-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 2

Can I Hedge Like a Hedge Fund Does?

Hedge funds have come to gain a cultural meaning. They’ve become associated with complex jargon and strategies, and many people may think of them as out of reach. However, many of the tools they use are now available to individuals.

The word has developed a meaning of its own. Still, at the end of the day, much of what they do in terms of managing and hedging risk and taking advantage of leverage is based a lot more on common-sense thinking than you might imagine based on the intimidating language and concepts that can often permeate discussions about these entities.

After the Global Financial Crisis, the image of the industry suffered. Occupy Wall Street and other political currents seemed to gather against Wall Street, and a once-in-generation regulatory overhaul was passed in response. If you pay attention only to the superficial narrative, you may have missed another reality; many tools such as leverage and derivatives that were once only the purview of institutions have been dramatically democratized.

The retail investor is empowered and has a broader suite of tools to define and manage risk than they have at any other time in history. Behind the evil bank, the narrative is a rapidly shifting landscape that tends to favor the empowerment of the retail investor. We believe this is being augmented by demographic currents and a general change from focusing on wealth preservation to wealth generation.

To understand what a lot of risk management and hedging is all about, let’s dive a little deeper into that metaphor. Black swans are rare; you don’t usually see them compared to white swans. Sort of like we hadn’t seen a major global pandemic since the end of the First World War.

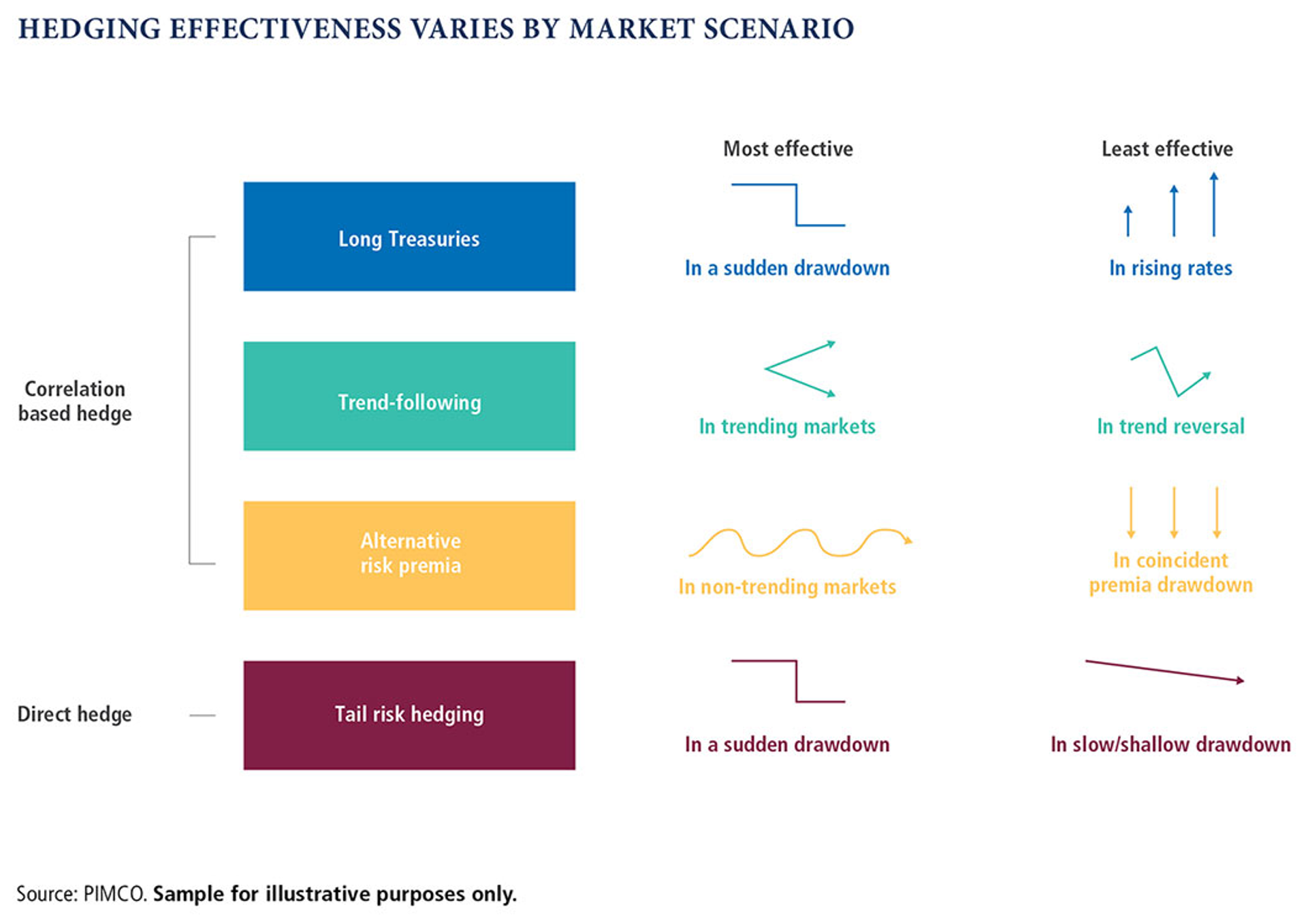

Or sort of like we had never imagined the level of financial contagion that could permeate the economy after the widespread adoption of asset-backed securities. One helpful distinction in the world of hedging is direct hedges versus cross-asset or correlation-based hedges. The chart below illustrates generally useful scenarios for the use of both categories of instruments.

Unfortunately, there is a lot of superficial and misinformed discussion about risk mitigation in finance, given the complexity and mathematics involved. Many new retail investors are using derivatives to amplify their risk and potential returns; however, the powerful financial instruments of derivatives have become the most effective, while also fraught with peril, ways to effectively hedge and mitigate risks. Using leverage enables people to hedge with fewer funds and to protect themselves against volatility.

Even the safest of investments can surprise even the most seasoned analysts. The debt ceiling debate is a perfect example. Is the full faith and credit of the United States Government actually in jeopardy right now?

No, it’s not, but risks we couldn’t have necessarily envisioned years ago now create a tremendous amount of risk, and there is greater than a minuscule chance that some people who purchased what they thought was the safest asset in the world are in for a rude awakening. This is why mitigating, understanding, and, if possible, hedging your risk enables you to invest with more confidence and success.

Related Guides

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInflation – What’s All the Fuss About?

A multi-part series about inflation and its impact on stock investors.

-

Series of 3~11 minutesLast updated3 years ago

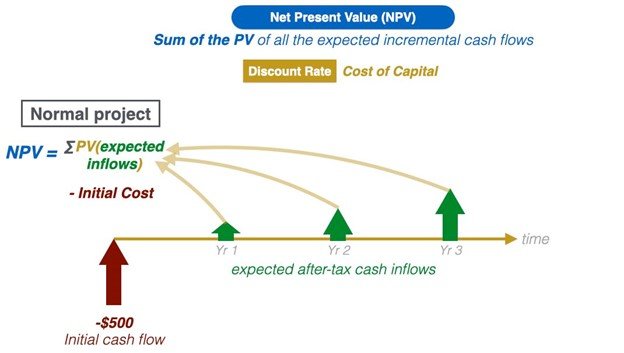

Series of 3~11 minutesLast updated3 years agoUnderstanding Net Present Value and The Basics of Discounted Cash Flow Models (DCF)

Acquaint yourself with the basics of net present value and discounted cash flow (DCF) models.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?

-

Series of 5~21 minutesLast updated3 years ago

Series of 5~21 minutesLast updated3 years agoThe VIX Series

What is the VIX? What does it indicate? How can I use it to improve my strategies?