-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 3

Don't Shout At The Market- It Doesn’t Care About You (Or Any One’s) Opinion

“The only one wiser than anyone is everyone.” -Napoleon Bonaparte

“We think it’s important to not shout at the market. What that means is the market does not care about my opinion. It doesn’t care about anybody’s opinion. You have to reverse how you look at the market, and you have to look at what the market is telling you, not what you think the market should be doing.” – Tom Lee

It’s important to remember that the collective wisdom of markets is greater than the wisdom of any one participant. Even though Napoleon is not typically associated with humility, he was wise enough to articulate this general principle. Our Tom Lee sticks to it through bull and bear markets alike.

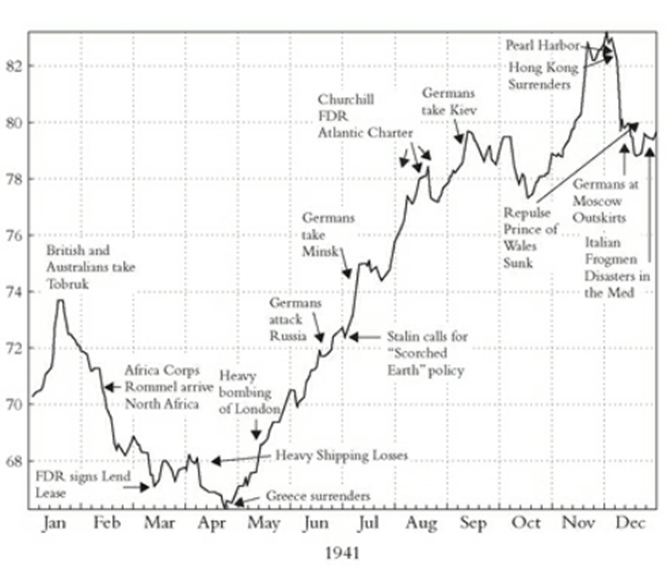

One human’s opinion is subject to bias, error and miscalculation. The beauty of markets is that it benefits from collective human wisdom. We believe that the ‘wisdom of the crowd’ embodied by Democracy is very similar to the reason the market gets right so often what many ‘experts’ get wrong. However, like a crowd the market is prone to be capricious and if it turns on you it’s not pretty. During Britain’s darkest hour, the experts were saying she didn’t have a shot against the Third Reich. The market said something different. It saw through the fog of the present.

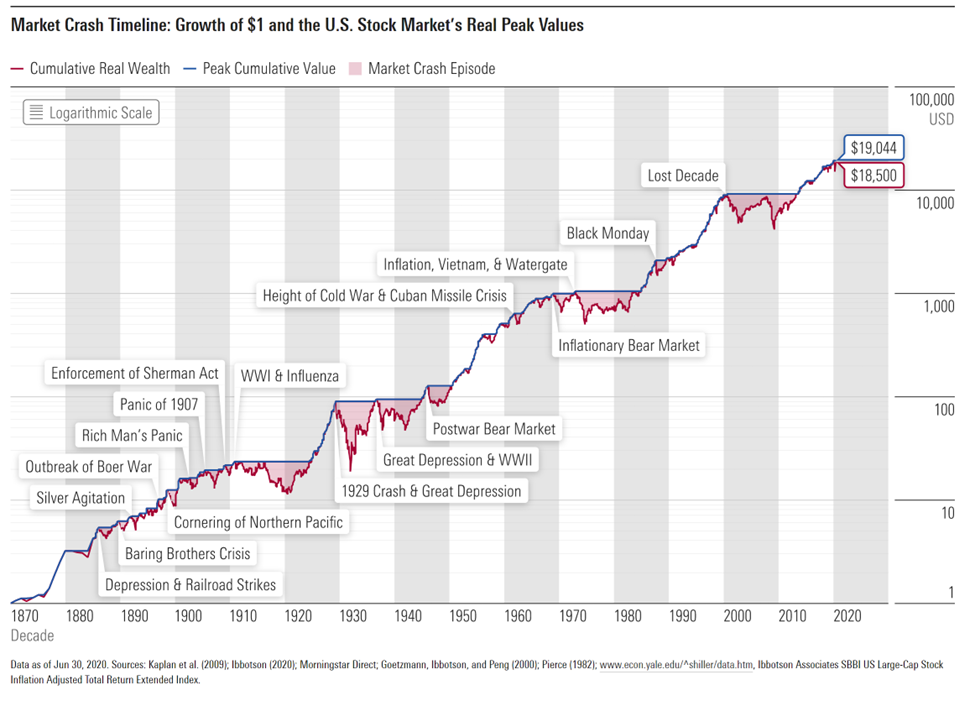

Most of the time, by a long shot, the market is more affected by endogenous economic cycles rather than exogenous economic shocks. The almighty ask and bid are the language of the market. Collapses happen when there are no more buyers, regardless of the reason. Most investors do most of their planning based on these more predictable events; these cycles are perennial, while each shock is unique. In some of the most trying circumstances in modern human history, stock markets went up when all common logic and experience would suggest otherwise, even in the face of the sky falling.

The difference can be illustrated quite easily. Regular endogenous economic cycles of boom and bust are driven by FOMO and the wealth management industry’s tendency to pile into ‘crowded’ trades (that we can help you avoid) until they cause a correction that is usually greatly amplified by investors being over-leveraged and unable to meet their commitments. The result is the thing that causes prices to go lower than any war, plague, or catastrophe so far: forced liquidation.

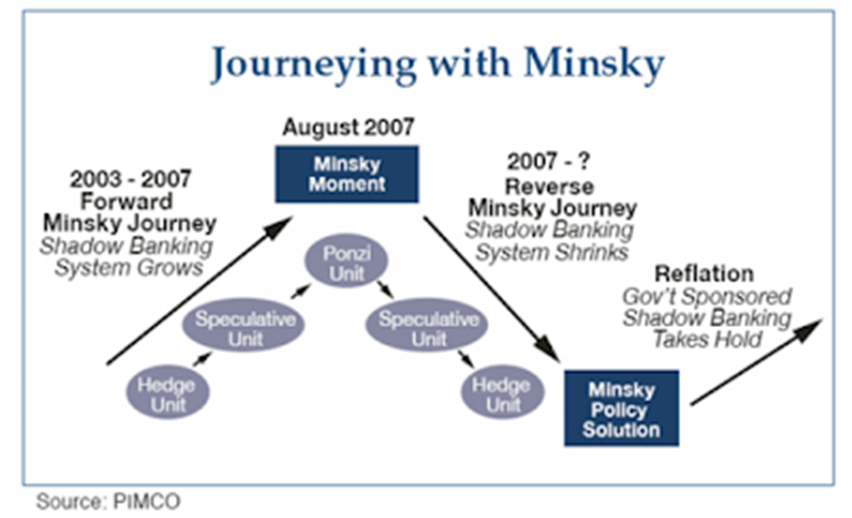

Hyman Minsky’s famous Financial Instability Hypothesis is an economic model that explains booms and busts within the context of internal dynamics unique to capitalist economies, perhaps the quintessential description of the herd behavior and mania that bears love to focus on. Prices go down mostly because of the irresponsible accumulation of private debt in Minsky’s model, and this seems unbeknownst to many bears apparently, even though it is a prerequisite for their grim conclusions coming true.

For the type of downward price movements to occur that ‘bubble-spotters’ and ‘perma-bears’ love to foretell markets need to be over-leveraged, and a significant proportion of market participants need to meet the definition of a ‘Ponzi borrower’ thus resulting in forced liquidation that drives all correlations towards one. Factoring into the last rule as well, we are encouraged by the immense strength in credit markets even at the high-yield end of the spectrum. Stocks follow bonds. Usually this would not be the case on the eve of a bear market.

The Global Financial Crisis is a good fit for demonstrating what happens in Minsky’s model because of an endogenous shock. An astute analysis by Economist Paul McCulley described how Minsky’s theory was expressed perfectly by the subprime mortgage crisis; with the hedge borrower being represented by those holding traditional mortgages, the speculative borrower holding interest-only loans, and the panic borrowers holding loans with negative amortization features.

Since World War II, aside from perhaps actions of OPEC in the 70s (although this is debatable), there does not seem to be an exogenous shock that has affected markets so significantly as the Coronavirus.

This is part of the reason why our Data Science team headed by Tireless Ken has maintained such a meticulous and sophisticated monitoring process. Pandemics are a particularly nasty exogenous threat since they can lead to wholesale shutdowns of economic activity and rapacious levels fear. Of course, they also can lead to millions of deaths as we’ve all sadly become too aware. Our First Word publication is so accurate and valuable that some notable businesses use it to make production and inventory decisions. We can safely say we are among the most data-driven when assessing COVID’s impact on markets.

The peculiar way markets price exogenous events is perplexing, and it doesn’t comport with our typical human logic of what will be ‘bad’ for the economy and what will not. Otherwise, the realistic prospect of nuclear apocalypse surely should have caused a more significant drop than the inexplicable ‘flash crash,’ right? Nope. Listen to Professor Price, don’t lecture him.

A great way to observe unbiased observations of markets is through Quant models as they are referred to on the street. Check out our Factor Investing Strategy and what it says about markets from Our Head of Quantitative Strategy, Adam Gould. You may also be interested in his recent note Rise of the Stock Pickers.

-

Nothing New Under The Sun- Importance of Looking at Cycles

-

Equities Are Junior in The Capital Structure- Bonds Lead Stocks

-

Don't Shout At The Market- It Doesn’t Care About You (Or Any One’s) Opinion

-

Don’t Carry The Lehman Hammer- Avoid Cognitive Bias

-

Confidence Drives Markets: Confidence Changes Faster Than Fundamentals

-

Demographics Are Destiny

-

Don't Fight the Fed: The Fed is The Most Powerful Entity in the Financial World

Related Guides

-

Series of 3~5 minutesLast updated2 months ago

Series of 3~5 minutesLast updated2 months agoKeep Calm and Carry on Investing

A guide to managing your emotions during market downturns.

-

Series of 2~4 minutesLast updated2 months ago

Series of 2~4 minutesLast updated2 months agoFS Insight Decoded

An ad-hoc series that explains sayings frequently used by members of the FS Insight research team

-

Series of 3~6 minutesLast updated5 months ago

Series of 3~6 minutesLast updated5 months agoYour Price Target Is Likely Going to be Wrong. Here’s Why You Should Set One Anyway.

Price Targets

-

Series of 3~9 minutesLast updated1 year ago

Series of 3~9 minutesLast updated1 year agoTechnically Speaking – The FS Insight Primer on Technical Analysis

Three-part series on technical analysis