-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

What Are Commodities?

The price of a commodity will never go to zero. When you invest in commodities futures, you’re not buying a piece of paper that says you own an intangible piece of company that can go bankrupt.

Jim Rogers

Open any business news publication and you’ll see the commodities markets discussed throughout. The same goes for many of the reports here on FS Insight, even when we are discussing the stock market or a specific company.

But what, exactly, are we talking about when we talk about commodities?

Well, the dictionary definition of a commodity is any widely traded good or service that is differentiated primarily by price, rather than any idiosyncratic characteristic conferred by the producer or seller. For example, gold is a commodity: pure gold ingots from one producer are no different from pure gold ingots from another, except for the price. Art, on the other hand, is not: for buyers, there is a significant difference between a Picasso and a kindergartner’s finger-painting efforts.

Beyond that, the definition can get a little fuzzy. You will sometimes see it argued that laptop computers have become commoditized, with some saying that (with the exception of Apple) all laptops use the same components and run the same software, so the only thing that matters is price. Even love has been deemed by some cynics to be a commodity, though that debate is beyond the scope of this article.

But in investment or economic terms, commodities are clearly defined. Commodities are the widely traded raw materials used by companies across business sectors to produce the goods and services that customers and consumers require. For the purposes of our discussion, we will use the word, “commodities” in this sense. The category includes both “hard commodities” – natural resources such as oil or gold that are extracted from the ground – and “soft commodities,” typically agricultural products like wheat or sugar that require human labor to bring to fruition.

So what?

It’s obvious why some people care about commodities prices. The owner of a trucking company is going to be directly impactedby the price of crude, and a farmer has obvious reasons to be concerned about how much a bushel of wheat goes for on the commodities exchanges. But why should you care about commodities and commodities prices?

We live in a holistic system in which everything affects and is affected by everything else. Take the price of energy commodities. When they fluctuate, retail consumers see the difference in how much it costs to drive their cars and how much it costs to heat and power their homes. This in turn affects their ability to purchase other goods and services. But energy prices have a much broader effect. Manufacturers and shipping companies also see their costs impacted, and the result can hit profits, stock prices, and inflation. And all of those influence the economy as a whole and politics in general.

Even companies not normally associated with the energy sector can be affected. In discussing its Q3 2022 results, for example, Microsoft explicitly warned that rising energy prices would result in an estimated $800 million in additional costs (presumably related to the powering of its data centers) and impact its 2022 results.

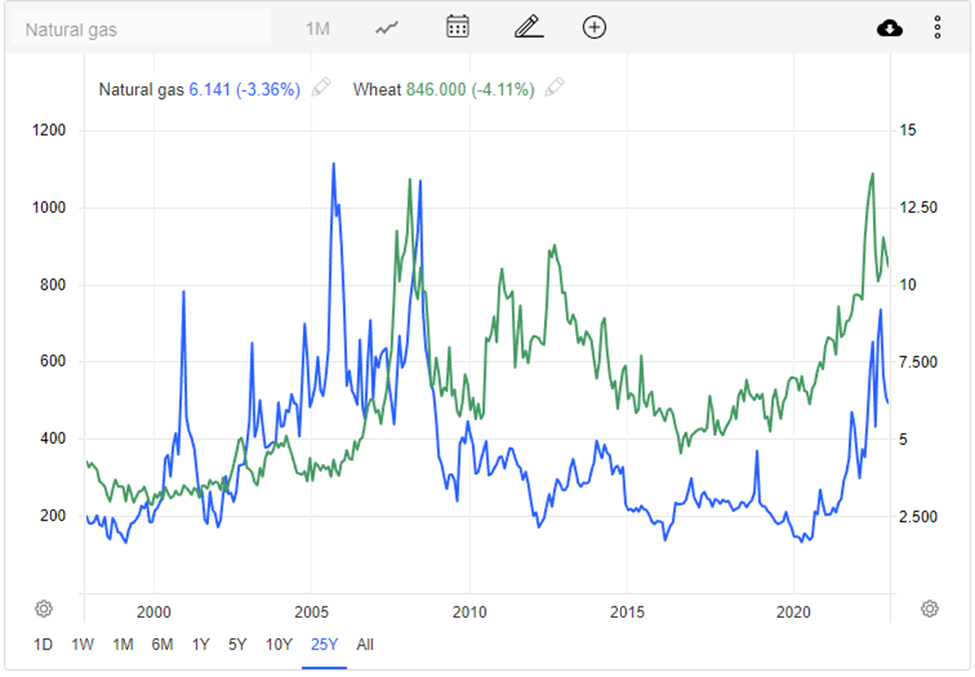

Energy costs have also been one significant underlying factor underlying the high food costs Americans experienced in 2022. Modern farms consume a lot of fuel to power machinery and irrigation systems, and natural gas is an essential raw material used in the production of many synthetic nitrogen fertilizers.

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated1 year ago

Series of 3~9 minutesLast updated1 year agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis