-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

Financial Instruments! How to use them and what are they for!

“The investor’s chief problem — and even his worst enemy — is likely to be himself.”

-Benjamin Graham, The Intelligent Investor

We are aware that we have many subscribers of varying skill levels and exposure to markets. We have received feedback that some subscribers would like educational materials to help bolster and crystallize our analysis, which comes directly from market experts to be complicated to newer audiences. One of the inevitable consequences of getting analysis directly from our Head of Research, Tom Lee, is that sometimes it will involve terminology and analysis that can be foreign to some.

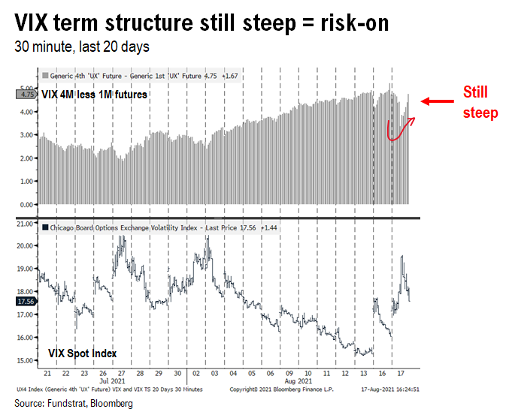

For example, Tom Lee will regularly cite the behavior of the CBOE Volatility Index, or VIX, as it is colloquially known. He periodically analyzes the term structure to decipher signals about where the market is going. Now is the VIX a complicated index? Yes, it absolutely is. This is why we prepared a complete guide to help you dive into precisely what it is and how it is calculated, which is available in our FSI Academy VIX Guide.

However, you don’t have to understand precisely how the VIX is calculated to understand the concept Tom is getting at. When the VIX term structure is inverted, what the market is saying is that there is a likelihood of more things going wrong in the next month than over the next four months or backwardation. More can happen over four months which is why this signal usually means panic has reached a local apex. The principle that more risks can happen over more time is one that most people fundamentally understand, but if you’re intimidated by the terminology, you may miss a valuable insight.

Investing today is quite different from investing hundreds of years ago; it is also a lot more similar to those days than you may initially think. Dozens of new asset types, revolutionary technologies, and the voracious risk appetite of younger generations have ensured that markets are constantly changing.

However, there are also several perennial dynamics in markets that will exist if fear and panic do. The myriad of different assets and the diverse needs of investors can quickly confuse and inundate those attempting to manage their own portfolios. We have created this educational guide based on feedback from our subscribers.

Our job at FSInsight is to help you navigate markets, and understanding the basics is necessary to do this. There are no dumb questions. Please don’t hesitate to let our team know what other subjects it would be helpful to produce educational content for. We design our guides to be entertaining, functional, and, most importantly, educational for all skill levels and investors who may read them. A refresher and new perspective NEVER hurt!

-

Financial Instruments! How to use them and what are they for!

-

What are Stocks and the Stock Market?

-

Why Do Investors Buy Stocks?

-

What Kind of Risks Affect Stocks and Bonds?

-

What Is The Difference Between Stocks and Bonds?

-

What About Derivatives? Where Do They Fit Into All Of This?

-

What About Exchange Traded Products?

-

Financial Instruments... Conclusion!

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated1 year ago

Series of 3~9 minutesLast updated1 year agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis