______________________________________________________________

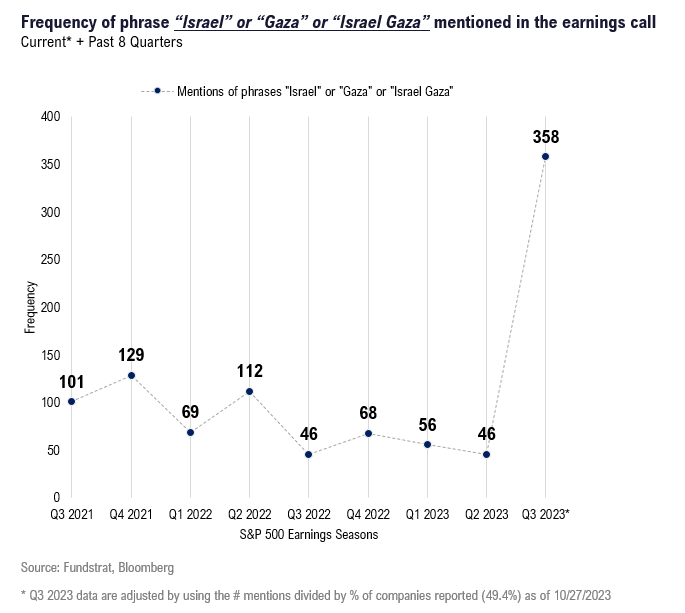

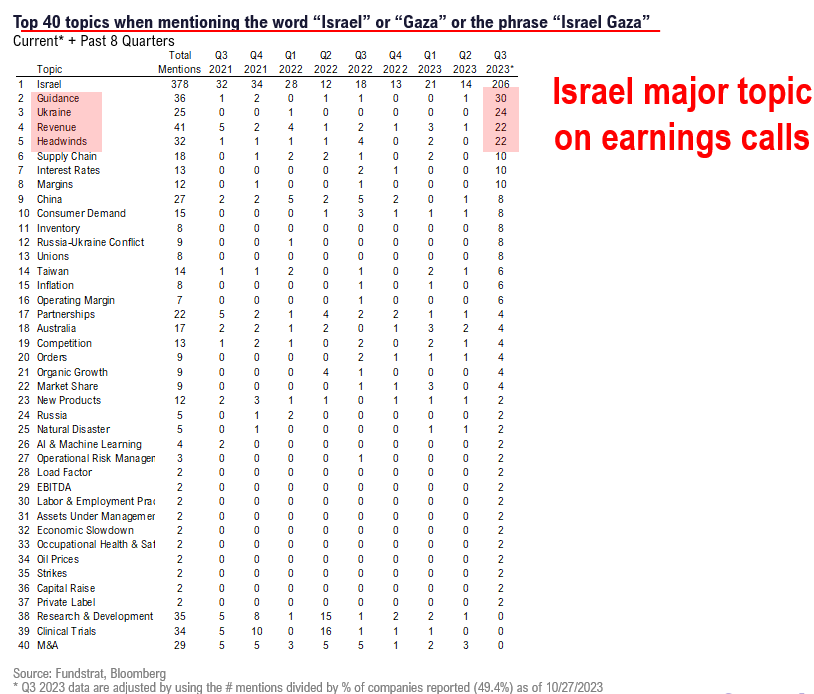

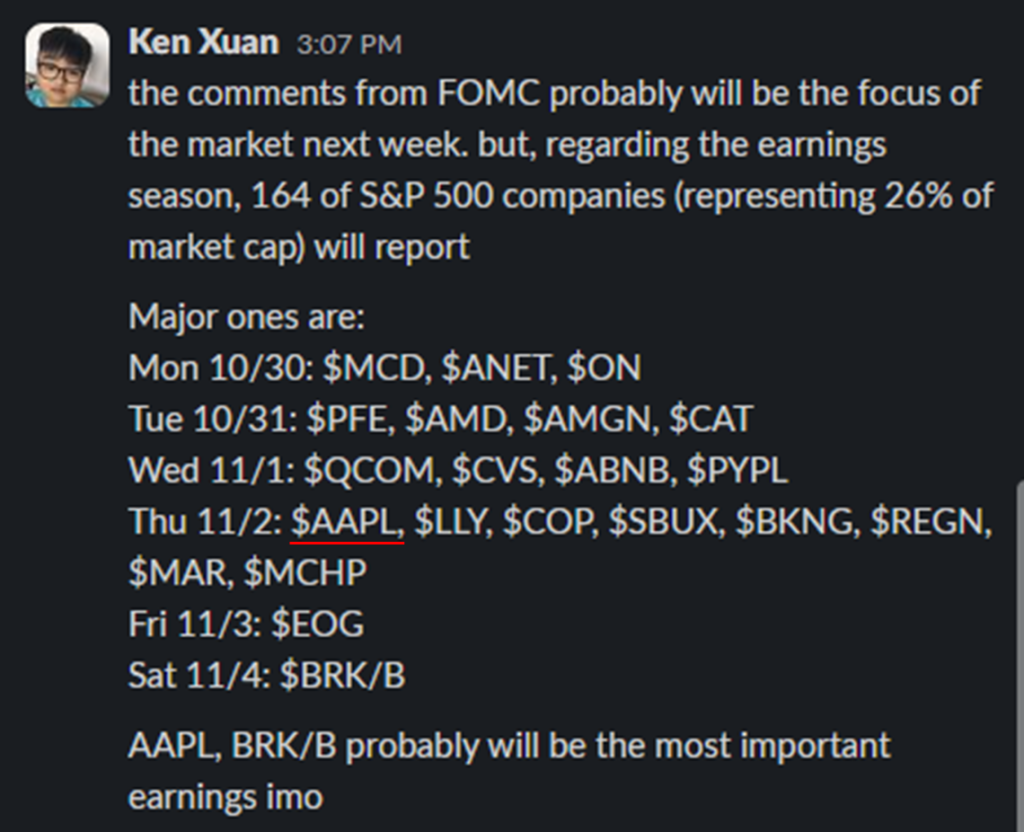

We discuss: Tireless Ken and team analyzed earnings transcripts and found 360 references to Israel-Gaza connected to headwinds, uncertainty, compared to ~45 to 50 past 5 quarters. So the war is even top of mind for CEOs and their caution. This week there are 9 key macro events and the could trigger a large convergence between bonds and stocks.

Please click below to view our Macro Minute (Duration: 7:16).

______________________________________________________________

Over the weekend, I spoke with a few of my larger macro clients (common on Sunday afternoons) and one was puzzled about why bonds have been relatively stable in the past week, yet equities fell -2.5% in the past week. In fact, this is the story this entire month, since the start of October, US 10-year yields have moved from 4.679% to 4.835% (up 16bp modest) while S&P 500 has fallen 4% (4,288 to 4,117).

- Some of these fixed income clients are puzzled because the incoming economic data had leaned dovish and hence, flattish rates. When I mentioned that equity investors seem to be bothered by the uncertainty around the Israel-Gaza war and threat of regional expansion, they noted this was not seen in the behavior of rates. If the bond market was bothered by “war risk,” interest rates would be falling (bonds rally on risk-off).

- At the heart of discussion is whether it is possible for equities to come under selling pressure stemming from war risks, even if the bond market seems to be largely ignoring geopolitical risk? To me, this is possible because:

– Equities are a sensitive to “uncertainty” of the GROWTH of future cash flows

– While bonds are concerned about economic stability –> war risks less for bonds

– Equities impacted by “risk premia” and mounting risks of war –> higher premia

– Companies can become cautious due to “war risks” –> slowing spending - Our data science team, led by “tireless Ken,” analyzed earnings transcripts and found a staggering 358 references to Israel-Gaza (combined with words like “headwinds” or “uncertainty”). This was 46-50 seen in the past 4 quarters. So this is a massive increase and sort of corroborates the above point.

- Anecdotally, it seems like Israel-Gaza and the divisive views dominate my conversations with friends and family in recent weeks. And this is obvious to anyone on social media or watching the news. My X.com feed has moved from primarily #fintwit to dominated by posts related to:

– the war,

– related protests somewhere in the World

– or a strongly divisive view representing one side or the other - In other words, this war impacts all of us personally and I think it also impacts how individuals (and even portfolio managers) view their own personal risk preferences. And as such, this seems like it would show up in equity markets more than the bond market. And add in that the bond market is largely institutional. So, there may be more “emotional spillover” in equities.

- Does this mean we believe stocks are stuck in a doom loop into year-end? I think stocks have become a good risk/reward as we head into November. There are multiple drivers including:

(i) earnings proving to be better (see past notes);

(ii) Fed likely to shift incrementally dovish;

(iii) incoming economic data likely soft-ish this week (below);

(iv) positioning and sentiment so cautious

(v) stocks more fearful of war risks than bonds (positive catchup)

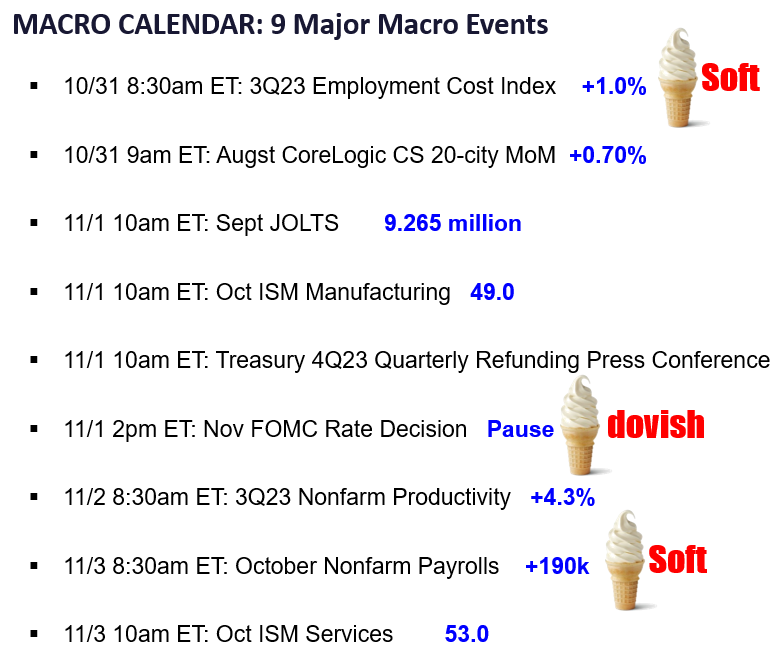

(vi) positive seasonals - This week is a huge macro week for incoming data and we highlight 9 key events this week. This is a very packed week for macro:

1. 10/31 8:30am ET: 3Q23 Employment Cost Index +1.0%

2. 10/31 9am ET: Augst CoreLogic CS 20-city MoM +0.70%

3. 11/1 10am ET: Sept JOLTS 9.265 million

4. 11/1 10am ET: Oct ISM Manufacturing 49.0

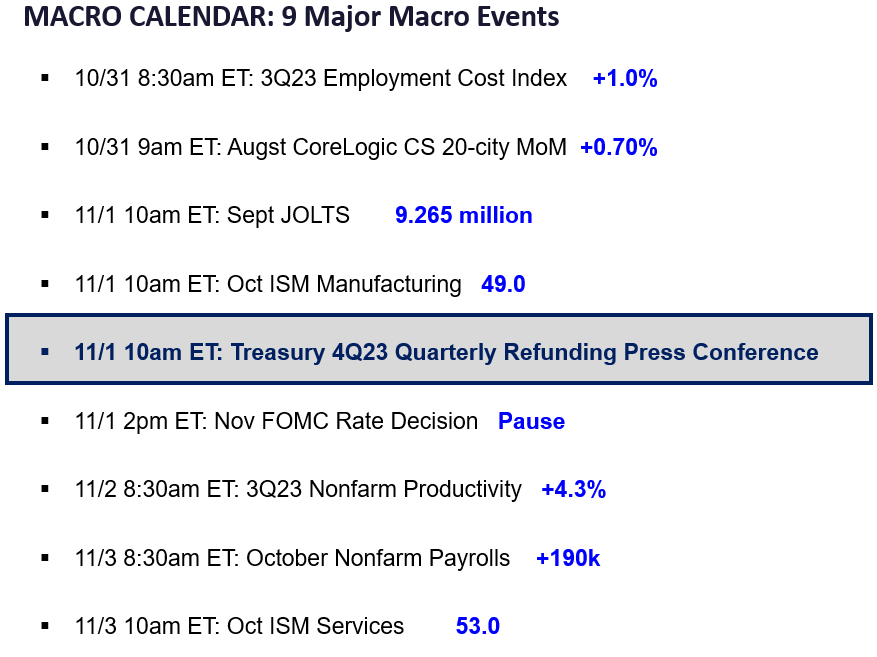

5. 11/1 10am ET: Treasury 4Q23 Quarterly Refunding Press Conference

6. 11/1 2pm ET: Nov FOMC Rate Decision Pause

7. 11/2 8:30am ET: 3Q23 Nonfarm Productivity +4.3%

8. 11/3 8:30am ET: October Nonfarm Payrolls +190k

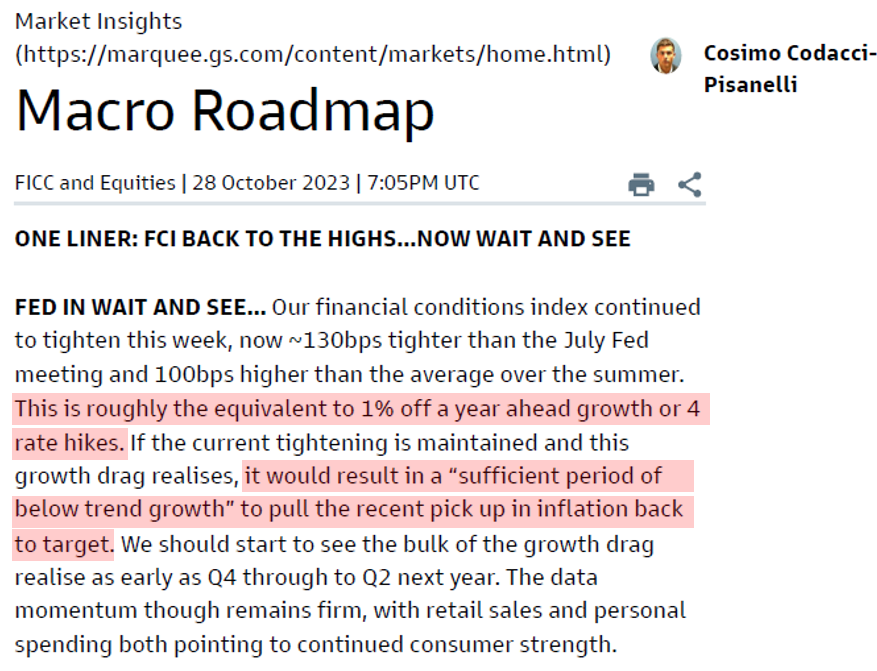

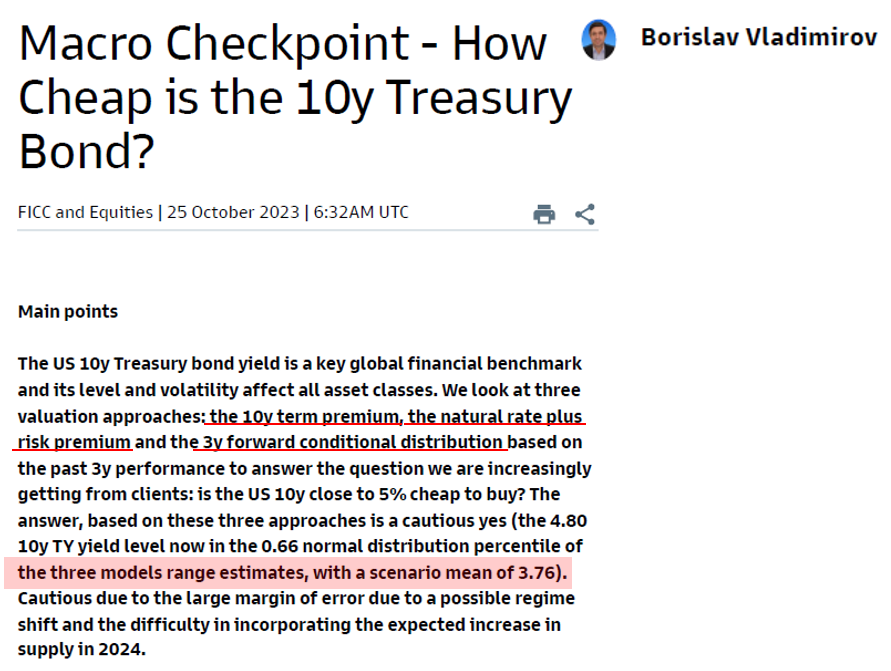

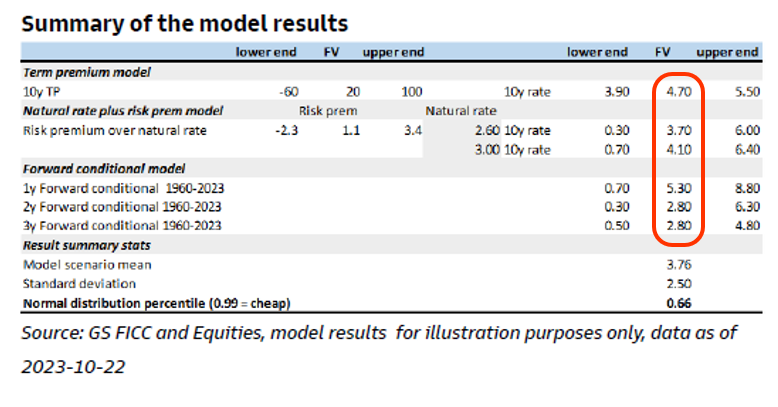

9. 11/3 10am ET: Oct ISM Services 53.0 - Financial Conditions (per Goldman Sachs Financial Conditions Index) have moved to the highest levels of 2023 and the tightest since November 2022. Analysis by Goldman Sachs Economics team estimates this is equivalent to 4 rate hikes by the Fed. By their model, this is enough to bring inflation back to target (potentially faster) and this is also why Fed-speak has shifted to a more patient mode recently.

- Because of this, our macro clients note that the Treasury Quarterly Refunding is arguably more important than the FOMC meeting. Normally, the November FOMC meeting (11/1) would be the most important event. This is a “supply” event for bonds and as we know, interest rates have been rising. So how the Treasury announces its upcoming mix of bonds, this will be market moving. Bloomberg story here.

- We also get the sense that employment market should be softer (despite jobless claims staying low) and we will get plenty of data this week:

– JOLTS, ECI, Non-farm productivity and payrolls report

– plus: Employment series of ISM manufacturing and services

BOTTOM LINE: A major week for macro data but as we expect this to lean “soft” should be supportive of equities

I think there is enough incoming data this week along with the negative positioning for stocks to finally break this doom loop. We may have to wait until month end (tax loss selling this month). And our bigger message is to not get too negative. We realize the war issues are flaming many divisive conversations and raises risk. But as we noted above, it seems like equities have become far more cautious than bonds around war risks.

Key incoming data November

- 11/01 9:45am ET S&P Global PMI October Final

- 11/01 10am ET JOLTS Job Openings September

- 11/01 10am ET October ISM Manufacturing

- 11/01 10am ET Treasury 4Q23 Quarterly Refunding Press Conference

- 11/01 2pm ET FOMC Rate Decision

- 11/02 8:30am ET: 3Q23 Nonfarm Productivity

- 11/03 8:30am ET October Jobs Report

- 11/03 8:30am ET: October Nonfarm Payrolls

- 11/03 10am ET October ISM Services

- 11/07 9am ET Manheim Used Vehicle Index October Final

- 11/10 10am ET U. Mich. November prelim Sentiment and Inflation Expectation

- 11/14 8:30am ET October CPI

- 11/15 8:30am ET October PPI

- 11/15 8:30am ET November Empire Manufacturing Survey

- 11/15 8:30am ET October Retail Sales Data

- 11/16 8:30am ET November New York Fed Business Activity Survey

- 11/16 8:30am ET November Philly Fed Business Outlook Survey

- 11/16 10am ET November NAHB Housing Market Index

- 11/17 9am ET Manheim Used Vehicle Index November Mid-Month

- 11/21 2pm ET Nov FOMC Meeting Minutes

- 11/22 10am ET: U. Mich. November final Sentiment and Inflation Expectation

- 11/24 9:45am ET S&P Global PMI November Prelim

- 11/27 10:30am ET Dallas Fed November Manufacturing Activity Survey

- 11/28 9am ET November S&P CoreLogic CS home price

- 11/28 10am ET November Conference Board Consumer Confidence

- 11/29 8:30am ET 3QS 2023 GDP

- 11/29 2pm ET Fed Releases Beige Book

- 11/30 8:30am ET October PCE

Key incoming data October

-

10/2 10am ET September ISM ManufacturingTame -

10/3 10am ET JOLTS Job Openings AugustHot -

10/4 10am ET September ISM ServicesTame 10/6 8:30am ET September Jobs ReportMixed-

10/6 9am ET Manheim Used Vehicle Index September FinalTame 10/10 11am NY Fed Inflation ExpectationsMixed-

10/11 8:30am ET September PPIMixed 10/11 2pm ET Sep FOMC Meeting MinutesTame-

10/12 8:30am ET September CPIMixed -

10/13 10am ET U. Mich. September prelim 1-yr inflationMixed 10/16 8:30am ET October Empire Manufacturing SurveyTame10/17 8:30am ET October New York Fed Business Activity SurveyTame10/17 8:30am ET September Retail Sales DataHot10/17 9am ET Manheim October Mid-Month Used Vehicle Value IndexTame10/17 10am ET October NAHB Housing Market IndexTame10/18 8:30am ET September Housing StartsTame10/18 2pm ET Fed releases Beige BookTame10/19 8:30am ET October Philly Fed Business Outlook SurveyTame10/19 10am ET Existing Home SalesTame10/19 12pm ET Fed (including Powell) at Economic Club of New York10/24 9:45am ET S&P Global PMI October PrelimTame-

10/26 8:30am ET 3Q 2023 GDP AdvanceStrong 10/27 8:30am ET September PCETame10/27 10am ET Oct F UMich Sentiment and Inflation expectationTame- 10/30 10:30am ET Dallas Fed September Manufacturing Activity Survey

- 10/31 8:30am ET 3Q23 Employment Cost Index

- 10/31 9am ET August S&P CoreLogic CS home price

- 10/31 10am ET October Conference Board Consumer Confidence

Key incoming data September

9/1 8:30am ET August Jobs ReportTame9/1 10am ET August ISM ManufacturingTame9/6 10am ET August ISM ServicesMixed9/6 2pm ET Fed releases Beige BookTame9/8 9am ET Manheim Used Vehicle Index August FinalTame9/8 2Q23 Fed Flow of Funds ReportTame-

9/13 8:30am ET August CPIMixed -

9/14 8:30am ET August PPITame -

9/15 8:30am ET September Empire Manufacturing SurveyTame 9/15 10am ET U. Mich. September prelim 1-yr inflationTame-

9/18 8:30am ET September New York Fed Business Activity SurveyTame -

9/18 10am ET September NAHB Housing Market IndexTame 9/19 9am ET Manheim September Mid-Month Used Vehicle Value IndexMixed9/20 2pm ET September FOMC rates decisionMarket saw Hawkish-

9/21 8:30am ET September Philly Fed Business Outlook SurveyMixed 9/22 9:45am ET S&P Global PMI September Prelim9/25 10:30am ET Dallas Fed September Manufacturing Activity Survey9/26 9am ET July S&P CoreLogic CS home price9/26 10am ET September Conference Board Consumer Confidence

Key incoming data August

8/1 10am ET July ISM ManufacturingTame8/1 10am ET JOLTS Job Openings JunTame8/2 8:15am ADP National Employment ReportHot8/3 10am ET July ISM ServicesTame8/4 8:30am ET July Jobs reportTame8/7 11am ET Manheim Used Vehicle Index July FinalTame8/10 8:30am ET July CPITame8/11 8:30am ET July PPITame8/11 10am ET U. Mich. July prelim 1-yr inflationTame8/11 Atlanta Fed Wage Tracker JulyTame8/15 8:30am ET Aug Empire Manufacturing SurveyMixed8/15 10am ET Aug NAHB Housing Market IndexTame8/16 8:30am ET Aug New York Fed Business Activity SurveyNeutral8/16 2pm ET FOMC MinutesMixed8/17 8:30am ET Aug Philly Fed Business Outlook SurveyPositive8/17 Manheim Aug Mid-Month Used Vehicle Value IndexTame8/23 9:45am ET S&P Global PMI Aug PrelimWeak8/25 10am ET Aug Final U Mich 1-yr inflationMixed8/28 10:30am ET Dallas Fed Aug Manufacturing Activity SurveyTame8/29 9am ET June S&P CoreLogic CS home priceTame8/29 10am ET Aug Conference Board Consumer ConfidenceTame8/29 10 am ET Jul JOLTSTame8/31 8:30am ET July PCETame

Key incoming data July

7/3 10am ET June ISM ManufacturingTame7/6 8:15am ADP National Employment ReportHot7/6 10am ET June ISM ServicesTame7/6 10 am ET May JOLTSTame7/7 8:30am ET June Jobs reportMixed7/10 11am ET Manheim Used Vehicle Index June FinalTame7/12 8:30am ET June CPITame7/13 8:30am ET June PPITame7/13 Atlanta Fed Wage Tracker JuneTame7/14 10am ET U. Mich. June prelim 1-yr inflationMixed7/17 8:30am July Empire Manufacturing Survey7/18 8:30am July New York Fed Business Activity Survey7/18 10am July NAHB Housing Market Indexin-line7/18 Manheim July Mid-Month Used Vehicle Value IndexTame7/25 9am ET May S&P CoreLogic CS home priceTame7/25 10am ET July Conference Board Consumer ConfidenceTame7/26 2pm ET July FOMC rates decisionTame7/28 8:30am ET June PCETame7/28 8:30am ET 2Q ECI Employment Cost IndexTame7/28 10am ET July Final U Mich 1-yr inflationTame

Key data from June

6/1 10am ET May ISM ManufacturingTame6/2 8:30am ET May Jobs reportTame6/5 10am ET May ISM ServicesTame6/7 Manheim Used Vehicle Value Index MayTame6/9 Atlanta Fed Wage Tracker AprilTame6/13 8:30am ET May CPITame6/14 8:30am ET May PPITame6/14 2pm ET April FOMC rates decisionTame6/16 10am ET U. Mich. May prelim 1-yr inflationTame6/27 9am ET April S&P CoreLogic CS home priceTame6/27 10am ET June Conference Board Consumer ConfidenceTame6/30 8:30am ET May PCETame6/30 10am ET June Final U Mich 1-yr inflationTame

Key data from May

5/1 10am ET April ISM Manufacturing (PMIs turn up)Positive inflection5/2 10am ET Mar JOLTSSofter than consensus5/3 10am ET April ISM ServicesTame5/3 2pm Fed May FOMC rates decisionDovish5/5 8:30am ET April Jobs reportTame5/5 Manheim Used Vehicle Value Index AprilTame5/8 2pm ET April 2023 Senior Loan Officer Opinion SurveyBetter than feared5/10 8:30am ET April CPITame5/11 8:30am ET April PPITame5/12 10am ET U. Mich. April prelim 1-yr inflationTame5/12 Atlanta Fed Wage Tracker AprilTame5/24 2pm ET May FOMC minutesDovish5/26 8:30am ET PCE AprilTame5/26 10am ET U. Mich. April final 1-yr inflationTame5/31 10am ET JOLTS April job openings

_____________________________

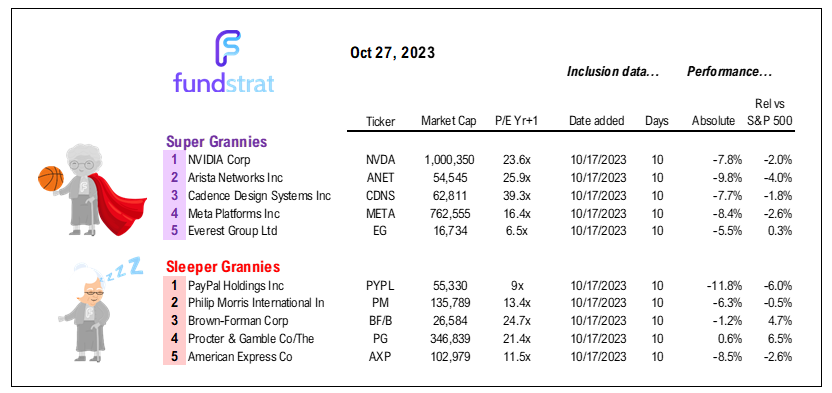

36 Granny Shot Ideas: We performed our quarterly rebalance on 10/18. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review on Google reviews —> Click here.

We publish on a 3-day a week schedule:

– Monday

– SKIP TUESDAY

– Wednesday

– SKIP THURSDAY

– Friday