Early Proof of “Catch-Up” Trade

Last week witnessed a significant development as traditional market participants, most notably BlackRock, entered the cryptocurrency space with a spot-based ETF application. This move not only carried implications for market structure but also sparked a noteworthy narrative shift. Despite Bitcoin’s relative resilience to regulatory pressures compared to other cryptoassets, it still faced some performance drag. However, the entry of BlackRock, Citadel, and other prominent players into the market changed the perspective of U.S. market participants toward the asset class. This development attracted individuals back into the crypto market.

We think that bitcoin appears well-positioned to serve as investors’ preferred “catch-up” trade to tech stocks. The rally of the Nasdaq index this year has been met with skepticism, leaving many investors on the sidelines. With the largest asset manager now entering the Bitcoin sphere, the narrative-driven momentum seems to be favoring Bitcoin in the latter half of the year.

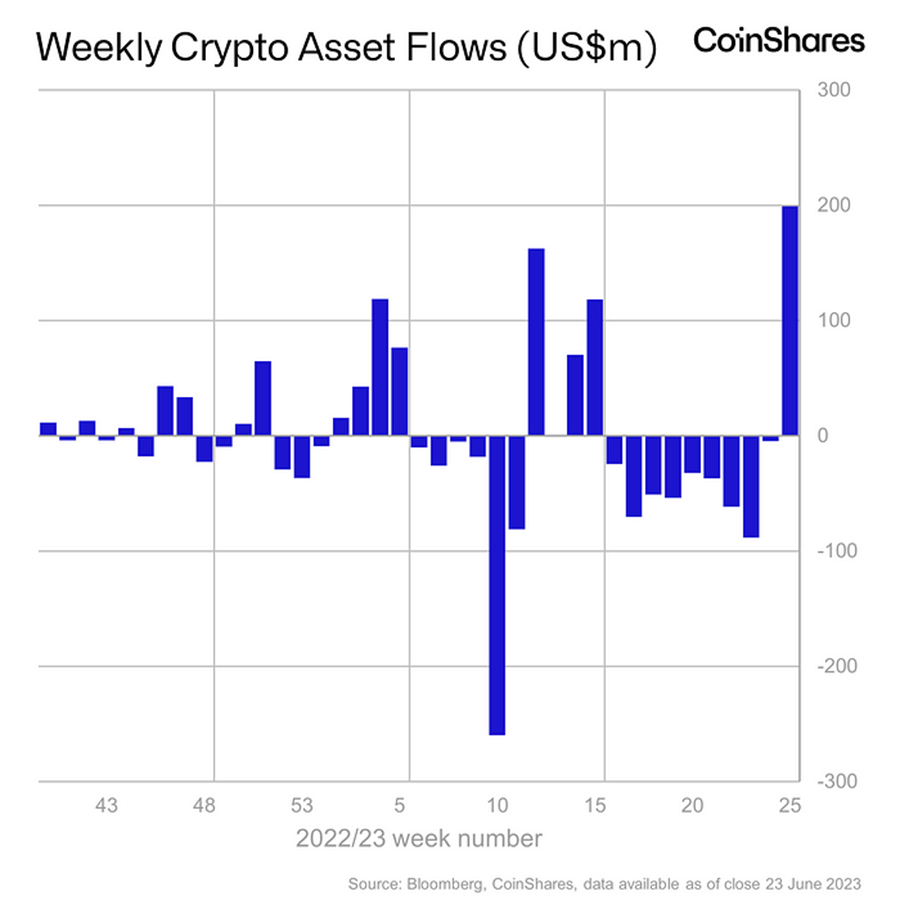

This shift in sentiment among the public is reflected in fund flows. Digital asset investment products experienced their largest weekly inflows since July 2022, totaling $199 million. Bitcoin was the primary recipient, receiving $187 million, accounting for an impressive 94% of the total inflows. Conversely, short Bitcoin products continued to see outflows for the ninth consecutive week, amounting to $4.9 million.

Sentiment Sweet Spot = Undercrowded Trade

As evident from our recent discussions, the reasons to be bearish on Bitcoin right now are few and far between. This sentiment was shared in an internal meeting, where our Technical Strategist, Mark Newton, raised an important point. He expressed caution about the overly bullish dialogue (such as “the reasons to be bearish are few and far between”). This often indicates extreme market positioning, which typically warrants caution, as traders could be getting out over their skis.

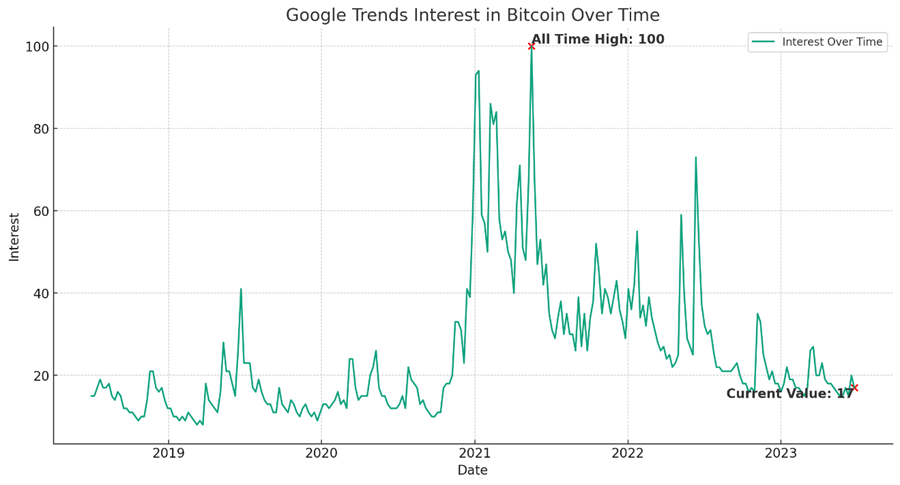

Frankly, I concur with his viewpoint. However, from our perspective, we are nowhere near the market froth we experienced at the peak of the last bull run in 2021. It’s not an exact science, but Google Trends is generally a reliable indicator of retail fervor. As demonstrated below, the current interest in Bitcoin from the general public is relatively low compared to historical levels.

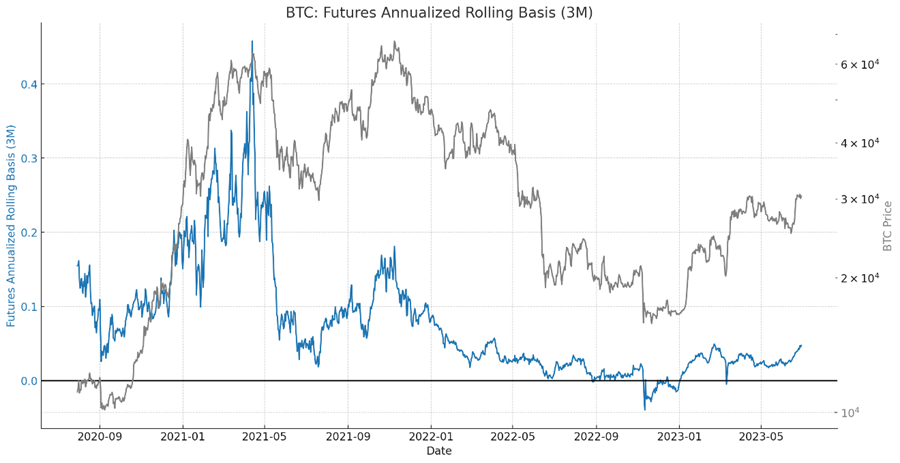

Further, while the derivatives market is certainly skewing bullish, the current prices being paid to assume a leveraged long position in the futures market is modest when compared to the prices paid during the late stages of the previous bull market.

We believe that the market is currently in a “sentiment sweet spot,” where both narrative-driven (such as potential ETFs and the return of US investors to the game) and fundamental factors (like the halving event in a few quarters and expanding global liquidity) are bullish. While market sentiment is shifting, the market still remains far from overcrowded.

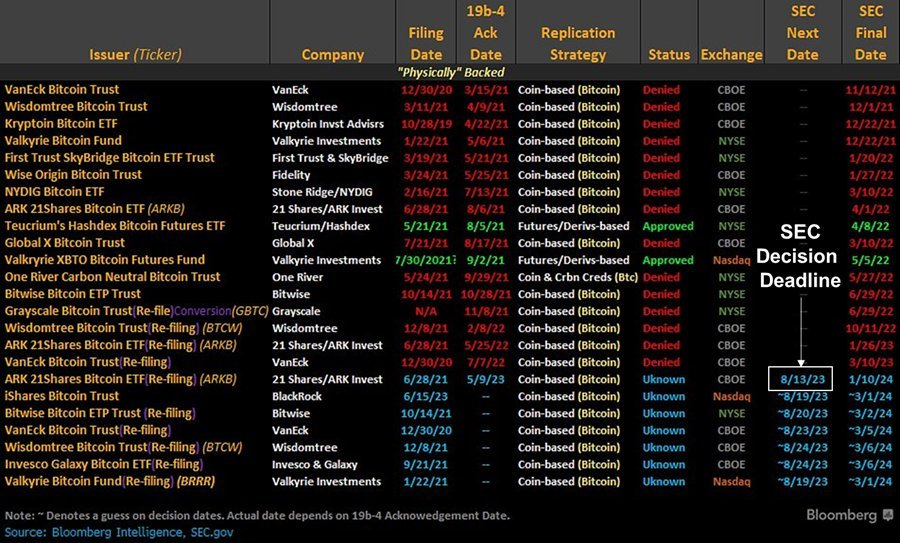

ARK Jumping the Line

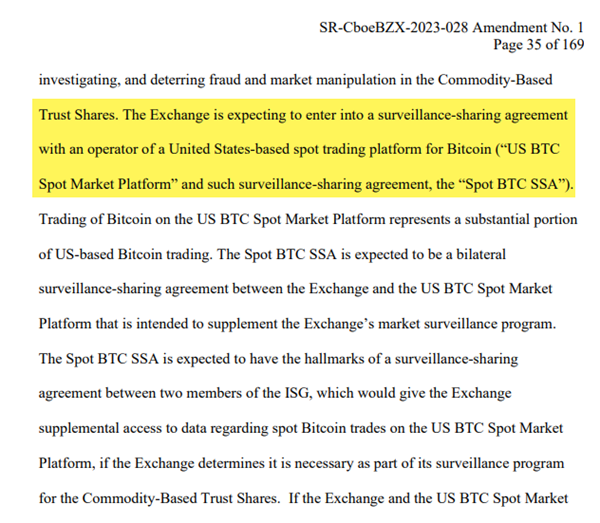

In a notable ETF-related development, this week ARK updated its existing spot ETF filing. ARK Invest has added a surveillance-sharing agreement in its Bitcoin ETF application, a strategy that mirrors BlackRock’s. This agreement, formed between the Cboe BZX Exchange and a U.S. Bitcoin trading platform, aims to prevent market manipulation by sharing data on market activity.

A caveat to add here is that they have yet to find a suitable exchange to enter into this SSA with. It is unlikely that they will chose to partner with Coinbase, as Coinbase is the chosen partner for BlackRock and it is likely that there was some element of exclusivity struck with that deal.

Since ARK technically submitted its application before BlackRock, it’s poised to receive a decision (which could include a decision to delay a final decision) before BlackRock does. This ruling is expected by August 13th, just weeks away from now and likely coinciding with the Grayscale decision.

While the range of potential outcomes remains vast, given all of the information presented, it is possible that we see the market receive approval for a spot-based bitcoin ETF (or several) by this mid-August timeframe.

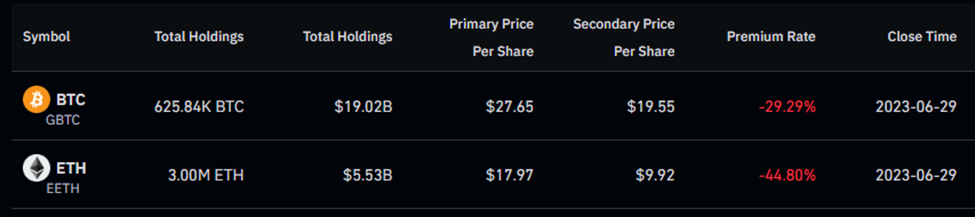

As noted last week, GBTC continues to trade at a 29% discount to its Net Asset Value (NAV), improving from a 35% discount the previous week. Given the potential approval of a spot-based ETF or a victory for Grayscale in the courts (or both), GBTC still likely presents a good risk-adjusted opportunity for quasi-leveraged exposure to BTC.

Furthermore, while trading the underlying crypto assets presents the best risk-adjusted opportunities in the long term, crypto equities currently offer another avenue for gaining leveraged exposure to BTC in the short term, given the prevailing ETF-driven tailwinds. Some equities we favor include COIN, MARA, RIOT, and other miners, offering diversified exposure via WGMI.

Bullish Seasonal Trends

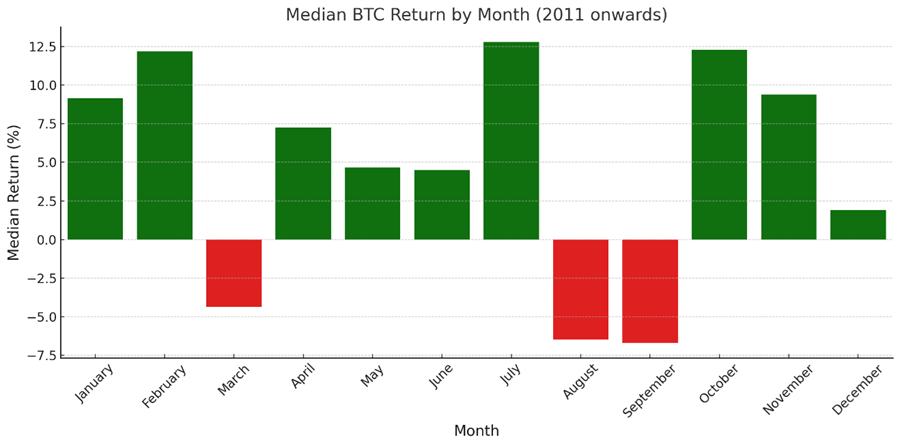

The last data point we want to revisit this week is the upcoming seasonally bullish period. Last month, we discussed the commonly perpetuated falsehood that summer is a seasonally bearish period due to a lack of interest. However, historical data shows that the months of June and July have actually been favorable for the asset class.

In the chart below, we can observe that July has consistently delivered higher median returns compared to other months, even surpassing October, which is widely regarded as the most bullish time of the year for bitcoin.

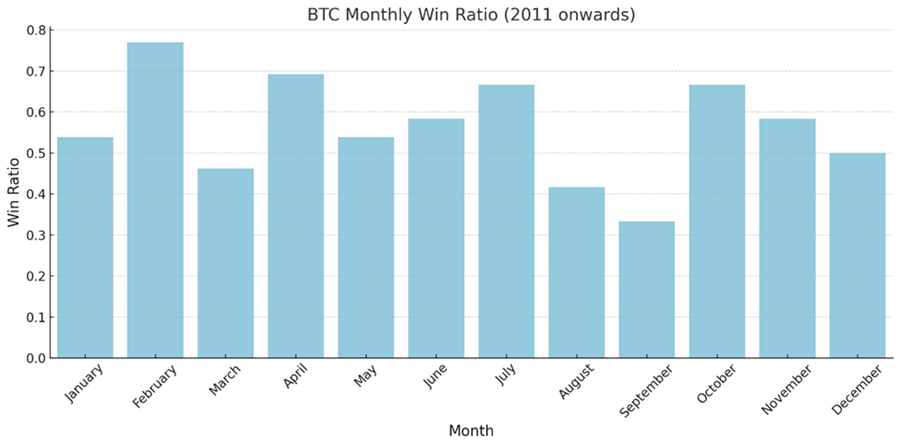

As expected, the win ratio for bitcoin has been impressive, with July boasting the third-largest winning percentage for investors since 2011. It is important to note that this data does not include monthly results from June 2023.

Core Strategy

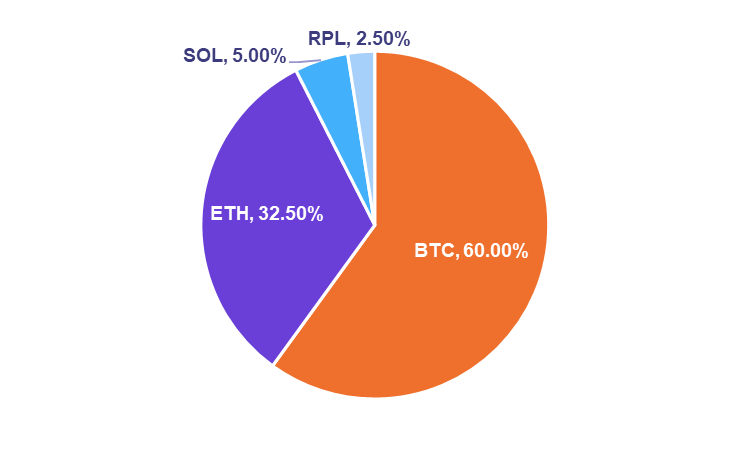

We believe that the market is currently in a “sentiment sweet spot,” where both narrative-driven (such as potential ETFs and the return of US investors to the game) and fundamental factors (like the halving event in a few quarters and expanding global liquidity) are bullish. While market sentiment is shifting, the market still remains far from overcrowded. With this in mind, we find it appropriate to decrease stablecoin exposure for increased bitcoin allocation.

Tickers in this report: BTC, ETH, SOL, RPL, COIN -2.32% , MARA -1.60% , RIOT -2.21% , WGMI,GBTC -1.98%