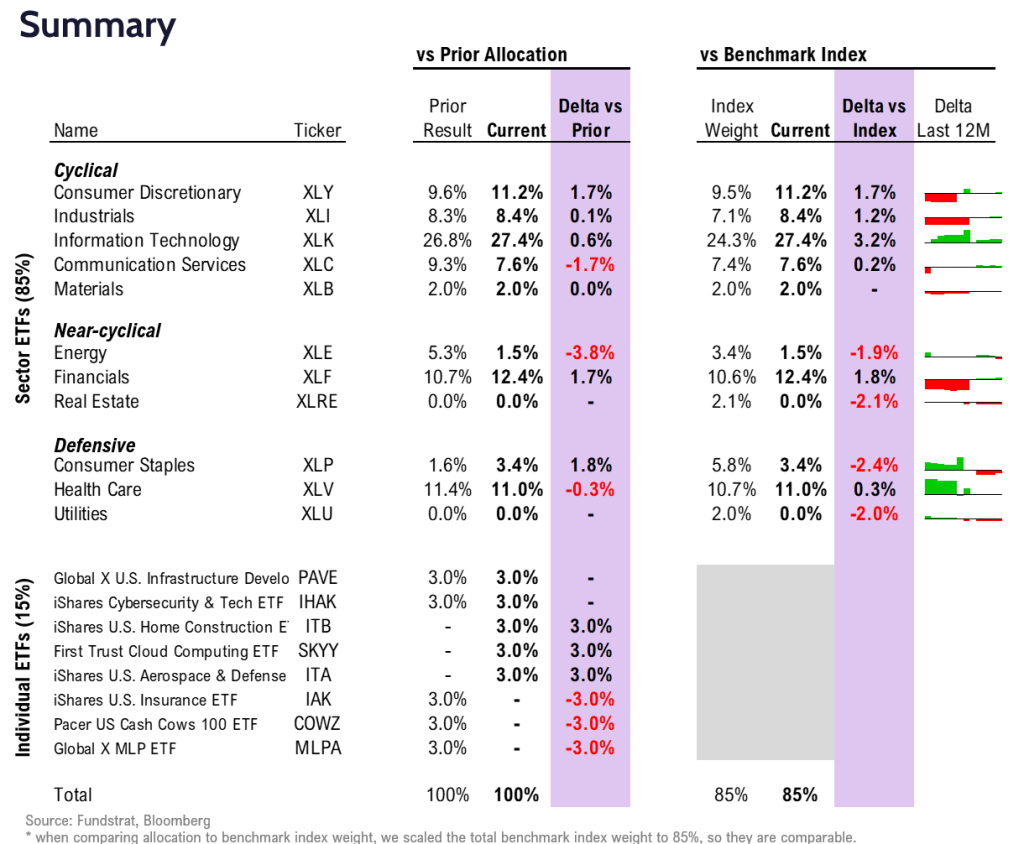

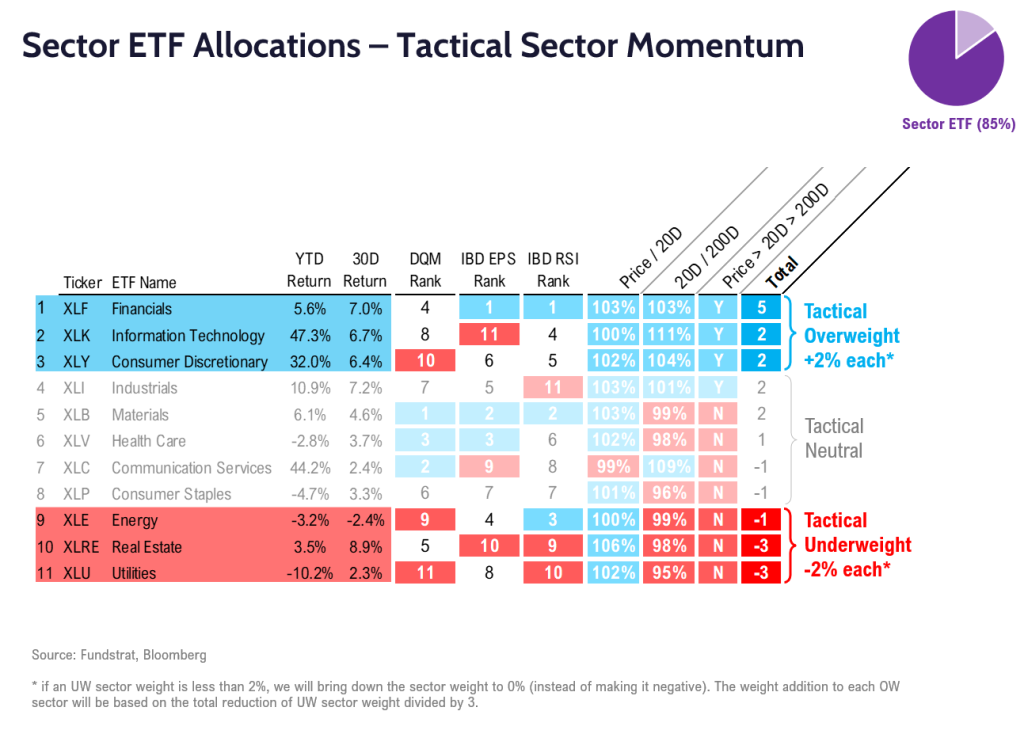

Below is the high-level summary of the December Sector Allocation result.

Summary of December Sector Allocation (Slide 3)

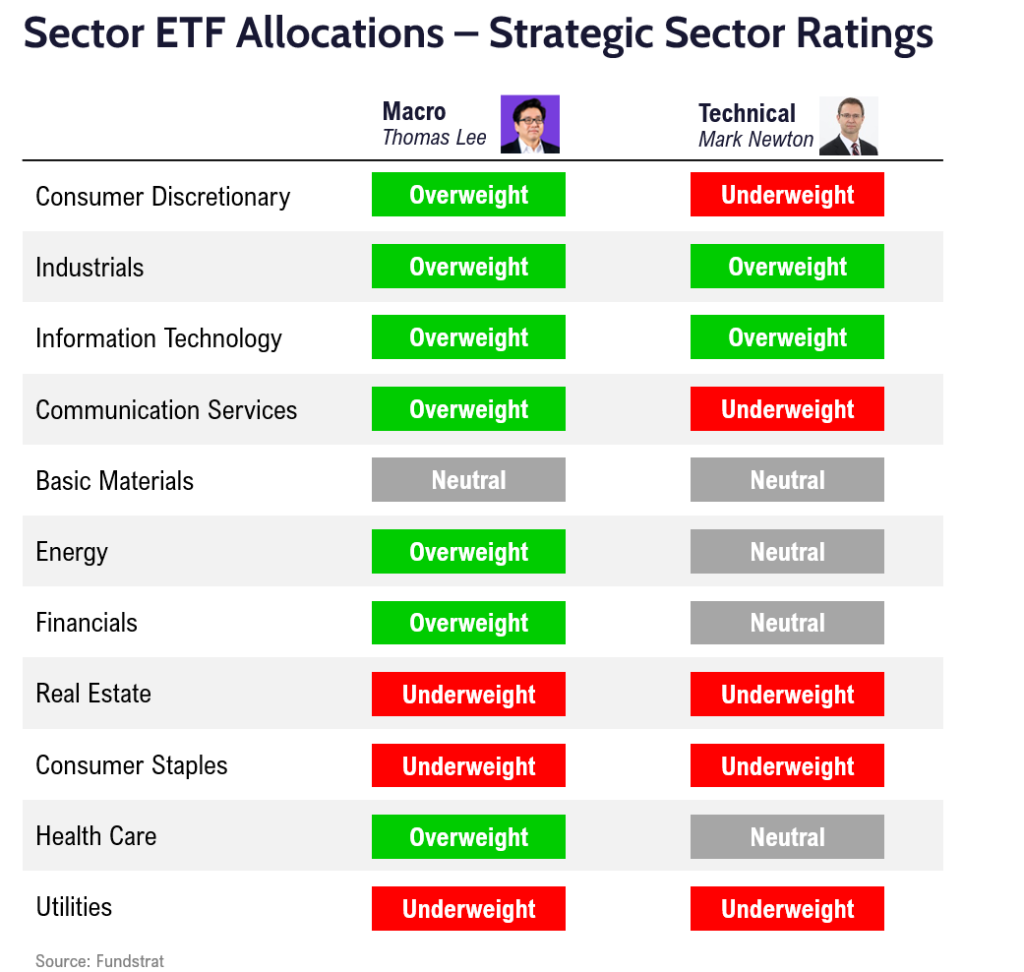

Sector Ratings

As we near the end of 2023, our research heads are dedicated to refining their 2024 outlook reports. To avoid spoilers, no changes have been made to the sector ratings in this update. For the latest market insights and complete sector update from our research heads, please click HERE to register and attend Tom Lee’s 2024 outlook webinar this Thursday at 1 PM ET, and HERE for Mark Newton’s 2024 Technical Outlook webinar next Thursday at 2 PM ET.

Sector Ratings (Slide 5)

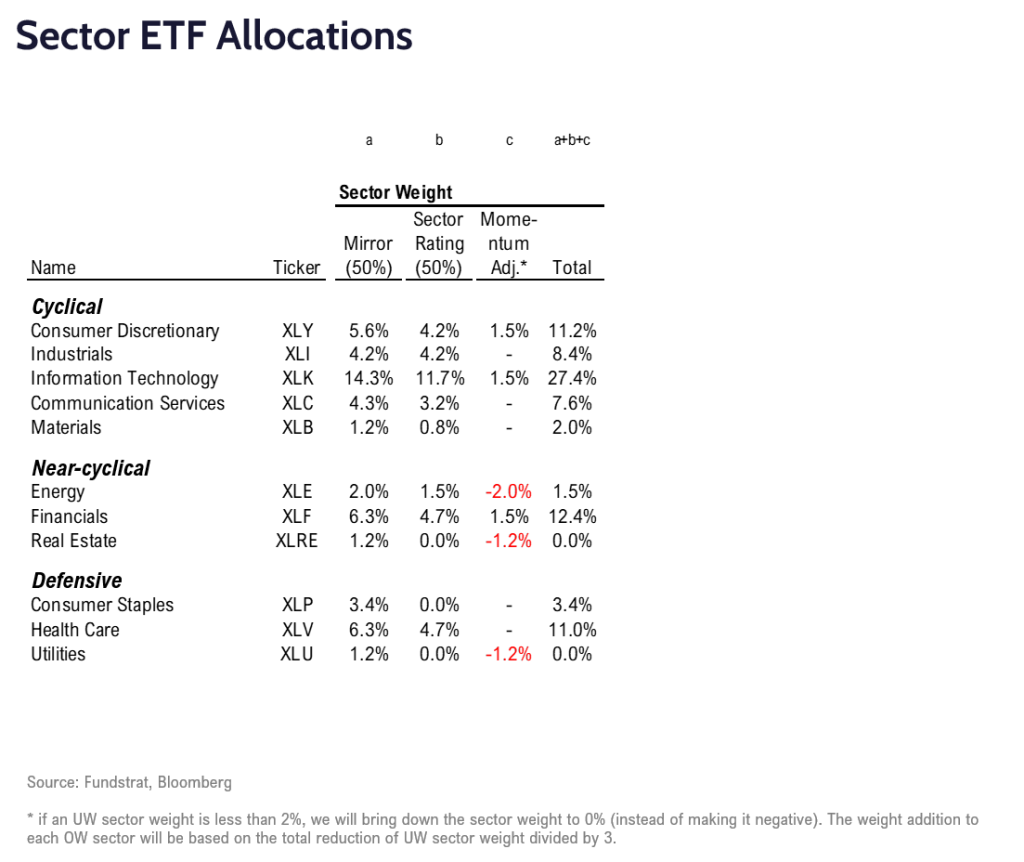

Momentum Adjustment

Since there were no changes in Sector Ratings, the main alterations compared to the November sector ETF allocation stem from Momentum Adjustments. Recall that the final allocation of sector ETFs is composed of three parts: Index Mirror (50%), Sector Ratings (50%), and increasing the weight of the top 3 momentum sectors while lowering the bottom 3.

- Notably in December update, the Energy sector’s momentum metrics score significantly decreased, shifting from “Tactical Overweight” to “Tactical Underweight.” Consequently, its weight was reduced from 5.3% in November to 1.5% in December. However, this is a short-term momentum-based adjustment; no changes have been made to the medium-to-long-term sector rating by our research head.

- Apart from Energy, the Communication Services sector was also downgraded from “Tactical Overweight” to “Tactical Neutral,” with its extra weight due to momentum adjustment being withdrawn, resulting in a 1.7% decrease.

- Financials and Consumer Discretionary, buoyed by strong performance in November, replaced Energy and Communication Services as “Tactical Overweight,” with their weights increased by 1.5%, respectively.

- Technology, Real Estate, and Utilities saw little change in the momentum matrix. Technology remains “Tactical Overweight” and is our most overweighted sector overall (vs. benchmark index). Real Estate and Utilities remain at the lower end of the momentum matrix. Despite strong performance in November, Real Estate scores low in other trend measurements like IBD scores, keeping it “Tactical Underweight.”

Three Components of Sector ETF Allocation (Slide 35)

Tactical Sector Momentum Matrix (Slide 38)

Individual ETF Picks

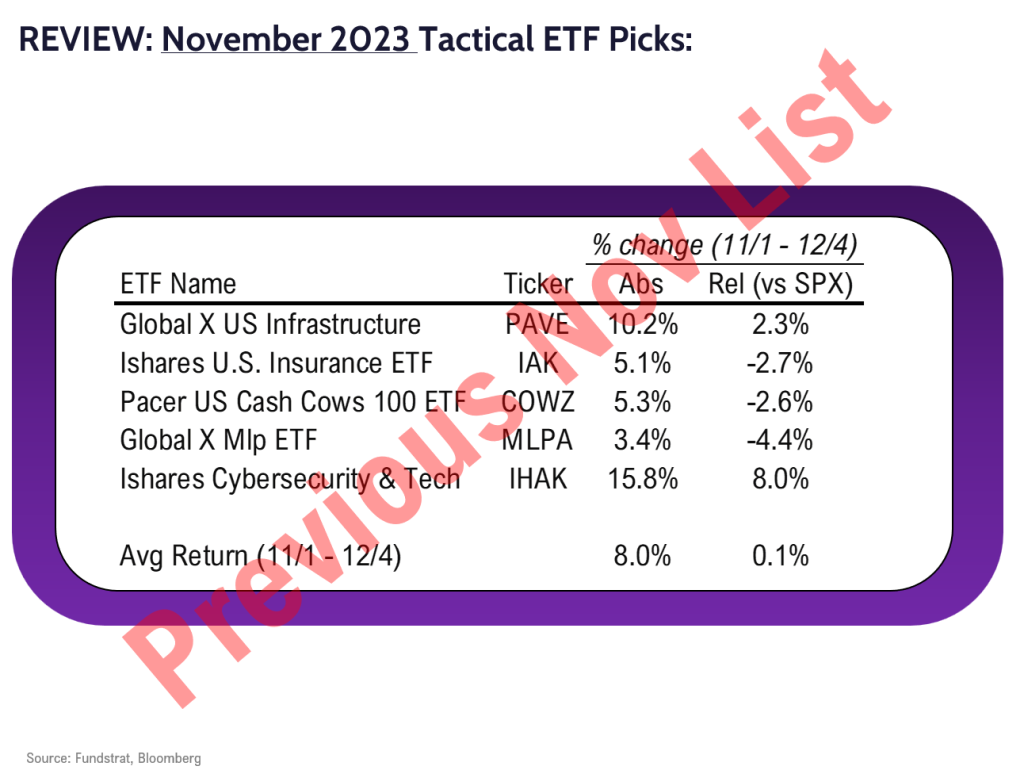

Since the November sector allocation update, our ETF picks have generally performed in line with the market, slightly outperforming it. IHAK 1.06% and PAVE 0.98% outperformed the market by 8.0% and 2.3%, respectively, while IAK -1.31% , COWZ 0.29% , MLPA 0.54% trailed.

November Individual ETF Selection Performance (Slide 18)

In December, we have made some adjustments to our recommended ETFs. We decided to remove IAK -1.31% , COWZ 0.29% , MLPA 0.54% , while adding ITB 1.19% , SKYY, ITA 0.40% . PAVE 0.98% and IHAK 1.06% will remain in our recommendation list.

- IAK -1.31% and COWZ 0.29% , despite both being up more than 5% in November, still trailed the overall market by more than 200 basis points. MLPA 0.54% , affected by the broader backdrop and although outperforming the Energy sector index, was temporarily removed from our recommendation list for re-evaluation later.

- ITB 1.19% was added mainly due to its good technical momentum and the historical seasonal trend (golden 6 months for home builders). SKYY was included for its strong momentum and being in an early stage, while ITA 0.40% is attractive following its breakout to new 2023 highs and could benefit from rising geopolitical risks. For more technical commentary, please see the sector details below.

December Individual ETF Selections (Slide 21)

Technical Takes from Head of Technical Strategy, Mark Newton.

Global X Infrastructure Development (PAVE 0.98% )

PAVE’s consolidation from August to October failed to do damage to its intermediate-term trend and its quick rebound has carried this back to within striking distance of new all-time highs. An upcoming test of resistance near $32.66 is likely and movement above would be quite constructive towards expecting that this rally could continue, with initial upside targets found at $34.20. However, until/unless PAVE’s intermediate-term trend gives way, pullbacks should serve as a buying opportunity for rallies higher and longer-range targets near $41. Overall, this infrastructure development ETF is part of the industrials group which is one of the best technical sectors to favor heading into 2024.

iShares Cybersecurity & Tech (IHAK 1.06% )

IHAK’s progress in recent weeks has helped to bolster its technical attractiveness, and this ETF has regained more than 61% of the decline from 2021. This recent surge in momentum is helpful to IHAK’s intermediate-term progress, and I suspect that this Cybersecurity and Tech ETF can likely continue to gain ground up to targets near $45 with an eventual challenge of 2021 peaks just above $48.50. Near-term overbought conditions might require consolidation before this can gain much further ground. However, any decline to $40-$41 would help this reach an attractive level of support which would make this an appealing risk/reward. Bottom line, the acceleration in recent weeks is a constructive technical sign and should make dips buyable in the weeks ahead.

iShares US Home Construction ETF (ITB 1.19% )

Last week’s close at new 2023 highs should help drive some acceleration in ITB, and while this rally might require consolidation if/when interest rates start to turn back up in the weeks to come, it’s difficult to fade ITB at new all-time highs. Technical targets lie initially at $97, with movement over this allowing prices to likely rise too $113.85 which would allow the rally from 2022 to equal this latest rise from October 2023. Seasonally speaking the Homebuilder group remains in a sweet-spot for gains, and the prospects of Treasury yields beginning a larger decline into 2024 bodes well for this group to continue higher in 2024.

First Trust Cloud Computing ETF (SKYY)

The First Trust Cloud Computing ETF’s weekly close over $82 has carried this to the highest levels since April 2022. This is a bullish development and has helped the stock break out of its Ichimoku cloud which had held gains, as SKYY had largely been consolidating since last Spring before turning up to hit new 52-week highs. Momentum is positively sloped but not meaningfully overbought, and gains up to $95 look likely, which could allow for resistance to appear after further rise in the weeks/months ahead. DeMark signals remain early to suggesting any type of weekly exhaustion, and as such this breakout should be respected and considered a bullish technical development which can help SKYY continue higher. Upside targets lie briefly near $87 but movement over this should allow SKYY to rise to Fibonacci targets near $94.

iShares US Aerospace & Defense ETF (ITA 0.40% )

Gains over the last six weeks have successfully carried ITA back to new highs, thanks to meaningful bounces from stocks like BA 0.25% , HWM 2.47% , TDG 0.20% and AXON 0.65% , which have all risen more than 8% in the past month. Its gradual ascent over the last three years following a steep 2020 decline is considered bullish technically, and this breakout to new all-time highs should allow for strength up to $130 initially and then further targets near $140.

We hope you will find the Sector Allocation Strategy useful in your investment journey. The strategy will be updated on a monthly basis, and we look forward to hearing your thoughts on how we can make it better. If you have any questions about this, or any other aspect of our work, please do not hesitate to e-mail us at inquiry@fsinsight.com.

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 08439a-a4962b-31c90b-00f8a8-d10d93

Already have an account? Sign In 08439a-a4962b-31c90b-00f8a8-d10d93