-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 5

How To Read The Fear Gauge: VIX Value and How It's Calculated

CBOE VIX trading and CBOE VIX options can be incredibly difficult. Technically, the VIX should represent one standard deviation of market returns for whatever period an index is calculating. The main VIX calculates 30 calendar days of implied volatility and interpolates options between 23 days and 37 days to expiry (remember not how it’s settled!). The spot price of the VIX is calculated on a minute to minute basis to keep up with the fast-paced markets. The CBOE Volatility Index is not an ETF, and it cannot be bought and sold, only futures and options contracts that derive their value from its price and time to expiry can be purchased. The index value acts as price mechanism, so if your strike price is $15 and the VIX is at $20 then your option’s intrinsic value would be $5. Of course, in a real situation the intrinsic value would be supplemented by time value, the longer until expiry, the higher the time value.

Since the index is made of options instead of stocks, which makes things a little bit different, similarly to other indexes, options, not commodities, are selected by rules to make up the wider index. The actual components of the VIX are the near and next-term SPX options. In fact, because of how the VIX needs to roll-over based on its rules the number of options used to calculate the VIX may change from day to day or even minute to minute, particularly since traders can game it a little bit by bidding zero on a strike price and therefore getting excluded from the index at that moment since zero bid/asks are not able to be used in the formula.

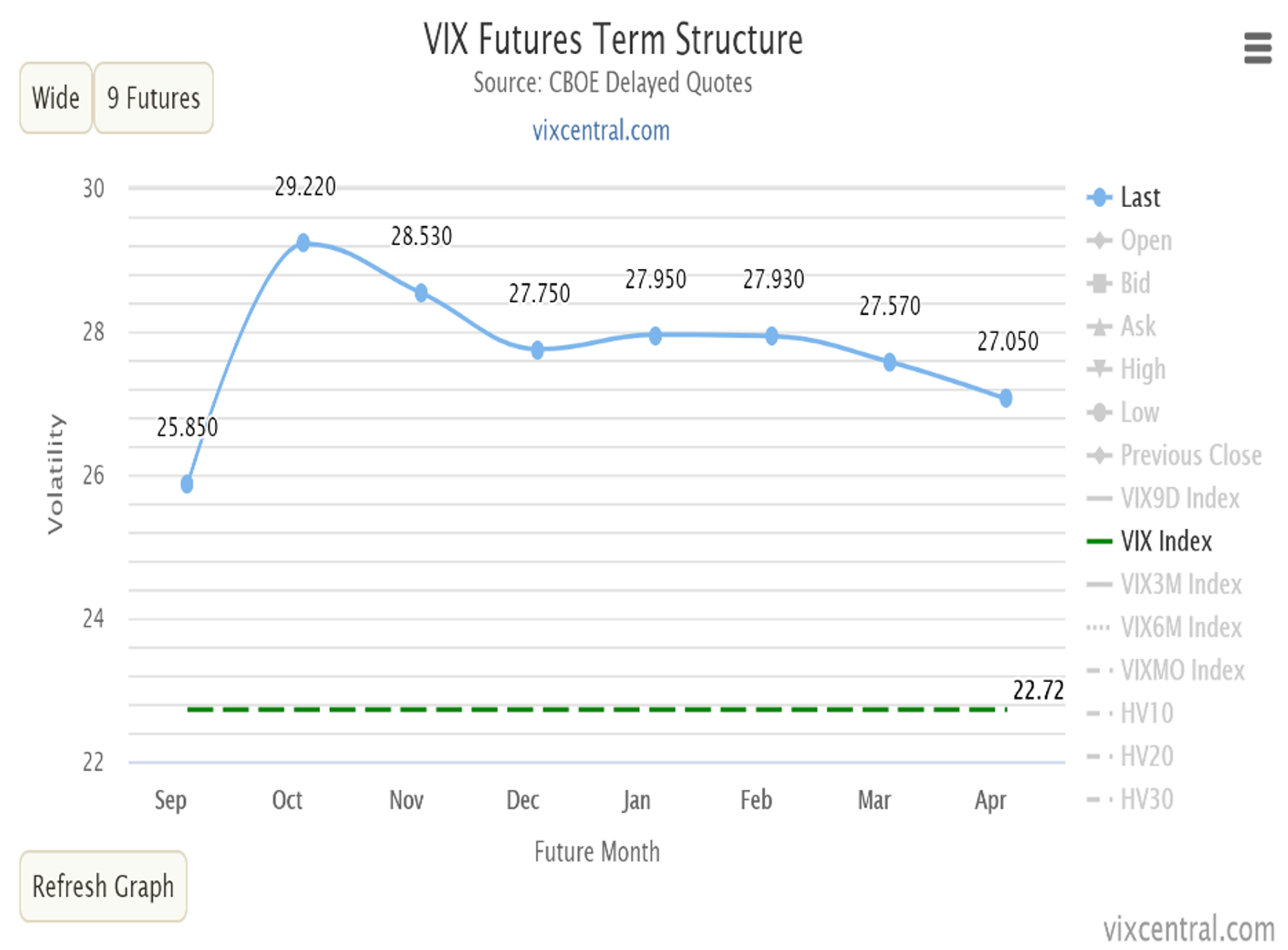

Volatility Term Structure: Getting Signals From CBOE VIX

There are robust futures markets for the VIX. Futures contracts create curves similar to interest rate curves (think T-cure) which can tell us quite a lot about anticipated index value. CBOE VIX trading can only be done with either futures or options, but are settled in cash at an agreed-upon reading of the index. The properties of these markets can tell us a lot about how markets perceive the future, particularly in the event of an ongoing disaster. For instance, during the panicked selling in March when the VIX reached highs its curve was in backwardation which happens rarely in times of great tumult. What this literally means is that the market is expecting more volatility in the short-term, than in the long-term.

One CBOE VIX trading strategy is to sell call options on the index when it is anomalously high. Any time the VIX is in backwardation, based on historical data, it will likely correct back to contango. Many engaged in CBOE VIX trading will use this strategy.

This means that the market expects more volatility in the near term than the short-term. If you picture a curve of VIX futures going out into the future like an interest rate curve, that is how the term structure usually is shaped; in contango. This means the market, as would be generally the case, would expect more volatility as time goes on. Since the rise in stock prices further out maturities like Dec 20 and Jan 21 have started to normalize, but the VIX curve still shows potential for elevated risk around the election, which is also normal. When the VIX goes into full and normalized contango again, it will be a very positive sign for markets. Generally, when $VIX.X goes below $20 it is also considered a bullish market indicator.

Stock returns have been observed over time to negatively correlated with realized volatility and positively correlated with implied volatility. One thing you can do is get into the weeds and calculate a volatility index of some of your favorite stocks and then compare the volatility term structures to see how they diverge and how they are similar. There are also many new ETFs and ETNs that own primarily, or partially a lot of volatility assets.

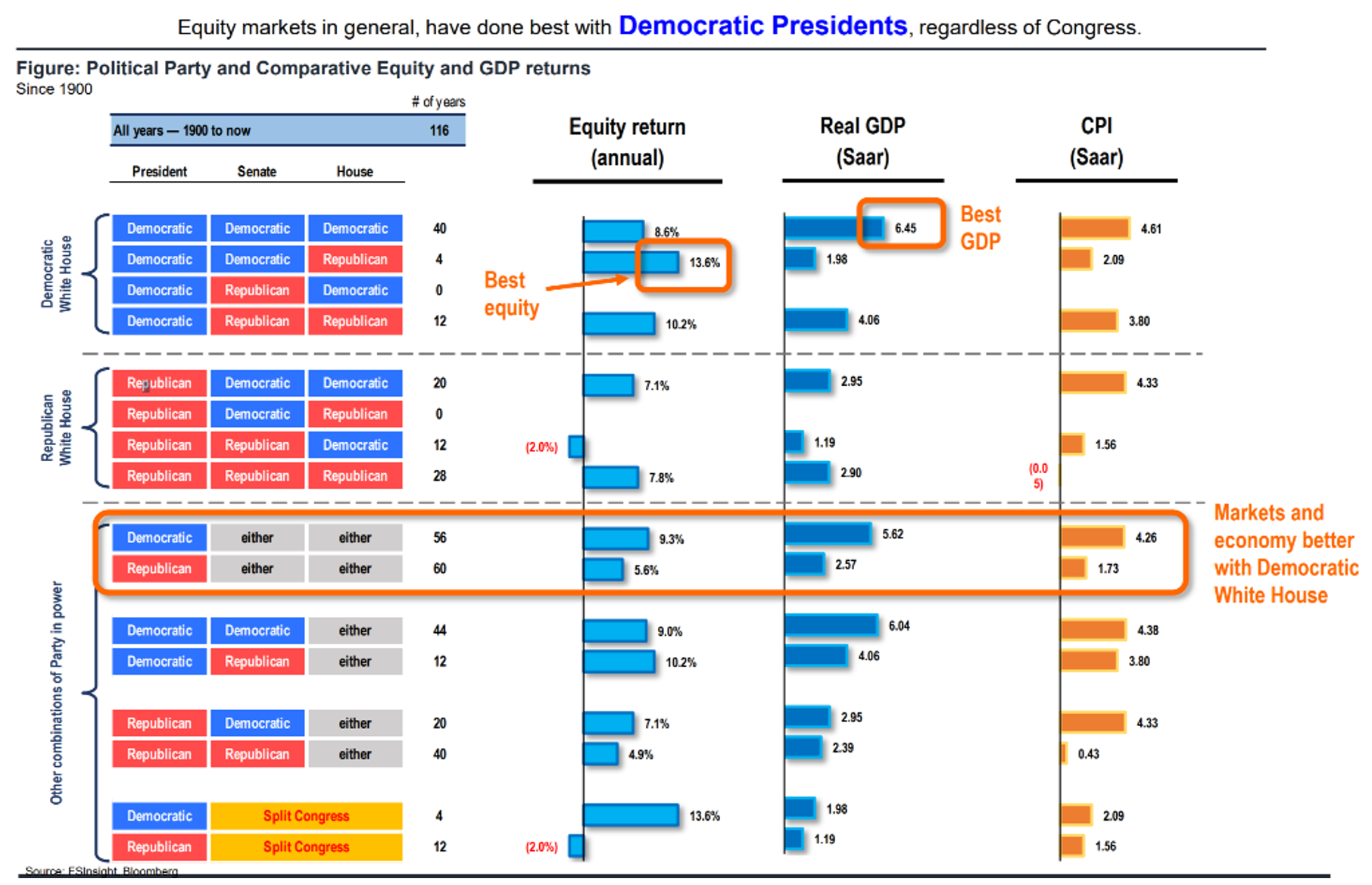

As you can see above, the VIX term structure has normalized but still has some elevated readings around the time of the election. Our Washington Analyst, L. Thomas Block, has provided some excellent analysis on what happens to the stock market during elections. We rely on him for assessing headlines with the benefit of a seasoned political operator. Based on our analysis, we don’t really get the glum sentiment on the street around the election.

Other Volatility Indices

The Chicago Board Options Exchange calculates several volatility indices and the VIX and the old VIX (VXO). They also calculate Cboe Short-Term Volatility Index (VIX9D) or nine-day expected volatility, it has the (VIX3M), (VIX6M) and (VIX1YR) which reflect the three month, six month and one-year volatility respectively.

You can find more on the VIX and the white paper on valuation at www.cboe.com

Related Guides

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInflation – What’s All the Fuss About?

A multi-part series about inflation and its impact on stock investors.

-

Series of 3~11 minutesLast updated3 years ago

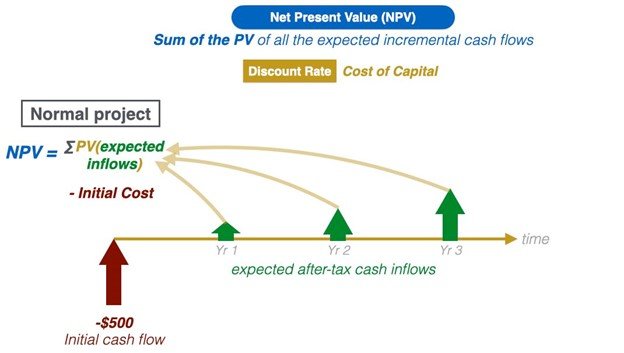

Series of 3~11 minutesLast updated3 years agoUnderstanding Net Present Value and The Basics of Discounted Cash Flow Models (DCF)

Acquaint yourself with the basics of net present value and discounted cash flow (DCF) models.

-

Series of 6~12 minutesLast updated3 years ago

Series of 6~12 minutesLast updated3 years agoIntroduction to Hedging

In this guide, we will cover the basics of hedging, what is hedging and what is the user for it.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?