-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

Hedge Your Bets

Many of us have tried our luck at the Blackjack table. Of course, most of us aren’t professional card counters. We’re probably all at least partially vulnerable to the intoxicating mix of chemicals in our brain that is released when we win at gambling.

We’ve all probably experienced that moment when we get a face card and get excited at impending victory, only to see that awkward smile go across the dealers’ faces as they flip an ace that was lying in hiding under their exposed face card. It is not a good feeling, and if you’ve had severe investing losses in the past, you probably recognize the feelings and thought processes involved.

There’s a product called insurance that will protect your bet in this worst-case scenario. It is a side bet that pays out 2/1. It offers the gambler a way to insure his bet even the dealer draws a blackjack and results in breaking even. If you’re doing a Martingale Strategy, it can really save the day. If the dealer’s face card is an Ace, players will often buy insurance against the close to 1/3 probability that the dealer will draw a ten and win.

The logic underpinning Blackjack insurance, insuring yourself against loss in bad scenarios, is the same logic that hedging has grown out of. Some laws require you to ensure what is most Americans’ main asset, their homes. If you insure your home, you should probably insure your portfolio to at least some degree. You have more options to achieve this objective than have ever been available to investors. Is it more important to eat well or sleep well, though?

This will depend on each investor’s individual objectives and risk tolerances. Hedging risk can get expensive, and therefore one of the most important things to consider when embarking on the mental journey of risk management can be how to protect yourself from risks cost-effectively. Maybe you can stomach small market movements; perhaps all you want to do is hedge against calamitous events. We’ll help you wrap your head around some strategies.

Traders love to use hedging and leverage to amplify returns and protect themselves against risk. While many newer investors have discovered how you can amplify returns using leverage when things are going your way, decidedly less have been practicing cost-effective, risk-defining strategies that can help you avoid a costly disaster.

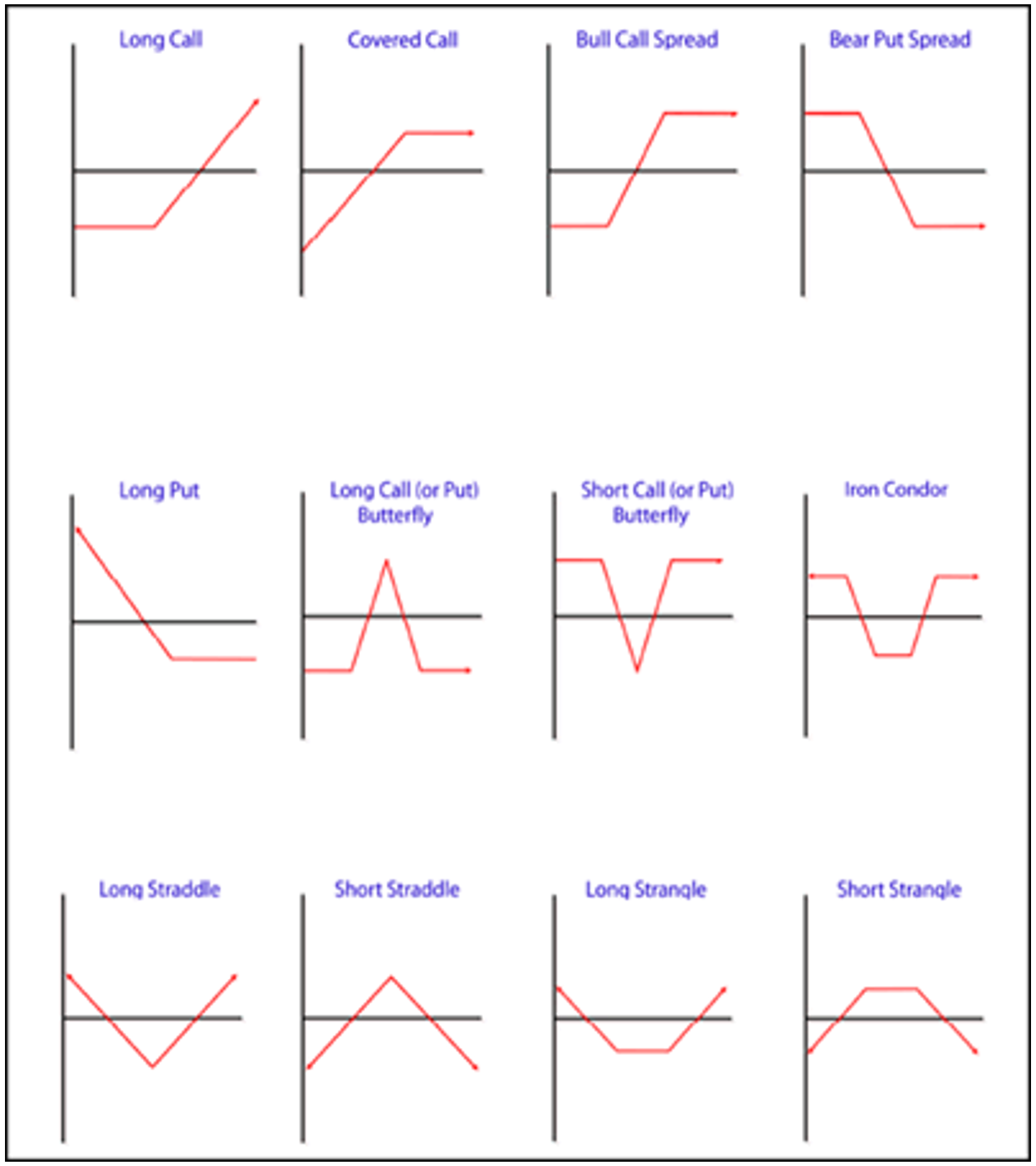

Many investors have a firm understanding of how long the call or put option can be used. However, combining different contracts can give you the power to control risk in a more precise fashion than you may have imagined possible.

Combining contracts to color within the lines you define for yourself is a powerful ability that was out of range for investors for much of the twentieth century. The derivatives market has grown to exceed $600 trillion in notional exposure, so we’d say they’ve gained some popularity. Despite reputational damage from the Global Financial Crisis, most of this is used to define and control risk, not augment it to problematic levels.

Related Guides

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInflation – What’s All the Fuss About?

A multi-part series about inflation and its impact on stock investors.

-

Series of 3~11 minutesLast updated3 years ago

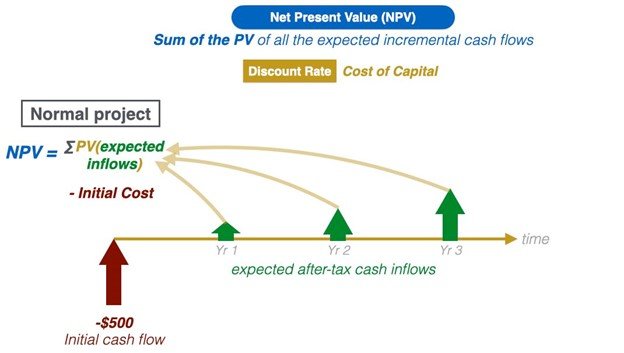

Series of 3~11 minutesLast updated3 years agoUnderstanding Net Present Value and The Basics of Discounted Cash Flow Models (DCF)

Acquaint yourself with the basics of net present value and discounted cash flow (DCF) models.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?

-

Series of 5~21 minutesLast updated3 years ago

Series of 5~21 minutesLast updated3 years agoThe VIX Series

What is the VIX? What does it indicate? How can I use it to improve my strategies?