Lessons From OPEC

We have witnessed a significant market panic partially related to formerly locked BTC hitting the order books. The major sources of supply include:

- Mt. Gox – 141,686 BTC

- US Government – 8,100 BTC

- German Government – 50,000 BTC

At current prices, this would equate to over $12 billion in supply.

This threat, combined with an inhospitable macro backdrop (rising DXY, higher rate expectations, hawkish Fed), has brought BTC down to around $60k, with altcoins experiencing outsized declines. From our perspective, it seems that investors are now wondering just how low we could go. This mentality is in stark contrast to the bullish sentiment seen merely a few weeks ago.

Our view is that while crypto can sometimes be less efficient than traditional markets, it is likely that this unlocked supply is already priced in, and that investors should shift their focus to potential increases in demand as well as other areas where the supply dynamics might improve.

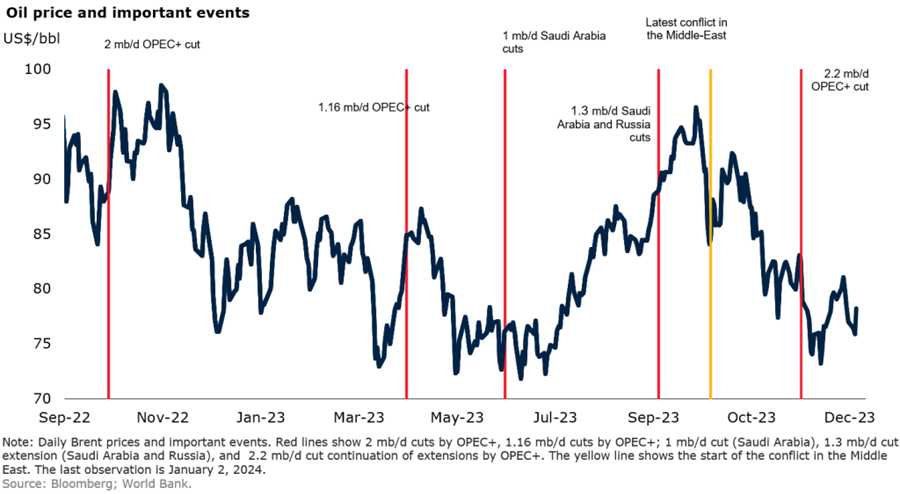

In traditional commodity markets, when OPEC announces a change in supply output, how does the oil market react?

One might assume that OPEC cuts lead to bullish price action for oil (less supply). It often does, in the short term. However, in recent history, OPEC cuts have more often resulted in initial price rallies, followed by eventual and more severe oil price declines.

In the instances cited in the chart above where oil prices declined post-cut, supply was presumably in the oil market’s favor, but demand was not, and therefore prices went lower. There was also likely unforeseen influence from other producers like the US who may have increased their output.

The current situation with the added float from Gox and government entities is much like the OPEC dynamic, but in reverse (Gox = oil output increase).

Now that the sales of these coins have been announced and the market has digested the news, we find it more important to assess the future level of aggregate demand and the behavior of other potential sources of added supply.

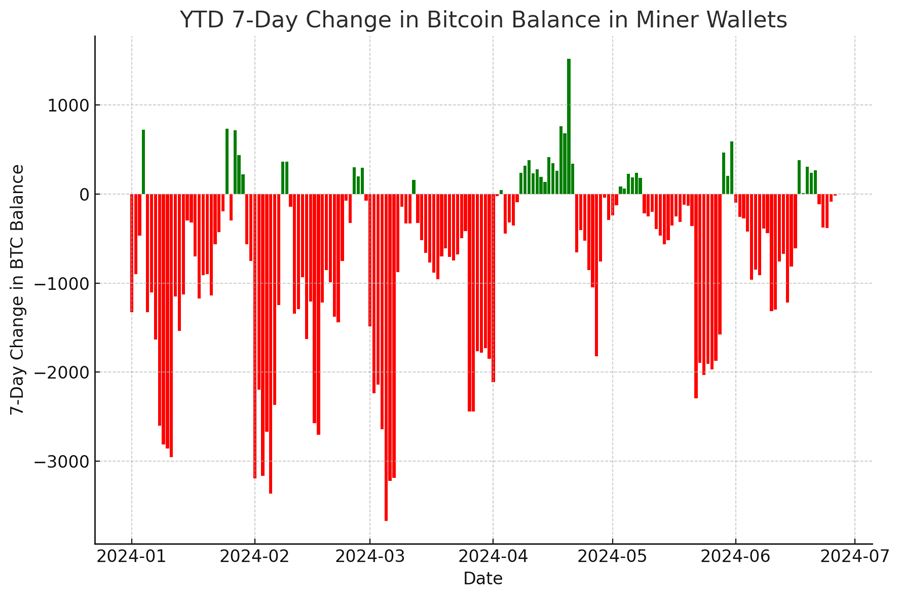

Other Potential Source of Supply = Miners

The other identifiable major source of increased float in the BTC market is miners, which have been selling their respective BTC stacks in the wake of declining profitability. However, as the chart below suggests, the pace of miner selling is likely slowing.

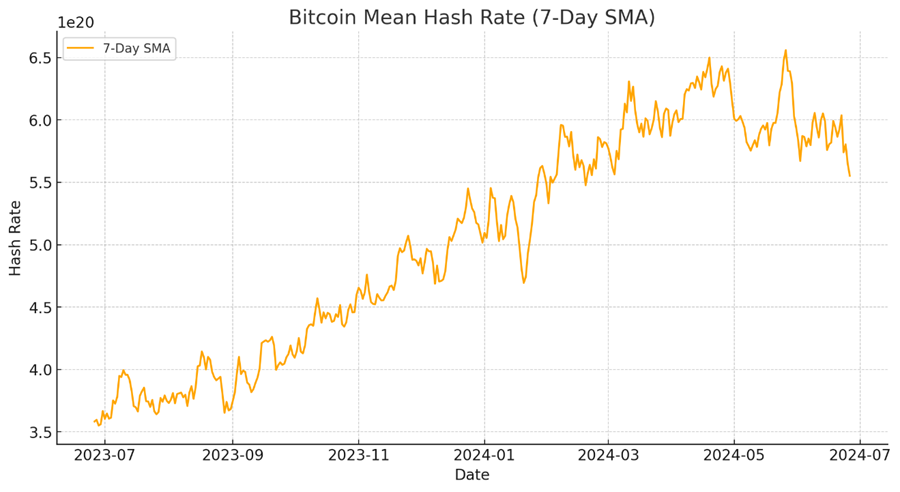

This pattern syncs with a network that has seen a significant decline in hash rate over the past couple of months, as unprofitable machines are taken offline. The implications here are that the next difficulty adjustment for miners is likely to be lower, making mining a more profitable endeavor and reducing the need to liquidate BTC held in treasury.

Overall, we think the worst of the recent bout of miner selling is over, and that this is an aspect of the supply/demand equation that many investors are overlooking.

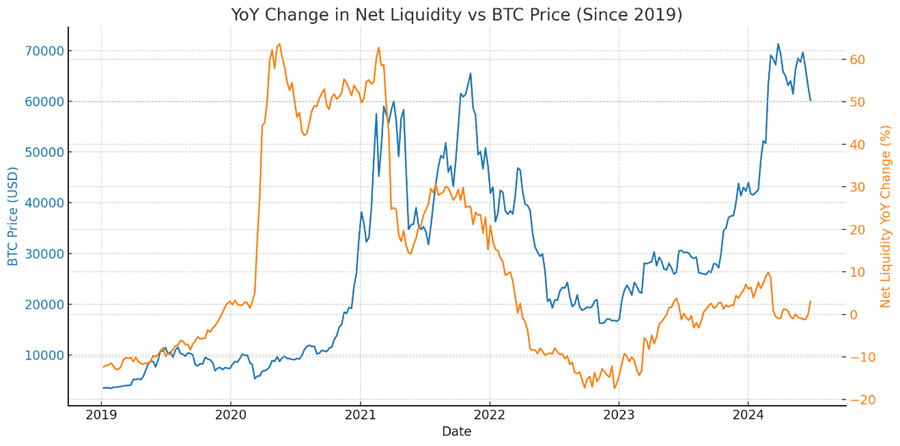

Estimating Aggregate Demand = Path of DXY, Rates, Liquidity

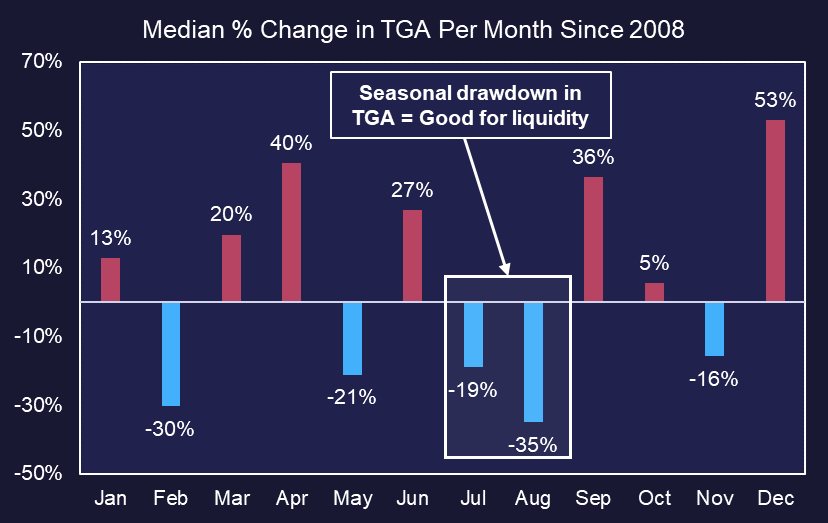

The near-term path of net liquidity appears poised to sway in crypto’s favor. Since 2008, July has consistently experienced a seasonal reduction in the Treasury General Account (TGA), positively impacting fiscal flows and overall liquidity conditions.

The TGA, essentially the Treasury’s bank account, does not utilize commercial bank deposits, and instead parks their reserves with the Fed. Thus, this affects banking system liquidity. When the TGA decreases, the treasury is spending more than it borrows, and reserves are effectively returned to the private banking system. Conversely, an increase in the TGA signifies a withdrawal of liquidity from the banking system. Therefore, a seasonal decrease in July would be advantageous for liquidity conditions.

Moreover, Quantitative Tightening (QT) is set to continue at its tapered pace. As a reminder the reduction in the monthly redemption cap on Treasury securities was from $60 billion to $25 billion. But the FOMC also maintained the $35 billion cap on agency debt and agency mortgage-backed securities, reinvesting any principal payments that exceed this cap back into Treasury securities, further easing supply pressure.

With the TGA likely to decline, the RRP facility expected to remain stable, and the QT continuing at its tapered pace, we anticipate a positive shift in net liquidity.

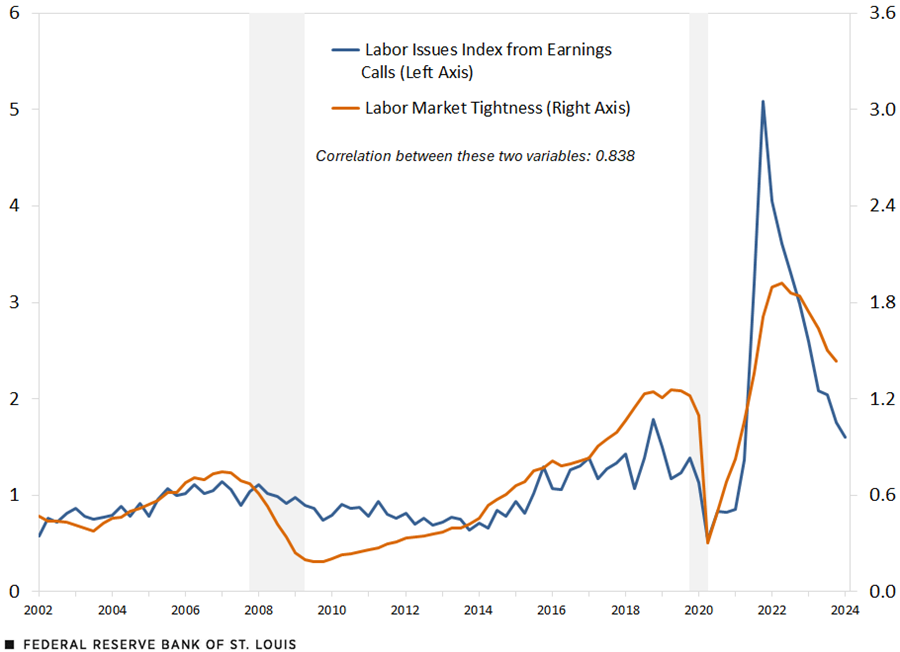

Meanwhile, the DXY has been stubbornly strong as of late, despite rates falling, as global growth has stagnated and rate expectations have held steady following a more hawkish-than-expected Fed at the latest FOMC.

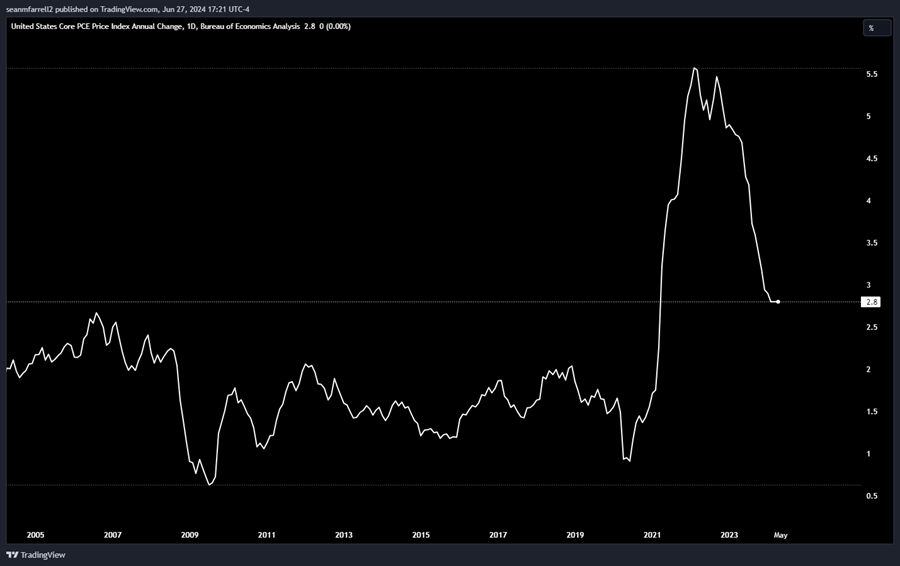

However, under the surface, we still have inflation trending lower, and economic data softening in a non-recessionary manner (a Goldilocks scenario). We think it is possible that the PCE figure released on Friday is the start of a DXY drawdown.

In summary, there is good reason to think that demand for BTC will increase in the near term.

Analyzing the ETH ETF Launch

As it stands, the market expects an ETH ETF to launch on or around July 2nd, less than a week from today. There is a lot of speculation over how flows will look post-launch, and from our conversations, most views skew towards the bearish end of the spectrum.

There are certainly reasons to doubt the level of flows that these spot ETFs will garner. ETH has generally had trouble marketing itself to crypto natives lately, so how will issuers market to a new investor cohort?

And even if issuers are effective marketers, it’s summer—who is around to buy these things? Additionally, there will probably be a lot of outflows, right?

Below we make the case that the market is too bearish on the ETH ETFs right now.

An Arguably Better Macro Setup

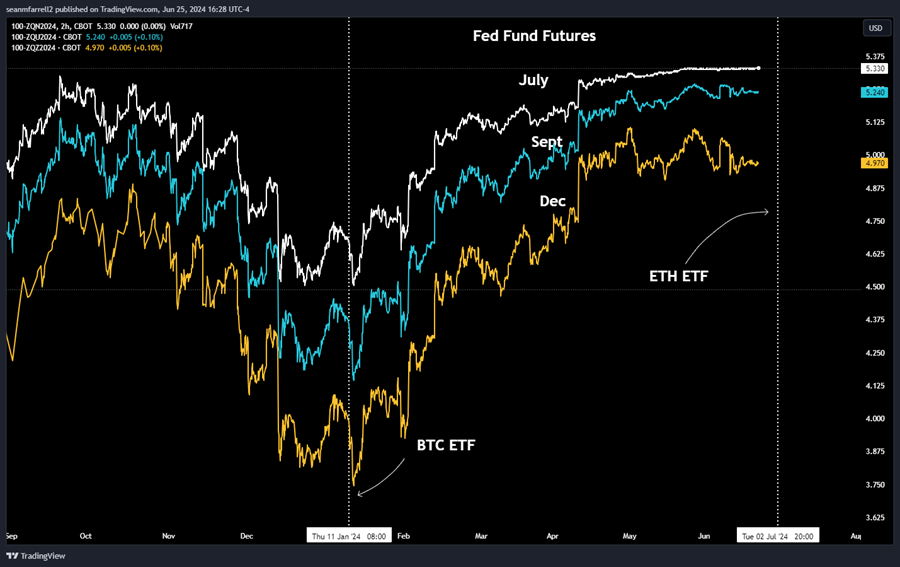

Before discussing how we think flows will pan out, it’s worth comparing the current macro setup to the setup at the time of the BTC ETF launch.

To restate our views articulated above, we think the near-term risk asymmetry for the DXY is to the downside, given the latest CPI print and jobs numbers. We also view a high likelihood of rate expectations getting priced back in.

Looking at where the DXY and rate expectations are right now ahead of the ETH ETF launch compared to where they were ahead of the BTC ETF launch, the setup begins to look much more constructive for ETH ahead of the big launch day.

In fact, just prior to the BTC ETF launch, we were on the precipice of a major upwards repricing of rates and the DXY – the opposite of our current views.

Less Upside Priced In

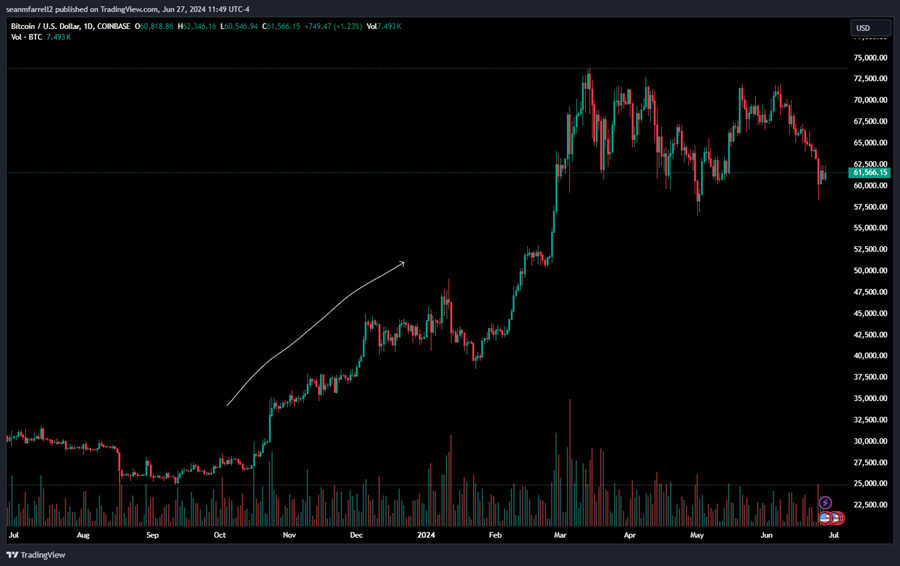

From a micro lens, ETH has not seen the same run-up in price ahead of the ETF launch. For BTC, the march higher from October into January was relentless—BTC nearly doubled from the time that the market gained confidence in the imminent approval of a spot BTC ETF.

For ETH, yes, there was a massive green candle on the news of a likely 19b-4 approval, but ETH has since retraced that move, now sitting a mere 15%above where it was trading the morning before the ETF news hit the tape. This is partially attributable to the recent macro weakness, but in our view, it is also due to the limited expectations ahead of the ETH ETF launch and the anticipation of ETHE redemptions on day 1 of trading.

Further, ETHBTC is also only up about 25% off the lows and up 5% YTD—it doesn’t seem that the market is pricing in much outperformance of ETHBTC ahead of the launch. Either way you look at it, the point here is that there seems to be limited upside priced into ETH ahead of the ETH ETF launch.

ETHE Redemptions Possibly Lower than Expectations

On the topic of ETHE redemptions, there will certainly be a good deal of those, as many who bought the discounted ETHE close out their arbitrage trade. However, we have reason to believe that outflows will surprise to the downside—the major reasons being:

- The comparatively less amount of ETHE held in bankruptcy estates. There were approximately $1B in GBTC holdings in the FTX estate that were liquidated within the first week of trading, comprising a good chunk of the outflows at the time. There is a good chance that the FTX estate has already liquidated its holdings, but if not, they hold about $200 million, or 20% of the GBTC amount prior to BTC ETF launch.

- As of the week ended 6/25, leveraged funds only had approximately $650 million in short interest on the CME ETH Futures. At the time of the BTC ETF launch, for the week ended 1/16, there was nearly $3.2 billion in BTC short interest from leveraged funds on the CME. So around launch, hedge funds have approximately 20% of the short OI that they had pre-BTC ETF launch (source: CME COT). While there certainly could be unhedged traders playing the ETHE trade into the ETF launch, this likely gives us a good barometer for the quantity of hedge funds playing the arb trade.

We Could See Limited Organic Flows – But It Might Not Matter

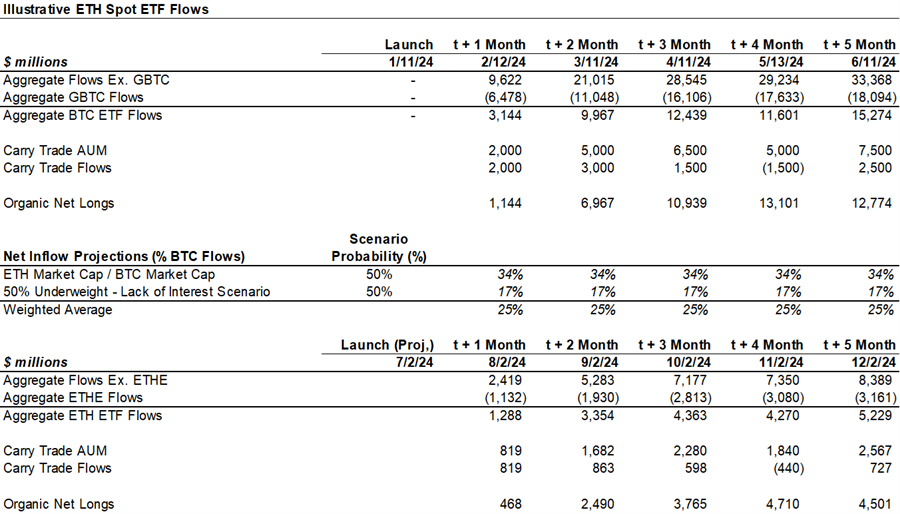

As we highlighted above, we believe there is a strong probability that outflows from ETHE are below market expectations (to be clear, there are no consensus estimates, so much of this is a qualitative assessment). To estimate inflows, we suggest using a market cap weighted ratio, incorporating a probabilistically weighted downside scenario.

Below we model out what flows might look like. We assume:

- Given our assessment that ETHE outflows might surprise to the downside, we project first month ETHE outflows to be 50% of the GBTC outflows as a percentage of total AUM at the launch date.

- The growth rate of ETHE outflows over the first 5 months is consistent with the observed growth rate of GBTC outflows in its first 5 months of existence as an ETF.

- ETH gross inflows are estimated by taking BTC gross inflows and multiplying them by a factor that approximates the market cap weight of the two assets, with a 50% downside scenario included for conservatism.

- We also estimate the amount of AUM in BTC ETFs that is attributable to the carry trade using CME COT data. It is tough to ascertain the exact amount of AUM in this category, but we approximated it based on the short positions of leveraged funds (some might just be outright shorts though). Then we assume a similar growth in carry trade inflows for ETH spot ETFs.

Ultimately, this gets us to about $5.2 billion in net inflows over the first 5 months of trading. Certainly not on BTC ETF levels, but it is our view that the market would see this as a pleasant surprise.

This brings us to an important point for those who are unable to see a path toward $5B in net inflows—we don’t need to see insane inflows from the jump. From our perspective, market expectations are quite low ahead of launch. Being bearish due to impending ETHE outflows is consensus. We think outflows likely surprise to the downside, which fuels speculation, increasing the basis and bringing hedge funds into the ETFs to lever up and participate in the basis trade. This will be enough for the market to deem the ETH ETFs a successful launch.

Summary

To put a finer point on it:

- The macro setup is conducive for crypto over the next month or so, with liquidity conditions likely to increase, the DXY likely to roll over, and rate cut expectations likely to increase.

- Trader sentiment around ETH (and crypto overall) is quite low, much lower than it was prior to the BTC ETF launch. There has been less upside priced in by market participants compared to the BTC ETF launch.

- We view a high possibility of ETHE outflows surprising to the downside, sending speculation higher, basis higher, and fueling carry trade inflows, which could beget “organic” inflows.

- This is bullish for ETH and ETH-adjacent assets in the near term.

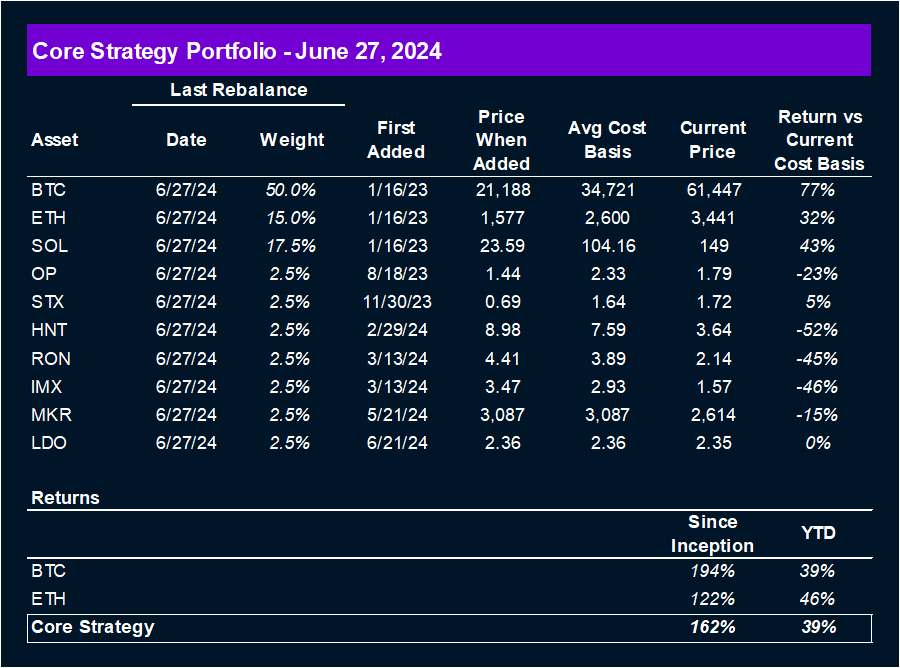

Core Strategy

We enter July with good reasons to think that the DXY starts to roll, rate cuts get priced back in, and liquidity conditions improve. We also have an ETH ETF launch coming next week that consensus is quite bearish on, leaving us to view the risk asymmetry to the upside. With the preceding notions in mind, we think it’s a good time to add risk and are moving the stablecoins in our Core Strategy into ETH and SOL in equal proportions, as we think both could play some catch-up over the next month.

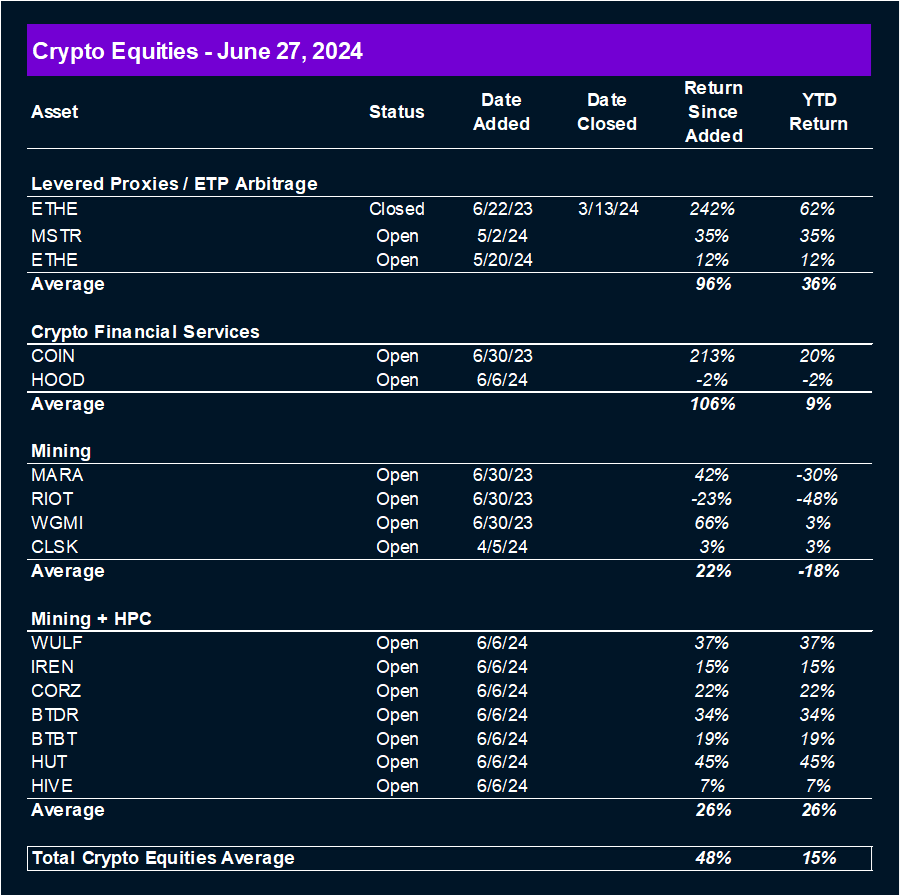

BTC 0.88% , ETH -0.01% , SOL -0.78% , OP -1.20% , STX -1.85% , HNT -3.68% , RON N/A% , IMX, MKR -0.13% , LDO -3.66% , USDC -0.01% , PENDLE -2.46% , ETHE N/A% , MSTR -10.17% , ETHE N/A% , COIN -0.79% , HOOD, MARA 1.17% , RIOT 0.22% , WGMI N/A% , CLSK, WULF, IREN, CORZ, BTDR, BTBT, HUT, HIVE -2.84%