Conf Board HWOL shows job openings fall in August, leads JOLTS by 3 weeks. Cum. inflation since 2020 is 7% above trend, compared to +75% when Volcker took helm = no need to go full "Volck-an"

Entire rise in June Fed funds has been reversed post Sept FOMC surge

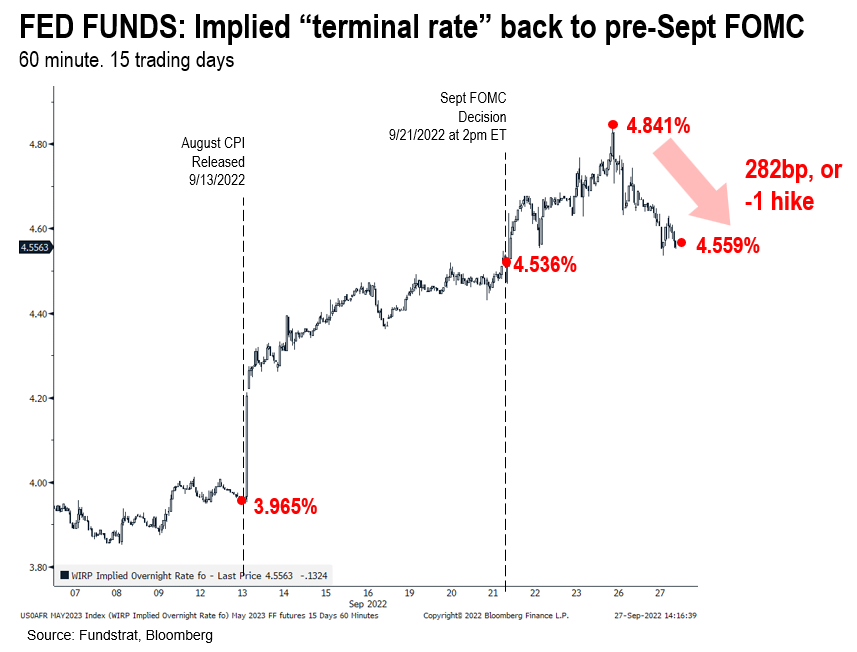

Stocks have declined consecutively for the past 6 trading days, reflecting financial markets adjusting to a “higher for longer” Fed. Take a look at the expected Fed Funds by June 2023 (implied using futures).

- pre-Sept FOMC, June 2023 Fed funds expected 4.536%

- in days post-FOMC, this surged to 4.841% (implying a terminal rate above Fed dot plots)

- in past two days, this figure dropped by to 4.559%, a round trip

- this figure is still ~50bp higher, or two hikes above pre-August CPI report (see below)

Current Fed funds upper limit is 3.25%. Thus:

- Terminal rate is 1.30%-1.40%, or 5-6 hikes above the current Fed funds

- Fed dot plots show an estimated 5 hikes between now and YE (+75bp and +50bp)

- Markets are back to seeing only 1 hike in 2023

- the S&P 500 has tumbled >6% in the past week, yet Fed funds forecasts are essentially flat post-FOMC

- the lack of higher “terminal rates” could be viewed as markets seeing “peak hawkish” Fed

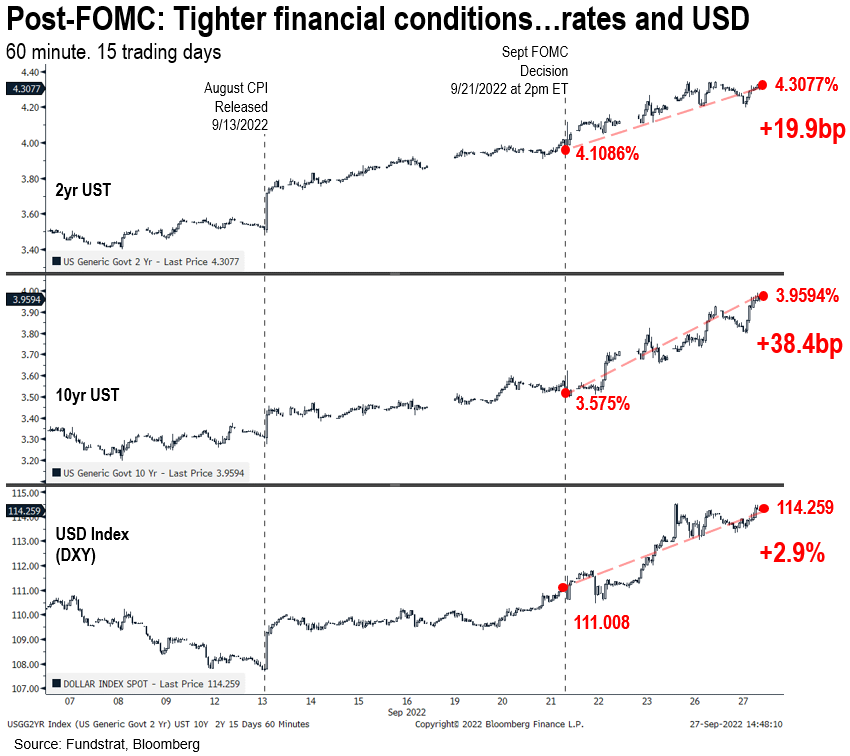

But financial conditions have tightened in the past week

But financial conditions have tightened in the past week, and it is not solely due to the Fed:

- UK announced fiscal stimulus that resulted in a plunge of currency and surge in rates

- Nordstream pipeline appears to have suffered sabotage, an escalation of energy war tactics

- Russia continues to take escalatory steps on the Russia-Ukraine war including initiating a draft and ordering a referendum on annexed territories

- and along with “higher for longer Fed” interest rates and USD have strengthened

- but higher 10-yr (+38bp) and higher USD (+2.9%) are consistent with what Fed wants to see

- both act to reduce inflationary pressures (via housing and via import prices), thus, consistent with Fed goals

The lack of rise in terminal rate (June 2023) does mean markets could be pushing back…

Monetary policy works with an unknown and variable lag. So, while the Fed has made it clear the committee would like to see faster progress, the Fed runs an increasing risk of “over-steering.” To date, the Fed would like to see faster progress in two areas:

- slowing the labor market, primarily JOLTs (aka job openings)

- services inflation, which is where inflation has perked up, and this is mainly housing

- the latest Conference Board Help Wanted Online Index shows a meaningful decline in August, which we believe bodes well for a decline in JOLTS

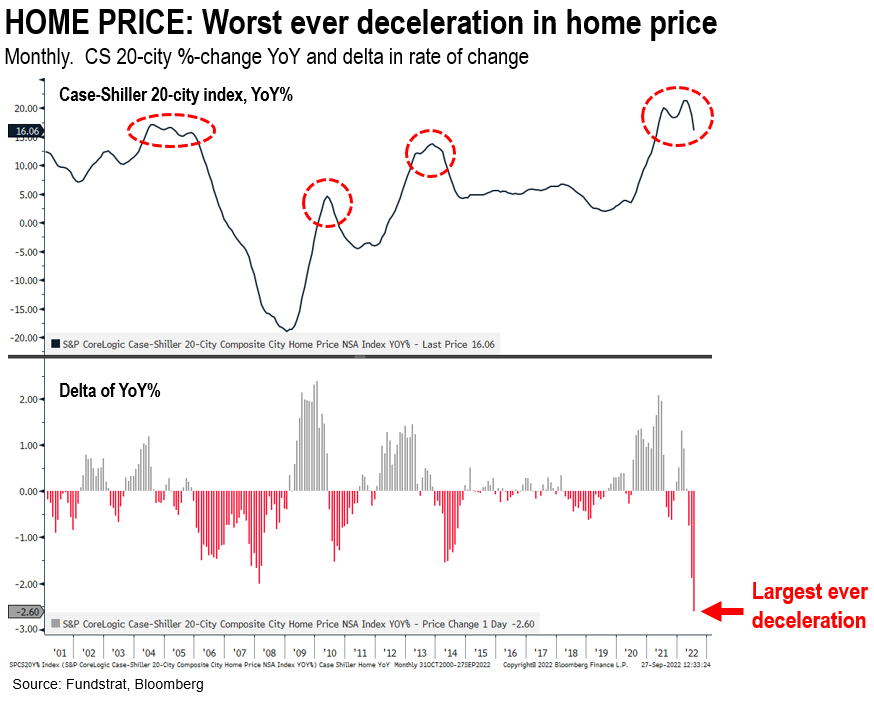

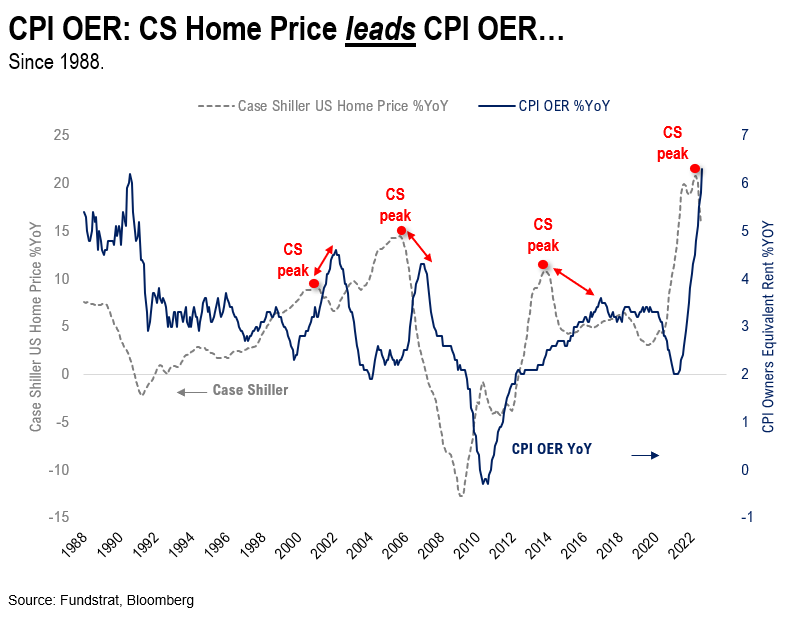

- And latest Case-Shiller shows the largest ever deceleration in home prices. While there is a huge lag before this is reflected in rents, this is also signs Fed hikes are impacting housing

- Rents (per apartmentlist.com) fell at the fastest September rate in more than 6 years

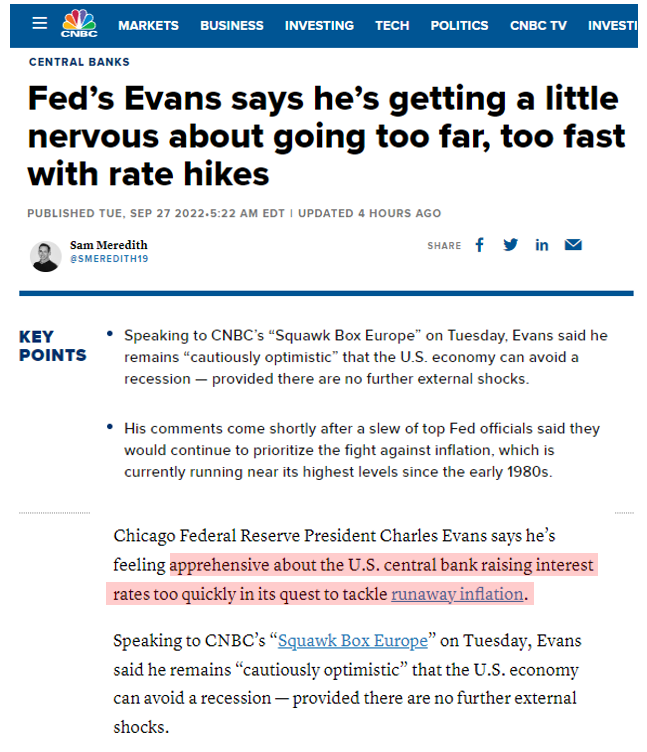

In fact, on CNBC Europe yesterday, Chicago Fed President, Charles Evans, also expressed apprehension the Fed might be pushing rates too quickly.

And even Rick Reider of Blackrock notes that there is a chance markets get Fed up with too much tightening.

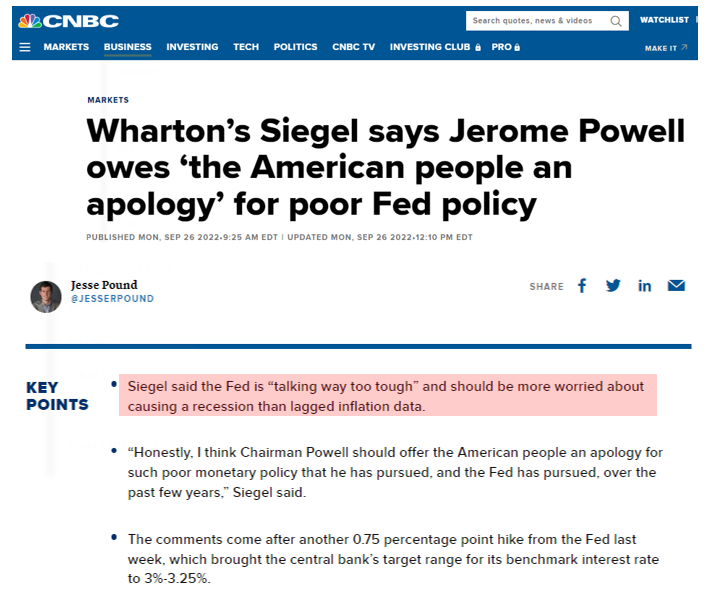

And we know Professor Jeremy Seigel made an impassioned commentary regarding Fed hikes last week. And earler this week, again pushed back against what Seigel sees as overly aggressive tightening.

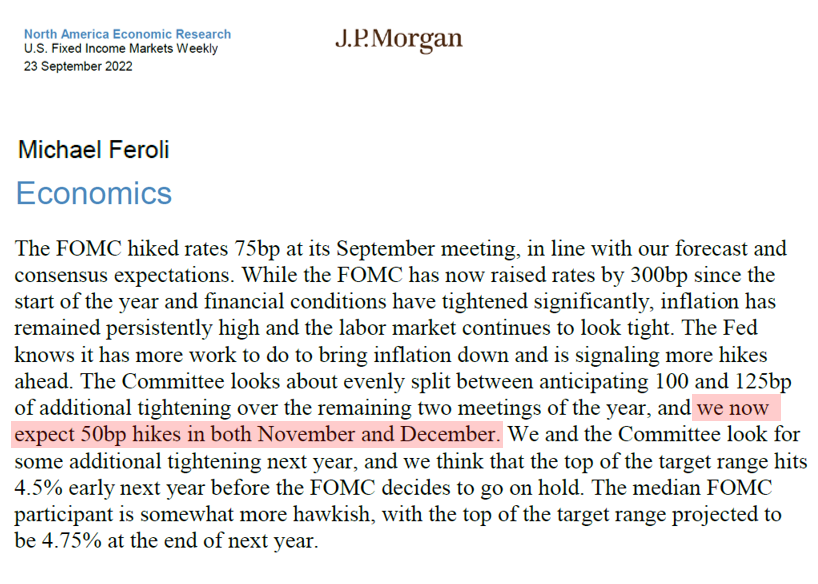

Economists such as Feroli at JPMorgan are also not necessarily raising hike forecasts for 2022. As he notes:

- Feroli sees

- +50bp in November

- +50bp in December

- and Fed reaching 4.5% before “going on hold”

- this is roughly 5-6 hikes from now, of which 4-5 are in the next two months

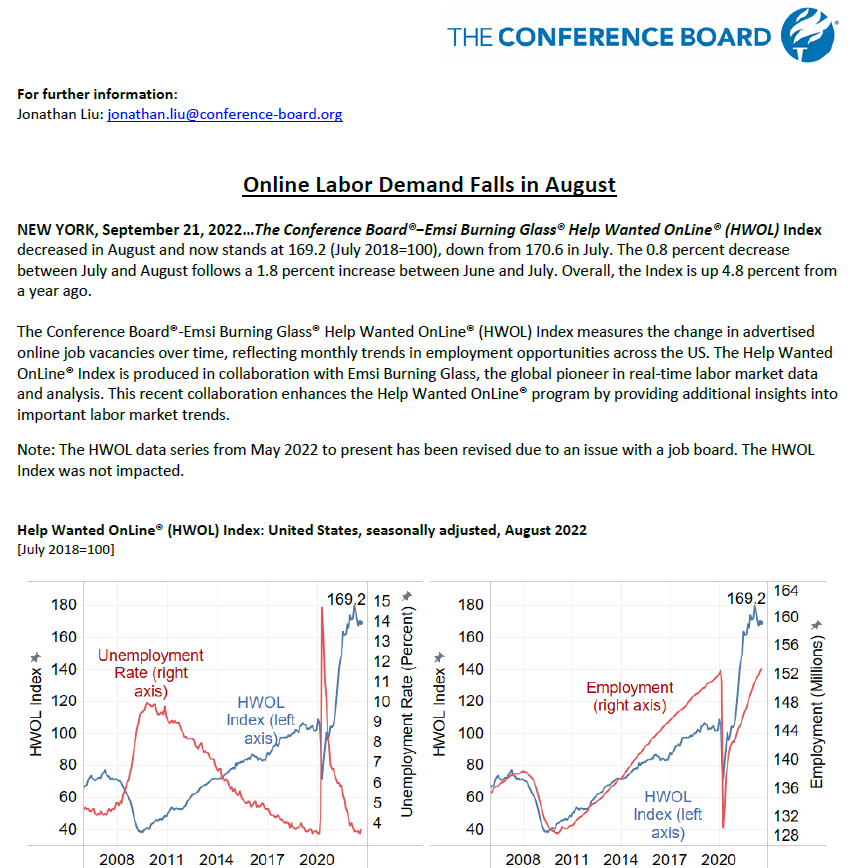

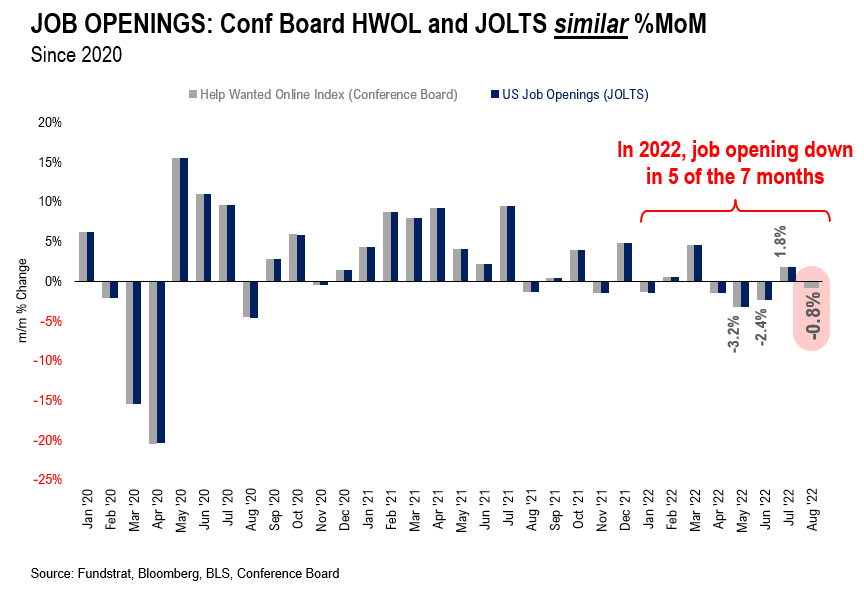

JOB OPENINGS: Conference Board HWOL Index shows jobs openings weakened in August

The Conference Board’s job opening index (HWOL) decreased in August by -0.8%.

- this is a comprehensive online help wanted index

- and as we discuss below, is a strong leading indicator for JOLTS, the Fed’s preferred measure of job openings

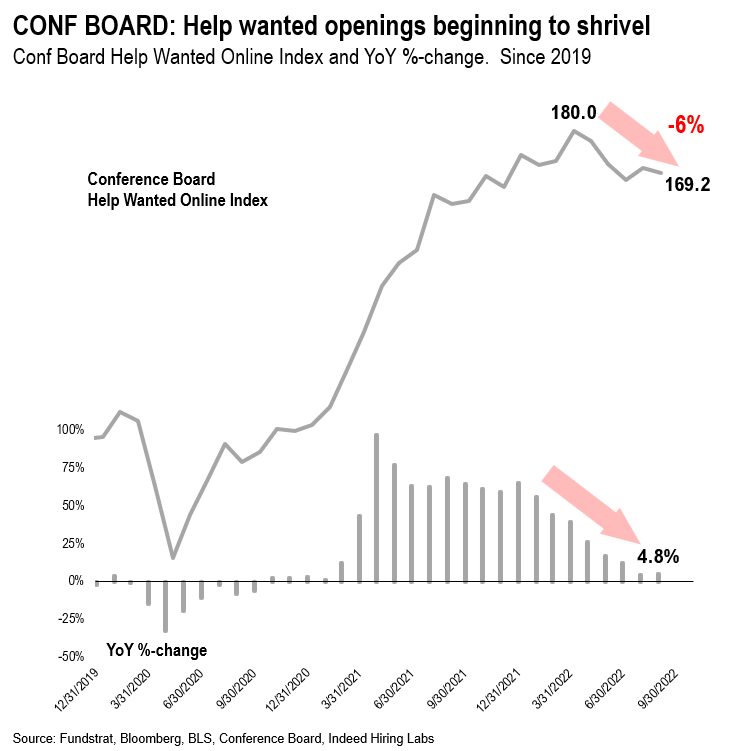

The HWOL is off 6% from its highs and as the lower part of the highlights, the YoY growth rate has slowed to 4.8%:

- this is the lowest growth rate since March 2021

- this is a sign that the labor market is softening

- economists expect job openings to get pulled

- then existing positions to be eliminated

- thus, falling openings is a sign the Fed wants to see

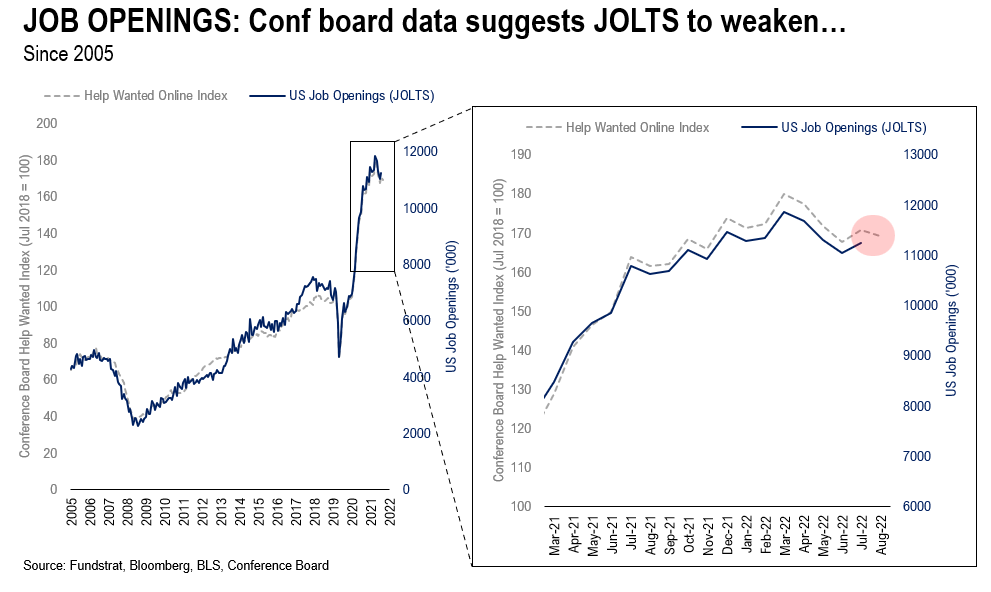

JOLTS follows Conf Board HWOL closely… HWOL has a 3-week lead time

The Fed’s preferred measure of job openings is the JOLTS survey. The Fed notes there remains nearly 2 openings for every available worker. Thus, they want to see progress here and unfortunately, JOLTS comes with a 6 week lag.

- take a look at the Conf Board HWOL (grey) and JOLTS (blue)

- these two series move very closely together

- in the past 18 months, they are also identical

- even month-over-month change is nearly identical

Look at how closely the JOLTS month-over-month mirrors HWOL.

- the %-changes are nearly the same

- job openings have decline in 4 of the last 5 months

- for all of 2022, opening down 5 of the 7 months

- July’s rise looks like an anomoly arguably

- job openings are down 6% since peak

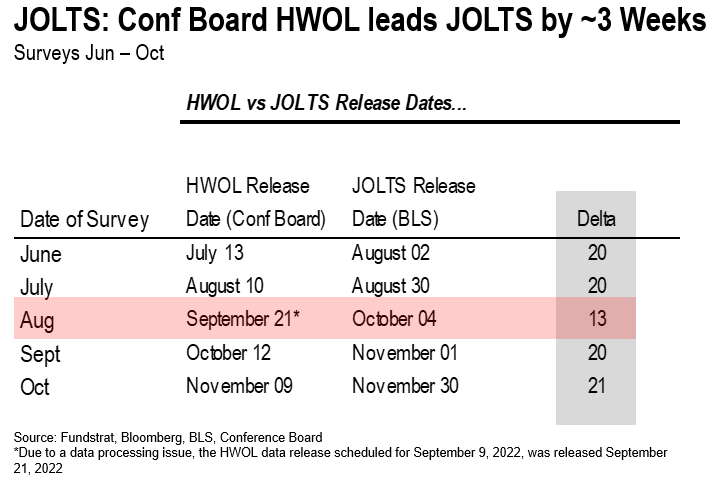

HWOL LEAD TIME: But HWOL comes out 3 weeks ahead of JOLTS

The HWOL is published roughly 10-12 days after the end of the month and as shown, has a significant lead time to JOLTS:

- the average delta is 20 days

- Sept HWOL was delayed until the Sept FOMC

- but as you can see, this HWOL survey is a good leading indicator for JOLTS

- the next update is October 12th, for Sept HWOL data

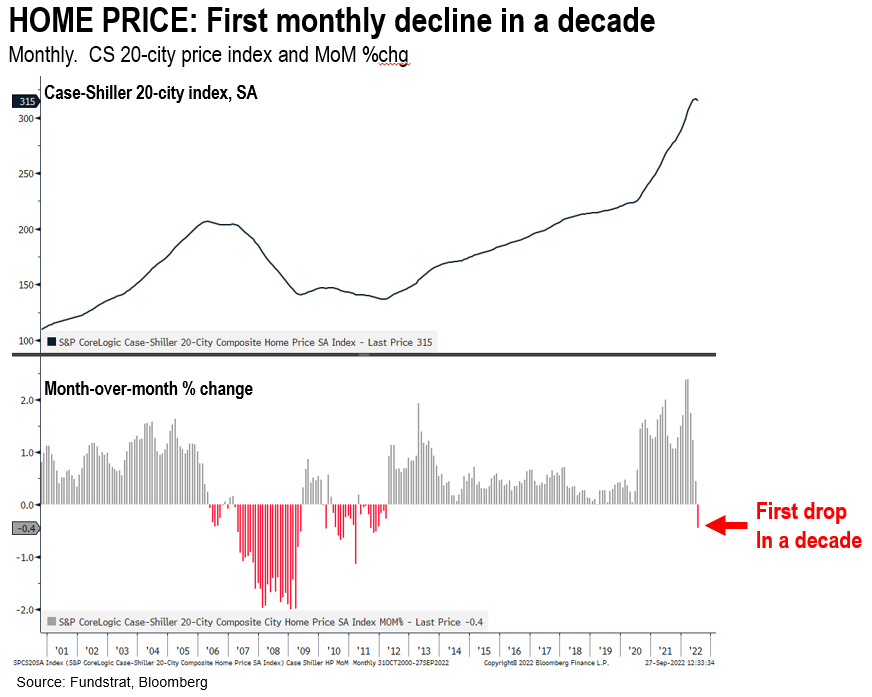

HOUSING: Home prices post first decline in a decade… faster ever deceleration

Case-Shiller July home price index was released yesterday. Home prices declined for the first time in a decade:

- this is for July, so there is a meaningful lag, like JOLTS

- given all the recent data on selling activity, August and Sept look to be even worse

- this is the first monthly drop since 2012

And on a YoY basis, this is the fastest ever deceleration (see bottom half).

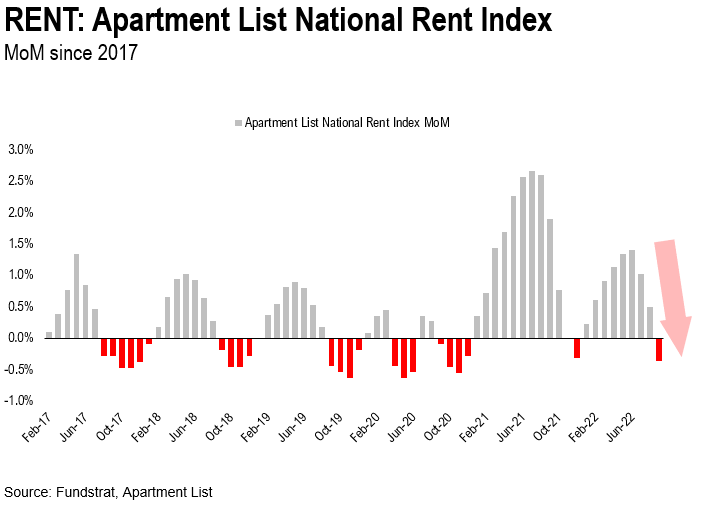

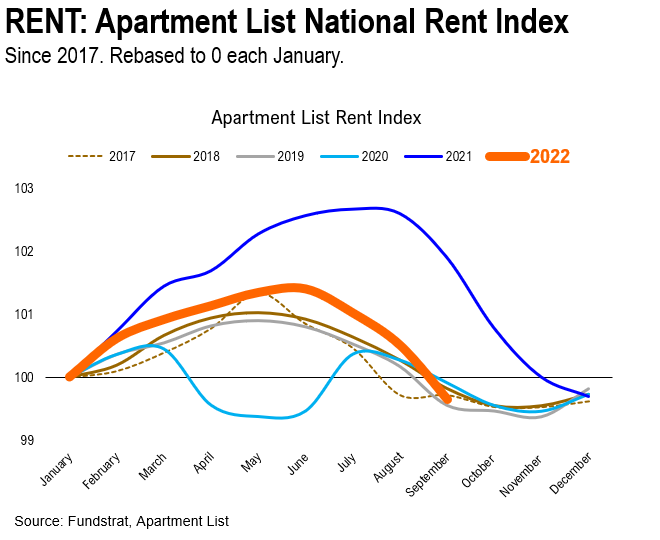

RENTS: Falling faster than seasonality — Biggest Sept drop in more than 6 years

While there is a known lag between housing prices cooling and this showing up in lower rents and owner’s equivalent rent, the process might be faster in 2022.

- the latest apartmentlist.com index was just published

- rents in Sept fell month over month

- this is the first decline in 2022 (see below)

And for those arguing that there is seasonality, take a look below at the monthly changes aligned by calendar:

- the seasonal chart below compares 2022 to each of the last 6 years

- as you can see, September 2022 is a particuarly steep drop

- rents are rolling over

- this is what the Fed would like to see

And with the decline in home prices, the “owners’ equivalent rent” will begin to show declines. There is a known lag as highlighted below. This is attributable to the natural smoothing mechanism of CPI but also the fact that ownerships equivalent rent is an estimated value (Based on the value of what a house could be rented for).

STRATEGY: Fed does not to go full Volck-an

The Fed is hawkish and the FOMC committee is largely hawkish. This is what is contributing to tightening financial conditions.

- and yet

- the Fed funds terminal rate has round-tripped back to 4.56% (pre-Sept FOMC)

- financial markets clearly respect the Fed’s commitment, evidenced by surging rates

- but the larger question is whether the Fed is at peak hawkishness

It is obvious the Fed wants to avoid a multi-year/decade of extended inflation. And hence, Powell is using the 1980s playbook of being committed to quashing inflation.

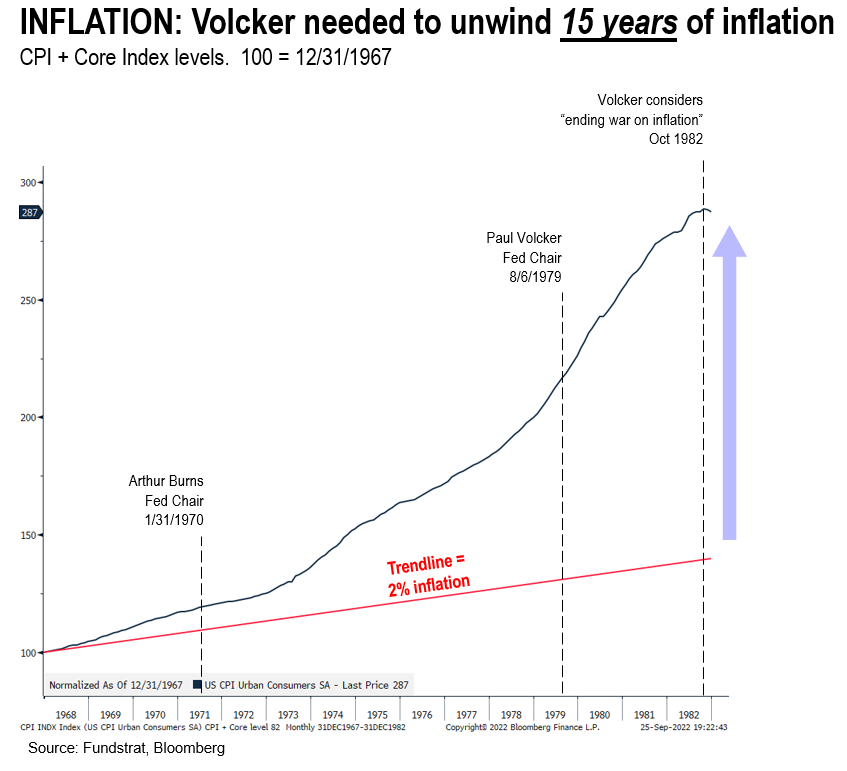

But Volcker was confronting more than a decade of realized inflation in this battle

An important perspective to keep in mind is Fed Chair Volcker accepted his role as Fed Chairman in 1979, a time when the US was already 12 years into high inflation:

- take a look at the timeline below

- inflation broke above 2% in 1967

- cumulative inflation by 1979 reflected 12 years compounding CPI >5%

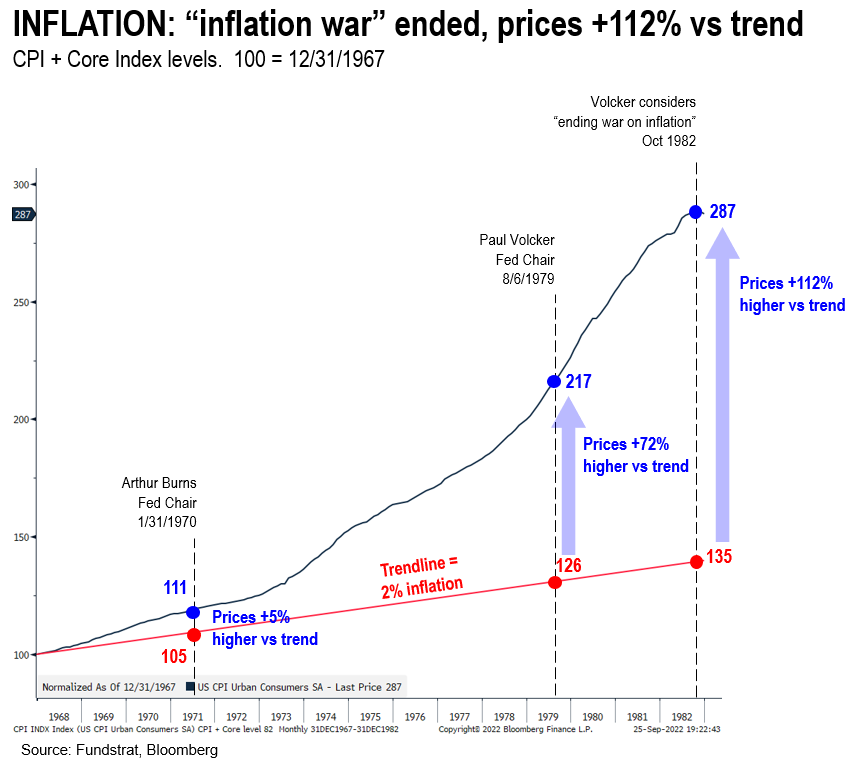

In fact, look at how far prices had risen compared to trend by 1979:

- The CPI from 1967 to 1979 rose from 100 to 217

- This is a 117% rise in prices

- a 2% trendline meant prices should only be 26% higher

- massive divergence

- by the time Volcker killed inflation, prices were +112% above trend

- staggering

So it is relatively easy to understand why the public was so grim about the inflation problem in the 1970s and 80s. That is a 15 years of baffling high price increases.

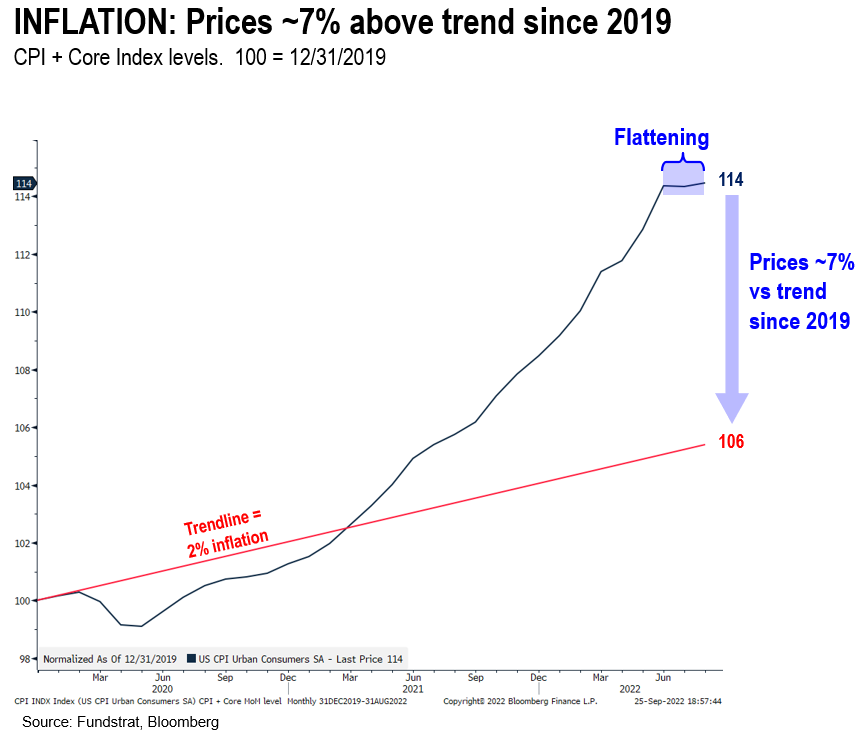

INFLATION 2022: Inflation is “young” and prices only 7% above trend

Below, we did the same analysis for the inflation since 2020.

- By contrast, the higher inflation since has brought prices 7% above trend

- this is compared to 2% trendline inflation

- 7% is far less than 72% that Volcker inherited (and had to battle)

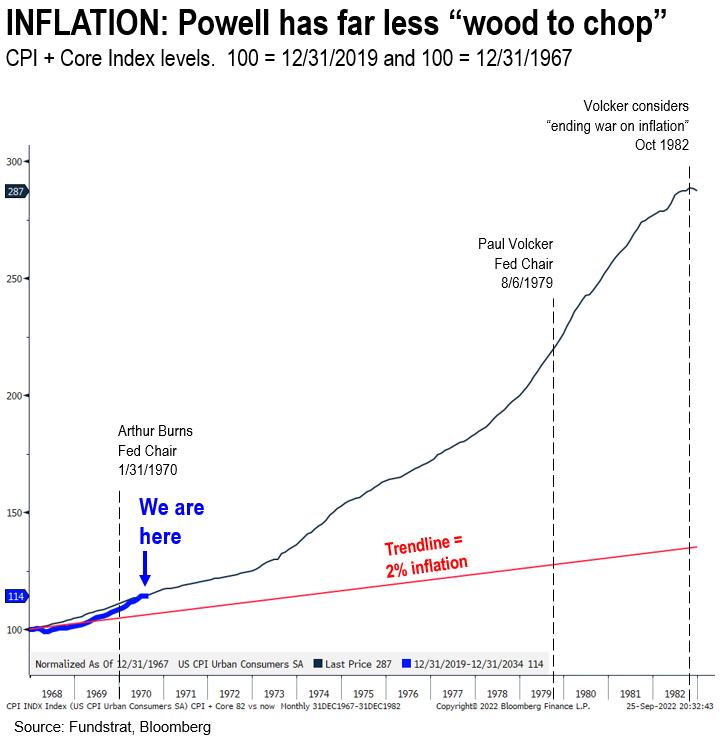

Compared to 1970s-80s, today’s inflation is nascent

We plotted 2020-2022 to 1967-1982. This is cumulative rise in CPI, or price level:

- inflation in 2022 is hardly “out of control”

- compared to the 1970s

Fed doesn’t have to go full “Volcker”

The takeaway, in our view, is the Fed does not need to go full Volcker. While the commitment to quash inflation makes sense, the battle against inflation is much younger.

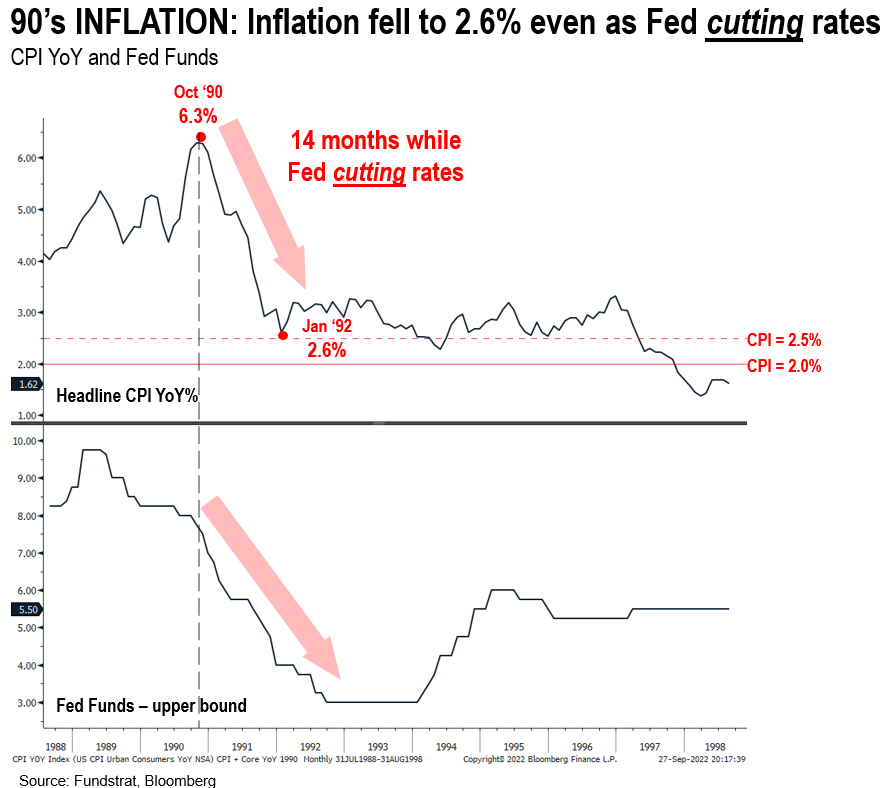

NO FULL VOLCK-AN: during the 1990s, Fed cutting rates but inflation fell to 2.6% in 14 months

In fact, the inflation episode of the 1990s is somewhat useful.

- in early 1990, inflation surged stemming from Gulf-war related rise in energy prices

- CPI YoY surged to 6.3% (Below) by October 1990, up from 4% in 1988

- CPI fell from 6.3% to 2.6% by January 1992

- That took 14 months

- BUT the Fed was cutting interest rates from 1990 to 1992

- YET CPI fell YoY sharply

In other words, someone pointing to the 90s as a period when inflation fell slowly is also overlooking the Fed was cutting rates.

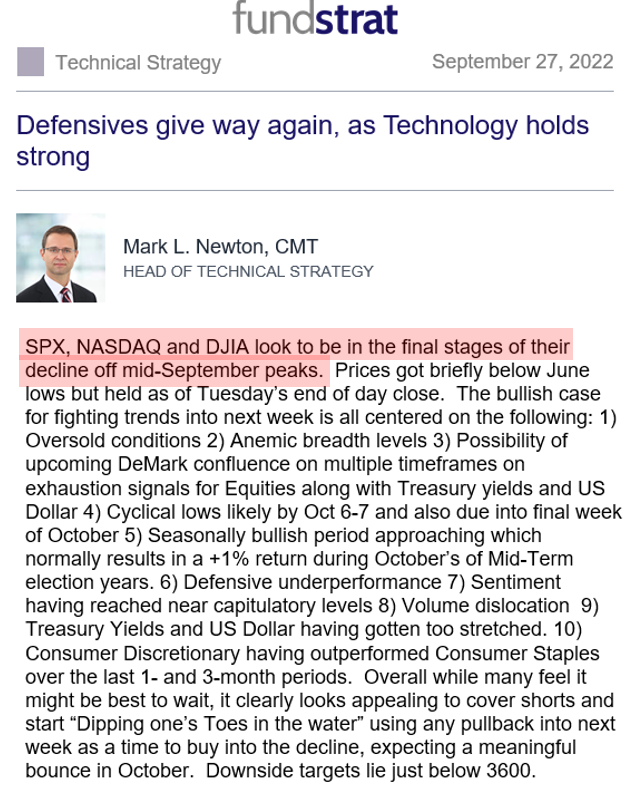

Stocks in a death spiral, but inflation remains key pivot

Equities have not managed to show any sustained traction in September. The initial weakness was fueled by the August CPI, which raised hike expectations. And then worsened by the hawkish September FOMC.

There are key incoming data points later this week:

- on Friday August PCE

- on Friday U Mich Consumer inflation expectations

While we do not have a read on the cadence of this report, the leading indicators all support the notion that headline inflation peaked in June. Core CPI still has some sticky components, but as we noted in recent reports, there are signs of slowing in labor markets and in housing. These are key to slowing core inflation.

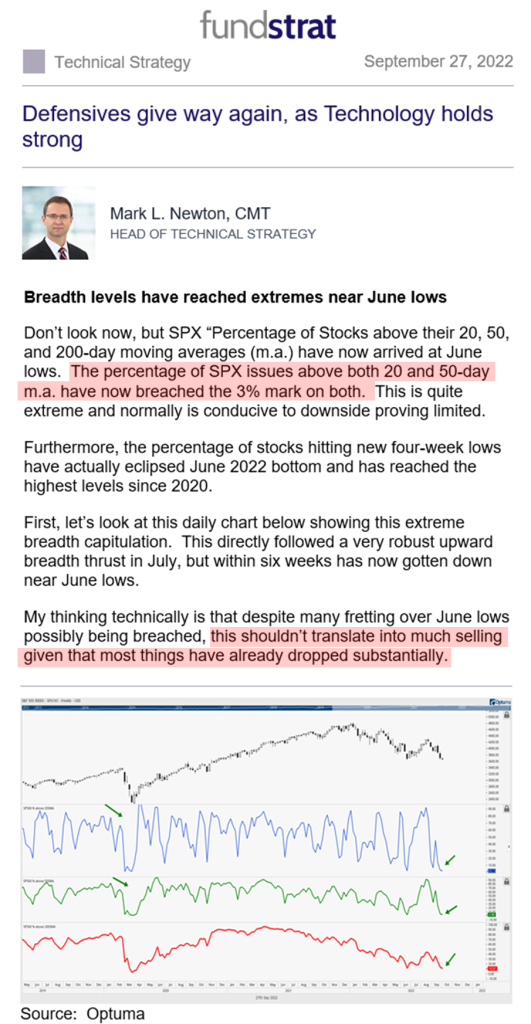

As for market psychology, investors are increasingly viewing equities as untouchable. And Mark Newton, our Head of Technical Strategy, still sees a bit of downside ahead. But as he notes,

“The bullish case for fighting trends into next week is all centered on the following:

1) Oversold conditions

2) Anemic breadth levels

3) Possibility of upcoming DeMark confluence on multiple timeframes on exhaustion signals for Equities along with Treasury yields and US Dollar

4) Cyclical lows likely by Oct 6-7 and also due into final week of October

5) Seasonally bullish period approaching which normally results in a +1% return during October’s of Mid-Term election years.

6) Defensive underperformance

7) Sentiment having reached near capitulatory levels

8) Volume dislocation

9) Treasury Yields and US Dollar having gotten too stretched.

10) Consumer Discretionary having outperformed Consumer Staples over the last 1- and 3-month periods.”

Markets are approaching levels where any rebound will be steep. As noted earlier, we think investors are overly skeptical on the economy’s ability to overcome inflation. While there remain upside risks and surprises, there are also signs of progress.

- and the number of stocks >moving averages is encouraging

We publish on a 3-day a week schedule:

Monday

SKIP TUESDAY

Wednesday

SKIP THURSDAY

Friday

_____________________________

33 Granny Shot Ideas: We performed our quarterly rebalance on 7/12. Full stock list here –> Click here

______________________________

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 0d5f05-d94c49-dd93c8-5d3514-c18c42

Already have an account? Sign In 0d5f05-d94c49-dd93c8-5d3514-c18c42