-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

Why Inflation Matters

For the better part of the past two years (2022-2023), market strategists, investors, and policymakers – to say nothing of everyday consumers – have been talking about inflation. For consumers, the primary concern has been a reduction in their purchasing power, particularly when it comes to household expenses such as food, gasoline, and/or rent.

For investors and market strategists, the inflation rate has been important because of how policymakers’ responses to high inflation can affect corporate earnings, interest rates, and thus, stock prices. A quick search for the word “inflation” on the FS Insight website shows that it appears in the vast majority of notes that we have published during this period.

Part of understanding the analyses provided by FS Insight requires an understanding of what inflation is, and why it matters. So what is inflation, exactly?

Inflation is the rate at which the price of goods and services rises over a sustained period of time. Importantly, inflation is what occurs when prices rise across many types of goods and services – not just one, and only when those prices rise over a sustained period of time (rather than a one-time increase.) So if the price of gas rises after a hurricane destroys refining facilities but settles shortly afterward as the supply chain adjusts, this would not be inflation, as price increases were seen only in one class of goods, and only for a limited time.

Why do policymakers care about inflation?

Inflation influences the spending, savings, and investment decisions of consumers and businesses in many ways. At more extreme levels (both high and low), these aggregate changes to consumer and business decisions can affect a country’s economic growth and social stability.

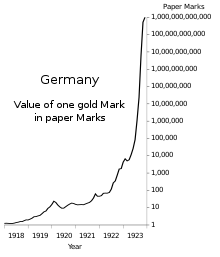

Perhaps the most famous example of the detrimental effects of extremely high inflation is the Weimar Republic – Germany between late 1918 and early 1933. The hyperinflation – with nominal prices roughly doubling every three days – caused such economic distress and popular unrest in post-World War I Germany that many historians believe it played a significant role in the rise to power of Adolf Hitler and the Nazi party.

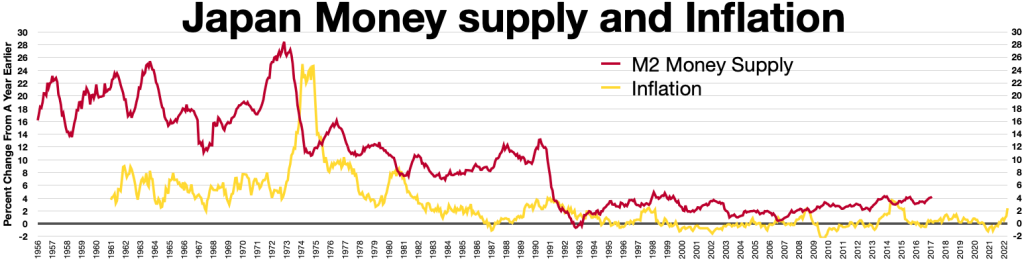

On the other side of the coin, deflation (extremely low inflation, including negative inflation), is widely seen as a major reason that Japan’s economy began to stagnate in 1990 and continued to do so for several decades afterwards. The country continues to struggle with the societal effects of what are popularly known as its “Lost Decades,” including an alarmingly low birth rate partially caused by an entire generation of Japanese opting not to have children due to limited resources.

At less extreme levels, high inflation is viewed as detrimental because it reduces purchasing power, causing instability through uncertainty and by exacerbating the effects of wealth inequality. It also makes it more difficult (and unlikely) for consumers and businesses to make sound long-term financial decisions.

Unsuitably low rates of inflation can make it difficult for households and businesses to service their debt. It can also reduce employment and disincentivize business capital expansion and investment, thus impeding long-term growth.

Is all inflation bad?

While overly high inflation and overly low inflation can each cause damage to a country’s economy, a moderate level of inflation is generally seen as a good thing. There is no hard and fast rule as to what that level is, but many economists – including those at the U.S. Federal Reserve – assert that the optimal level for inflation is somewhere around 2-3%. Deviating slightly from this range might not result in any noticeable consequences, but the larger and more sustained the deviation, the more likely it is that consumers, businesses, and the economy will notice an impact.

An appropriate and relatively stable level of inflation can encourage the proper levels of spending, saving, and investment – both by companies and businesses. These, in turn, fuel economic growth, corporate profits, employment, and living standards.

In future discussions, FSI Academy will cover how to measure inflation, what causes it, and what can be done to keep it under control.

Related Guides

-

Series of 3~11 minutesLast updated3 years ago

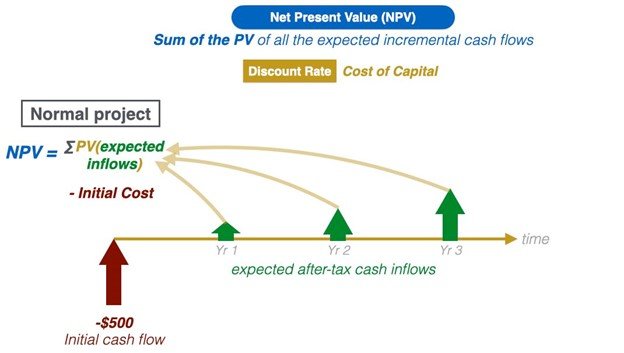

Series of 3~11 minutesLast updated3 years agoUnderstanding Net Present Value and The Basics of Discounted Cash Flow Models (DCF)

Acquaint yourself with the basics of net present value and discounted cash flow (DCF) models.

-

Series of 6~12 minutesLast updated3 years ago

Series of 6~12 minutesLast updated3 years agoIntroduction to Hedging

In this guide, we will cover the basics of hedging, what is hedging and what is the user for it.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?

-

Series of 5~21 minutesLast updated3 years ago

Series of 5~21 minutesLast updated3 years agoThe VIX Series

What is the VIX? What does it indicate? How can I use it to improve my strategies?