-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 1

Understanding Net Present Value and The Basics of Discounted Cash Flow Models (DCF)

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – Benjamin Graham

Investor psychology is incredibly important. Markets are continually driven by a swinging pendulum between greed and fear. In the short-term markets are volatile but in the long-term, as Mr. Graham wisely pointed out, they are more like a weighing machine. The weighing is done in a somewhat complicated fashion, but this doesn’t mean it’s hard to implement the eminent Mr. Graham’s concept in practice. One of the most accessible, and also easiest, ways to beat the market is to own quality stocks over the medium and long term. Amazingly, some of the most successful retail accounts at Fidelity were found to have been owned by investors who simply forgot they had them. In the act of forgetting their accounts, they spared themselves from their own short-term and emotionally driven mistakes. They stayed out of consensus during bear markets and bull markets alike.

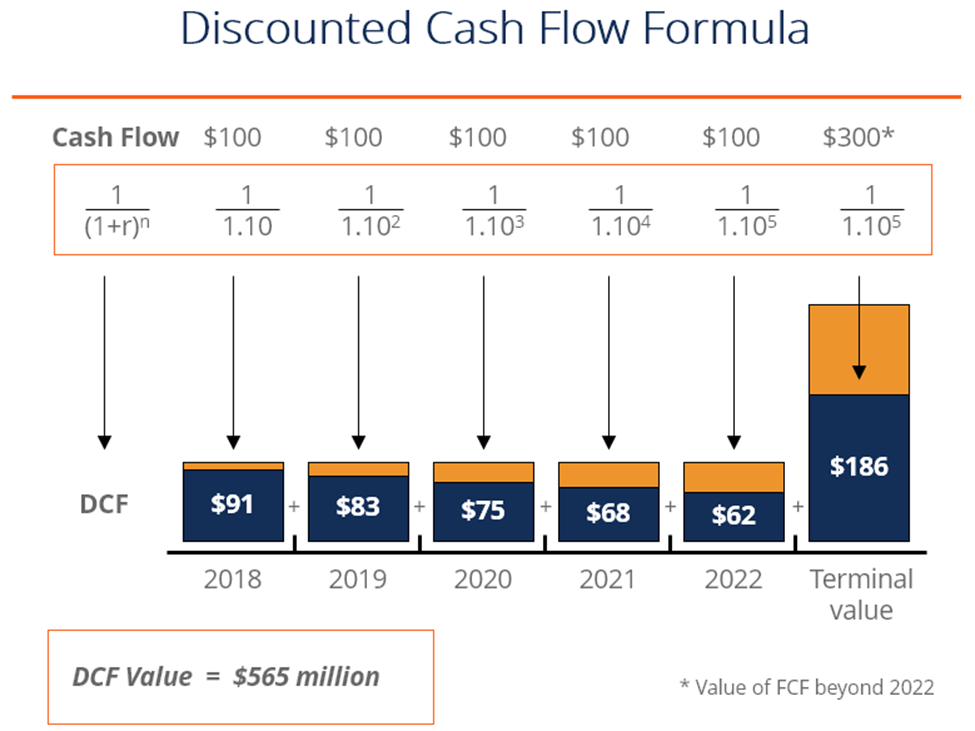

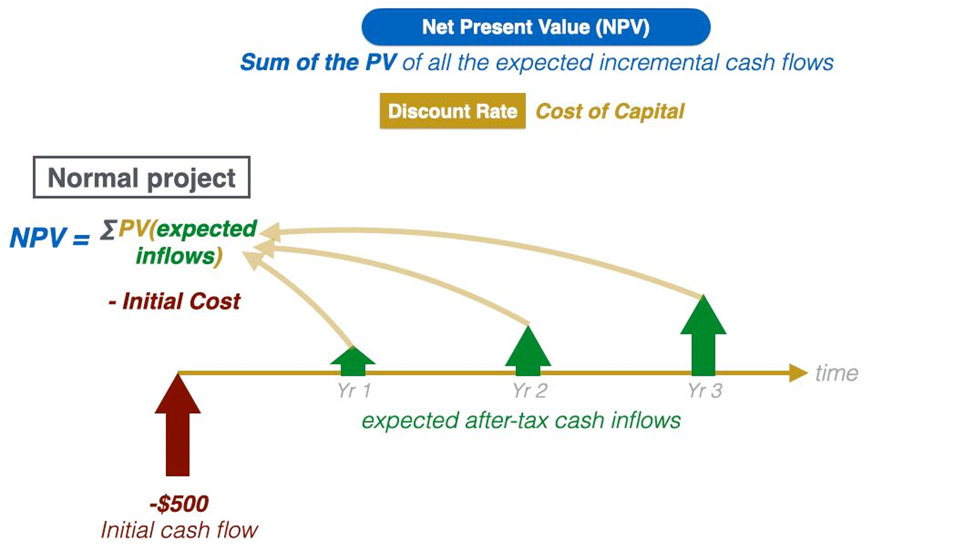

So, in line with Mr. Graham’s important insight, how do you “weigh” a stock? Well, we’re going to try to explain it to you in as simple a way as possible but please bear in mind this content can be perplexing. We suggest you take time to understand it though, as this is one of the most important anchors of fundamental equity analysis. In a short and simplified answer, the way you weigh stocks is with Discounted Cash Flow models (DCF). Or you can weigh them relative to other similar investments, comparing P/E ratios for instance. But with the DCF model you are using the company’s cash flows to value it, not comparing it to other stocks. The important metric you should pay attention to is something called Net Present Value. To conduct a successful DCF analysis a research analyst needs to possess the below information:

- The first piece of information is an estimated discount rate. This rate is used to calculate the present value of future cash flows. A dollar tomorrow is not worth as much as one today, so given the greater uncertainty associated with cash flows in the future they need to be discounted. The discount rate is the rate at which they are handicapped given the many risks that can prevent future cash flows from materializing. High discount rates are bad for high P/E stocks and good for Pension Funds (as their liabilities in the future lose net present value.)

Source: Corporate Finance Institute

- The second piece of crucial information is an estimate of the cash flows for a given forecast period. Let’s take for instance the many investments large Technology companies make in the future. They may have investments in everything from the Metaverse to Autonomous Driving to Quantum Computing. These projects may, or may not, succeed in being accretive to shareholders. However, for our purposes we need to handicap those odds as best we can in the present to estimate the cash flows over the period covered by the model.

Source: Prepnuggets.com

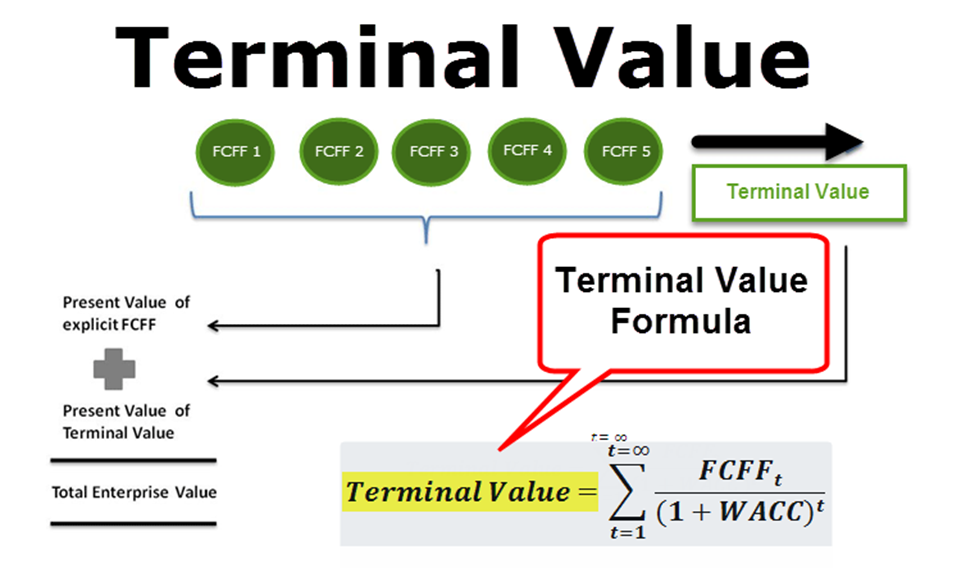

- The third piece of crucial information is called Terminal Value. This is a very important concept to understand and estimating this somewhat accurately is crucial to a successful DCF model evaluation of a company’s value. The forecast period is usually 3-5 years and it is easier to get a somewhat accurate level of cashflows based on historical data and proactive forecasting. However, after the forecast period you need a constant rate of growth you believe the company can maintain to complete a DCF model. Determining terminal value correctly is incredibly important because it can often end up comprising a significant portion of net present value. The perpetual growth method is used in academic assessments of value whereas the exit multiple method is more generally used by industry practitioners because they like having real-life observed transactions to anchor their analytical methods against. Real transactions involving comparable companies serve as the basis for the exit multiple method.

Source: WallStreetMojo.com

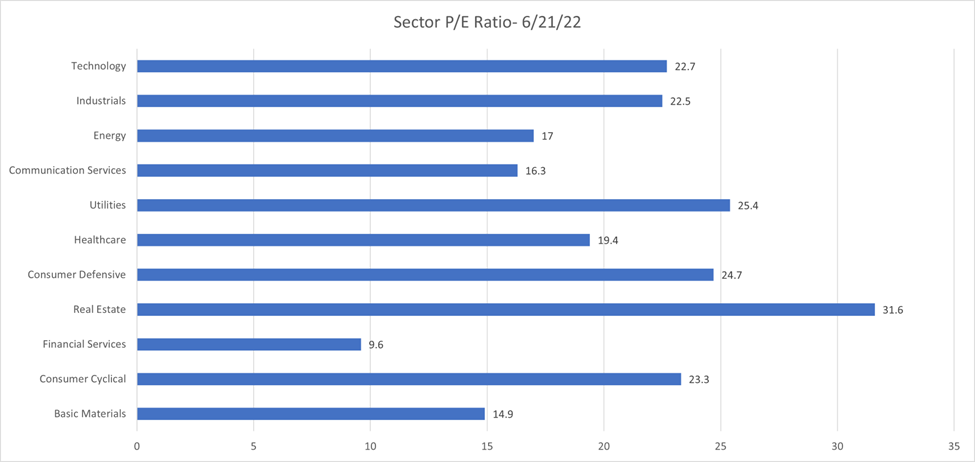

The DCF model is one of the most important things to understand in how equities are valued. It is a way of valuing not only the companies current cashflows and earnings potential, but even more importantly it is a way of valuing expected future cash flows simultaneously into one number. One of the most common metrics when evaluating a stock is crucial to understanding the DCF valuation. The Price-to-Equity Ratio(P/E ratio) will give you an idea of just how much of a company’s current valuation is reliant on potential future earnings versus actual earnings in the most recent filing.

The higher a company’s P/E ratio, the higher the proportion of net present value comprised of potential future earnings. Why is this important? Well, some of the best performing stocks in the past decades have been stocks with high P/E ratios. Technology stocks tend to have higher P/E ratios then Energy stocks or Financial stocks for instance. That is because the market sees their future earnings as more reliable than the other two sectors. Importantly they also have the potential for growth rates far above the long-term average GDP growth. Hence the title “Growth Stocks.” Remember though, a growth stock doesn’t have to be a technology company, it just has to have higher rates of growth than the wider economy,

Source: Gurufocus.com

Related Guides

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInflation – What’s All the Fuss About?

A multi-part series about inflation and its impact on stock investors.

-

Series of 6~12 minutesLast updated3 years ago

Series of 6~12 minutesLast updated3 years agoIntroduction to Hedging

In this guide, we will cover the basics of hedging, what is hedging and what is the user for it.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?

-

Series of 5~21 minutesLast updated3 years ago

Series of 5~21 minutesLast updated3 years agoThe VIX Series

What is the VIX? What does it indicate? How can I use it to improve my strategies?