-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 3

Inflation: Causes and Responses

Now that we know why inflation matters to investors and policymakers, and we know how it is measured, it is time to turn our attention to the meat of the issue: What causes inflation, and what can be done about it when it is not at optimal levels?

What causes high inflation?

To begin, it is important to realize that an economy is a complex system with literally millions of moving parts. Changes to such large, complex systems are generally the result of multiple developments, rather than any single factor working in isolation. Sometimes those trends are linked and simultaneous, but often, they are separate and sequential. It might be easier to study a few famous cases of high inflation to illustrate how that works, and this begins with the most recent wave of global inflation.

As we do so, recall that inflation refers to a period of sustained price increases across multiple categories of goods and services. As any Econ 101 student knows, price is a function of supply and demand. Price rises when supply and demand are not in balance – when demand is too high or supply is too low. Inflation rises in response to conditions in which overall demand or supply remain out of balance for a sustained period of time.

Two examples from the 1970s

The 1973 oil embargo helped to spark two of the most serious examples of sustained inflation in modern history. Imposed by OPEC on allies of Israel during the 1973 Arab-Israeli War (aka the Yom Kippur War), the embargo seriously restricted oil supply, thus causing a spike in not just oil, but in the price of all goods and services that rely on oil. This, in turn, triggered a surge in inflation – first on target countries such as the United States, and then indirectly in many countries in Latin America.

In the United States, the oil embargo caused a spike in costs for many sectors and for millions of households. Yet other factors arguably played as big a role in causing the decade-long “Great Inflation” crisis. Among the other factors were the currency devaluation after the collapse of the post-World War II Bretton Woods agreement, fiscal policies that encouraged cheap-and-easy money to combat unemployment, promote growth, and fund the U.S. involvement in the Vietnam War, and a massive crop failure in the Soviet Union that sent global grain prices soaring.

The embargo had originally targeted Israeli allies like the U.S., but the spike in prices for the essential and globally traded commodity came to trigger an even longer inflationary crisis in a number of Latin American countries, among them Brazil, Argentina, and Mexico. Many of the same factors that caused U.S. Great Inflation were at play in Latin America – loose monetary policy, currency devaluation, and a spike in global food prices. Howeer, Latin American countries also had to contend with the effects of extensive inflation indexation mechanisms, political instability, and significant deficits in their respective balances of payments with other countries.

Present-day inflation

At the time of this writing, the most recent case of sustained inflation began mid 2021. As with the previous cases, multiple factors combined to cause this inflation, most related to the global COVID-19 pandemic. During the pandemic,non-essential businesses were shut down. This suspended production in a wide range of goods and services. Many of those employed in some of these sectors were laid off.

Simultaneously, governments imposed lockdown-type policies, requiring most people to stay at home and avoid public places except when absolutely necessary. As consumer spending plunged, consumers found themselves saving at an elevated rate. Aggregate savings levels were also boosted by financial assistance that authorities provided to those whose livelihoods were affected by the lockdowns.

As a result, as the pandemic came to a close and the economy re-opened, economies saw constrained supplies across a broad range of products and services. At the same time, people released from lockdown restrictions found themselves in a relatively strong financial situation, thanks to months of (forced) elevated savings and the aforementioned government assistance. They were thus able to both engage in “revenge spending” – seeking to make up for lost time – and postpone their return to work (or, in the case of older American workers, retire altogether.)

This imbalance was further exacerbated by Russia’s invasion of Ukraine, which caused energy prices to spike, further raising intermediate costs for producers.

The commonalities

These three major instances of sustained inflation have several commonalities. They include:

- A supply-shock trigger. In the 1970s, OPEC oil embargos and a wheat-crop failure in the Soviet Union combined to act has supply-side shocks that pushed up costs across multiple sectors. Similarly, the latest inflation battle began with supply-side shocks from a global pandemic, along with energy- and food-related shocks triggered by the Russian invasion of Ukraine.

- Easy fiscal and monetary policy. In the 1970s, both U.S. and Latin American governments used deficit spending and stimulus in their efforts to stave off unemployment. They also kept interest rates low in order to encourage economic growth. More recently, governments similarly provided stimulus to assist those financially impacted by the pandemic lockdown while keeping interest rates low. Each of these had the effect of pushing up demand.

- Tight labor markets. The recent wave of inflation was partly propelled by tight labor markets. Many older workers decided to simply retire after the pandemic rather than return to the workforce, and younger workers were able to delay their return due to a period of enforced, elevated savings and government assistance. Similarly, the late 1960s were marked by low unemployment rates, which tightened labor supply and gave unions enough bargaining power to successfully demand indexation clauses (automatic pay raises in response to inflation) in labor contracts. In all three cases, this helped to spark a wage-price spiral (see below).

Responding to inflation

Policymakers have typically found that bringing high inflation back under control to be a challenge. The economists and officials at the Federal Reserve learned some hard lessons from the Great Inflation of the 1970s.

One such lesson was that the Federal Reserve must communicate clearly to set policy and inflation expectations. Although the Fed has a number of tools to influence the economy, one of the most powerful are its words. Through press statements, speeches, and guidance about policy plans and their views on various aspects of the economy, the Fed can sometimes exert influence without making concrete moves.

But a failure to exert this policy – or exert it properly can have damaging effects. The Federal Reserve’s language in the late 1960s and early 1970s suggested that it was willing to tolerate higher inflation rates in the service of economic growth and low unemployment. Even when inflation began to surge, the Federal Reserve did not adequately communicate a strong commitment to addressing the inflation problem. This helped solidify inflation expectations, setting off a wage-price spiral. Inflation presents a serious challenge to policy makers because it tends to cause what is known as a wage-price spiral. (A wage-price spiral occurs when high inflation expectations become widespread enough to tilt aggregate behavior toward purchasing more today to avoid higher prices tomorrow. This creates a self-fulfilling prophecy in which demand and prices surge; businesses ramp up hiring, tightening labor markets and boosting wages; and consumers use their higher earnings to buy more.)

During the Great Inflation, this spiral that did not end until Paul Volcker took over as Fed Chair and – among other things – clearly communicated that bringing inflation back under control was so important that the Fed was willing to cause a recession to do so.

What else the Federal Reserve can do

Managing inflation and monetary policy in general remains difficult, in large part because it takes time to see the effect of any policy changes on the economy. Nobel Laureate Milton Friedman famously coined the “fool in the shower” analogy to describe this challenge, likening it to trying to get the water in the shower just right. As you have probably experienced, when the water in the shower is too cold, it is natural to turn up the hot water. However, because it takes time for the hot water to arrive and warm up the shower temperature, most people tend to overadjust – eventually scalding themselves. Similarly, policymakers are wont to overadjust in response to inflation, often overshooting and causing unwanted effects.

The Federal Reserve’s response to inflation generally involves actions to cool down growth. The challenge lies in acting strongly enough to bring inflation under control, but not cooling down growth to the point of tipping the economy into recession.

These can include:

- Rate hikes. As investors know, the Fed sets a target range for the Fed funds rate. Officially, this is the interest rate banks charge each other for overnight lending to meet reserve requirements, but it generally has the effect of raising short-term interest rates – making borrowing more expensive. This tends to slow spending and growth. Interestingly, there was a time when the Fed did not disclose its target range. Instead, it would set this range internally and achieve its objective through …

- Open market operations. The Fed buys and sells U.S. Treasuries on the open market. When faced with high inflation, the Fed can seek to cool growth by selling Treasuries, effectively putting upward pressure on interest rates. (Conversely, buying Treasuries can inject money into the economy, lower rates, and stimulate growth.)

- Reserve requirements. The Fed can also raise banks’ reserve requirements. This results in banks having less money to lend, thus weighing on growth and slowing spending.

Although the Fed’s effect on the stock market can be profoundly complex, Fundstrat Head of Research Tom Lee always tells investors, “Don’t fight the Fed,” referring to the Fed as the most powerful entity in the world. Stocks aggregately tend to rise in response to any Fed action seen as stimulating growth, and to fall whenever the Fed takes action to chill the economy and control inflation.

Related Guides

-

Series of 3~11 minutesLast updated3 years ago

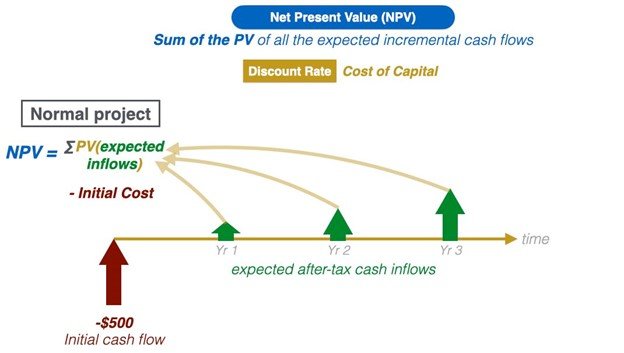

Series of 3~11 minutesLast updated3 years agoUnderstanding Net Present Value and The Basics of Discounted Cash Flow Models (DCF)

Acquaint yourself with the basics of net present value and discounted cash flow (DCF) models.

-

Series of 6~12 minutesLast updated3 years ago

Series of 6~12 minutesLast updated3 years agoIntroduction to Hedging

In this guide, we will cover the basics of hedging, what is hedging and what is the user for it.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?

-

Series of 5~21 minutesLast updated3 years ago

Series of 5~21 minutesLast updated3 years agoThe VIX Series

What is the VIX? What does it indicate? How can I use it to improve my strategies?