-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 2

Why Is DCF and Net Present Value So Important?

The reason why understanding net present value and DCF models is so important is because it can give you A LOT of insights about the markets. The way the DCF model works also has a direct bearing on how stocks will be valued at any given time. For example, in the era of ultra-loose monetary policy when the Fed is accommodative and interest rates are low, the Discount Rate that is used to discount potential future earnings (usually the risk-free interest rate) is correspondingly low and thus high P/E stocks experience less economic gravity on the heights their P/E ratios can climb to in such an environment. More liquidity means multiple expansion can more easily occur. Less liquidity means multiple compression is more likely.

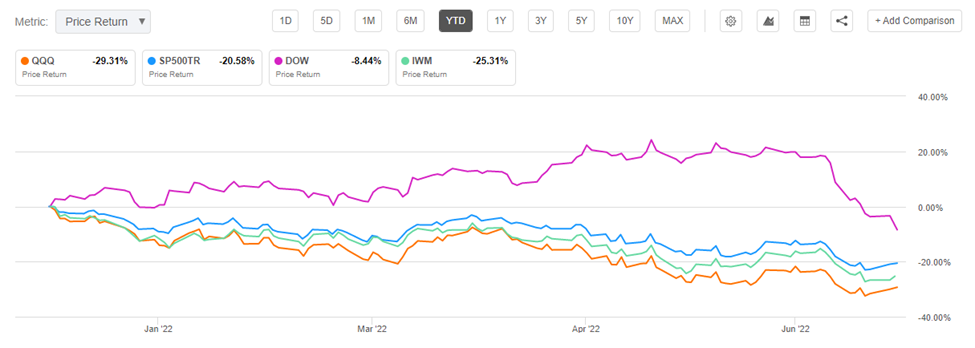

Correspondingly, when the Federal Reserve begins tightening by raising the benchmark Federal Funds rate, then it has the effect of raising the discount rate on potential future earnings. Potential earnings which investors expect companies to make in the future become worth less as rates rise. What does this mean? It means as the interest rate rises, the net present value of future earnings falls and thus the P/E ratio falls. You can see how this principle affected markets. The Fed announced a beginning to tightening in November 2021 and the turmoil in markets began soon after. The Nasdaq 100 has fallen more than any of the other indexes on a YTD basis, even more than the Russell 2000. The Nasdaq is made up of some of the strongest companies on earth, but they have a higher proportion of their net present value comprised of future cashflows. As rates have risen while the Fed tightened, it has hit these names particularly hard as their future cashflows now must be more heavily discounted.

Source: SeekingAlpha.com

Has anything occurred that has cast doubt or dispersion on the future earnings potential of the Technology names? Certainly, on a company-by-company basis some catalysts and a decelerating economy may cast doubts. For example, many pandemic beneficiaries that enjoyed robust idiosyncratic demand may be seeing it evaporate faster than they thought it would. However, the rising interest rates and tightening cycles make some of the strongest and most competitive companies’ share prices deflate as the discount rate rises, regardless of individual company fundamentals. This is financial gravity and the relationship between equities, particularly those with high P/E ratios, and interest rates is incredibly important to understand. This relationship is also crucial to Tom Lee’s 7th Principle of Evidence-Based Research, Don’t Fight the Fed.

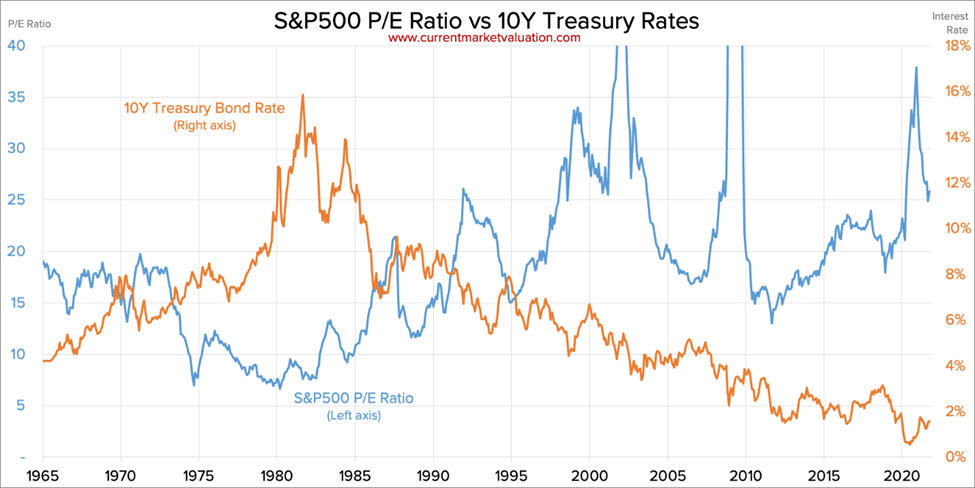

If you’ve ever heard the oft-repeated metaphor that the Fed has a bazooka, this is what investors are referring to. The bazooka the Fed wields is its ability to influence rates throughout the entire economy with the Federal Funds rate. As you can see below rates and the S&P 500 have an inverse relationship that holds steady over the past decades. The Fed, by controlling the Federal Funds rate controls how much liquidity is in the economy. If the economy was a farm, then the Fed controls the rain. This is the source of the world’s most powerful Central Bank’s awesome power in the financial realm.

So, some sectors are better to own then others given the directionality of interest rates. During rising rate environments, it is better to own financial stocks (which directly benefit from rising rates), stocks that have a high dividend yield and stocks with low multiples which might sometimes be referred to as Value stocks. During a period of low or falling rates it is easier to invest and a wider group of stocks tends to benefit. Utilities are extremely dependent on credit so when rates go down it is beneficial for these names. Healthcare performs in falling rate environments as well. Consumer staples, Midcaps and Pharma stocks also tend to benefit during falling rates. When rates are falling or low, stocks have a higher probability of undergoing multiple expansion, whereas when rates are rising multiple compression is the more likely outcome.

Source: Currentmarketvaluation.com

Cost of Capital Is Supremely Important in Discounted Cash Flow Model Valuation

Most businesses need to continue investing in different projects to maintain their cashflows over any extended period. Otherwise, they would fall into obsolescence and would be outcompeted by peers who are making investments in projects that will result in growth. The cost of capital is essential for DCF models. It is essentially the required rate of return necessary to entice a company to pursue a project. Obviously, if the company can determine the cost of a project won’t cover the cost of capital necessary to fund the project, then the company should not pursue this project. If a company engages on a project that is accretive to shareholders, this means the project’s return was greater then the cost of capital. If there is no dilutive or accretive effect on the shares as a result of a project, it equals the cost of capital.

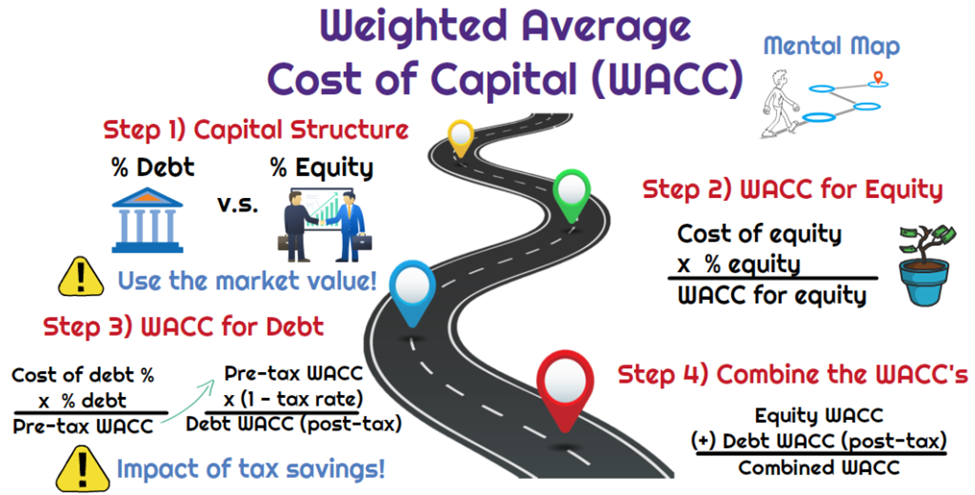

Source: UniversalCPAreview.com

Of course, there are different types of ways to raise capital, and these often have different costs. For example, a company may decide to raise equity instead of issuing debt during periods of low interest rates. This is because it is less costly to issue equity during these periods. Companies can get capital by selling bonds, preferred stock, or common stock. However, for the purposes of DCF calculations we need to aggregate the total cost of capital to evaluate projects and their impact on a company’s stock. The combined cost of capital which includes all the different components companies use to raise capital is referred to as the Weighted Average Cost of Capital (WACC).

Related Guides

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInflation – What’s All the Fuss About?

A multi-part series about inflation and its impact on stock investors.

-

Series of 6~12 minutesLast updated3 years ago

Series of 6~12 minutesLast updated3 years agoIntroduction to Hedging

In this guide, we will cover the basics of hedging, what is hedging and what is the user for it.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?

-

Series of 5~21 minutesLast updated3 years ago

Series of 5~21 minutesLast updated3 years agoThe VIX Series

What is the VIX? What does it indicate? How can I use it to improve my strategies?