A daily market update from FS Insight — what you need to know ahead of opening bell

“Reality is that which, when you stop believing in it, doesn’t go away.” ― Philip K. Dick, I Hope I Shall Arrive Soon

Overnight

NYCB downgraded to junk by Fitch, as Moody’s goes even deeper

BlackRock abandons ‘ESG’ investing for ‘transition investing’

OPEC+ members extend oil output cuts to second quarter

North Korean hackers breach two South Korean chip gear makers

First news

- Actual demand for AI is outstripping forecasts and conjectures

- Lawyers for the shareholder who successfully contested Elon Musk’s Tesla pay package seek record compensation in the form of the very shares whose transfer they contested.

Charts of the Day

MARKET LEVELS

| Overnight |

| S&P Futures -7

point(s) (-0.1%

) overnight range: -11 to +0 point(s) |

| APAC |

| Nikkei +0.5%

Topix -0.12% China SHCOMP +0.41% Hang Seng +0.04% Korea +1.21% Singapore -0.43% Australia -0.13% India +0.12% Taiwan +1.95% |

| Europe |

| Stoxx 50 +0.25%

Stoxx 600 -0.1% FTSE 100 -0.5% DAX -0.08% CAC 40 +0.06% Italy -0.16% IBEX -0.16% |

| FX |

| Dollar Index (DXY) -0.03%

to 103.83 EUR/USD +0.13% to 1.0851 GBP/USD +0.17% to 1.2677 USD/JPY +0.19% to 150.4 USD/CNY +0.03% to 7.1993 USD/CNH -0.01% to 7.2109 USD/CHF +0.12% to 0.8845 USD/CAD +0.06% to 1.3569 AUD/USD -0.09% to 0.6521 |

| Crypto |

| BTC +3.48%

to 65040.51 ETH +0.79% to 3506.25 XRP +3.75% to 0.6531 Cardano +7.21% to 0.7805 Solana +4.22% to 133.39 Avalanche +3.48% to 43.65 Dogecoin +4.75% to 0.161 Chainlink -0.37% to 20.51 |

| Commodities and Others |

| VIX +3.05%

to 13.51 WTI Crude -0.64% to 79.46 Brent Crude -0.45% to 83.17 Nat Gas +5.56% to 1.94 RBOB Gas -0.82% to 2.593 Heating Oil -1.44% to 2.665 Gold +0.01% to 2083.08 Silver -0.02% to 23.12 Copper +0.17% to 3.861 |

| US Treasuries |

| 1M +0.4bps

to 5.3799% 3M -0.9bps to 5.3636% 6M +0.5bps to 5.2916% 12M -0.9bps to 4.9306% 2Y +2.3bps to 4.5539% 5Y +2.4bps to 4.1815% 7Y +2.6bps to 4.2134% 10Y +2.3bps to 4.2033% 20Y +2.6bps to 4.4784% 30Y +2.7bps to 4.3541% |

| UST Term Structure |

| 2Y-3

M Spread widened 2.6bps to -82.8

bps 10Y-2 Y Spread narrowed 0.3bps to -35.5 bps 30Y-10 Y Spread widened 0.4bps to 14.9 bps |

| Yesterday's Recap |

| SPX +0.8%

SPX Eq Wt +0.7% NASDAQ 100 +1.44% NASDAQ Comp +1.14% Russell Midcap +0.57% R2k +1.05% R1k Value +0.41% R1k Growth +1.04% R2k Value +0.73% R2k Growth +1.36% FANG+ +1.91% Semis +4.05% Software +1.0% Biotech +3.16% Regional Banks -1.1% SPX GICS1 Sorted: Tech +1.78% Energy +1.17% REITs +1.08% Healthcare +0.97% SPX +0.8% Comm Srvcs +0.51% Cons Disc +0.39% Materials +0.38% Indu +0.36% Cons Staples -0.04% Fin -0.22% Utes -0.72% |

| USD HY OaS |

| All Sectors +1.5bp

to 369bp All Sectors ex-Energy +0.3bp to 356bp Cons Disc -5.6bp to 300bp Indu +4.2bp to 279bp Tech -8.4bp to 456bp Comm Srvcs +11.8bp to 580bp Materials -6.2bp to 336bp Energy +2.7bp to 303bp Fin Snr -1.4bp to 340bp Fin Sub -2.2bp to 257bp Cons Staples +3.2bp to 315bp Healthcare +7.9bp to 457bp Utes -0.0bp to 236bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 3/5 | 9:45AM | Feb F S&P Srvcs PMI | 51.4 | 51.3 |

| 3/5 | 10AM | Feb ISM Srvcs PMI | 53.0 | 53.4 |

| 3/5 | 10AM | Jan F Durable Gds Orders | -6.1 | -6.1 |

| 3/6 | 10AM | Jan JOLTS | 8890.0 | 9026.0 |

| 3/7 | 8:30AM | 4Q F Nonfarm Productivity | 3.1 | 3.2 |

| 3/7 | 8:30AM | Jan Trade Balance | -63.5 | -62.201 |

| 3/7 | 8:30AM | 4Q F Unit Labor Costs | 0.7 | 0.5 |

| 3/8 | 8:30AM | Feb AHE m/m | 0.2 | 0.6 |

| 3/8 | 8:30AM | Feb Unemployment Rate | 3.7 | 3.7 |

| 3/8 | 8:30AM | Feb Non-farm Payrolls | 200.0 | 353.0 |

MORNING INSIGHT

Good morning!

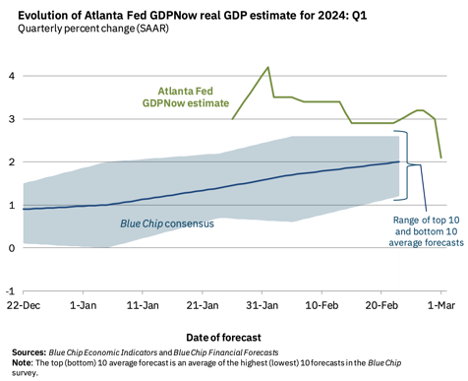

Inflation and the monetary policy path are in focus this week because of Fed testimony and the jobs report. The bond market has priced in a surging inflation back toward 4%.

The Fed speaking and the jobs report Friday bring inflation back into focus. Keep in mind that much of this is a head fake.

Click HERE for more.

TECHNICAL

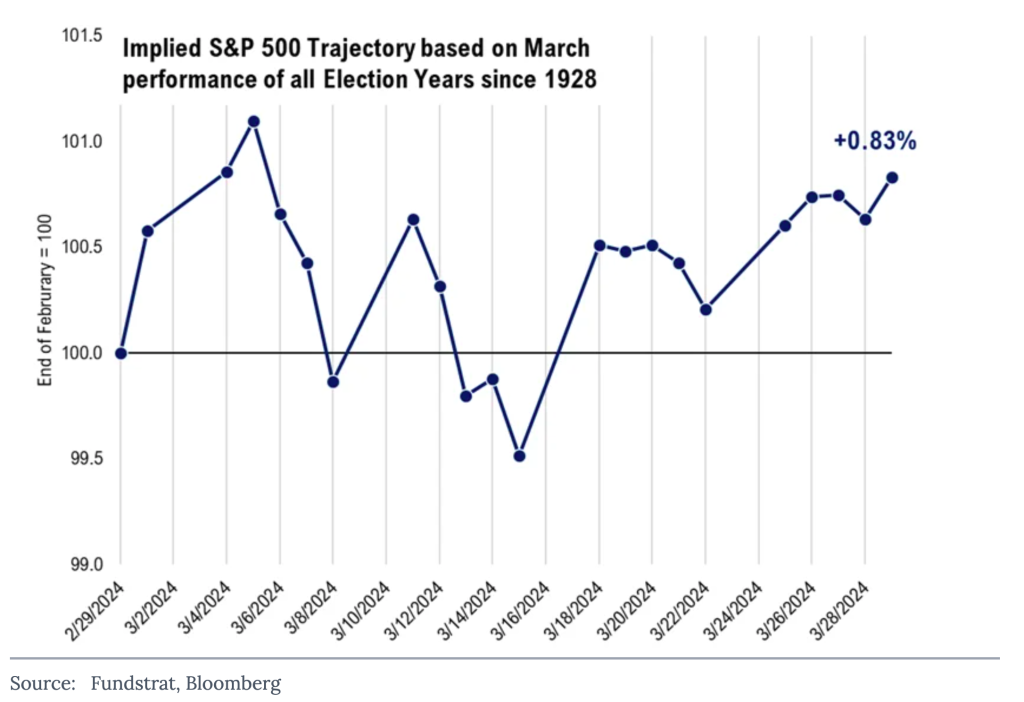

Equity trends show no evidence of wavering. February managed to finish with gains greater than 5% on the heels of three prior months of gains, and this winter rally still shows very few signs of letting up, as more and more sectors have begun to show participation. Following new monthly all-time high closes in S&P’s Equal-weighted S&P 500 (RSP -0.08% ) as well as the NASDAQ Composite to join SPX, QQQ, and DJIA, further gains look possible into mid-March ahead of possible minor consolidation. Outside of U.S. indices, it’s proper to note that Europe’s STOXX 600 index has hit new all-time highs, along with Australia’s ASX, India’s BSE Sensex, along with the Japanese NIKKEI 225, which finally managed to claw back to new all-time highs after peaking out nearly 35 years ago, in 1989.

Click HERE for more.

CRYPTO

Despite total deal count rising 33% to 36 deals, total fundraising last week fell almost 40% to $143 million. Only three projects raised over $10 million, while the average deal size was $6.5 million. Similarly to the week before, funding was concentrated in Infrastructure and DeFi, together representing 95% of total fundraising and 81% of the deal count. CeFi continues to be an unpopular category, with just two deals in the last three weeks.

Seed rounds garnered the lion’s share of funding and deal flow, comprising 38% of fundraising and 19% of deal count. Seed rounds have been the dominant deal stage in 2024 thus far, with a significant lack of mid-to-late-stage deals. There have been zero series C+ in 2024, and just two series B rounds. It will be worthwhile to see whether this trend reverses in the second half of the year as companies mature and see more substantial adoption.

Click HERE for more.

FIRST NEWS

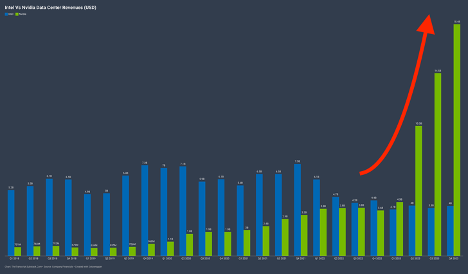

Genuine Demand for Artificial Intelligence. Unlike previous speculative tech booms – such as, say, blockchain or 3D printing – during which business leaders spilled much ink and boomed into mics protruding from mandibles on TED stages about ‘exploring’ the potential, companies today are actually ordering AI technology and deploying it right away. Little surprise that Nvidia, a leading provider of AI hardware, reported a blowout quarter on Wednesday, with revenue surging 265% year-over-year to $22.1 billion in Q4. Data center revenue, which includes chips used in generative-AI computing, skyrocketed 409% to $18.4 billion while adjusted earnings per share rose 486% to $5.16.

During his own time at the mic, Nvidia CEO Jensen Huang said that “accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.” This has actually been true for some time.

Back in June 2023, a panel of BlackRock analysts was asked whether they thought ‘the AI story’ was getting ahead of itself in terms of surging stock prices. They didn’t. BlackRock CIO Tony DeSpirito said: “The demand is really real. … The orders are there.“

And it’s not just data centers. Also back in June 2023, this is what was happening.

From the vantage point of March 2024, the popular saying associated with emerging technology – “most people overestimate what can be achieved in a year and underestimate what can be attained in 10 years” – seems only half-applicable. People underestimated what could be achieved within the space of a year, and, as a result, are now afraid to contemplate what will be achieved in the next decade.

In related news, Huang has predicted that, depending on how it’s defined, artificial general intelligence (AGI) could be here within five years, with AI capable of doing well on “every single test that you can possibly imagine,” such as legal or medical exams, within five years, although that wouldn’t mean that the AI was conscious or thought like a human. Huang also said that AI algorithms and processing were progressing ‘tremendously’, meaning that the number of chips required to complete tasks like the ones mentioned above would grow more slowly as each chip is able to do more work. Semafor

Let Me Get This Straight Dept. Imagine you knew a guy who owned a pumpjack (aka a jack pump) pumping away in a vast field of other such contraptions. The founder and largest shareholder of this oilfield wants to award himself a bunch of extra shares in the thriving enterprise as compensation for expanding the business handsomely over the past few years. You’re just a little guy, but you don’t think he deserves that share grant, and so you hire a sweet-tongued artificer to state your case to the authorities. It takes five years, but your cause prevails. The largest shareholder doesn’t get his extra shares; you, as well as the other small shareholders, avoid having the value of your extant shares diluted. The only thing is that now, all of a sudden, the sweet-tongued artificer wants a significant percentage of the prevented dilution – what he calls recovery – for his fee, and he wants it in the form of the very asset shares in which you hold (thus diluting your ownership in a way similar to what the big, bad head honcho’s share grant would have done). It seems the light crude flowing from that jack pump is sweeter to the artificer than cold, hard cash.

Now, put your imagination on pause and take in the shark-infested oil slick of reality.

The lawyers who had successfully contested Elon Musk’s 2018 $56 billion pay package as unlawful are requesting $5.6 billion in Tesla stock – or ~11% of the money Elon Musk will now not be paid as a result of their efforts – as their fee.

The attorneys, who represented a Tesla shareholder in the case decided in January, made the request of Judge McCormick of the Delaware Chancery Court in court papers filed Friday. The same judge had earlier revoked Musk’s pay package, finding it unfair to shareholders.

If approved, the amount would be far and away the largest such award, setting a new precedent for attorney compensation. In 2008, lawyers in class-action suits resulting from the collapse of Enron received a record $688 million in legal fees. Speaking for the lawyers in the Tesla case, the plaintiff’s lead attorney Greg Varallo wrote in Friday’s filing, “We are prepared to ‘eat our cooking’”.

In that filing, the attorneys asked for more than 29 million shares in Tesla stock and an additional $1.1 million to cover expenses. Those shares would have been worth around $5.6 billion as of late January, when McCormick’s decision came down. The ultimate value of the fees could go up or down depending on Tesla’s stock price.

Per the judge’s decision in the case, Musk’s defense failed to explain why the ‘historically unprecedented compensation plan’ was necessary to motivate the CEO to achieve ‘transformative growth’. It seems the attorneys were impressed and inspired by the ‘historically unprecedented’ part, and decided to strike a blow for their profession and set a precedent for years to come.

We’re gonna need a bigger money bag

“The size of the requested award is great because the value of the benefit to Tesla that plaintiff’s counsel achieved was massive” were the exact words from the attorneys.

Generally, judges in Delaware’s specialized business court calculate legal fees based on the size of the judgment or settlement, as well as the stage at which the case was completed. In some cases, this can mean larger fee awards than in other courts.

It’s typical for attorneys to receive about a third of a settlement or verdict won for their clients, especially in cases where the cases proceeded through a trial to a final verdict – although a request to be compensated in the very currency of shareholder dilution, which was putatively the thing the lawyers worked so long and hard to prevent, is problematic from a fiduciary standpoint.

A back-of-the-envelope calculation yields the following. The lawyers involved, who are requesting $5.6 billion for five years’ work, want $1.12 billion a year. Assuming an hourly rate of $1000,* which sounds a bit high for Delaware, but let’s go with it, and a workforce of 100 lawyers – which, again, is pushing it, but we’re feeling generous – we arrive at a figure of 466.66 days (that’s 24-hour days, in which every single hour was a billable hour, mind you) that this legal A team for the ages toiled in each of the five years. (NB For the benefit of any extraterrestrials (or AI chatbots) reading this, each year is made up of 365 years; except for leap years, like the one we’re having right now, which have 366. No year sports 466.66 days.) ABC News, WSJ

* In order to bring the working lives of these attorneys into congruence with the actual time it takes the Earth to go around the Sun, their hourly rate would have to go up to something closer to $4,000.

It Takes One to Know One. In related news, swimming with whale sharks – a $1.9 billion global industry and, as new research suggests, one not harmful to the sharks, at least as practiced in Australia – is taking off. Whale sharks can grow to over 36 feet long, are far and away the largest fish in the world (whales not being fishes), and are harmless to humans. Apparently, a whopping 25+ million people sign up to swim with them each year at 46 sites in 23 countries the world over, and this has raised scientists’ concerns about the potential negative impact on the sharks of all this interaction with humans. Still, researchers who attached tags to sharks off Ningaloo, Western Australia, have found the ocean giants have had limited exposure to tourists, with minimal impact of any kind. The researchers said that Ningaloo’s shark-swimming industry shows that “wildlife tourism can be sustainable.” Reports that almost all of the tourists signing up for the swims have been vacationing attorneys, and that the sharks have avoided harming them on account of professional courtesy, were not confirmed at the time of publishing. Semafor

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In f4ba62-485f8d-845009-74413e-b0e337

Already have an account? Sign In f4ba62-485f8d-845009-74413e-b0e337