Market Update

- The U.S. Attorney General Merrick Garland and Treasury Secretary Janet Yellen are set to host a joint conference at 3pm EST to announce “separate but related cryptocurrency enforcement actions.” It is believed they will announce a settlement of the DOJ’s criminal case against Binance. Details of the settlement are already beginning to emerge. Binance founder Changpeng Zhao (CZ) has officially stepped down as CEO and is pleading guilty to anti-money laundering charges. Additionally, Binance is admitting wrongdoing and paying $4.3 billion in fines. The plea deal settles all DOJ charges but does not settle the SEC lawsuit against Binance for violating investor protection laws. CZ will retain majority ownership of the exchange but will not be permitted to hold an executive role. Before details about what the actions would entail, crypto markets were dropping sharply, with Bitcoin reaching the low $36,000s, but following all the headlines BTC (-1.46%) has pared losses, rebounding to $37k. BNB is reacting negatively to the news, falling 5.19% amid the resignation and significant fines.

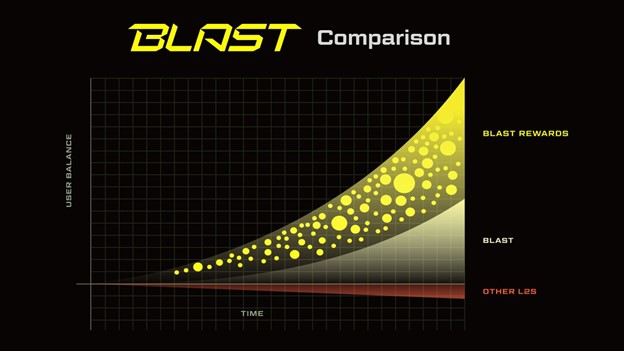

- Blur founder Tieshun Roquerre, has announced a new Ethereum layer-2 network called Blast. Blast will be the first L2 offering users native yield on their Ether and stablecoins. Roquerre will oversee development of both Blur and Blast. Blast raised raised $20 million from Paradigm and Standard Crypto, with other participation from Hasu and eGirl Capital. Blast plans to natively stake Ether and invest stablecoins into on-chain treasury protocols to pass yields on to users. They are projecting to offer 4% on Ether, 5% on stablecoins, and additional “Blast Points” as extra yield. Blast mainnet is not live yet, but a bridge has been opened, and users have already deposited over $30 million in assets. Bridged assets are currently going to a multisig wallet controlled by five people, and withdrawals are not enabled, drawing scrutiny from the crypto community. Mainnet is planned to launch in February, at which point withdrawals will be enabled. The native yield model will be an interesting experiment as it’ll highly incentivize deposits and activity while granting users faster and cheaper transactions.

Figure: Blast vs. Other L2s

Source: Blast

- In another U.S. regulatory action, the SEC has filed a lawsuit against Kraken’s parent companies, Payward and Payward Ventures, for allegedly operating as an unregistered trading platform. The SEC claimed that without any formal registration, Kraken is operating as a broker, dealer, exchange, and clearing agency for all securities on its platform. The lawsuit continues, alleging that Kraken’s business practices, controls, and record-keeping are insufficient and that Kraken has commingled customer assets with its own. The SEC is seeking to prevent Kraken from breaking securities laws and to stop acting as an unregistered broker-dealer. Kraken said they “strongly disagree with the SEC claims, stand firm in our view that we do not list securities, and plan to vigorously defend our position.” The lawsuit is very similar to the one that was brought against Coinbase this summer, and Kraken will likely approach its defense similarly.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Chainlink has managed to show positive performance during a day when many Cryptocurrencies are lower. As daily LINK -2.93% charts show, the early day weakness proved short-lived before a push back to above $15.50, which represents the highest daily close in over seven days. The area near $16 has importance and generally resulted in a slowdown as this was roughly double of the area of the breakout last month. Over the next 1-2 months, further strength looks likely despite the current overbought state, and rallies up to $23.50 look likely with an outsized chance that this moves to $29 which would represent a 50% retracement of the entire selloff from May 2021 peaks. Pullbacks should find ample support near $12.50 but breaching that level would temporarily derail the rally while LINK pulls back to $10. Overall, LINK is technically attractive here and Tuesday's gains likely could jumpstart the move over $18 in the weeks to come.

Daily Important Metrics

All metrics as of November 21, 2023 1:00 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $722B | $36,923 | ↓ -1.71% | ↑ 123% | |

ETH ETH | $237B | $1,973 | ↓ -3.55% | ↑ 65% | ↓ -58% |

SOL SOL | $23B | $53.40 | ↓ -7.57% | ↑ 440% | ↑ 317% |

ADA ADA | $13B | $0.3659 | ↓ -5.65% | ↑ 48% | ↓ -75% |

DOGE DOGE | $10B | $0.0739 | ↓ -8.14% | ↑ 5.41% | ↓ -117% |

LINK LINK | $7.6B | $13.74 | ↓ -7.89% | ↑ 147% | ↑ 25% |

MATIC MATIC | $6.9B | $0.7448 | ↓ -10% | ↓ -2.28% | ↓ -125% |

DOT DOT | $6.2B | $4.98 | ↓ -7.94% | ↑ 15% | ↓ -108% |

NEAR NEAR | $1.8B | $1.78 | ↓ -13% | ↑ 40% | ↓ -83% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -11% | $29.63 | ↓ -0.54% | ↑ 257% | ↑ 135% |

| BITW | ↓ -27% | $21.65 | ↓ -2.52% | ↑ 303% | ↑ 180% |

| ETHE | ↓ -13% | $16.41 | ↓ -2.96% | ↑ 245% | ↑ 122% |

| BTCC | ↑ 0.07% | $6.74 | ↓ -1.75% | ↑ 122% | ↓ -0.44% |