-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 5

Confidence Drives Markets: Confidence Changes Faster Than Fundamentals

“Whenever we’re looking at something and how it affects markets, it’s not necessarily how fundamentals will change. It’s the confidence about those fundamentals. That’s why sometimes you see the market go a little crazy.” -Tom Lee

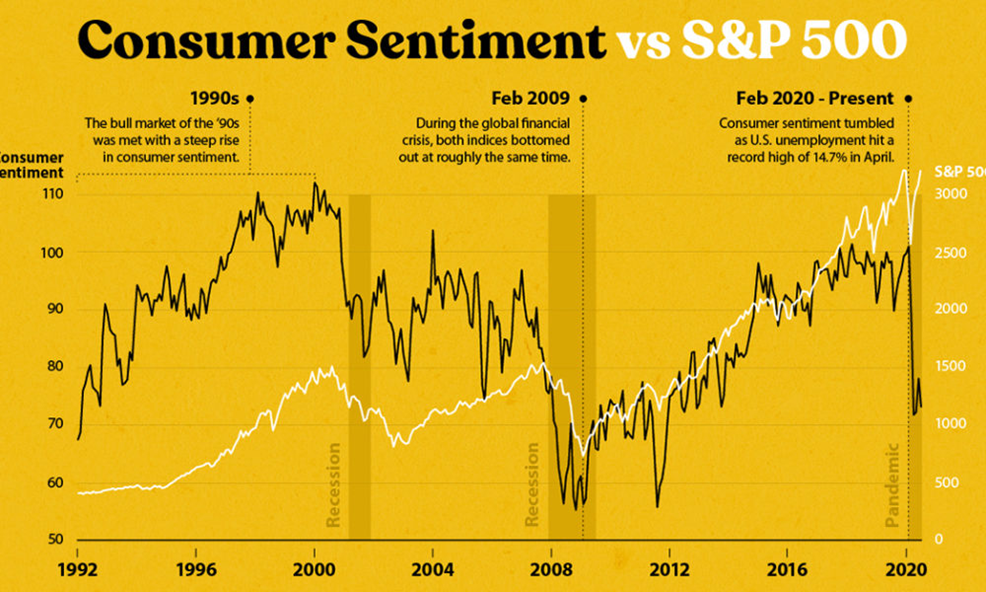

The stock market and consumer sentiment usually rise and fall in tandem. As consumers and investors become more optimistic about the state of the economy and their personal financial circumstances, stocks tend to rise. Similarly, when they become less confident about the economy, stocks usually fall. It’s often that simple, especially in the short run. Confidence detects market direction.

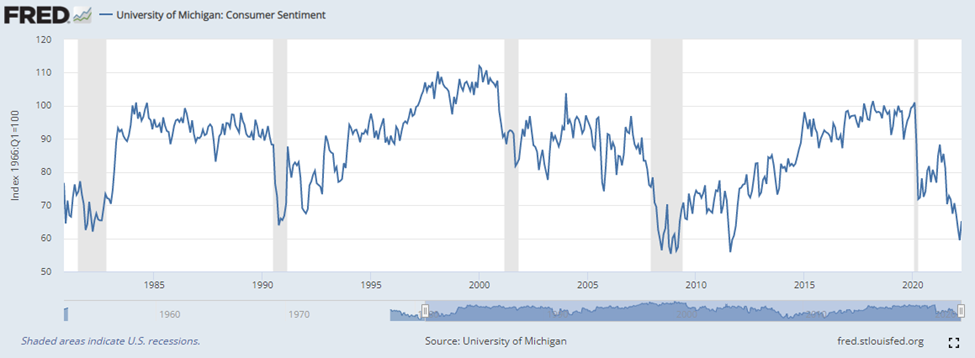

When consumers are confident in the future, they spend money and drive economic growth higher. When they aren’t confident, they save more than they spend, which restricts economic growth. Consumer confidence indices can be used as leading indicators for a broad economic turnaround. It can also be used to gauge the effectiveness of monetary policy, stimulus, or other measures. The University of Michigan Consumer Index is one of the chief sources investors often use to assess the consumer’s temperature.

As you can see, drops in consumer confidence have been a key feature of recessions (highlighted in grey) over the past 40 years. At its core, consumer confidence is particularly important in that consumer spending is arguably the most vital component of the economy. There are other important measures of consumer confidence as well. The Consumer Confidence Index (CCI), and the Consumer Sentiment Index, are both based on a household survey and reported monthly. The CCI is one of the more accurate and closely watched economic indicators, based on a survey of five questions posed to 5,000 households, measuring their optimism on the economy’s health. But it’s widely viewed as a lagging indicator that tells us what has happened – not what will happen.

What result does increasing consumer confidence have on markets? Manufacturers increase production. Banks extend more credit. Real estate markets usually benefit from an increase in home sales.

What determines consumer confidence? The state of the economy, headlines, changes in house prices, unemployment rates, and inflation all factor. Falling home prices, for example, erode consumer confidence. Increased unemployment rates also negatively affect consumers’ confidence. Inflation is an indicator of too much growth, and the rise in prices can reduce consumers’ purchasing power and confidence.

In 2020 and 2021, investor confidence soared as the Federal Reserve stepped in with economic stimulus. Combined with the re-opening of the economy following the COVID-19 shutdowns, consumers grew increasingly optimistic, and the stock market posted strong returns in both 2020 and 2021. In the spring of 2022, however, sentiment dropped sharply, mostly on concern of the Federal Reserve’s desire to increase interest rates to curb inflation, as well as the Ukraine war.

But generally, the loss of confidence isn’t necessarily an ominous sign for stocks. When confidence in the market drops sharply over three months, the S&P 500 rises more than 20% over the next year. Thus, negative sentiment is often a reliable contrarian signal over time. This worked inversely last fall when markets hit all-time highs. Just as sentiment and confidence had soared, it was time to become less optimistic on markets. Conversely, when sentiment reaches abysmal historical lows, it might be a sign that brighter days for markets are ahead. Of course, these are just some of many indicators that must be used successfully with other vital pieces of data.

-

Nothing New Under The Sun- Importance of Looking at Cycles

-

Equities Are Junior in The Capital Structure- Bonds Lead Stocks

-

Don't Shout At The Market- It Doesn’t Care About You (Or Any One’s) Opinion

-

Don’t Carry The Lehman Hammer- Avoid Cognitive Bias

-

Confidence Drives Markets: Confidence Changes Faster Than Fundamentals

-

Demographics Are Destiny

-

Don't Fight the Fed: The Fed is The Most Powerful Entity in the Financial World

Related Guides

-

Series of 3~5 minutesLast updated4 weeks ago

Series of 3~5 minutesLast updated4 weeks agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated1 month ago

Series of 2~4 minutesLast updated1 month agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated4 months ago

Series of 3~6 minutesLast updated4 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated10 months ago

Series of 3~9 minutesLast updated10 months agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis

-

Series of 4~10 minutesLast updated2 years ago

Series of 4~10 minutesLast updated2 years agoCommodities 100

An introduction to commodities for novice investors.