Ticker Appearances

⚡ FlashInsights

⚡ FlashInsights

Daily Technical Strategy

Bullish reversal as Growth starts to make a comeback

SHORT-TERM TRENDS FOR US EQUITIES REMAIN NEGATIVE BUT WEDNESDAY’S REVERSAL DID HAVE THE MAKINGS OF BEING IMPORTANT FROM A TRADING STANDPOINT, AND OCCURRED ON CAPITULATORY...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Expect Regional Banks and Biotechnology will also benefit as Small caps rally

US EQUITY INDICES ARE STARTING TO MOVE HIGHER IN TANDEM, WITH ^SPX -0.21% , RSP -0.54% , DJIA 0.08% AND ALSO QQQ -0.27% ALL SHOWING GAINS OF ROUGHLY +0.45%. SMALL CAPS,...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Live Technical Stock Analysis

LIVE Technical Stock Analysis April 2024

Mark will be conducting a live Webinar session for the most popular stocks requested by our subscribers. Mark will give his quick take (45 sec-1-minute...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Minor Bond yield breakout results in SPX selloff to near support

I CONTINUE TO SEE THE US STOCK MARKET AS BEING ATTRACTIVE, TECHNICALLY SPEAKING, AND DO NOT FEEL SUFFICIENT RISK IS THERE TO WARRANT A SELLOFF...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Bullish reversal as Growth starts to make a comeback

SHORT-TERM TRENDS FOR US EQUITIES REMAIN NEGATIVE BUT WEDNESDAY’S REVERSAL DID HAVE THE MAKINGS OF BEING IMPORTANT FROM A TRADING STANDPOINT, AND OCCURRED ON CAPITULATORY...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Expect Regional Banks and Biotechnology will also benefit as Small caps rally

US EQUITY INDICES ARE STARTING TO MOVE HIGHER IN TANDEM, WITH ^SPX -0.21% , RSP -0.54% , DJIA 0.08% AND ALSO QQQ -0.27% ALL SHOWING GAINS OF ROUGHLY +0.45%. SMALL CAPS,...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Live Technical Stock Analysis

LIVE Technical Stock Analysis April 2024

Mark will be conducting a live Webinar session for the most popular stocks requested by our subscribers. Mark will give his quick take (45 sec-1-minute...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Minor Bond yield breakout results in SPX selloff to near support

I CONTINUE TO SEE THE US STOCK MARKET AS BEING ATTRACTIVE, TECHNICALLY SPEAKING, AND DO NOT FEEL SUFFICIENT RISK IS THERE TO WARRANT A SELLOFF...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Equal-weighted SPX has yet to gain traction while QQQ/SPY down to support

EQUITY TRENDS SHOW NO EVIDENCE OF WAVERING. DESPITE THIS WEEK’S MILD CONSOLIDATION IN EQUITY INDICES, THE CYCLICALS HAVE MANAGED TO KICK INTO GEAR TO PROVIDE...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

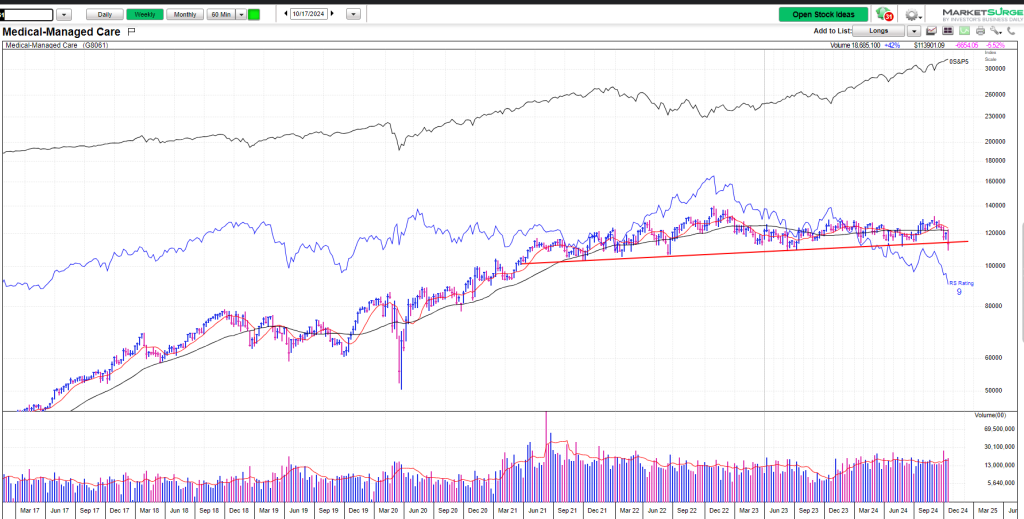

SPX pullback should prove short-lived; Healthcare deserves an Overweight

SPX AND QQQ LOOK TO HAVE BEGUN MINOR PULLBACKS WITH WEDNESDAY’S DECLINE, WHICH HAPPENED DURING A SIGNIFICANT WEEK OF FOMC MEETING, “MAGNIFICENT 7” EARNINGS AS...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Bullish reversal as Growth starts to make a comeback

SHORT-TERM TRENDS FOR US EQUITIES REMAIN NEGATIVE BUT WEDNESDAY’S REVERSAL DID HAVE THE MAKINGS OF BEING IMPORTANT FROM A TRADING STANDPOINT, AND OCCURRED ON CAPITULATORY...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Expect Regional Banks and Biotechnology will also benefit as Small caps rally

US EQUITY INDICES ARE STARTING TO MOVE HIGHER IN TANDEM, WITH ^SPX -0.21% , RSP -0.54% , DJIA 0.08% AND ALSO QQQ -0.27% ALL SHOWING GAINS OF ROUGHLY +0.45%. SMALL CAPS,...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2

Daily Technical Strategy

Minor Bond yield breakout results in SPX selloff to near support

I CONTINUE TO SEE THE US STOCK MARKET AS BEING ATTRACTIVE, TECHNICALLY SPEAKING, AND DO NOT FEEL SUFFICIENT RISK IS THERE TO WARRANT A SELLOFF...

This report is accessible to

FSI Pro, FSI Macro

memberships.

You have viewed the limit of 2 reports for free this month.

To continue reading our research please sign up below.

Already have an account? Sign In 88f86a-bc2148-6126f9-f188f7-b09cf2

Visitor: 88f86a-bc2148-6126f9-f188f7-b09cf2