-

Research

-

Latest Research

- Tom Lee, CFA AC

-

First Word

FSI Pro FSI Macro

-

Intraday Word

FSI Pro FSI Macro

-

Macro Minute Video

FSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical Strategy

FSI Pro FSI Macro

-

Live Technical Stock Analysis

FSI Pro FSI Macro

- L . Thomas Block

-

US Policy

FSI Pro FSI Macro

- Market Intelligence

-

Your Weekly Roadmap

FSI Pro FSI Macro FSI Weekly

-

First to Market

FSI Pro FSI Macro

-

Signal From Noise

FSI Pro FSI Macro FSI Weekly FSI Community

-

Earnings Daily

FSI Pro FSI Macro FSI Weekly

-

Fed Watch

FSI Pro FSI Macro

- Crypto Research

-

Strategy

FSI Pro FSI Crypto

-

Market Update

FSI Pro FSI Crypto

-

Funding Fridays

FSI Pro FSI Crypto

-

Concepts

FSI Pro FSI Crypto

-

Comments

FSI Pro FSI Crypto

-

Liquid Ventures

FSI Pro FSI Crypto

-

Deep Research

FSI Pro FSI Crypto

-

Miscellaneous

FSI Pro FSI Crypto

-

DeFi Digest

FSI Pro FSI Crypto

-

Technical Analysis

FSI Pro FSI Crypto

-

Latest Research

-

Media

-

Latest Media

FSI Pro FSI Macro FSI Crypto

- Video Reports

-

Macro Minute Video

FSI Pro FSI Macro FSI Crypto

-

Daily Technical Strategy

FSI Pro FSI Macro FSI Crypto

-

Crypto Video

FSI Pro FSI Crypto

- Webinars

-

Latest Webinars

FSI Pro FSI Macro FSI Crypto

-

Market Outlook

FSI Pro FSI Macro FSI Crypto

-

Granny Shots

FSI Pro FSI Macro FSI Crypto

-

Technical Strategy

FSI Pro FSI Macro FSI Crypto

-

Crypto

FSI Pro FSI Macro FSI Crypto

-

Special Guest

FSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

Latest Media

-

⚡FlashInsights

-

Stock Lists

-

All Stock Lists

FSI Pro FSI Macro FSI Crypto

- Granny Shots

-

Intro

FSI Pro FSI Macro

-

Stock List

FSI Pro FSI Macro

-

Performance

FSI Pro FSI Macro

-

Commentary

FSI Pro FSI Macro

-

Historical

FSI Pro FSI Macro

-

FAQ

FSI Pro FSI Macro

- Upticks

-

Intro

FSI Pro FSI Macro

-

Stock List

FSI Pro FSI Macro

-

Performance

FSI Pro FSI Macro

-

Commentary

FSI Pro FSI Macro

-

FAQ

FSI Pro FSI Macro

- Sector Allocation

-

Intro

FSI Pro FSI Macro

-

Current Outlook

FSI Pro FSI Macro

-

Prior Outlooks

FSI Pro FSI Macro

-

Performance

FSI Pro FSI Macro

-

Sector

FSI Pro FSI Macro

-

Tools

FSI Pro FSI Macro

-

FAQ

FSI Pro FSI Macro

- Crypto Core Strategy

-

Intro

FSI Pro FSI Crypto

-

Strategy

FSI Pro FSI Crypto

-

Performance

FSI Pro FSI Crypto

-

Reports

FSI Pro FSI Macro

-

Historical Changes

FSI Pro FSI Crypto

-

Tools

FSI Pro FSI Crypto

- Crypto Liquid Ventures

-

Intro

FSI Pro FSI Crypto

-

Strategy

FSI Pro FSI Crypto

-

Performance

FSI Pro FSI Crypto

-

Reports

FSI Pro FSI Crypto

-

All Stock Lists

-

Watchlist

-

FSI Community

-

FSI Snapshot

-

FSI Academy

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Community Interviews

-

FSI Snapshot

Part 2

What are Stocks and the Stock Market?

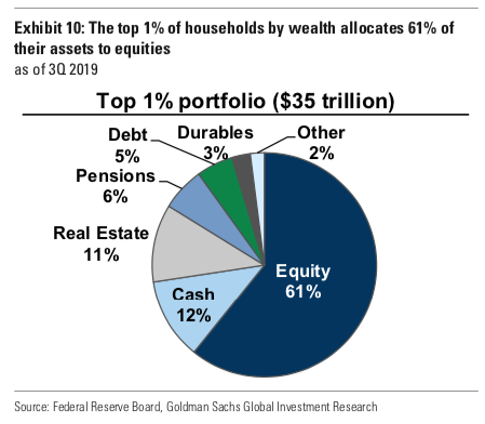

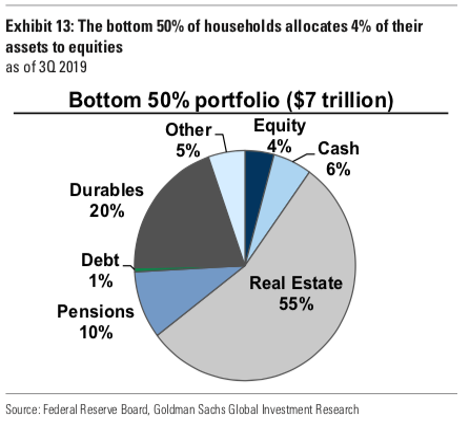

Stock markets intimidate a lot of people. People may think the stock market is out of reach and is maybe only for the wealthiest few. There is certainly some merit to this. Rich people in the United States tend to have the majority of their wealth inequities. Whereas the bottom 50% of households in terms of wealth tend to hold the majority of their wealth in real estate assets, namely probably their primary home, the rich tend to have their holdings in stocks.

There’s a lot of misconceptions out there about stock markets. The jargon can seem a little more intelligible than Greek, and there’s a lot that can make you want to run for the door rather than fork out your hard-earned dollars to gain a partial stake in the future earnings of a business you may or may not know a lot about. Then there is also the fact that one of the main things, financially speaking, that distinguishes the rich from the poor is that they have a lot more of their assets in stocks than their less fortunate brothers and sisters. Like more than 15 times as much on a proportional basis. So, there’s genuinely something to these stocks, and if you’re looking to learn more, you’ve come to the right place.

The Perennial and Ultra-Modern Are Simultaneously At Home In The Stock Market

You may think stocks are the epitome of modernity with the flashy screens and complicated graphs you see being displayed. However, the equity asset class has origins that are centuries old and predate capitalism as we know it, despite now being one of the modern capitalist system’s pillars. The first publicly traded company was the Dutch East India Company, traded on the Amsterdam stock exchange. It began trading in 1602.

Before there was an established exchange dedicated to equity and debt, most of the transactions occurred in coffee houses. So if you’re sitting in Starbucks on the Wall Street Bets message board, you have more in common with the original stock market participants than you may think. Just as cafes were a hotbed of revolutionary political activity in France, they were the nexus of a blossoming innovation that would significantly improve society by connecting investors with instruments that can provide them with specified uses that help them manage risk and increase returns.

The first joint-stock company came about because people realized it made a lot more sense to fund multiple trade expeditions at once rather than one at a time. This idea to diversify risk and limit liability would eventually become enshrined in the corporate entity that has become such a cornerstone of modern capitalism.

-

Financial Instruments! How to use them and what are they for!

-

What are Stocks and the Stock Market?

-

Why Do Investors Buy Stocks?

-

What Kind of Risks Affect Stocks and Bonds?

-

What Is The Difference Between Stocks and Bonds?

-

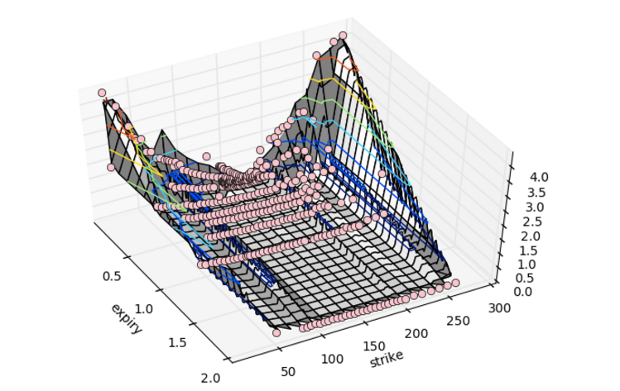

What About Derivatives? Where Do They Fit Into All Of This?

-

What About Exchange Traded Products?

-

Financial Instruments... Conclusion!

Related Guides

-

Series of 3~9 minutesLast updated1 week ago

Series of 3~9 minutesLast updated1 week agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis

-

Series of 4~10 minutesLast updated1 year ago

Series of 4~10 minutesLast updated1 year agoCommodities 100

An introduction to commodities for novice investors.

-

Series of 3~11 minutesLast updated2 years ago

Series of 3~11 minutesLast updated2 years agoUnderstanding Risk and Return: Hallmarks of Investing

Risk/return is so crucial to investing that it is sometimes considered the essential element of the whole craft. In this guide, we provide insights and tools to better understand risk and how to control it.

-

Series of 7~24 minutesLast updated2 years ago

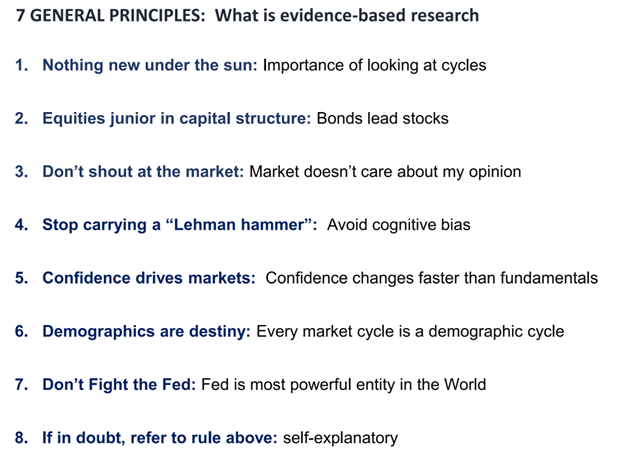

Series of 7~24 minutesLast updated2 years agoTom Lee's Seven Principles of Evidence-Based Research

It is important to be evidence-driven when making decisions in equity markets. People have acclaimed some of our team’s market calls, but if you look closely much of the time, we were just following the data.

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInvestor Psychology 100

You may have heard this before: Many of the world’s top investors manage their portfolios well because they manage their emotions well. But what does that look like? If you want to know more about investor psychology – arguably the most critical component of the entire game -- you’ve come to the right place. Let’s dive in.