Market Update

- Equity indices are declining today on higher-than-expected PPI data for July. The SPY 0.54% and QQQ 0.97% have fallen 0.24% and 0.88%, respectively, while U.S. Treasury yields have risen across the board. Crypto markets are faring better, with BTC (+0.17%) trading near $29.5k and ETH (+0.12%) hovering around $1,850. Rocket Pool (RPL) has been a strong performer over the last three trading days, rising 11.30% after Coinbase announced a strategic investment in the liquid staking provider. Looking ahead, the SEC’s second deadline on Ark’s spot Bitcoin ETF is 8/13 (Sunday), so many expect a decision to be announced after market close today. The consensus is that they will defer the decision. A deferral would make early September the next key date to watch as multiple ETF applicants, including Blackrock, approach their decision deadlines.

- Coinbase’s newly launched layer-2 network Base overtook Optimism in daily active users (DAU) yesterday as a new dApp, Friend.tech, has caught the attention of the crypto community. Base’s DAUs hit a record high yesterday at 136,047 and has seen $175 million bridged to the network since launching. A large amount of the activity can be attributed to Friend.tech, a social network that is rumored to be airdropping a token to its users. Friend.tech allows users to buy and sell shares of social tokens tied to Twitter accounts. The crypto community has a large presence on Twitter, so it’s unsurprising that many so-called “influencers” were quick to launch their own tokens and have users speculate on their value. Owning shares of specific accounts grants access to their content and enables the holder to message the account owner. Friend.tech has seen so much adoption in the last 24 hours that their website has been down for an extended period of time, causing their Twitter account to tweet, “We genuinely did not realize there were still so many people into crypto.” There has been no mention of when a potential airdrop might come from Friend.tech or how to qualify, but using the platform likely increases one’s chances.

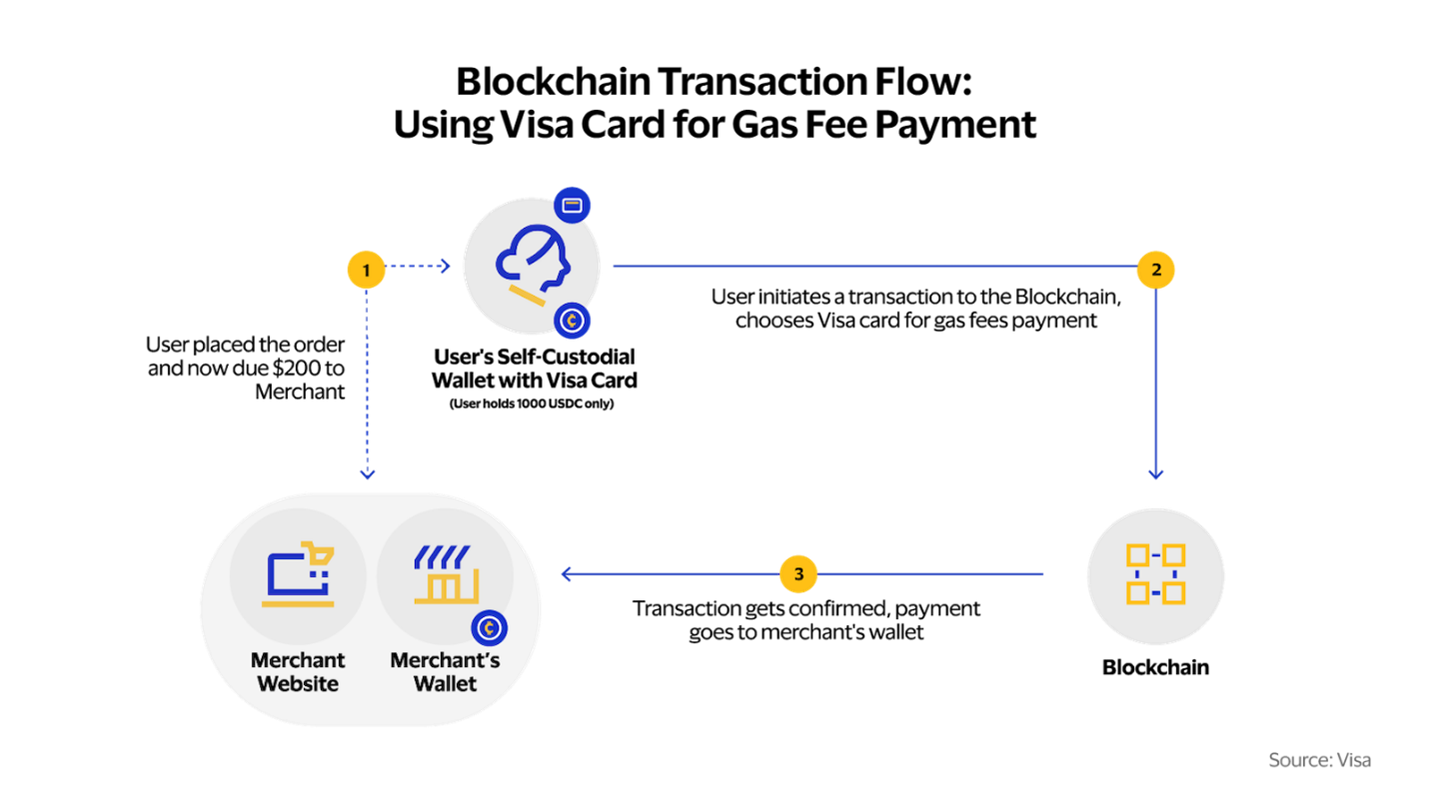

- Visa, the major payments provider, has been testing a new solution to allow on-chain gas fees to be paid via a Visa card. Users traditionally fund their wallets with ETH, which is required to complete transactions on the Ethereum blockchain. Gas fees tend to fluctuate depending on network activity, rising significantly during times of high blockchain congestion. Visa’s new solution uses the ERC-4337 standard and a “paymaster” smart contract. Paymaster smart contracts are smart contracts that can sponsor gas fee payments for accounts, enabling payment to be made with sources other than the blockchain’s native token. Once a transaction is triggered with Visa’s wallet-linked card, Visa will process the gas fee payment off-chain (like any regular card payment) and cover the fee on behalf of the user behind the scenes (on-chain). This reduces friction for crypto users because they don’t need to hold ETH (or any native blockchain token) in their wallets to complete transactions. Visa has been testing Paymaster on Ethereum’s Goerli testnet but has not released any info on moving the product to mainnet.

Daily Technical Strategy

Mark L. Newton, CMT

Head of Technical Strategy

Please note that Mark is traveling and will not be providing technical analysis today. His comments will resume on Monday, and you can find yesterday's analysis listed below.

ICE 2.84% 25% rally today gives some technical conviction that its one-month pullback is likely complete. Daily ICE 2.84% charts show the ongoing consolidation which has been ongoing since April 2023, roughly four months ago. Rally attempts into early July made a lower high than April before nearly completely retracing its bounce back to $0.85 which proved to be a nearly exact 50% absolute retracement from 7/3 highs. This week's progress, thanks to Thursday's (8/10) lift could help ICE form a positive weekly close after its last four straight weekly losses. Volume is spiking sharply on Thursday which helps to add credibility this big rise and price remains near the highs of today's range. Overall, a rally back to $1.45 looks to be underway which likely carries ICE higher over the next few weeks. Exceeding $1.45 would suggest a much larger intermediate-term rally is underway, which at present is difficult to forecast without technical improvement. Eventual upside targets lie near $.2.10 and above that allows for a rally which eventually should reach $9.75-$10. Overall, this high-volume rally is bullish, making ICE look technically attractive for gains in the weeks to come.

Daily Important Metrics

All metrics as of August 11, 2023 11:40 AM

All Funding rates are in bps

Crypto Prices

| Symbol | Market Cap | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

BTC BTC | $571B | $29,351 | ↓ -0.42% | ↑ 77% | |

ETH ETH | $221B | $1,843 | ↓ -0.55% | ↑ 54% | ↓ -23% |

ADA ADA | $10B | $0.2943 | ↓ -1.24% | ↑ 19% | ↓ -58% |

SOL SOL | $10.0B | $24.64 | ↑ 0.33% | ↑ 149% | ↑ 72% |

MATIC MATIC | $6.3B | $0.6795 | ↓ -1.36% | ↓ -11% | ↓ -88% |

DOT DOT | $6.0B | $4.98 | ↓ -0.68% | ↑ 14% | ↓ -63% |

LINK LINK | $4.0B | $7.50 | ↓ -2.37% | ↑ 35% | ↓ -42% |

NEAR NEAR | $1.2B | $1.33 | ↓ -0.46% | ↑ 4.22% | ↓ -73% |

DOGE DOGE | $0.0000 | $0.0001 | ↑ 0.00% | ↓ -100% | ↓ -177% |

Exchange Traded Products (ETPs)

| Symbol | Premium to Nav | Last Price | Daily Change | Year to Date | Relative to BTC YTD |

| GBTC | ↓ -25% | $19.86 | ↑ 0.33% | ↑ 140% | ↑ 62% |

| BITW | ↓ -49% | $12.75 | ↓ -0.23% | ↑ 137% | ↑ 60% |

| ETHE | ↓ -36% | $11.50 | ↓ -0.09% | ↑ 142% | ↑ 64% |

| BTCC | ↑ 0.06% | $5.38 | ↓ -0.19% | ↑ 78% | ↑ 0.38% |

News

QUICK BITS

CoinDesk Coinbase Layer 2 Base Overtakes Optimism in Daily Active Users as Friend.Tech Hype Soars A grayed-out "airdrop" icon at the top of the Friend.Tech app suggests the platform will release a token. |

Bitcoin.com Digital Currency Group Strikes Back: Motion to Dismiss Gemini’s Lawsuit Filed Digital Currency Group (DCG) has filed a motion to dismiss the lawsuit brought against them by Gemini Trust Company, LLC. The motion, filed in the Southern Dist... |

MARKET DATA

Decrypt.co $170M Bridged to Coinbase Layer-2 Base as Daily Active Users Hit 136,000 The new chain has entered the top five layer-2 networks by total amount bridged, while daily active users hit 136,000. |

CRYPTO INFRASTRUCTURE

Coin Telegraph Visa explores crypto gas fees payments through cards Visa’s innovative solution employs Ethereum’s ERC-4337 standard and the “Paymaster” smart contract, enabling off-chain... |

REGULATION

Decrypt.co Crypto Exchange Bittrex Agrees to Pay $24 Million to Settle SEC Lawsuit Four months after the SEC sued, bankrupt exchange Bittrex has agreed to a settlement without admitting to or denying the allegations. |

FUNDRAISING AND M&A

BTC Manager Coinbase invests in Rocket Pool, RPL rises 8% Coinbase Ventures, the investment wing of the cryptocurrency exchange, Coinbase, has invested in the liquid staking platform, Rocket Pool |

Decrypt.co Binance Labs Invests $10M to Accelerate Helio Protocol's Liquid Staking Pivot LSDfi is a fast growing space within DeFi. Now Binance is throwing capital into it. |

NewsBTC Curve DAO Scores $5 Million Boost From Binance, Eyes BNB Chain Expansion In a strategic move to bolster the decentralized finance (DeFi) sector, Binance Labs, the venture capital and incubation arm of Binance, has committed a substan... |