-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

How Focus and Patience Can Become Your Investing Superpower

We’ve all been there: An unsettling feeling comes over us when the numbers grind lower on our screen. The next day, everything’s green, and we believe our portfolio might be in good shape. Then, from the time the bell opens, it feels as though we’re hit with a crossfire hurricane. The markets bleed. Inflation chugs along. Our portfolio grinds lower. Following a surging market in 2020 and 2021, almost everything has come down in 2022. Some investors are experiencing their first true downturn. For others, it’s not their first rodeo. But that doesn’t dull the pain.

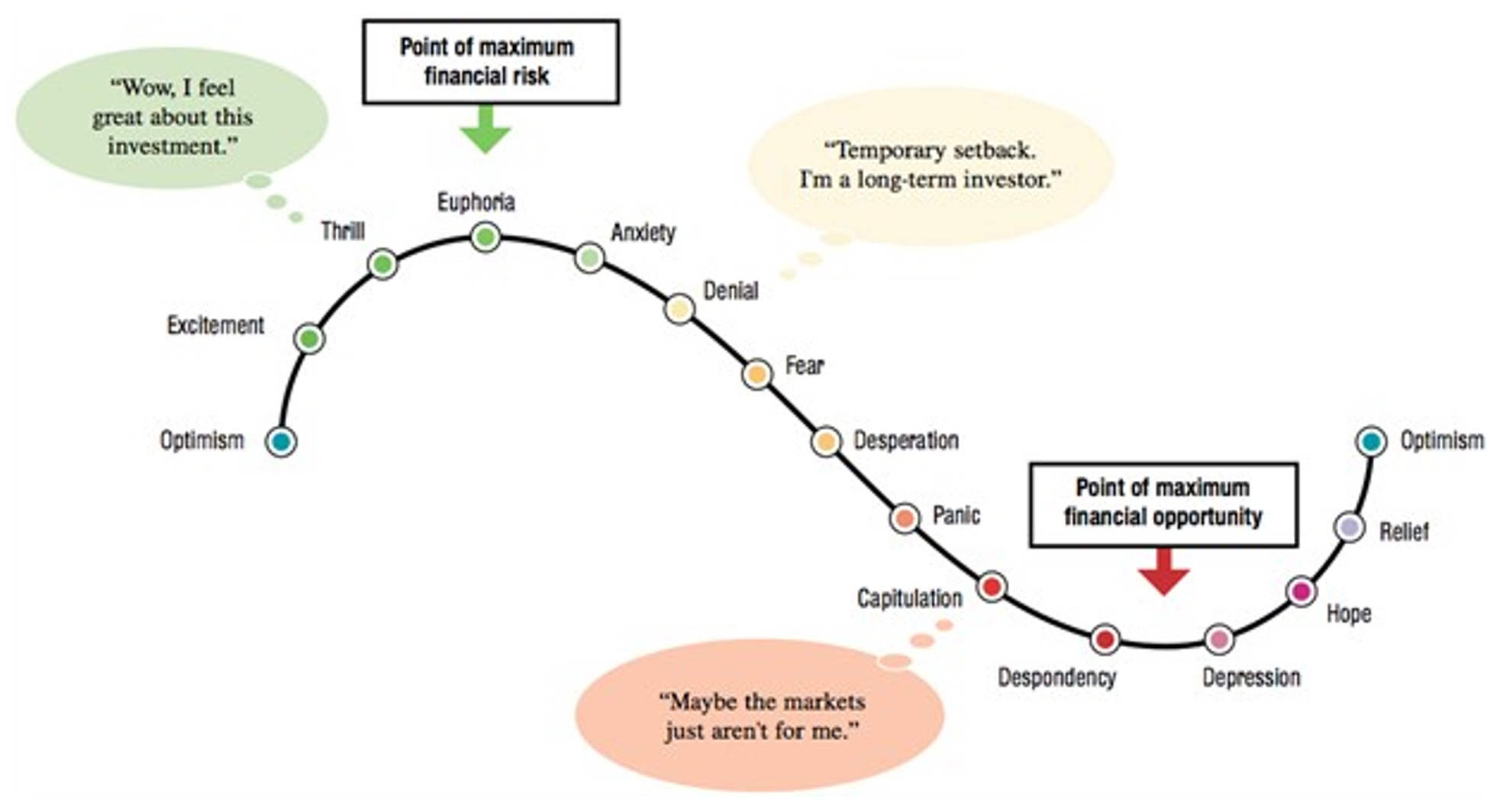

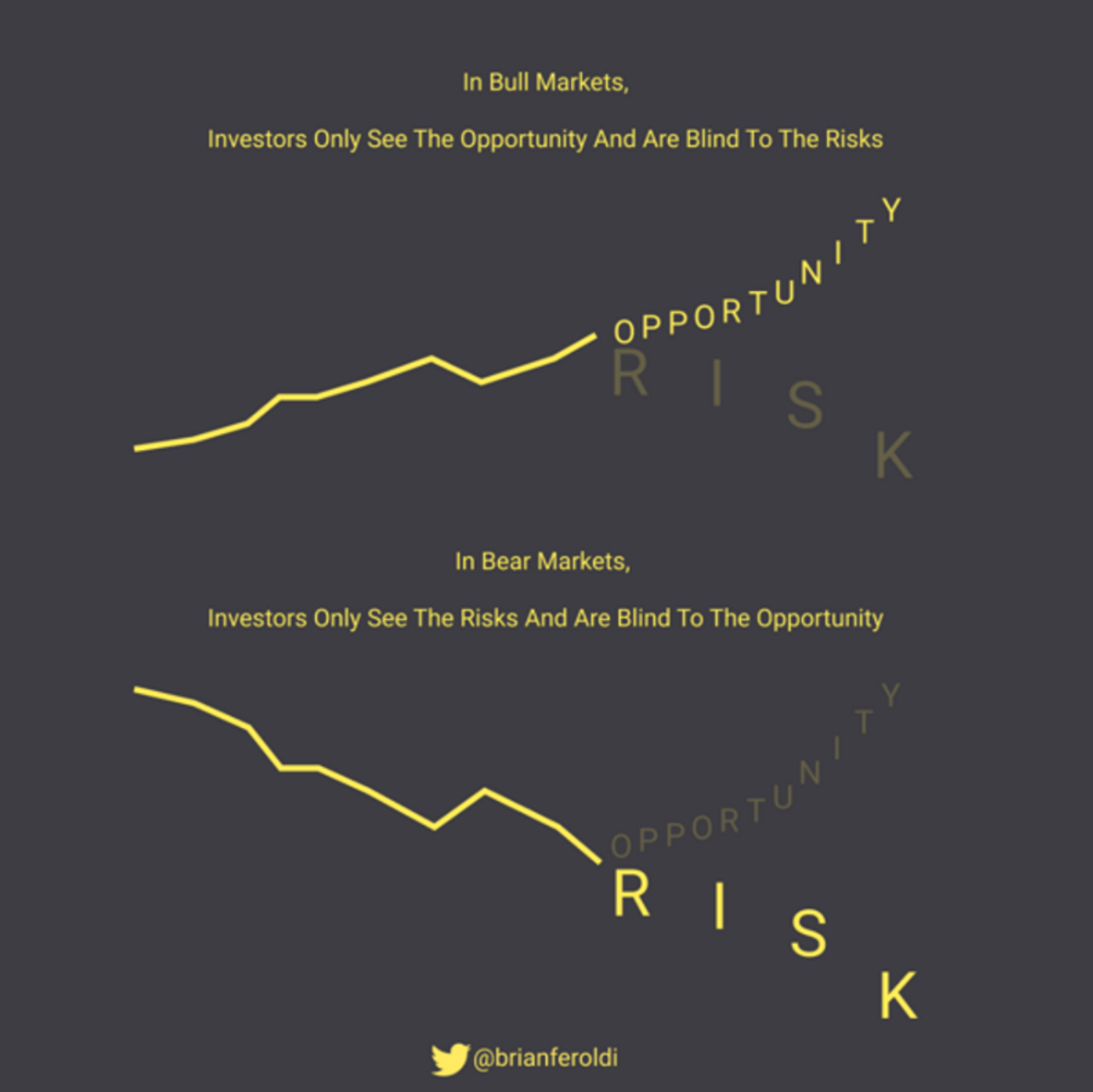

In investing, our minds tend to work against us. Because of behavioral biases, we find ourselves buying high and selling low. Sir John Templeton advocated buying at the point of maximum pessimism. The problem? That point is truly known only in retrospect, and the concept is much more difficult in real time. Patience is a virtue. It’s also an asset in the investment game. It means waiting on your investment to increase in value. It means sometimes sitting on cash, ready for the right time to pounce. It means having the patience to stay true to your plan, focused on looking for a great opportunity at a fair price. The intense focus and patience required to perform well over long periods of time can become your superpower.

“Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ,” Warren Buffett has said. “Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

Tom Lee, our head of research, characterized the recent selloff as “painful.” New investors and some of the most seasoned veterans on Wall Street have experienced the volatility and uncertainty that’s synonymous with market downturns. There’s a human tendency for investors to feel that this time is different. This downturn feels unique. Most portfolios have been declining, including 401Ks, brokerage accounts, and crypto. “Anybody who owns stocks today feels like they’re caught in a vortex of downward misery, and I’m sure a lot of people are questioning their own sanity,” Lee said in April.

But Lee will be among the first to tell you that downward action is the price we must pay for positive return. Some investors call troubling markets the “tax to the market Gods” or “tuition payments” to the market. It’s true that markets are positive only slightly more than 50% of all days, and they make new highs about 5% of the time. Despite the down days, the stock market remains an incredible mechanism for wealth generation.

Even though downturns occur regularly, financial panics are inevitable. Maintaining fortitude is a requirement to sound investing. To fully reap the benefits of compounding, you need a portfolio you can stick with through the declines. Uncertainty always looms, and we must stomach drawdowns for the best returns. Declines are a matter of when, not if. Many experts say our panic lies in a fear of the unknown and believing that a dramatic event warrants a dramatic response. Acting during a panic helps us feel in control of the situation. Herd mentality also plays a role: Other people panicking can prompt us to participate in the panic, exacerbating the pain.

Worry and panic are understandable, but neither is helpful. Successfully navigating turbulence requires charting a middle course, with clear goals and a clear plan. We can do this with the proven, effective tools we already have, while giving in to neither dismay nor dismissal.

Remember, the stock market doesn’t come without risk. Volatility is the price we pay. But history tells us that you will do well if you hang in there. Over the long run, this approach has led to good fortune.

Which is why it’s important to stay focused on your plan, without getting awash in the day-to-day fluctuations. This year Elon Musk tweeted: “Don’t panic when the market does. This will serve you well in the long-term.” We’re careful when heeding investment advice from billionaires, but that principle aligns with our approach to evidence-based research. Similarly, Roman emperor Marcus Aurelius emphasized the importance of “ignoring the mob,” and warned of blindly following consensus view.

Greek Stoic philosopher Epictetus, who started his life as a slave before opening his own school of philosophy, taught that all external events are beyond our control. But we are responsible for our own actions. The financial parallel is the macro- and microeconomic events that affect individual companies and their corresponding rising and falling stock prices. How we respond to them, whether we learn from them, is in our power.

This brings us to an observation by our Tom Lee in April: “For whatever reason, markets seem far more prone to panic today (last 5 years) compared to the 30 years I have been following markets (yup, 30 years peeps). Is this because of: social media? Alternative data/machine learning? Algos? Reddit/Wall Street bets? Not clear.”

Lee’s point underscores the significant impact of social media, the “noise,” and sensationalist headlines on the psyche of investors. Lee also underscores the importance of focus: We need time to reflect and focus. We need the calm that comes from stillness to reboot us and think clearly about our life and our investments. We must find stillness within the chaos, as Seneca and Aurelius, the ancient Stoic philosophers, point out. Many successful investors ignore forecasts, opinion, and predictions. Others famously refrain from watching financial TV or reading the news altogether. Rather, they stay rooted in rigorous research that is reliant on unbiased data. For them, discipline is the way.

“The human tendency is to aim to buy at the bottom,” Mark Newton, our head of technical strategy, said during one of his monthly live webinars. “But the money is made during the meat of the move, not during the beginning of the move. Let the bottom fishers do what they will do.”

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated1 year ago

Series of 3~9 minutesLast updated1 year agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis