-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 4

What Kind of Risks Affect Stocks and Bonds?

When you buy a stock, one of the reasons you have the opportunity for profit is precisely because you are willing to take the risk that your investment goes to zero. If you are trying to invest for a ‘sure-thing or nearly guaranteed returns, then those types of investments are available to you. One instrument that is often used as a proxy for the risk-free rate of return is the 10-yr treasury bond. This risk-free rate is significant because it is a necessary input to calculate a fundamental metric in the world of investing, the risk-adjusted return, or alpha as it is also known. This effectively measures how much you are getting compensated per unit of risk. The pursuit of alpha is getting the highest possible return while taking the least possible amount of risk to get it.

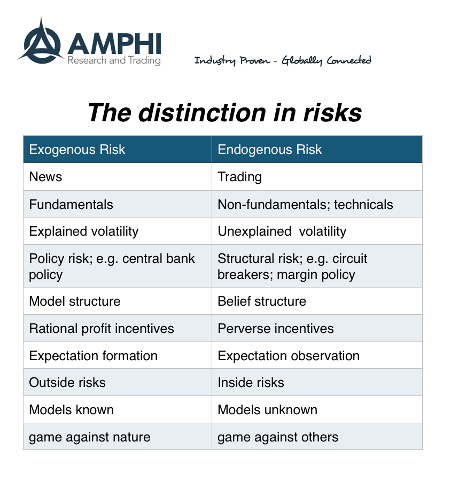

External exogenous risks are one of the main types of risks a stock faces. Let’s take us back in time to history when the Dutch East India Company was the only publicly traded stock around to analyze what kind of risks a stock faces. So, since the company’s business primarily involved sea-faring expeditions to far-flung regions of the world, the news that a terrible storm had adversely affected travel conditions might increase the chance that there will be a higher than average proportion of unsuccessful voyages.

Therefore, news about adverse weather in relevant geographies, even in 1602, would likely have harmed the most popular shares of the day. Of course, that news would take much longer to travel before modern communications. To this day, an unforeseen hurricane can affect asset prices just as it would have back then. For example, when hurricanes hit the Southeastern United States, they often cause elevated oil prices. The bulk of refinery capacity in these areas can be shut down by inclement weather. These types of external risks are different from the more idiosyncratic risks associated with each stock or company, known as endogenous risks.

Risks that are specific to each company are often called endogenous risks. Operational risks arising from dysfunction in an organization or its mechanical processes would be an example of endogenous risk. One critical endogenous risk that is always hanging over any management team is how it chooses to invest its excess profits relative to its peers. When you own a stock, a company’s management is one of the most essential elements of endogenous risk you can pay attention to. If a company has a management team that lacks integrity or has a poor track record in allocating capital, then this is a significant risk to shareholders.

Often, management teams will create additional incentives for shareholders to purchase their stock by either buying back shares, which thus increases the earnings per share for the remaining shares (and therefore the value of the company’s equity). One important thing to remember about stocks is that actions that reduce the share count and thus increase your proportional claim to the company’s residual earnings tend to increase the value of the shares.

On the other hand, dilutive actions tend to reduce the value of the stock by making your claim a lower proportion of the claims outstanding. These actions involve selling additional shares or increasing the float. In other words, when the company reduces shares, it means your claim is worth more, and when they increase them, your claim is worth relatively less.

So, when companies buy back shares, this immediately increases the value of your stock because it is now more scarce. The company has not done anything to improve its economic prospects but has still boosted its price. This leads some critics to be wary of gains from share buybacks instead of genuine increases in growth expectations.

Similarly, when air travel was pretty much forbidden by decree, many airlines would not have survived the lost revenue without raising money by offering more equity. These dilutive actions tend to reduce share prices. Many companies undertook dilutive action during the period following the COVID-19 crisis.

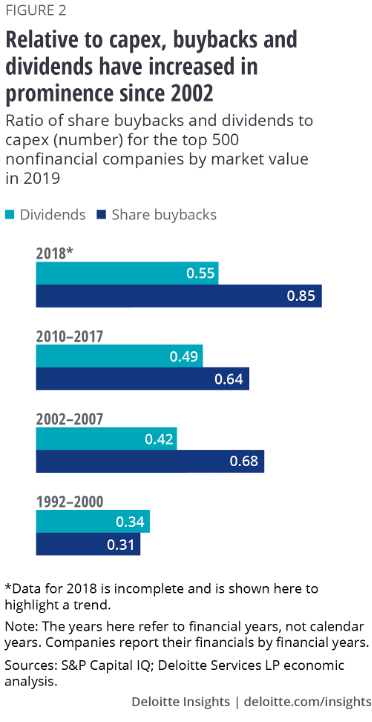

Some investors have worried that share buybacks and dividends have risen in importance at the expense of the accretive CAPEX that companies must continually make to maintain their growth and competitive edge. The dividend versus buyback debate is prominent on Wall Street right now, with esteemed thinkers on both sides.

-

Financial Instruments! How to use them and what are they for!

-

What are Stocks and the Stock Market?

-

Why Do Investors Buy Stocks?

-

What Kind of Risks Affect Stocks and Bonds?

-

What Is The Difference Between Stocks and Bonds?

-

What About Derivatives? Where Do They Fit Into All Of This?

-

What About Exchange Traded Products?

-

Financial Instruments... Conclusion!

Related Guides

-

Series of 3~5 minutesLast updated1 month ago

Series of 3~5 minutesLast updated1 month agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated11 months ago

Series of 3~9 minutesLast updated11 months agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis