-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 3

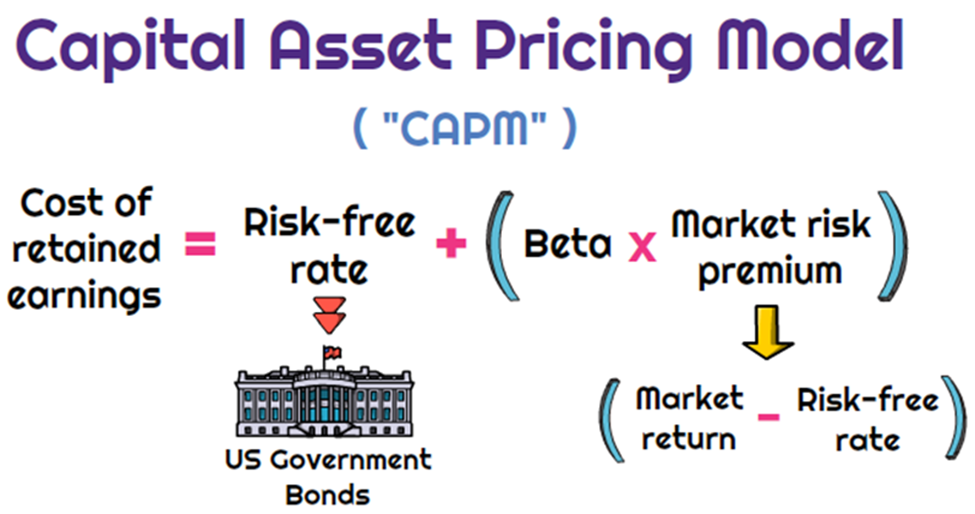

The Capital Asset Pricing Model (CAPM)

“Remember that time is money.” -Benjamin Franklin

“Some investments do have higher expected returns than other. Which ones? Well, by and large they’re the ones that will do the worst in bad times.” -William Forsyth Sharpe

Source: UniversalCPAreview.com

The Capital Asset Pricing Model was largely developed by William Forsyth Sharpe, the namesake of the Sharpe Ratio which measures risk-adjusted return. Put simply, the CAPM is one of the cornerstones of modern financial theory and is used extensively in practice to estimate the vital discount rate for discounted cash flow models. The model breaks up risk into two categories: market risk and risks unique to the stock. The all-important Sharpe ratio, or risk-adjusted return is at the core of successful investment and measures not the return of an investment, but the return of an investment relative to the market risk. Crucial to CAPM is a question. What is the opportunity cost of investing in one asset compared to another opportunity?

The risk-free rate is key to the formula. It shows what investors would receive for a zero-risk investment and thus serves as a vital comparison tool. How much are you getting compensated for the risk you are taking? This question is central to the goal of the model. To answer it you need to understand what you’ll get for not taking any risk. Beta measures returns relative to the market. We discuss the concepts of Alpha and Beta more extensively here in our guide on Investor Psychology.

Beta is the return of a security relative to the market. If an investment has a beta above 1 then it has greater volatility then the market, if it is less than 1 then it is less volatile then the market. An investment with a beta of one would have the same volatility as the market.

The market risk premium is the additional return you are getting by being invested in a particular security versus what you would earn in a risk-free asset. Crucial to the operation of this model are many assumptions including the assumption that a stock which has been more volatile in the past is likely to continue being volatile relative to the market. The CAPM is crucial to determining the Cost of Equity, which in turn is essential to determining the Weighted Average Cost of Capital if the company is leveraged. If the company is unleveraged then the Cost of Equity alone will suffice.

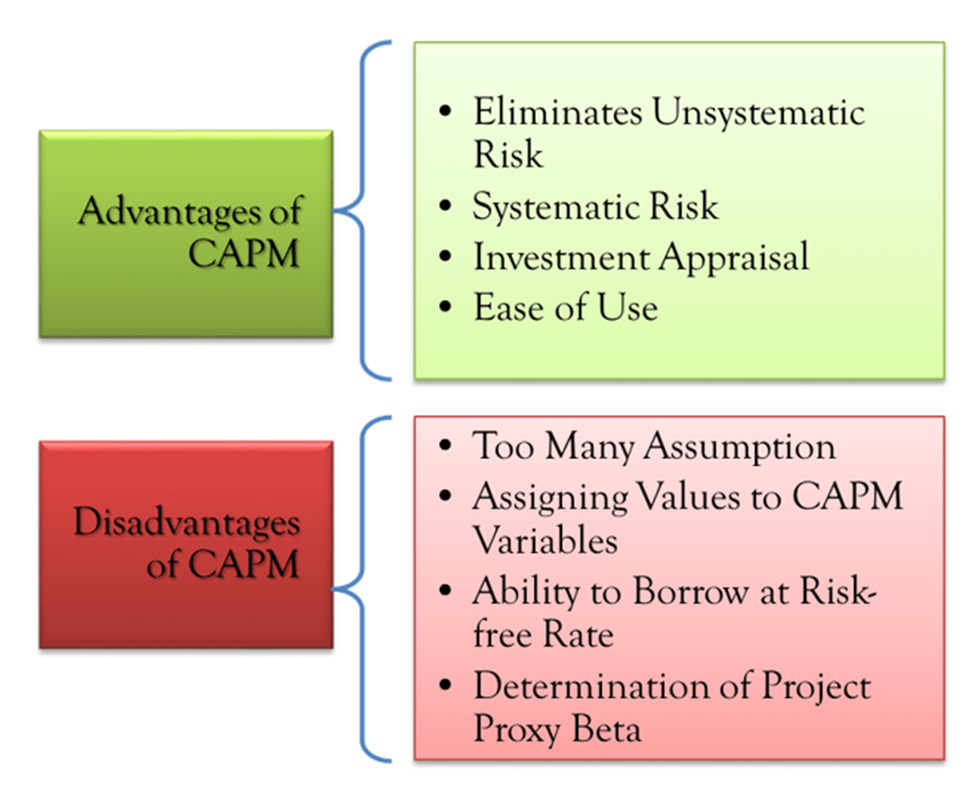

Source: eFinanceMangement.com

One advantage of the CAPM is that it is pretty simple and easy to implement. However, some of the cons come into play with regard to the assumptions it rests on, which some deem as overly simplistic and of limited utility in the real world. Regardless of where you fall on the theoretical nuances of the underpinnings of this theory understanding it and being able to use it to successfully estimate a discount rate are crucial to equity analysis.

Related Guides

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInflation – What’s All the Fuss About?

A multi-part series about inflation and its impact on stock investors.

-

Series of 6~12 minutesLast updated3 years ago

Series of 6~12 minutesLast updated3 years agoIntroduction to Hedging

In this guide, we will cover the basics of hedging, what is hedging and what is the user for it.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?

-

Series of 5~21 minutesLast updated3 years ago

Series of 5~21 minutesLast updated3 years agoThe VIX Series

What is the VIX? What does it indicate? How can I use it to improve my strategies?