INTRADAY ALERT: Sept CPI in-line except for a boggling +51% rise in hotel CPI. Buy this dip as Sept CPI is good enough to keep Fed on pause

This intraday alert will replace tomorrow morning’s First Word (10/13) and tonight’s Macro Minute Video (10/12)

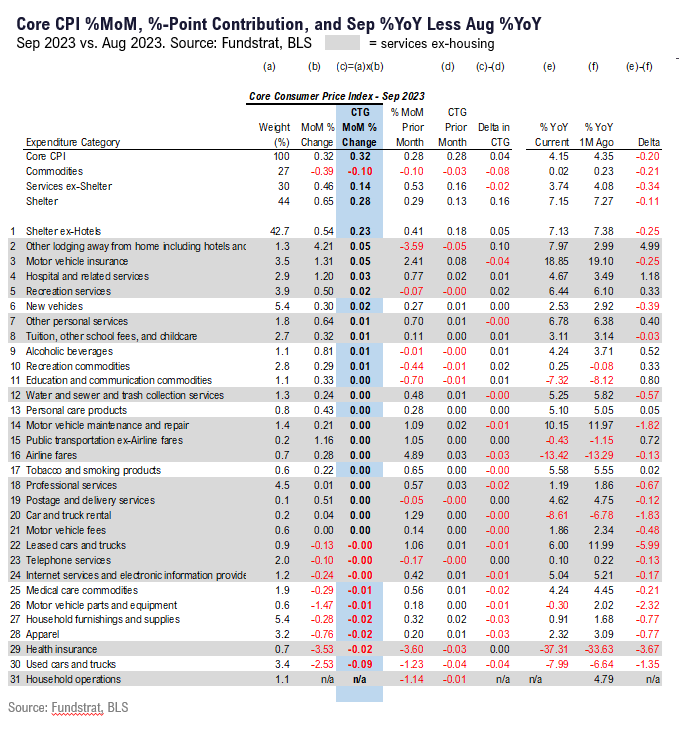

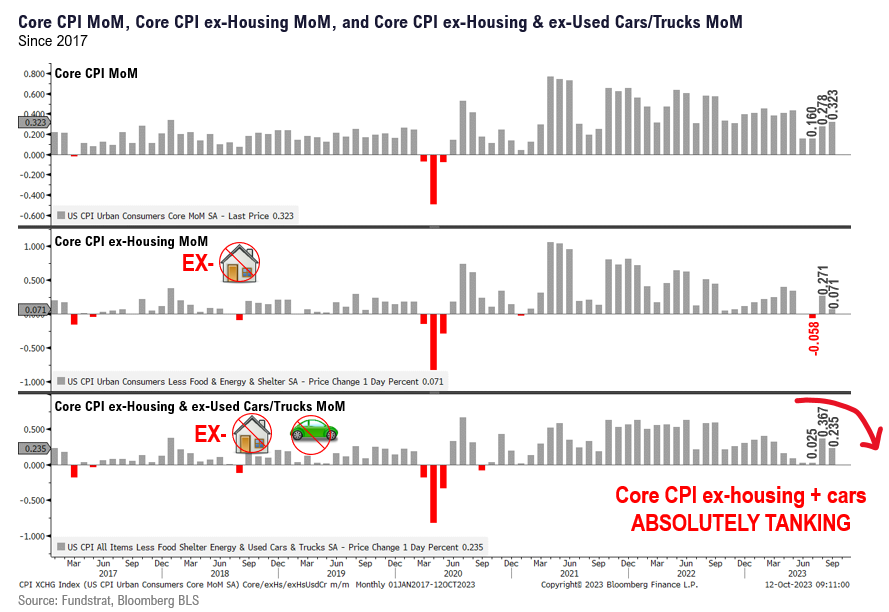

September CPI, released this morning, was largely in line with Core CPI coming in at +0.32% vs Street of +0.30 and last month’s +0.28%. The largest contributor to the rise in Sept Core CPI was shelter. And more specifically, “lodging away from home” which is hotel stays.

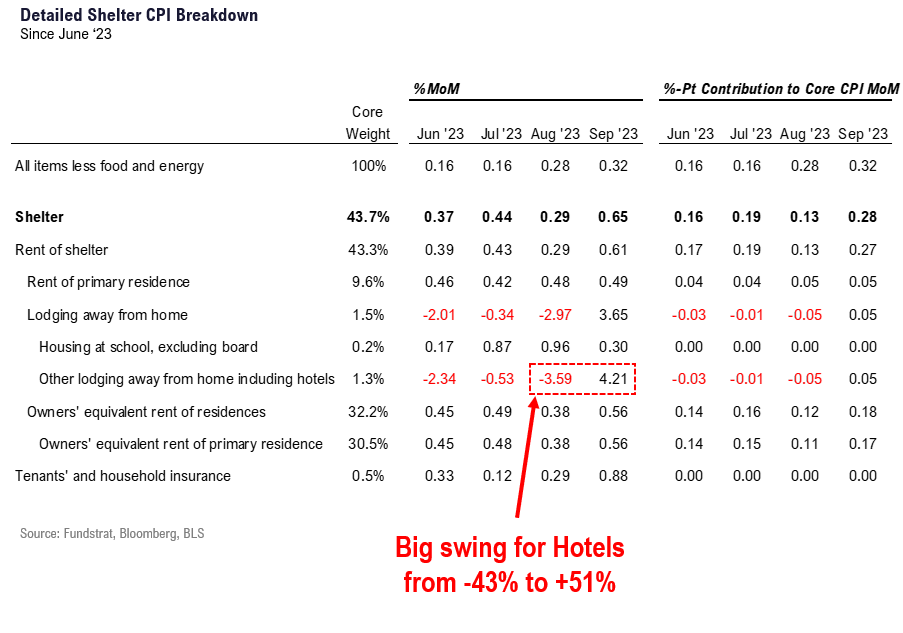

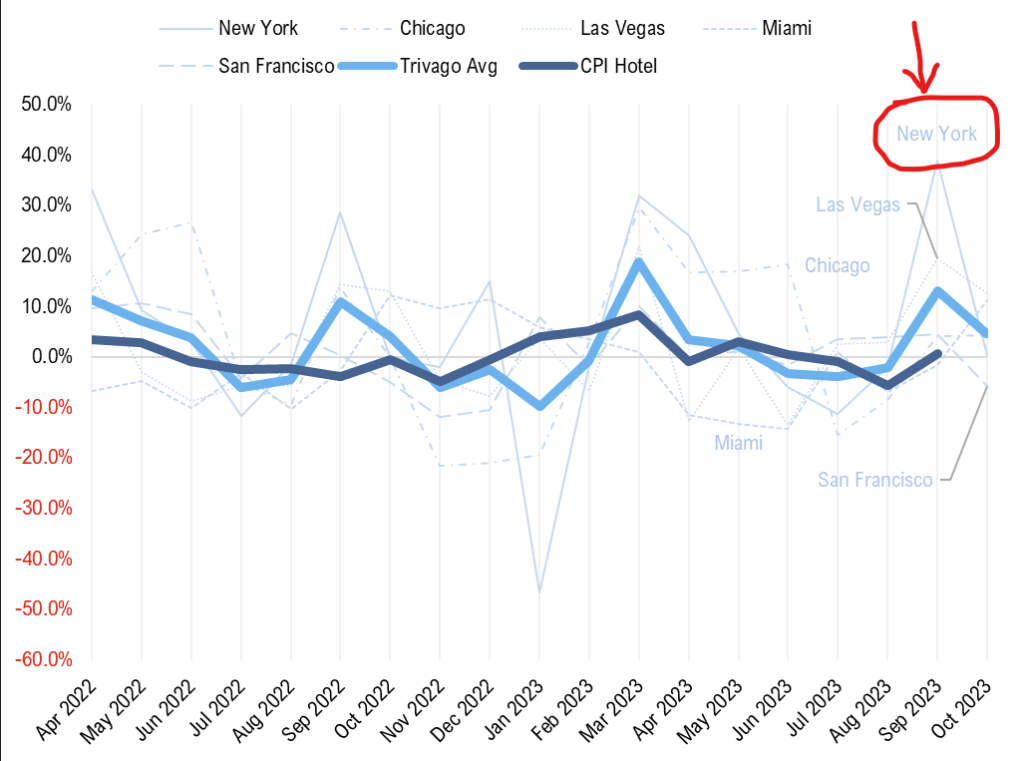

- Hotels CPI rose +4.21% MoM, or a 51% annualized rate. Does anyone really think hotel prices from at a 51% annualized rate in the month of September? This doesn’t make sense.

- August Hotel CPI was -3.59%, or an annualized decline of -43%. That did not make much sense either. So, to us, this seems to be a case of bad seasonal adjustment. If we net the two months, the annualized Hotel CPI is +0.31% or +3.8% YoY.

- Hotel CPI accounted for +0.10% of the +0.32% rise in Core CPI. This is a huge contribution from a single line item.

- Using data from Trivago, the spike in hotel rates is primarily NYC which saw a +30% surge in September. Why did NYC spike suddenly this year? Is this related to the UN General Assembly? That happens every year. Is this related to the influx of migrants into NYC? Not entirely clear.

- Outside of Hotels, the rest of the CPI report was in line. So, we generally view this as an inline report and not warranting any major changes in terms of Fed reaction function or equity markets.

- This is a good thing. We still believe the last Fed hike (of this cycle) was July 2023 and they likely skip Nov and December. Oddly, the cumulative probability of a hike by December rose to 43% today, up +14% from yesterday.

- In a data dependent world, we see futures markets becoming hyper-sensitive to each data point. But we see that as an over-reaction. After all, if someone thinks the Fed needs to keep raising Fed funds to slow hotel prices, this just seems off-base

Bottom line: Buy this dip as Sept CPI is good enough to keep Fed on pause

We would be buyers of any pullback stemming from this CPI report. We do not believe the rise in hotels will sway the Fed to raise again. And outside of that, the inflation story is showing significant improvement.

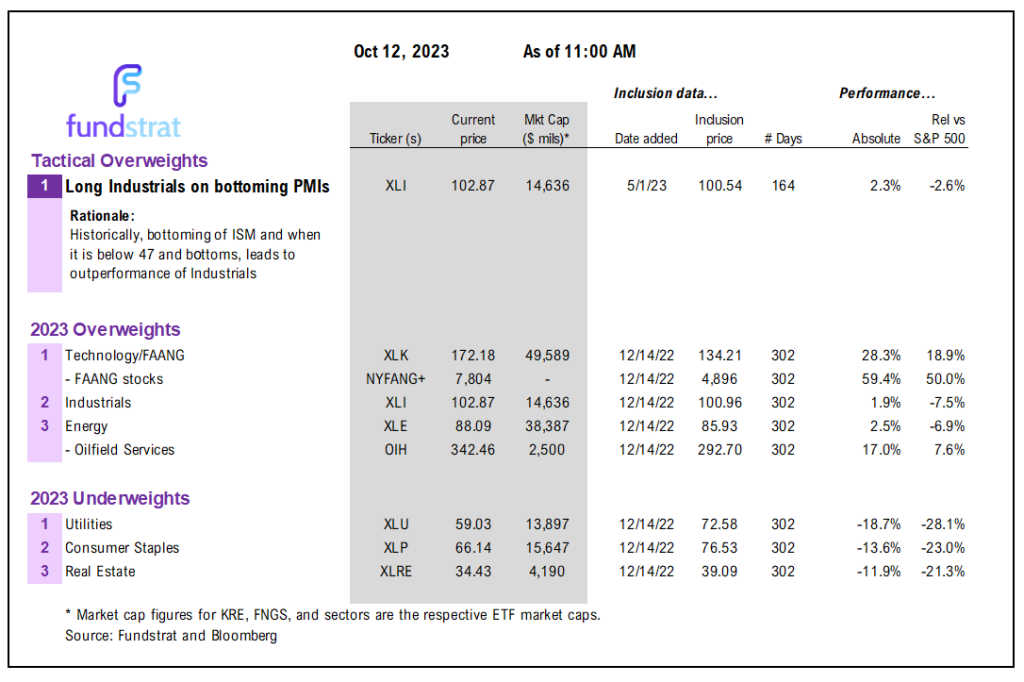

- We favor adding FAANG/Technology and Industrials

- Interest rates remain key and we still expect longer-term yields to adjust lower

_____________________________

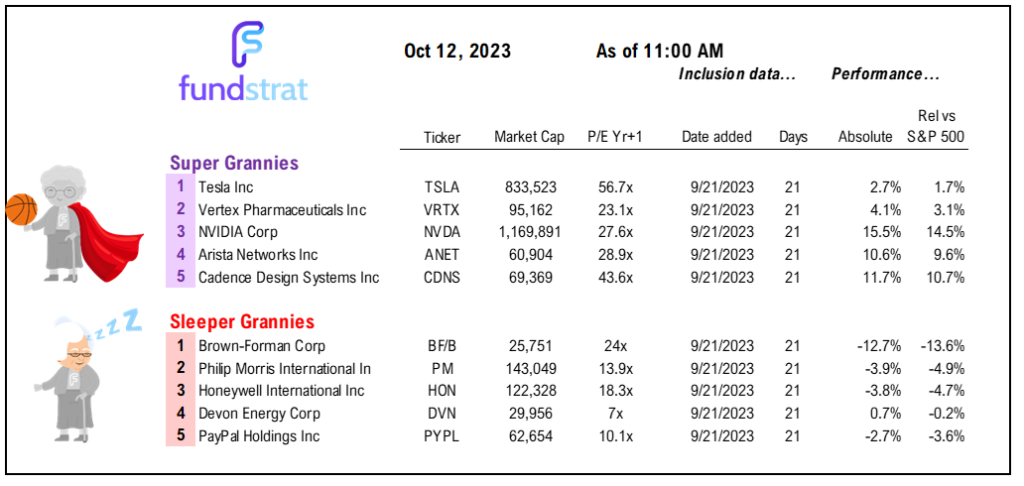

35 Granny Shot Ideas: We performed our quarterly rebalance on 7/18. Full stock list here –> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

We publish on a 3-day a week schedule (See schedule change in red highlight at the top of note)

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– Friday

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In dcd65b-da68a4-a52ed0-9e7244-9ac158

Already have an account? Sign In dcd65b-da68a4-a52ed0-9e7244-9ac158