Crypto Market Update

Despite May PCE data coming in line with expectations at 0.0% MoM, U.S. Treasury yields are moving higher across the curve, and the DXY is holding steady at $105.8. Equity indices are flat on the day in the final trading session of Q2. Crypto is showing weakness, with BTC 0.73% declining to $60.7k and ETH -0.24% falling below $3,400. After surging upon news of VanEck filing for a Solana ETF, SOL -1.10% has given back most of yesterday’s gains, while Solana meme coins BONK -3.82% and WIF -5.57% are among today’s worst performers. Conversely, AVAX 0.86% continues to flex its relative strength this week, rising above $28.4 amid broad-based declines in altcoins.

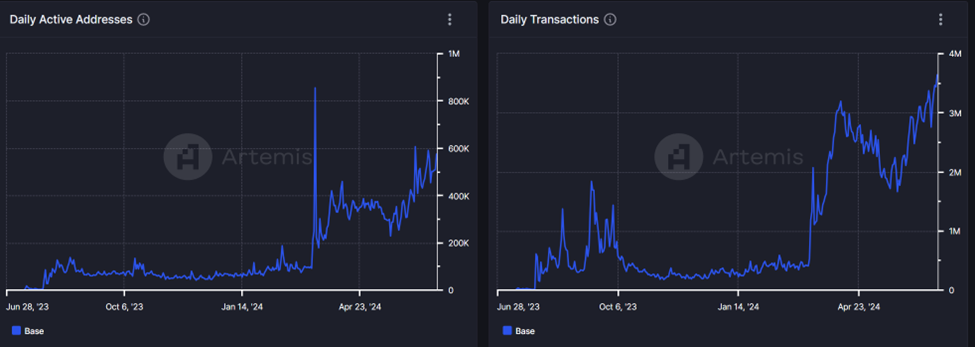

Coinbase and Stripe Form Partnership

Coinbase has inked a partnership with payments company Stripe to increase on-chain adoption and provide faster and cheaper financial infrastructure. The partnership features three key integrations across the two companies; Coinbase (COIN -0.79% ) will integrate Stripe’s crypto-to-fiat onramp directly into Coinbase Wallet, enabling Stripe as a payment option when funding wallets. Stripe will add support for USDC on Base to its onramp so users can convert between fiat and USDC seamlessly as well as integrate it into its crypto payouts product, supporting USDC transfers across 150+ countries. Coinbase continues to add new features and integrations that make transacting on Base more accessible and less arduous than other blockchains, fueling the network’s rapid growth. Daily active addresses are approaching 600,000, while daily transactions have reached new highs, surpassing 3.5 million.

Animoca Brands Exploring a Public Listing

Animoca Brands, an Asian-based web3 and venture capital firm, is considering pursuing a public listing next year. Animoca would explore a listing in a crypto-friendly jurisdiction such as Hong Kong or Singapore, and if it were to happen, it would more likely be in the second half of 2025. Animoca has been one of the most active crypto venture capital firms this year, participating in 59 rounds, including Io.net, Humanity Protocol, and Polyhedra Network, with other prominent investments include TON, The Sandbox, and Axie Infinity. Animoca completed a private funding round in September 2022, valuing the company at $5.9 billion, but given industry volatility and the significant decline in private valuations since 2022, it’s difficult to estimate a potential valuation for Animoca. As of March 2024, Animoca reported close to $3 billion in assets, not including approximately 400 minority VC investments.

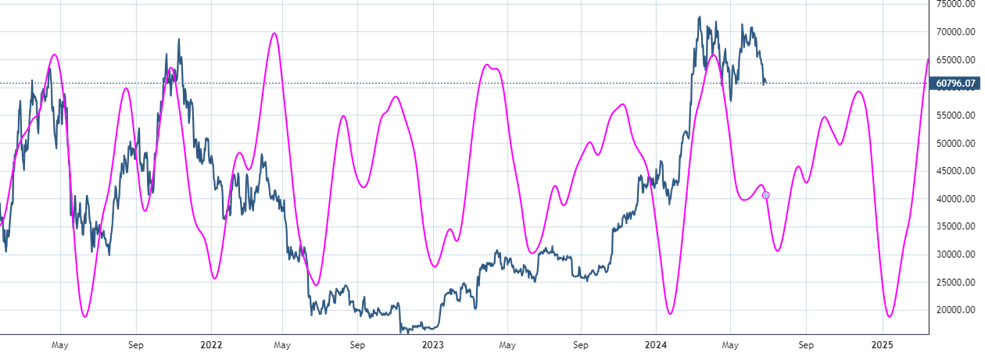

Technical Strategy

Bitcoin’s recent decline very well might be coming to an end when considering the cycle composite created by daily cycles of Bitcoin which show the possibility of a short-term low by the 2nd week of July before a turn higher in the months ahead. Despite the bearish slope of intermediate-term weekly Bitcoin cycles until the US Election before turning higher (Not shown) this Daily cycle composite seems to suggest the possibility of a near-term low approaching. However, both daily and weekly cycles suggest that November 2024 into next Summer should be a very bullish time for BTC 0.73% as both start to trend sharply higher. At present, near-term trends remain bearish and could allow for a drop to test and break early May lows near $56,500. To have faith that a rally has begun before that target is reached, BTC 0.73% requires a push back over $65k which looks premature at this time.

Daily Important MetricsAll metrics as of 2024-06-28 12:00:24 All Funding rates are in bps Crypto Prices

All prices as of 2024-06-28 11:52:22 Exchange Traded Products (ETPs)

News

|