NEW BULL VS LATE CYCLE: 6 reasons in favor of “new bull”

- US cos survived 6th major “stress test” yet P/E lower

- Investment outlook better now than in Feb 2025

- Still most hated rally

- Better visibility Tariffs, tax and de-regulation visibility

- Earnings solid

- Fed more dovish in 2026

___________________________________

Attached below is our latest marketing deck.

Please CLICK HERE to access the presentation in PDF format.

___________________________________

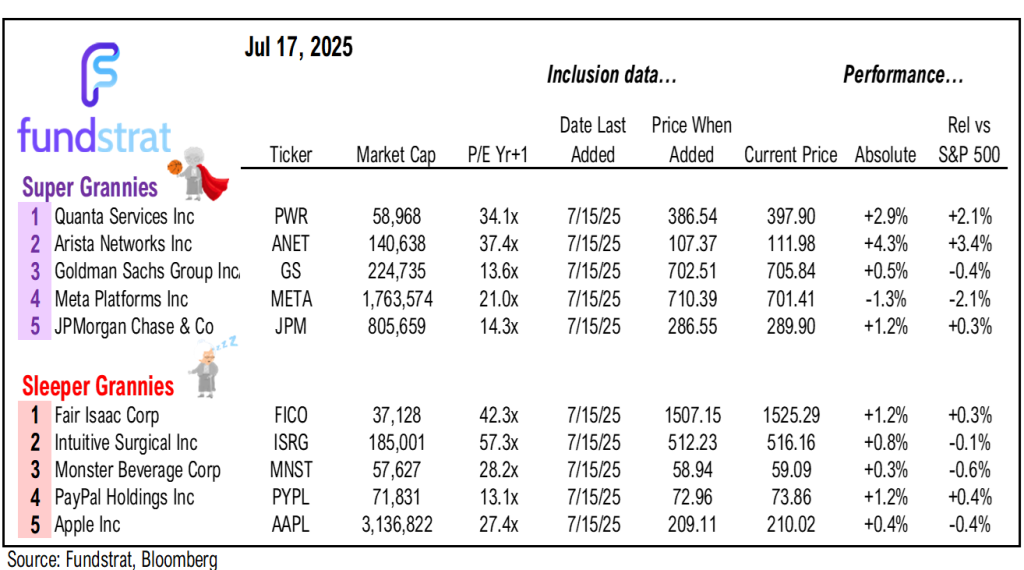

The bull market has proven itself intact. We previously identified two lists of “wash out” stocks, both large-cap (22 names) and SMID-cap (27 names). We want to look at stocks which did not make a new low between April 1-April 8, even as the S&P 500 fell to new lows.

The large-cap criteria is as follows:

- Current Market Cap >$15 Billion

- Declined more than 30% before Feb 18th

- Didn’t make new closing low between April 1st & April 8th

- Current price down more than 25% from 52W High

The large-cap “washed out” tickers are:

WBD 0.98% LULU 1.62% TSLA -3.59% DKNG 8.68% DG 3.42% DLTR 3.66% BF STZ -0.23% RKT 3.52% COIN 4.40% HOOD 3.09% HUM 0.55% UAL 1.73% LDOS 1.14% TEAM 1.09% HUBS 0.03% MSTR 1.98% CRM 0.25% NET 3.06% SMCI -1.00% EIX 0.85% VST 3.18%

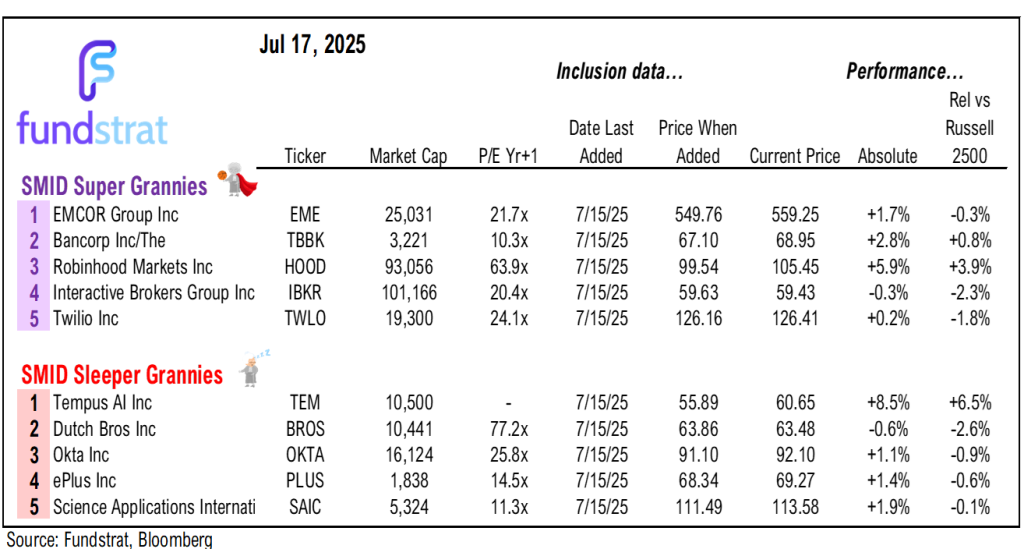

The SMID-cap criteria is as follows:

- Current Market Cap <$15 Billion

- Declined more than 30% before Feb 18th

- Didn’t make new closing low between April 1st & April 8th

- Current price down more than 25% from 52W High

- Short interest Day to Cover Ratio >2

The SMID-cap “washed out” tickers are:

DJT -1.05% ROKU -2.92% AS -0.44% LCID -3.84% RIVN 0.20% LKQ 1.17% CROX 0.54% NCLH 4.61% WBA CELH -8.06% SOFI 3.94% MKTX 0.92% COLB 1.93% GRAL -0.82% INSP -2.41% PRGO -3.28% CNXC -5.11% DAY -0.28% LUV 2.19% LYFT 3.53% CFLT -1.31% DT 2.52% ESTC 3.97% PCOR 0.64% LITE 0.18% ALAB 1.64% AES -0.42%

_____________________________

45 SMID Granny Shot Ideas: We performed our quarterly rebalance on 5/22. Full stock list here -> Click here

______________________________

PS: if you are enjoying our service and its evidence-based approach, please leave us a positive 5-star review

Key Incoming Data July:

7/1 9:45 AM ET: Jun F S&P Global Manufacturing PMITame- 7/

1 10:00 AM ET: May JOLTS Job OpeningsMixed 7/1 10:00 AM ET: Jun ISM Manufacturing PMITame7/3 8:30 AM ET: Jun Non-farm PayrollsMixed7/3 8:30 AM ET: May Trade BalanceTame7/3 9:45 AM ET: Jun F S&P Global Services PMITame7/3 10:00 AM ET: May F Durable Goods Orders MoMTame7/3 10:00 AM ET: Jun ISM Services PMITame7/8 6:00 AM ET: Jun Small Business Optimism SurveyTame7/8 9:00 AM ET: Jun F Manheim Used Vehicle IndexMixed7/8 11:00 AM ET: Jun NYFed 1yr Inf ExpTame7/9 2:00 PM ET: Jun FOMC Meeting MinutesMixed7/15 8:30 AM ET: Jun Core CPI MoMTame7/15 8:30 AM ET: Jul Empire Manufacturing SurveyTame7/16 8:30 AM ET: Jun Core PPI MoMTame7/17 8:30 AM ET: Jul Philly Fed Business OutlookTame7/17 8:30 AM ET: Jun Retail SalesTame7/17 9:00 AM ET: Jul M Manheim Used Vehicle IndexTame7/17 10:00 AM ET: Jul NAHB Housing Market IndexTame7/17 4:00 PM ET: May Net TIC FlowsTame- 7/18 10:00 AM ET: Jul P U. Mich. 1yr Inf Exp

- 7/22 10:00 AM ET: Jul Richmond Fed Manufacturing Survey

- 7/23 10:00 AM ET: Jun Existing Home Sales

- 7/24 8:30 AM ET: Jun Chicago Fed Nat Activity Index

- 7/24 9:45 AM ET: Jul P S&P Global Services PMI

- 7/24 9:45 AM ET: Jul P S&P Global Manufacturing PMI

- 7/24 10:00 AM ET: Jun New Home Sales

- 7/24 11:00 AM ET: Jul Kansas City Fed Manufacturing Survey

- 7/25 8:30 AM ET: Jun P Durable Goods Orders MoM

- 7/28 10:30 AM ET: Jul Dallas Fed Manuf. Activity Survey

- 7/29 9:00 AM ET: May S&P CS home price 20-City MoM

- 7/29 10:00 AM ET: Jul Conference Board Consumer Confidence

- 7/29 10:00 AM ET: Jun JOLTS Job Openings

- 7/30 8:30 AM ET: 2Q A GDP QoQ

- 7/30 2:00 PM ET: Jul FOMC Decision

- 7/31 8:30 AM ET: Jun Core PCE MoM

- 7/31 8:30 AM ET: 2Q ECI QoQ

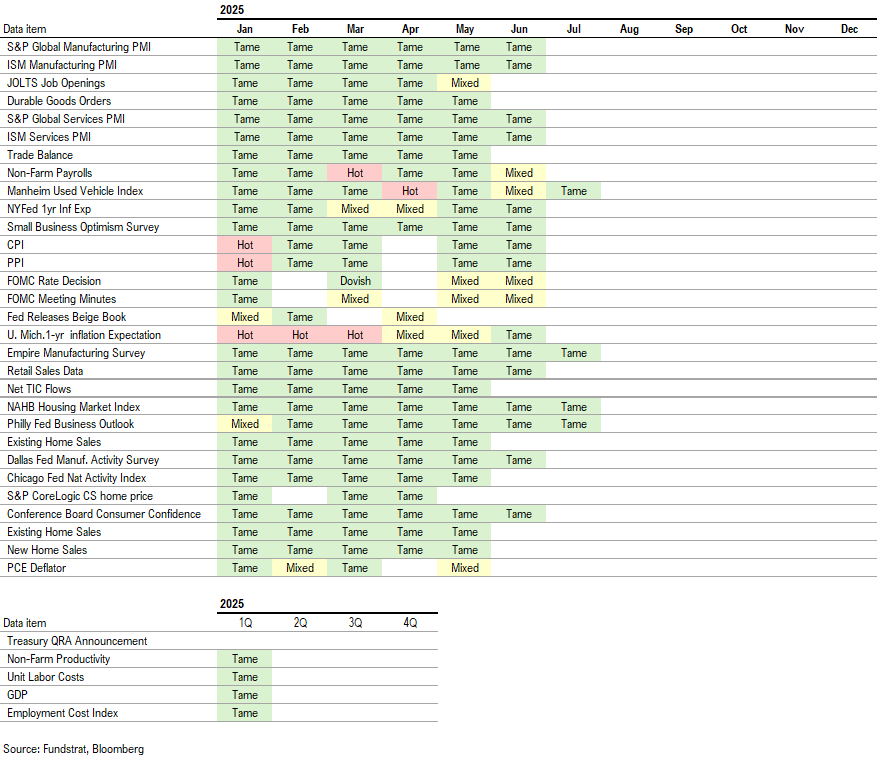

Economic Data Performance Tracker 2025:

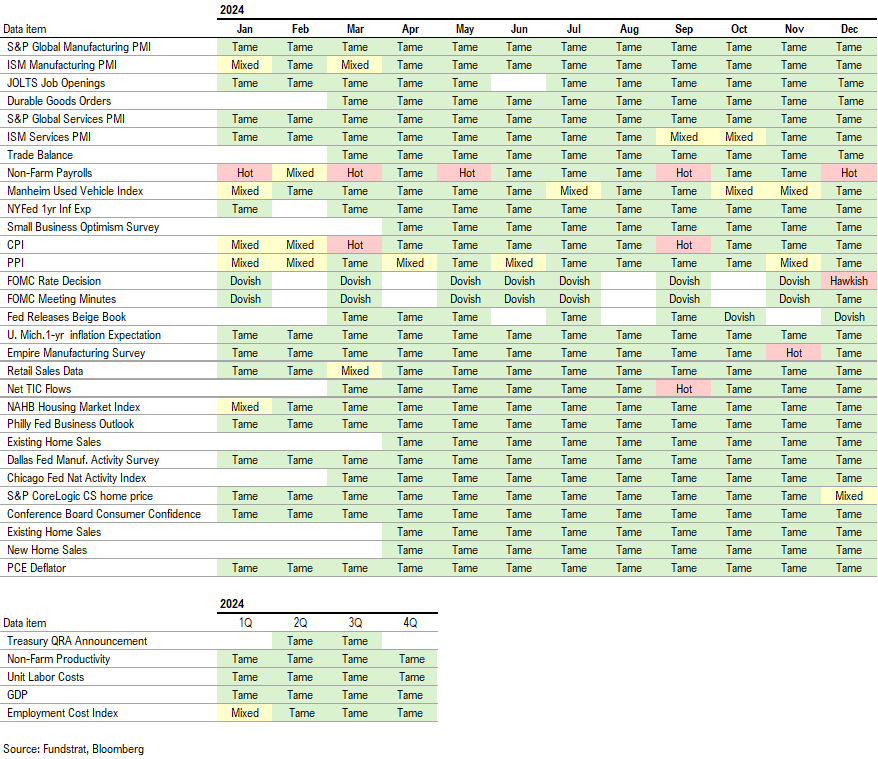

Economic Data Performance Tracker 2024:

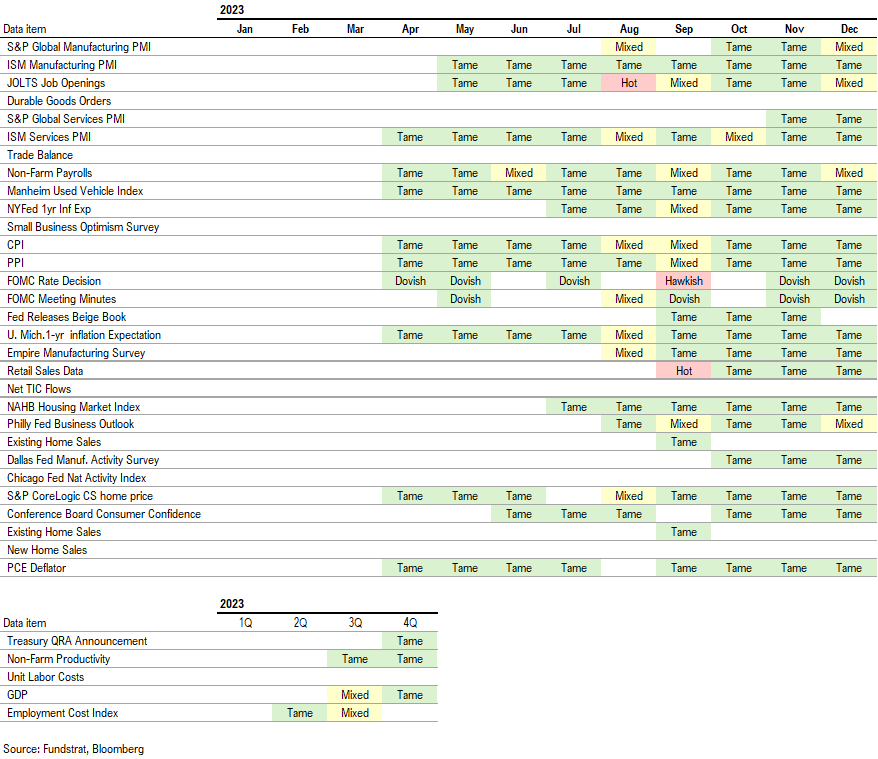

Economic Data Performance Tracker 2023: