-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 5

What Is The Difference Between Stocks and Bonds?

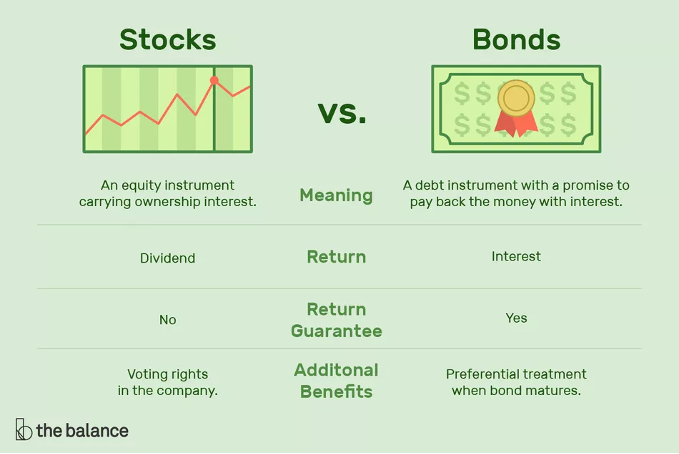

Stocks are rights to a portion of residual cash flows in a business. If a company does better than investors thought and has more profits than expected after all expenses, then the value of your claim on that business’s cashflows should go up. Therefore, you want to pick winners that will engender a level of profits that will cause the value of your equity to appreciate. In terms of bonds, they are specified cash flows tied to a specific debt.

As long as a company is financially solvent, it should make its debt payments. So fixed income investing is much more about finding the losers, the companies that will not be able to meet their obligations, and avoiding them. Bonds are favored by more conservative investors who want to preserve wealth in many cases, whereas stocks tend to be preferred by younger investors who aim to augment their wealth. Stocks are inherently riskier than bonds and are junior to them in the capital structure.

What does this mean? It means that in the event of bankruptcy, which is the bane of shareholders, bondholders are in line to get paid before shareholders. In most cases, a bankruptcy occurs because the firm does not have enough resources to pay its debt obligations, much less compensating equity holders with residual profits (which don’t exist in the event of bankruptcy). This is what folks mean when they say that equity is junior to debt. This is a fundamental concept to remember when selecting stocks. This is also very important to remember because developments in a company’s debt obligations and their value can significantly affect how their stock is valued. The price of a stock effectively reflects what the market thinks of a company’s future prospects, whereas valuing debt involves evaluating the value of a company or nation’s promise and ability to make agreed-upon payments.

We’ll take, for example, a tremendous and impactful fixed income call in history made by Junius Morgan, the storied patriarch of JP Morgan. The great banking families like the Baring Brothers and Rothschilds marked the term high-finance by dealing with heads of states and financing some of the most important military expeditions of the 19th century. For instance, the Rothschilds funded Wellington’s peninsular campaign that began eroding at Napoleon’s military dominance on the continent and financed the Crimean War. The Baring Brothers had underwritten the Louisiana Purchase and the French indemnities incurred after the defeat at Waterloo.

The ambitious French government led by Napoleon Bonaparte’s nephew got into a war with Germany’s Iron Chancellor, Otto Von Bismarck, in 1870. The conflict proved devastating for France, and its forces were defeated quickly in the field as the Germans utilized railroads to shift troops rapidly.

The shoddy government of France was looked down on by the Baring Brothers and Rothschild’s as they begged for financial support as Prussian armies fought the Paris Commune. Junius had presciently given the French government a loan at 80% of par value. They began purchasing up more of the paper at a steep discount after the Prussians imposed a seemingly insurmountable indemnity against France, which caused the value of the bonds to plummet.

Junius claimed he was quite sure the French would payback, having examined their government’s finances going back to 1789, although some allege it was a wild bet. Either way, it was a wildly successful bet that would lay the foundation for the bank’s future as one of the most important financial institutions on Earth—it also earned Morgan the respect of the Baring Brothers and Rothschilds. Their erroneous judgment kept them from sharing in his considerable profits. The French ended up paying back the entire loan at par, and the windfall would help enshrine JP Morgan’s place thenceforth as a pillar of high finance.

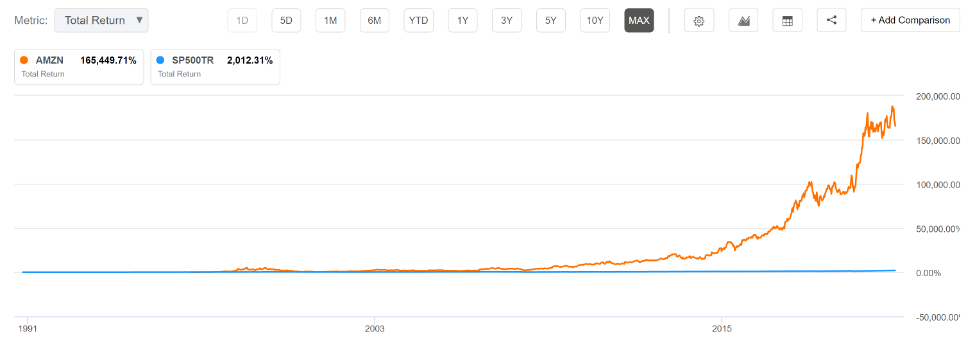

Let’s contrast to one of the greatest stock stories of recent times. Beyond a shadow of a doubt, Amazon is considered one of the most successful stock stories of all time. It has grown to epic proportions in more ways than one. Since the stock launched, it has provided incredible returns.

However, many mainstream Wall Street analysts hated the stock and would regularly forecast its’ doom. That was because the stock had low margins, whereas shareholders typically like to see strong and expanding ones. However, its management had a long-term strategy to make it one of the most ubiquitous companies on Earth. It used the low margins and cost savings to continually gain a competitive advantage over its many smaller competitors who were simply unable to compete on price to the same degree. Anyways, AMZN was seen by many on Wall Street as a loser, and those who had the foresight to visualize how successful its strategy could be ended up getting rich.

Everybody thought the recently defeated French government in exile over a nation in political upheaval was an untenable credit risk. They had not done the analysis that Junius Morgan had done going back to 1789 to see just how seriously the French state considered its debt obligations. Even during the extreme political tumult of the aftermath of the Franco-Prussian War and the Paris Commune, the French government was able to make its debtors whole, despite the popular sentiment it would not be able to.

So, what is expected in these two very successful trades in different asset classes? Success in these investments requires a significant fundamental understanding of the strategy and investment considered, but it also required the investor’s confidence to disagree with the prevailing sentiment firmly. This is called contrarian investing. Even though everyone thought France would default, they did not.

Even though most Wall Street analysts believed there was absolutely no future in a low-margin strategy, it is precisely by following that strategy that Amazon was able to become one of the most dominant companies in the world. So, stocks and bonds are different and have different risk drivers. However, successful traders often have to do with understanding the crowd and their assumptions just as much as understanding the fundamentals of the investment. This is an important lesson to remember.

-

Financial Instruments! How to use them and what are they for!

-

What are Stocks and the Stock Market?

-

Why Do Investors Buy Stocks?

-

What Kind of Risks Affect Stocks and Bonds?

-

What Is The Difference Between Stocks and Bonds?

-

What About Derivatives? Where Do They Fit Into All Of This?

-

What About Exchange Traded Products?

-

Financial Instruments... Conclusion!

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated1 year ago

Series of 3~9 minutesLast updated1 year agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis