-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

Technical Analysis, Part I: Trend Lines

This is Part One of our Fundstrat Academy piece on Technical Analysis.

Technical Analysis of Markets and Securities

Introduction

Technical analysis is a method of evaluating securities, commodities, Treasuries, FX, cryptocurrencies, and other assets which focuses specifically on historical price movement, volume, and time to forecast future price action. Unlike fundamental analysis, which analyzes a company’s financial health and the intrinsic value of the business to understand its prospects, technical analysis is primarily concerned with price patterns, market trends, cycles, and seasonality. Thus, one can use sentiment, seasonality, cycles, volume, and price action to arrive at an understanding of trends, the potential for trend continuation and/or trend reversals using historical data, with no focus on the fundamentals of the underlying issuer.

The what (price action) is more important than the why (earnings, news, etc). This approach assumes that all known information is already reflected in the stock price, making past trading activity and price changes the most reliable indicators for predicting future movements.

Technical analysts use various tools and techniques to identify patterns and trends in price charts in order to arrive at informed trading recommendations. This three-part primer will cover three fundamental aspects of technical analysis: Trend Lines, Moving Averages, and Momentum and Volume.

Part I: Trend Lines

What are trend lines?

Trend lines are one of the most basic and commonly used tools in technical analysis. They are straight lines drawn on a price chart that connect significant price points, such as highs or lows, to represent the prevailing direction of the market. Trend lines can help traders identify the direction and strength of a trend, providing insights into potential support and resistance levels.

Types of trend lines

- Uptrend lines: An uptrend line is drawn by connecting a series of ascending lows. This line acts as a support level, indicating that demand (buying pressure) is greater than supply (selling pressure) at progressively higher prices

- Downtrend lines: A downtrend line is drawn by connecting a series of descending highs. This line acts as a resistance level, suggesting that supply exceeds demand at progressively lower prices

- Horizontal trend lines: These lines are drawn to mark significant price levels where the market has repeatedly reversed direction. Horizontal trend lines can function as both support and resistance, depending on whether the price is approaching from above or below

- Both arithmetic and logarithmic trendlines are used, and it is the scale difference that makes both of them worthwhile.

- A logarithmic line or semi-logarithmic line chart features a logarithmic scale on the y axis and an arithmetic scale on the x axis. The vertical distance between points (or amounts) in arithmetic charts is constant at all price levels, while the vertical separation in logarithmic charts varies depending on the percentage change between points (or amounts).

Arithmetic chart

Logarithmic chart

Drawing and using trend lines

To draw a trend line, technical analysts:

- Identify at least two significant points (highs or lows) on the chart

- Draw a straight line connecting these points

- Extend the line into the future to see how it interacts with subsequent price movements

- The most important rule when using trend lines and drawing uptrends is to connect the low to the low that precedes the highest high on a chart, no matter the time frame.

Trend lines are used to:

- Confirm trends: If the price respects the trend line by bouncing off it multiple times, the trend is considered strong and likely to continue.

- Identify breakouts: When the price breaks through a trend line, it can signal a potential reversal or acceleration of the trend.

- Visualize entries and exits: Traders can use trend lines to identify optimal entry and exit points. For example, buying near an uptrend line or selling near a downtrend line.

Limitations of trend lines

While trend lines are valuable tools, they are not infallible. False breakouts, where the price temporarily breaches the trend line but then reverses direction, can occur. It is also important to keep in mind that trend lines are subjective; different analysts might draw them differently based on their interpretation of significant points.

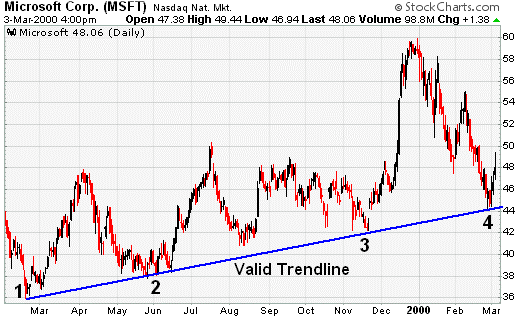

The chart of Microsoft (MSFT) above shows an uptrend line that has been touched four times. After the third touch in Nov-99, the trend line was considered a valid support line.

Look for our exploration of Moving Averages in Part 2 of the FSI Academy series on Technical Analysis.

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 4~10 minutesLast updated2 years ago

Series of 4~10 minutesLast updated2 years agoCommodities 100

An introduction to commodities for novice investors.