50%+ retracements following big declines are typically positive

- SPX pullback to new multi-day lows should be buyable by end of week.

- 50%+ Retracements following a big decline are typically quite positive.

- Strengthening in US Dollar and Rates needs to be watched carefully.

Note: I’ll be traveling the balance of this week, and there will be no market reports nor videos for Thursday 8/18, nor Friday, 8/19. These will resume the following Monday, 8/22. Thank you for your continued support and understanding.

Wednesday’s About-face might have seemed like a welcome change for those fighting this rally, but it accomplished precious little with regards to trend deterioration. Most of this decline occurred within Materials, and Communication Services, and Semiconductors within Technology. Meanwhile, Consumer Staples and Energy outperformed, as the WTI Crude decline found temporary support. Overall, until SPX-4186 is broken, this decline might not extend too dramatically and might find support near the ongoing one-month uptrend.

As detailed last evening, while near-term overbought conditions and the start of some Defensive trading might bring about a minor pullback at any time, the larger peak to the rally from June/July lows likely won’t materialize until September. That’s a time when the DXY and TNX rallies might accelerate a bit more towards June/July highs, providing a possible larger stock market reversal. At present, pullbacks should find support either at 4240-50, or below near 4186, providing a spot to buy for a push up to near 4350. Bottom line, while upside might seem limited, Wednesday’s selloff really hasn’t proven strong enough to warrant much concern.

SPX hits 200-day m.a. and Downtrend while eclipsing the all-important 50% retracement zone

As discussed yesterday, the ability to have 90% or more SPX names trade above their respective 50-day moving averages (m.a.) is typically a fairly bullish sign for broad-based participation that has historical success in coinciding with market averages pushing higher on 1, 3 month and 6-month basis.

However, the ability to recoup more than 50% of a 20% or greater prior decline also should be embraced as something which has had success in coinciding with stocks moving higher.

In this case, when looking at 20% SPX declines that reverse and retrace more than 50% of this prior range, it tends to be promising towards thinking a further rally can occur. (I’ll detail the findings of this study a bit later in this report). However, at present, it looks like SPX is finding resistance right at its eight-month downtrend, having surpassed its 50% retracement of this prior range. The DJIA has also successfully broken out above this 50% retracement zone, while the broader-based Value Line and QQQ1.27% remain at but under this area but nearing meaningful resistance.

Thus, upside could prove minimal in the short-term (4350-4400 max), but yet there still looks to be little to no real index deterioration just yet. This will be something to watch for in September. However, at present, stock indices might push a bit higher over the next few weeks, which from a time perspective, would have importance.

Recapturing 50% retracement levels is typically a good sign

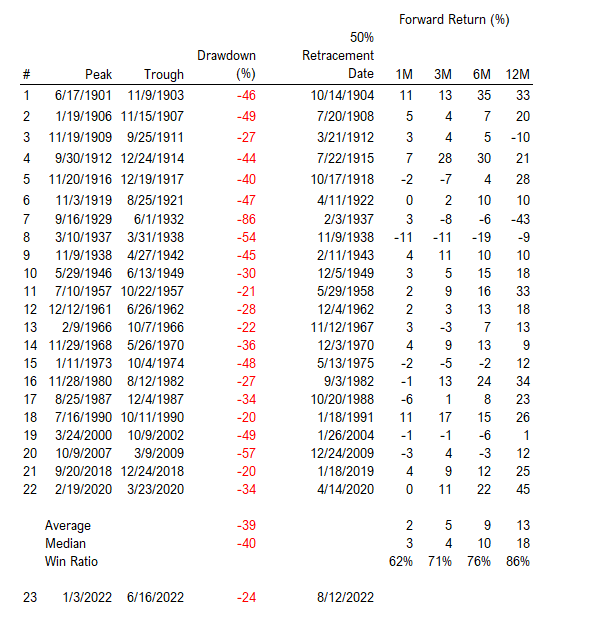

Below shows future performance after SPX fell 20% and then recovered more than 50% of the prior range. As discussed, both SPX and DJIA-0.31% have recouped this important retracement zone, and this often can be important in helping the rally maintain some staying power and not retrace back to the lows right away, as many Market bears are expecting.

Results below show that following a 20% or greater selloff (and some of these instances, markets have sold off more than double 2022’s decline) that recouping their respective 50% of this prior range typically tends to be quite positive. Average win rates have been well over 60% and even better on a three-month, six-month, and 12-month basis.

When looking at the prospects for the balance of 2022 (which we’ll use 3 months as the basis for this study) we see that the six occasions since 1900 that a 50% or greater percentage retracement has still been negative three-months forward, five of six occurrences followed a greater than 40% decline. 2022’s decline has been far less, at 24%. (Special thanks to John Bush and “Tireless Ken” Xuan’s help in creating this table).

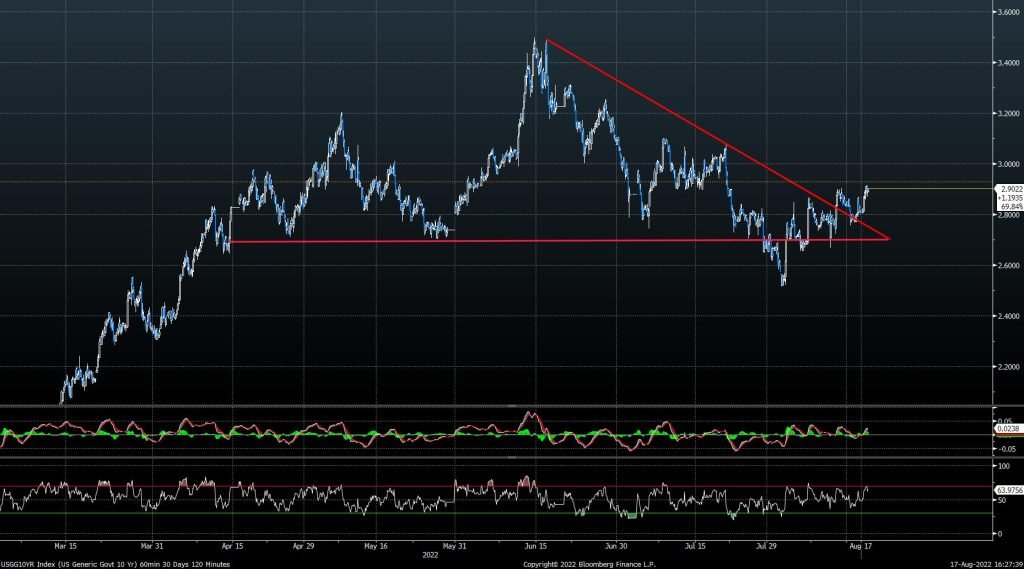

Treasury yields are extending recent breakouts across the Curve

As discussed last week, Treasury yields have started to turn back higher across the curve. Wednesday’s stronger than expected Retail sales report directly coincided with rates spiking higher, and this looked to directly coincide with Equities starting to weaken.

This positive correlation between the Treasury market and Equities (Negative correlation with Yields and Equities) has been ongoing all year, and remains important to watch closely. While this will take some time before yields start to accelerate higher (and this likely won’t begin to move quickly until September). I do expect a challenge of June highs in 10 and 30-year yields.

Bottom line, yields spiking higher should directly coincide with Equities weakening, but I would argue a move back over 3.08 will start to lead this move more quickly. At present, this move has begun, and along with US Dollar strength, these are two non-equity related factors that could lead Commodities and Emerging markets down in the month of September.

My target for yields over the next 6-8 weeks is 3.50-3.60% which might take until October before being achieved. This would then result in yields rolling back over and pulling back into year-end.

Thus, the quicker yields rally (given past history) it could be likely that Technology might also underperform. Conversely, once this bounce in yields has run its course (Potentially October-December) I expect Technology to start to strengthen and lead Equities higher during Q4.

More from the author

Articles Read 1/2

🎁 Unlock 1 extra article by joining our Community!

Stay up to date with the latest articles. You’ll even get special recommendations weekly.

Already have an account? Sign In 3f4445-705a4b-f51a07-3b998f-bf4005

Already have an account? Sign In 3f4445-705a4b-f51a07-3b998f-bf4005