Market Update

- The cryptocurrency market is currently experiencing a downturn, falling 3% overall. Ethereum and select ecosystem projects are bucking the trend, with ETH relatively flat in the last day, trading 0.2% lower at ~$2.6k and hitting a two-month high against Bitcoin as ETHBTC reaches 0.059. Outperformers in the top 100 include ETH NFT marketplace BLUR (+8.7%), layer-two OP (+6.8%), and ETH domain service ENS 0.14% (5.2%). In contrast, BTC is noticeably underperforming, dropping by 5.7% to $43.4k following the debut of eleven Bitcoin ETFs. The first day of trading saw an extraordinary volume exceeding $4.5 billion. However, whether this represents new investments or simply a shift from GBTC remains unclear. Several brokerages are not yet facilitating trades of these ETFs, and others, like Vanguard, have decided not to support them in the future. Many investors are considering moving their assets elsewhere in response to Vanguard's decision. Equities are slightly lower today as investors digest fourth-quarter earnings and December PPI data. PPI unexpectedly fell 0.1% in December, contrasting hot CPI earlier this week and encouraging the falling inflation camp that last month's hot CPI could be a one-off rather than a trend reversal.

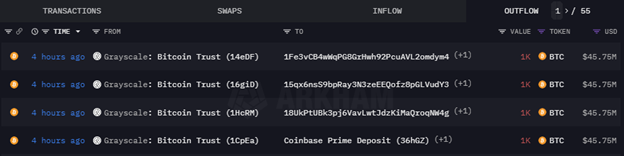

- According to data from Arkham, Grayscale has transferred about $200 million worth of Bitcoin (4,000 BTC) to Coinbase Prime, a key participant in the newly launched Bitcoin ETFs. This move at around 9 a.m. EST this morning hints at potential ETF redemption activity, as Coinbase is the broker and trading counterparty for most ETF issuers, including Grayscale. This transfer suggests that Grayscale might be managing outflows from its trust following sales. The process for the creation and redemption of ETF shares, such as those in the Grayscale ETF, involves specific timing and procedures. Orders are placed before 2:00 p.m., New York time, on business days, with Bitcoin transfers occurring on T+1 or T+2, depending on the order's timing. These transactions could influence Bitcoin's spot price, although the extent of the impact depends on various factors like the order size and market conditions. Grayscale's recent activities coincide with significant inflows into Bitcoin ETFs, with BlackRock's ETF receiving about $112 million on the first day, excluding $10 million in seed capital. On the first day, Bloomberg's Eric Balchunas estimated around $720 million in total inflows into Bitcoin ETFs. The high fees charged by Grayscale compared to other ETFs (1.5% annually vs. as low as 0.2%) may also be influencing the market. Cash must be used for share creation in these ETFs, and Bitcoin cannot be transferred between funds even if an investor shifts from one ETF to another. With the T+2 settlement period and a U.S. bank holiday on Monday, any unsettled Bitcoin might not be resolved until Tuesday, potentially leading to volatile price movements over the weekend.

- In a recent interview, Larry Fink, CEO of BlackRock, expressed strong support for an Ethereum ETF. He highlighted the potential value of such an ETF, reinforcing that this could be the start of a broader integration of blockchain technology into traditional finance. Fink's comments follow BlackRock's filing with the SEC for a spot ETH ETF in November, with analysts predicting a high likelihood of approval based on the precedent set by the approval of Bitcoin ETFs. Fink also envisions a future where financial assets are tokenized, viewing ETFs as the first step in this technological revolution in finance. He commended the impressive success of Bitcoin ETFs on their first trading day, which saw $4.5 billion in trading volume. These ETFs allow traditional investors to engage with Bitcoin without directly holding the cryptocurrency, a model that an Ethereum ETF would replicate for Ethereum. Analysts estimate that Bitcoin ETFs have opened up the cryptocurrency to a traditional financial market worth approximately $14 trillion in the U.S.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

ETHBTC has successfully broken out of its 16-month downtrend following four very sharp days of outperformance. As this daily chart shows, ETHBTC has advanced to the highest levels since last October after this recent breakout. Following a lengthy period of underperformance from Ethereum vs. Bitcoin since September 2022, this recent surge in relative strength argues for a period of outperformance in Ethereum vs. Bitcoin in the months to come. While Ethereum might have some coming resistance near $2900 following its recent steep ascent, pullbacks likely will provide attractive risk-reward opportunities to favor. Moreover, there remains no evidence of counter-trend exhaustion signals on weekly charts at present to argue for a major peak. Overall, ETHBTC looks attractive, and dips should be used to buy in the weeks to come, as Ethereum should continue to show above-average performance vs. Bitcoin and increasingly vs. other cryptocurrencies in the months ahead.

Daily Important Metrics

All metrics as of January 12, 2024 1:10 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $855B | $43,644 | ↓ -5.76% | ↑ 3.34% | |

ETH ETH | $311B | $2,591 | ↓ -0.08% | ↑ 14% | ↑ 11% |

SOL SOL | $41B | $95.73 | ↓ -4.52% | ↓ -5.89% | ↓ -9.23% |

ADA ADA | $20B | $0.5599 | ↓ -3.42% | ↓ -5.54% | ↓ -8.88% |

DOGE DOGE | $12B | $0.0814 | ↓ -3.79% | ↓ -8.55% | ↓ -12% |

DOT DOT | $10B | $7.83 | ↓ -4.39% | ↓ -3.47% | ↓ -6.81% |

MATIC MATIC | $8.6B | $0.8947 | ↓ -3.12% | ↓ -6.82% | ↓ -10% |

LINK LINK | $8.2B | $14.42 | ↓ -3.99% | ↓ -3.64% | ↓ -6.98% |

NEAR NEAR | $3.6B | $3.55 | ↓ -2.18% | ↓ -1.40% | ↓ -4.74% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -2.94% | $37.25 | ↑ 4.78% | ↑ 1.09% | ↓ -2.25% |

| BITW | ↓ -37% | $24.10 | ↑ 3.88% | ↓ -1.87% | ↓ -5.21% |

| ETHE | ↓ -12% | $19.73 | ↑ 4.50% | ↑ 1.39% | ↓ -1.95% |

| BTCC | ↓ -0.43% | $8.07 | ↑ 3.46% | ↓ -1.34% | ↓ -4.68% |

News

QUICK BITS

CoinDesk Franklin Templeton's Bitcoin ETF Now the Cheapest After 10 Basis Point Reduction After initially revealing their fees on Monday, several providers then reduced them spying the impending battle for market share that would ensue once the funds... |

Bitcoinist Vanguard Faces Extreme Backlash For Denying Customers Access To Bitcoin Spot ETFs American Investment management company Vanguard Group is currently facing severe backlash after reportedly rejecting customers’ requests to access and trade Spo... |

MARKET DATA

CryptoSlate Grayscale transfers $200M Bitcoin to Coinbase Prime hinting at possible ETF redemption activity Grayscale has begun moving Bitcoin out of its trust and sending it to Coinbase as of 2 p.m. GMT, Jan. 12. A total of 4,000 BTC (roughly $200M) has been sent as ... |

The Block PayPal’s stablecoin market cap grows 70% over last month to $290 million PYUSD sa a market cap increase of over 70% in the past month, ranking PayPal among the top ten dollar-based stablecoin issuers. |

Decrypt.co Ethereum Rallies as BlackRock Boss Eyes ETH ETF After Bitcoin Analysts think an ETH ETF is now a slam dunk, sending Ethereum pumping 18% in the last week amid the Bitcoin ETF rollout in the U.S. |

REGULATION

Decrypt.co Genesis Pays $8 Million and Forfeits BitLicense to Settle New York Charges Genesis Trading has had its BitLicense since 2018. |