-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

Nothing New Under The Sun- Importance of Looking at Cycles

To watch the video please click here.

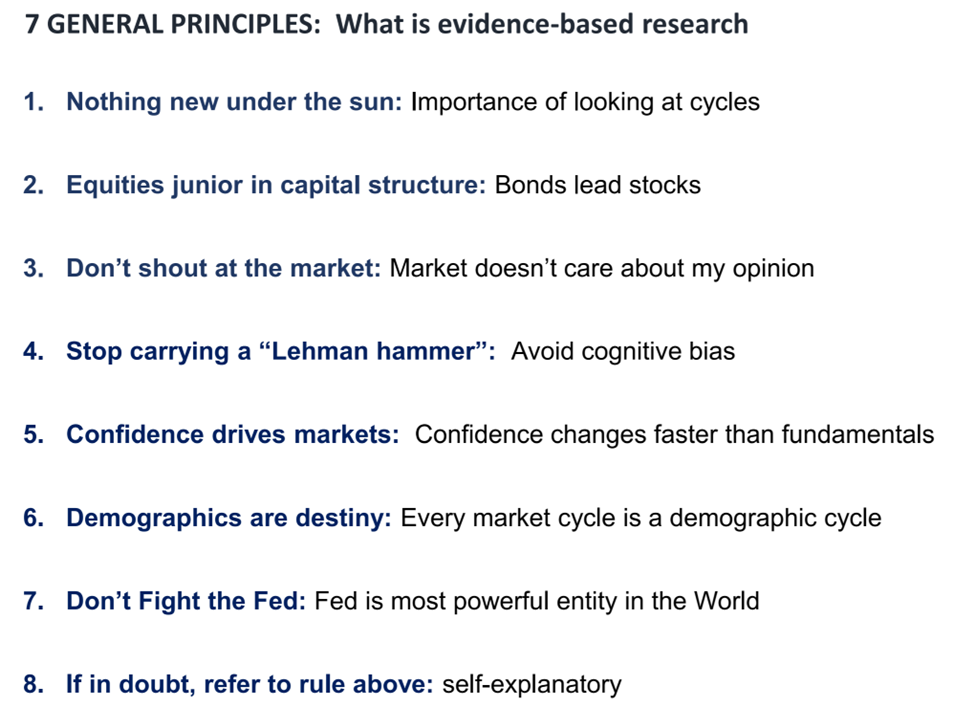

In Tom Lee’s 2022 Outlook he gave insight into the central principles that guide our macro research. It’s critical to be evidence-driven when making decisions in equity markets. People have acclaimed some of our team’s market calls, but if you look closely much of the time, we were just following the data.

Keeping a cool head grounded in the data, instead of letting greed and fear compromise judgement, is key. We think few major minds focused on markets exceed our Head of Research when exhibiting this important characteristic. In March 2020, amid the onset of the COVID-19 pandemic, Tom made one of the best “Blood in the Streets” calls of modern times. He told everyone exactly why he was making his bullish call against the backdrop of an incredibly uncertain and bearish consensus. It was simply based on data and rigorous analysis.

- Nothing New Under The Sun- Importance of Looking at Cycles

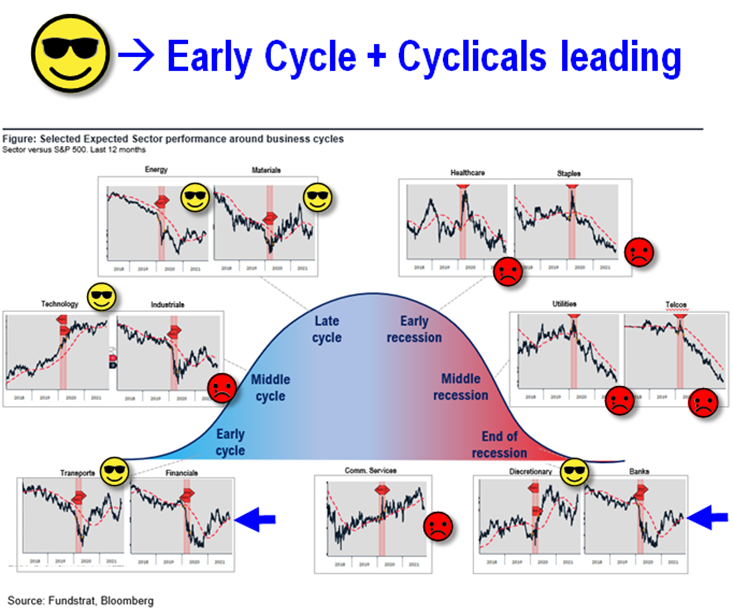

“We really emphasize the importance of looking at cycles. Population cycles, demographic cycles, market cycles, inflation, and rate cycles. Everything really is a fractal of various cycles.” – Tom Lee

At FSInsight, we are dedicated to leveling the playing field between institutional and retail investors. Institutional investors play a different game from that of most retail investors. Institutions have more money, technology and data at their disposal relative to retail investors.

Institutional investors also have performance tied to a benchmark, and one of the most important metrics to them is a Sharpe Ratio, or risk-adjusted return. This is not just how well your portfolio performed, but how it performed in comparison to the market-return, which is usually a particular benchmark such as the S&P 500. One of the main ways institutional investors aim to outperform is by orienting themselves as to where the economy is in the economic cycle. Certain sectors tend to outperform during different periods of the cycle.

Interested In Beating the Market with An Active Sector Allocation Strategy? Click here for Brian Rauscher’s FSI Sector Allocation tool aimed to outperform the market, while taking minimal risk.

While some market theorists like Burton Malkiel contend that any blindfolded monkey throwing darts randomly at stocks on a dartboard can be just as effective at stock-selection as the leading hedge fund (over time of course), at FSInsight we’re convinced that active management can result in achieving a better risk-adjusted return than the market. The key is sticking to a data-driven process.

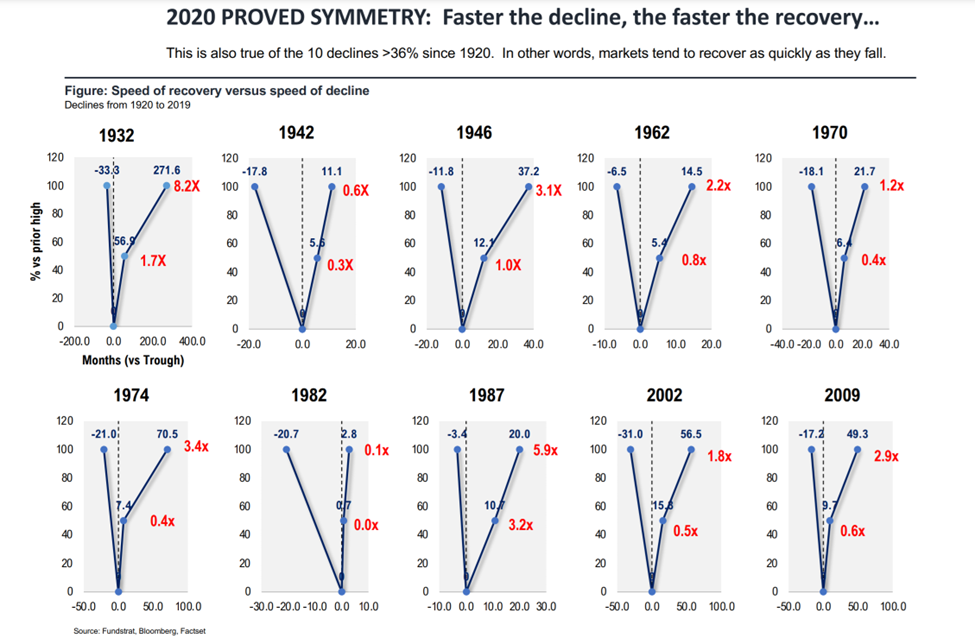

So, when Tom Lee appeared on TV and famously told folks to buy Epicenter stocks, or those most affected by the social and economic consequences of COVID-19, he did so with the confidence of someone informed by data. He was chastised and called recklessly bullish. But since Tom knew that there is nothing new under the sun he looked at what had happened when the stock market experienced comparable drops in the past. They typically didn’t precede extended bear markets but preceded rapid “V” shaped recoveries. While the financial discourse was permeated with doomsaying, Tom Lee and his team were looking at the data. Investors who listened profited handsomely.

As you can see, this is what Tom Lee found. Even in the face of being called “absurd,” Tom stuck to the data. No voo doo and no hoo doo, just data and looking at what happened in the past along with the understanding that the strongest companies in the commercial universe are usually those that are publicly traded, and they had the resources and access to capital markets to make it through even a prolonged revenue interruption.

You didn’t have to look too far back into history to see that sometimes the worst-struck companies can rise to the occasion and beat expectations. They fight like cornered racoons. For example, we take a lot of stock in the experience of one group of companies that were recently hit by a virtual complete stop in demand; prognosticators and market talking heads vehemently proclaimed the imminent collapse of the Homebuilders in the early days of the Financial Crisis.

How could they possibly deliver to shareholders with the collapse in demand? The homebuilders exceeded even the most bullish expectations, and by Q1 2010 they had the same operating income with 69% less revenue. The Global Financial Crisis was hard on housing demand for obvious reasons, but by aggressively cutting costs and re-engineering their business with a mind toward maximizing operating leverage, these businesses not only survived but thrived.

-

Nothing New Under The Sun- Importance of Looking at Cycles

-

Equities Are Junior in The Capital Structure- Bonds Lead Stocks

-

Don't Shout At The Market- It Doesn’t Care About You (Or Any One’s) Opinion

-

Don’t Carry The Lehman Hammer- Avoid Cognitive Bias

-

Confidence Drives Markets: Confidence Changes Faster Than Fundamentals

-

Demographics Are Destiny

-

Don't Fight the Fed: The Fed is The Most Powerful Entity in the Financial World

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated1 year ago

Series of 3~9 minutesLast updated1 year agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis