-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 2

What Is Volatility?

You may have a negative connotation of the word volatility, and for a good reason. But what is volatility, really? It is usually in the common parlance most often when things are bad or expected to be soon. It’s an emotive word, but not necessarily in the financial context all the time, believe it or not. However, the word’s official definition doesn’t mean bad, or emotional. In finance, volatility is a less loaded term that simply means the change in price over a given amount of time.

So, in a straightforward sense, it is just the actual price movement of an asset. Calculating historic, or realized volatility is usually a good way to determine the future price range of your asset, but not always. Over-reliance on historical data plagued institutions during the crisis. Stochastic risk models, Monte Carlo simulations, and Regime Switching Rare Disaster models have been found to be effective ways to model volatility in addition to historical data. Relying solely on historic volatility can be very risky. Investors need something more than just past data to make the best decisions possible, and since Future or Options markets give a lot of information about the mood of investors, it is exactly what is used to derive the CBOE VIX.

Many investors are familiar with the VIX, or they have been conditioned in a Pavlovian fashion to know one thing, the VIX going up suddenly and sharply usually means frantic selling and hard times. Think back to March. We can all pause and think of a moment when we saw the VIX spike to a level that made us lose our breath for a moment, but so far, it is coming out of backwardation and moving toward more normal levels. Trading options or futures on VIX is tricky business, particularly if you’re not highly experienced with options, and the effects on valuation and liquidity risk that come with owning European-style options, which can only be exercised at expiration opposed to at any time up until expiration are complicated. VIX is perhaps the most complex of the commonly cited indexes in how it is calculated. Unlike ETFs or stocks, you cannot simply buy and own the VIX.

What Is Implied Volatility?

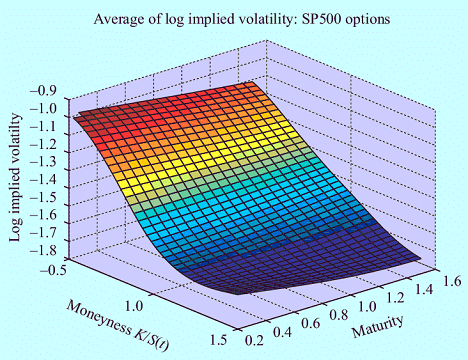

Derivatives are assets that have their value derived from an underlying asset. Thus, their market prices are subject to much more wild swings as a result of the leverage these instruments utilize. You cannot buy and hold derivatives, like options and futures, because they have an expiration date. They give you the right to buy or sell a security or commodity at a previously specified price regardless of the underlying price. A call option is the right to buy a security at a certain price before a certain date, and a put option is the inverse, the right to sell. You can be short or long options, long meaning you have rights (to exercise or sell your option) and short meaning you have obligations, to purchase or sell the securities. The strike price determines how far away from the actual price, the option’s value is. Options with strike prices closer to the actual price of the asset have higher premiums. This principle is the basis of Black-Scholes. When an options chain is following the model in real life you will be able to observe something called the ‘Volatility Smile’. This is the natural tendency of the implied volatility to go up, just as interest rates would on a curve with maturity. So, the further out of the money an option is, the high its implied volatility.

It is impossible to predict the future. However, we can make sense of the best information we have, coupled with assumptions. This is what Fisher Black and Myron Scholes did when they created their revolutionary options pricing model, The Black-Scholes Formula. Subsequent options pricing models have been developed to enhance and improve the original. However, implied volatility is the only factor of these models not directly observed in the market. In other words, implied volatility is derived through the model using other observable data. The higher an implied volatility, the higher the potential move in the premium of an option, and the underlying stock price.

The inputs used to derive implied volatility are the European-style S&P 500 index for near term options with more than 23 days until expiration and next term options with less than 37 days as well as risk-free US T-Bill Rates, which are used as a proxy for the input of the risk-free interest rate.

One important thing to remember about implied volatility is that it does not determine which direction an asset will move in price. It only has a high probability of moving away from the current price. This metric tries to approximate the future value of the option using the available information at hand. So, primarily to find a stock’s implied volatility, you would work backward from the Black-Sholes inputs. This is important to remember because the model is based on assumptions that sometimes deviate from actual market conditions. So, it is important to remember that implied volatility is not predicting the future, just giving the best indication of its probability that we can find. Due to the centrality of agriculture in early derivatives trading, Chicago and the Chicago Board of Options Exchange (CBOE) became key to the development of the financial industry. One of its biggest contributions to finance and markets was the volatility index. What is volatility? It is something that can now be traded, managed, and hedged better than at any time in previous world history. Whether you are buying VIX options or futures, or maybe getting some exposure through an ETF or other passive vehicle, you can significantly mitigate your downside loss when volatility rears its ugly head when you use all the tools the market has to offer.

Related Guides

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInflation – What’s All the Fuss About?

A multi-part series about inflation and its impact on stock investors.

-

Series of 3~11 minutesLast updated2 years ago

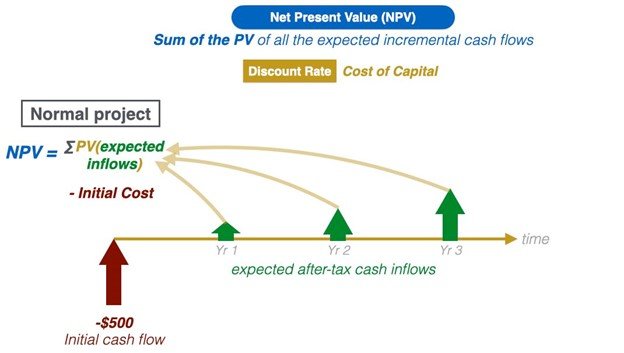

Series of 3~11 minutesLast updated2 years agoUnderstanding Net Present Value and The Basics of Discounted Cash Flow Models (DCF)

Acquaint yourself with the basics of net present value and discounted cash flow (DCF) models.

-

Series of 6~12 minutesLast updated2 years ago

Series of 6~12 minutesLast updated2 years agoIntroduction to Hedging

In this guide, we will cover the basics of hedging, what is hedging and what is the user for it.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?