Market Update

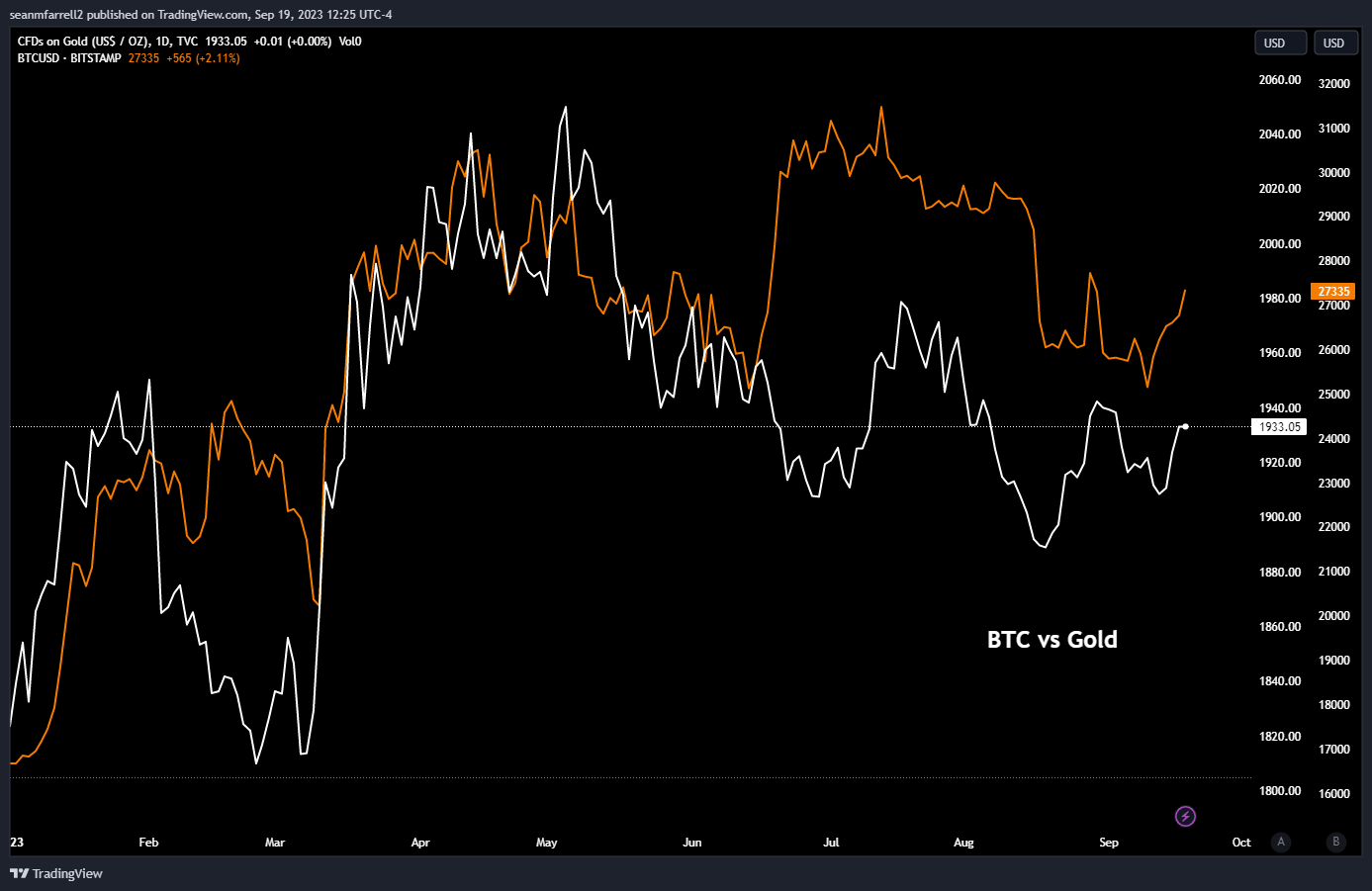

- Major equity indices are trending lower today, while interest rates are on the rise, with the US 10-Year seemingly poised to hit a new YTD high. The DXY started the day strong but has since plateaued, currently sitting flat. In the commodities market, gold, which BTC has directionally tracked quite well this year, is also up. In the crypto market, Bitcoin experienced a morning rally, surging back up to nearly $27.5k and lifting the broader market along with it. We discuss some interesting details surrounding this price action below. Meanwhile, ETH is currently hovering around the $1,650 mark. One of today's big winners is GMX, the decentralized perps exchange, which is up nearly 5%. All eyes are on the upcoming FOMC meeting scheduled for today and tomorrow, where a pause in interest rate hikes is expected to be announced during tomorrow's press conference.

- The early morning uptick in BTC price has mirrored a simultaneous increase in open interest, echoing the trend observed yesterday. Interestingly, this open interest was withdrawn around midday, aligning with a price pullback, suggesting that if the spot market lacks momentum, we might witness a similar drawdown this afternoon. This dynamic is part of a broader pattern observed over the past week, where price action during Asia-Pacific (APAC) trading hours has outperformed that of the US and European markets. This trend is particularly noteworthy given the current instability in Asian local currencies, especially the Chinese Yuan (CNY). Given these factors, this is a trend that merits ongoing attention.

- Traditional financial institutions continue to wade into the crypto ecosystem, as evidenced by new digital asset services launched this week by Laser Digital, a subsidiary of Nomura, and Citigroup. Laser Digital has introduced its asset management arm with a Bitcoin fund designed to provide long-only exposure to institutional investors. This fund is part of a broader suite of crypto investment products that the firm plans to roll out and leverages Komainu, a digital custody solution co-founded by Nomura, for asset custody. Concurrently, Citigroup has entered into a new custodial partnership with BondbloX Bond Exchange (BBX), becoming the world’s first digital custodian for the inaugural fractional bond exchange. This partnership allows Citi's institutional clients to trade fractionalized bonds almost instantaneously via atomic settlement. In addition, Citigroup is piloting a program to transform customer deposits into digital tokens for swifter global transfers. While this latter initiative is part of a private blockchain service and may not solve issues related to uptime, immutability, or composability, both Laser Digital's and Citigroup's initiatives illustrate a growing commitment from traditional financial market participants to integrate crypto into their services.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

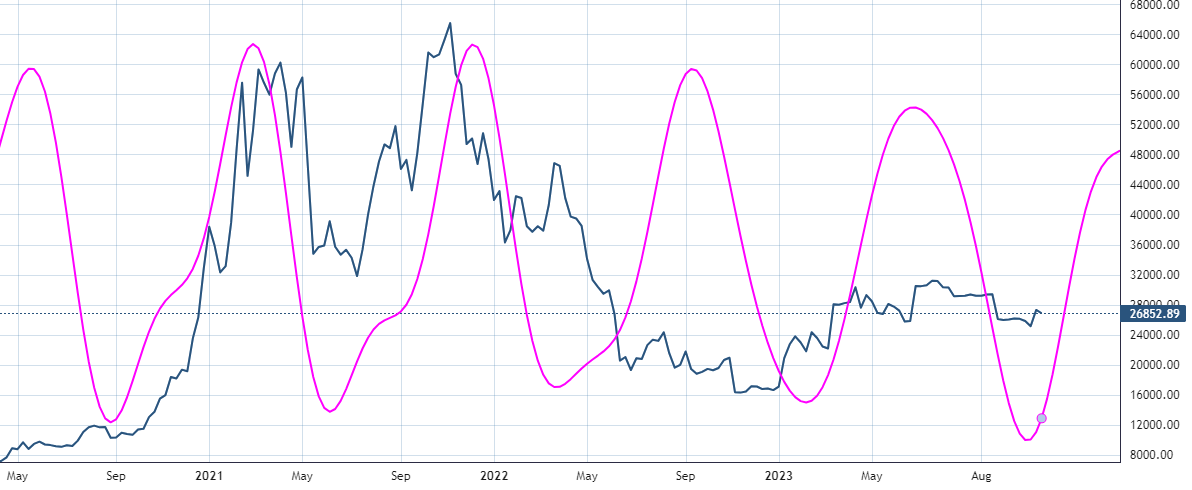

Bitcoin's recent resilience in holding up in the wake of Equity weakness might be due to a recent cyclical low which could be playing out following the consolidation into mid-September. Weekly cycle composite charts based on important cycles such as 41-weeks (along with several other inputs for BTC) show a distinct rally between the time of late September into early December. (Daily cycles such as the 196-trading day cycle also confirms that a low should be approaching) Given that many investors are carefully eyeing mid-October as having importance, gains over late August highs at $28,142 would help to add some conviction that BTC has already bottomed and should be starting a push back towards mid-July highs. Momentum and trends remain negative from mid-July on Bitcoin, so it's imperative to see some proof of trend improvement before expecting this cycle composite has definitely turned higher. However, any ability to exceed $28,142 likely could lead to $30,414, which likely wouldn't hold on any retest. Intermediate-term targets lie at $36k, and above at $40-$42k for BTC.

Daily Important Metrics

All metrics as of September 19, 2023 12:12 PM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $530B | $27,188 | ↓ -0.44% | ↑ 64% | |

ETH ETH | $198B | $1,646 | ↓ -0.96% | ↑ 37% | ↓ -27% |

ADA ADA | $9.0B | $0.2560 | ↑ 0.77% | ↑ 3.72% | ↓ -60% |

DOGE DOGE | $8.8B | $0.0627 | ↑ 0.24% | ↓ -11% | ↓ -75% |

SOL SOL | $8.2B | $20.03 | ↑ 0.75% | ↑ 102% | ↑ 38% |

DOT DOT | $5.1B | $4.13 | ↓ -1.70% | ↓ -5.01% | ↓ -69% |

MATIC MATIC | $5.0B | $0.5381 | ↑ 1.05% | ↓ -29% | ↓ -94% |

LINK LINK | $3.8B | $6.79 | ↓ -0.04% | ↑ 22% | ↓ -42% |

NEAR NEAR | $1.1B | $1.12 | ↓ -0.16% | ↓ -12% | ↓ -76% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -20% | $19.65 | ↑ 2.18% | ↑ 137% | ↑ 73% |

| BITW | ↓ -46% | $12.20 | ↑ 1.24% | ↑ 127% | ↑ 63% |

| ETHE | ↓ -27% | $11.63 | ↑ 0.81% | ↑ 144% | ↑ 80% |

| BTCC | ↑ 0.01% | $5.01 | ↑ 2.04% | ↑ 65% | ↑ 1.22% |

News

QUICK BITS

CoinDesk Citigroup Unveils Token Services for Institutional Clients In a pilot, Citi used smart contracts to serve the same purpose as bank guarantees and letters of credit working with shipping company Maersk and a canal author... |

CoinDesk Nomura's Laser Digital Starts 'Bitcoin Adoption Fund' for Institutional Investors The Bitcoin Adoption Fund will provide long-only exposure and will be the first in a range of such digital asset investment products offered by Laser Digital. |

MARKET DATA

Decrypt.co PayPal Shares First PYUSD Report as Stablecoin Market Fades to $131 Billion PYUSD’s $44 million market capitalization suggests the stablecoin’s initial adoption has been slow so far. |

CoinDesk Binance Staked Ether Experiences $573M in Inflows This Month Binance's staked ether token (BETH) experienced $573 million in deposits across two single days in September, more than quadrupling total value locked to $731 m... |

Coin Telegraph Tether authorizes $1B USDT to "replenish" Tron network Blockchain trackers flag $1 billion “authorised but not issued” USDT mint at Tether’s Treasury, CTO Paolo Ardoino clar... |

Decrypt.co Base Onchain Assets Surpass Solana as Friend.tech, DeFi Activity Surge Base is building an economic moat thanks to a resurgence in Friend.tech activity and the launch of new DeFi applications. |

REGULATION

CoinDesk ‘I Just Want to Keep Things Moving’: Judge Makes No Ruling in SEC-Binance Document Dispute A U.S. judge declined to order Binance.US to make its executives more available for depositions, or for the U.S. Securities and Exchange Commission (SEC) to bac... |

Bitcoin.com Circle CEO Jeremy Allaire: Stablecoin Bill Unlikely to Be Signed Into Law Jeremy Allaire, CEO of Circle, the issuer of USDC, the second-largest stablecoin in the market, has shared his skepticism about the passing of a stablecoin law ... |

Coin Telegraph Indian state governments spur blockchain adoption in public administration Numerous initiatives by local and state governments in India — from data management systems to verifiable certificate ... |

MINING

Bitcoin Magazine Over 50% of US Bitcoin Miners to Back New Policy Group The Digital Power Network's mission is to advocate for Bitcoin mining and drive forward productive energy policy. |