-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

All ResearchFSI Pro FSI Macro

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

All ResearchFSI Pro FSI Macro

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

-

Markets WrappedFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

- Archive

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Market UpdateFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

Hardika Singh

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Fundstrat Large-Cap Core List

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Fundstrat SMID-Cap Core List

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Equities Portfolio

-

StrategyFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

Part 2

Can I Hedge Like a Hedge Fund Does?

Hedge funds have come to gain a cultural meaning. They've become associated with complex jargon and strategies, and many people may think of them as out of reach. However, many of the tools they use are now available to individuals.

The word has developed a meaning of its own. Still, at the end of the day, much of what they do in terms of managing and hedging risk and taking advantage of leverage is based a lot more on common-sense thinking than you might imagine based on the intimidating la...Unlock This Free Guide from Tom Lee’s FSI Academy

Enter your email to read this guide

In addition to your unlocked guide, you will receive our weekly market newsletter FSI Snapshot, as well as occasional updates and offers. You can unsubscribe at any time. For more information, see our privacy policy.

Related Guides

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInflation – What’s All the Fuss About?

A multi-part series about inflation and its impact on stock investors.

-

Series of 3~11 minutesLast updated3 years ago

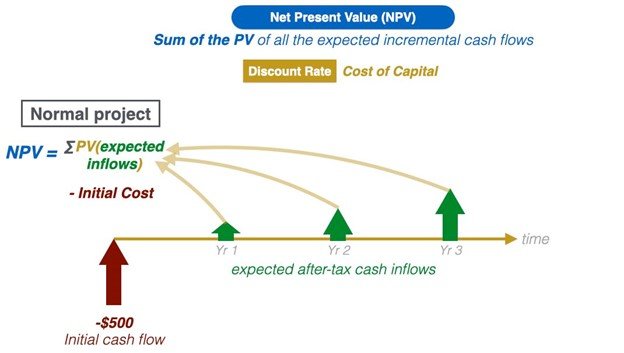

Series of 3~11 minutesLast updated3 years agoUnderstanding Net Present Value and The Basics of Discounted Cash Flow Models (DCF)

Acquaint yourself with the basics of net present value and discounted cash flow (DCF) models.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?

-

Series of 5~21 minutesLast updated3 years ago

Series of 5~21 minutesLast updated3 years agoThe VIX Series

What is the VIX? What does it indicate? How can I use it to improve my strategies?