-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 6

What About Derivatives? Where Do They Fit Into All Of This?

“The world of derivatives is full of holes that very few people are really aware of. It’s like hydrogen and oxygen sitting on the corner waiting for a little flame.”

Charlie Munger

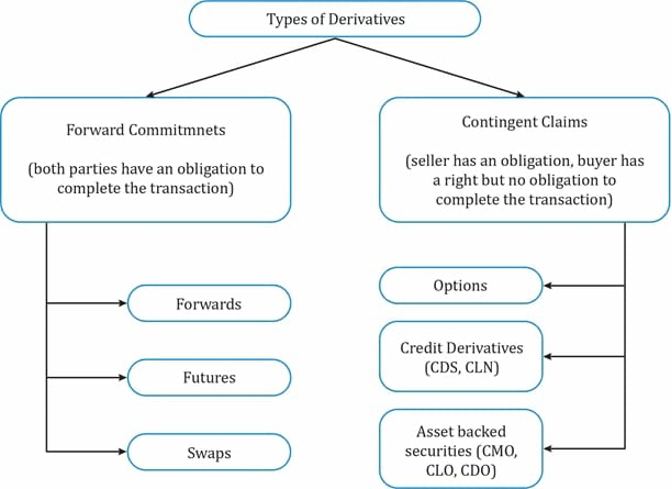

If all this weren’t complicated enough, there are an entire group of assets whose value is derived from the underlying value of other assets. This larger umbrella category of derivatives encompasses many different types of contracts like options, futures, forwards, swaps, and credit derivatives. These instruments are based on an agreement of specified rights and obligations.

In futures, forward, and swaps, both sides of the contract have obligations. In contrast, on the contingent claims side of the derivative asset class, usually, one counterparty has rights, and the other counterparty has obligations, like in the case of options and credit default swaps.

The person who gains rights from the contract is said to be “long,” and the person who assumes obligations is said to be “short.” It’s important to remember that this terminology is distinct from being short and long in the traditional sense. For example, you could simultaneously be shorting a stock but be on the long side of the options contract.

Charlie Munger’s quote should give you pause, but if it doesn’t, also remember that Warren Buffet referred to derivatives as ‘financial weapons of mass destruction.’ The advice to tread lightly and only use these instruments when you have a thorough and tested understanding should not be disregarded. When using options as a substitute for equity, you assume much more risk in most cases than you need to be and likely ceding many of the benefits that owning stocks provides.

However, there is more to derivatives than just the supposed villainy that was crystallized in many minds after massive derivative losses resulted in the failure of Lehman Brothers and the $86 billion bailout of AIG. Despite the nasty downside, these financial innovations make markets better and more efficient. They give investors a number of powerful tools to manage and define risk. They also democratize access to leverage, which had for years been something only institutional investors could genuinely utilize.

A successful options strategy is like flying a plane or helicopter. You have to worry about many different dynamics and dimensions, and you have to balance many competing things. For example, you could have a contract that is expiring in the money, but you notice there’s a widening ask/bid spread developing. You could have done everything right in terms of your economic bet on the direction of the underlying, but if there’s nobody to buy it, then you can’t sell it.

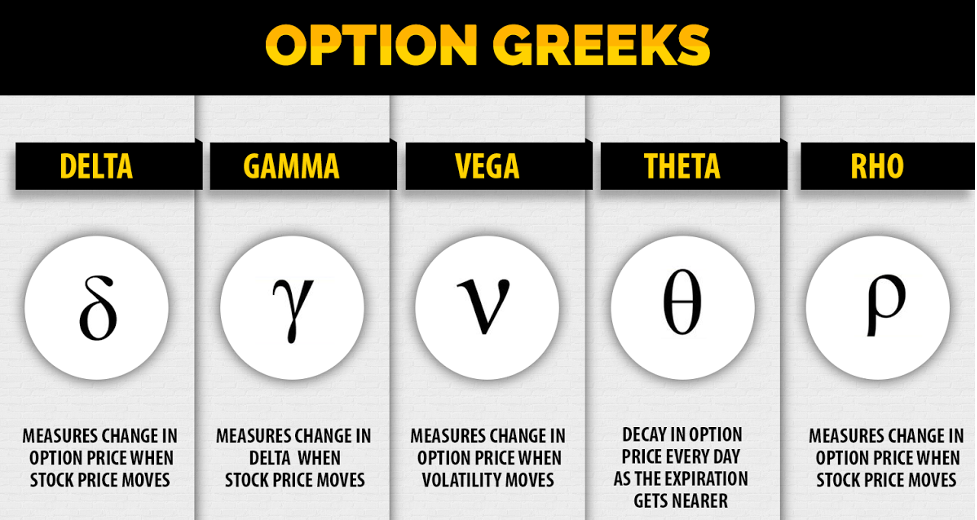

Similarly, as options approach expiration, their values tend to get extremely volatile. One key metric to pay attention to is implied volatility. This metric is distinct from historic volatility and is a crucial input in the Black-Scholes options pricing formula. It is an effective estimate of future price movement. Other critical planes of risk to consider are in The Greeks, which refers to the different ways different risks of an option contract can be quantified.

Options are generally traded on cleared exchanges and have a strike price. When the underlying stock price goes above the strike price, in the case of a call option, the option is considered in-the-money. In the case of an American-style option, the owner of the option (long-side) would be able to exercise that option and buy the underlying security at a lower price than it is currently trading on the market. The counterparty who exercised that option could then sell their stock and collect a premium that is the difference between the market price of the underlying asset and the option’s strike price. This difference is called intrinsic value.

This is distinct from another component of an option’s value, that is, the time left to expiration. Even though the option is in the money, it may be much further in the money if the owner waits until closer to the expiration date. This is why options with more time to expiration are worth more even though the underlying asset price is the same. This is really the reverse side of the same logic Tom Lee uses when observing inversions in the VIX term structure. Since it is so bizarre and seems to contradict reality, it is often a valuable signal. If you saw a longer-dated call option of the same strike price as a shorter-dated call option, you would immediately buy it because you’d be getting free time value.

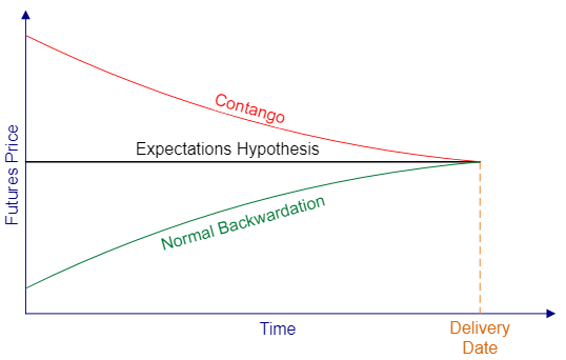

Futures are different and are generally concerned with the physical delivery of commodities but can also involve securities as well. For example, there are futures on the S&P 500. Indeed there are also VIX futures which is what Tom often uses to detect backwardation in the illuminating index. However, these instruments are primarily the realm of those playing in commodities markets.

Individual investors may play in futures markets. However, it is primarily the domain of institutional investors. One example of an industry that uses derivatives very extensively in the average course of business is airlines. One of their greatest variable costs as an industry is the price of airline fuel, and therefore hedging strategies can very effectively mitigate the impact of price volatility on earnings. These uses show the beneficial side of derivatives use that constitutes the vast majority of activity, even though many younger retail investors have recently shown problematic use patterns.

Derivatives markets were dramatically reformed since the unregulated past. Title VII of the Dodd-Frank Act, among other things, banned the type of over-the-counter (OTC) derivatives between two counterparties that had been so problematic and had resulted in so much financial liability to the American taxpayer. Now derivatives all have to be centrally cleared at an authorized clearinghouse like ICE or the CME. These clearinghouses may in themselves present a tail risk, though, as they are ultimately responsible for the integrity of hundreds of trillions of dollars in notional value.

-

Financial Instruments! How to use them and what are they for!

-

What are Stocks and the Stock Market?

-

Why Do Investors Buy Stocks?

-

What Kind of Risks Affect Stocks and Bonds?

-

What Is The Difference Between Stocks and Bonds?

-

What About Derivatives? Where Do They Fit Into All Of This?

-

What About Exchange Traded Products?

-

Financial Instruments... Conclusion!

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated11 months ago

Series of 3~9 minutesLast updated11 months agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis