-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 2

Understand The Rules of The Game: Lead the Herd, Don’t Follow It

What is beautiful? Is there any universal standard? Beauty is indeed in the eye of the beholder, as they say, but this fact implies something else: the common, or average, standard of beauty may deviate significantly from that of any individual. John Maynard Keynes is one of the most influential economists in history. When looking at a 1930s newspaper game that asked contestants to select the six most beautiful women, he had a pretty stark realization about the implications of this game for stock market valuation. The insight: If you were to win the beauty contest, you shouldn’t pick who you think is the most beautiful. Instead, you should choose what you believe the average opinion will consider the most beautiful. Understanding the other contestants’ conception of beauty is just as important as looking at the actual pictures of contestants.

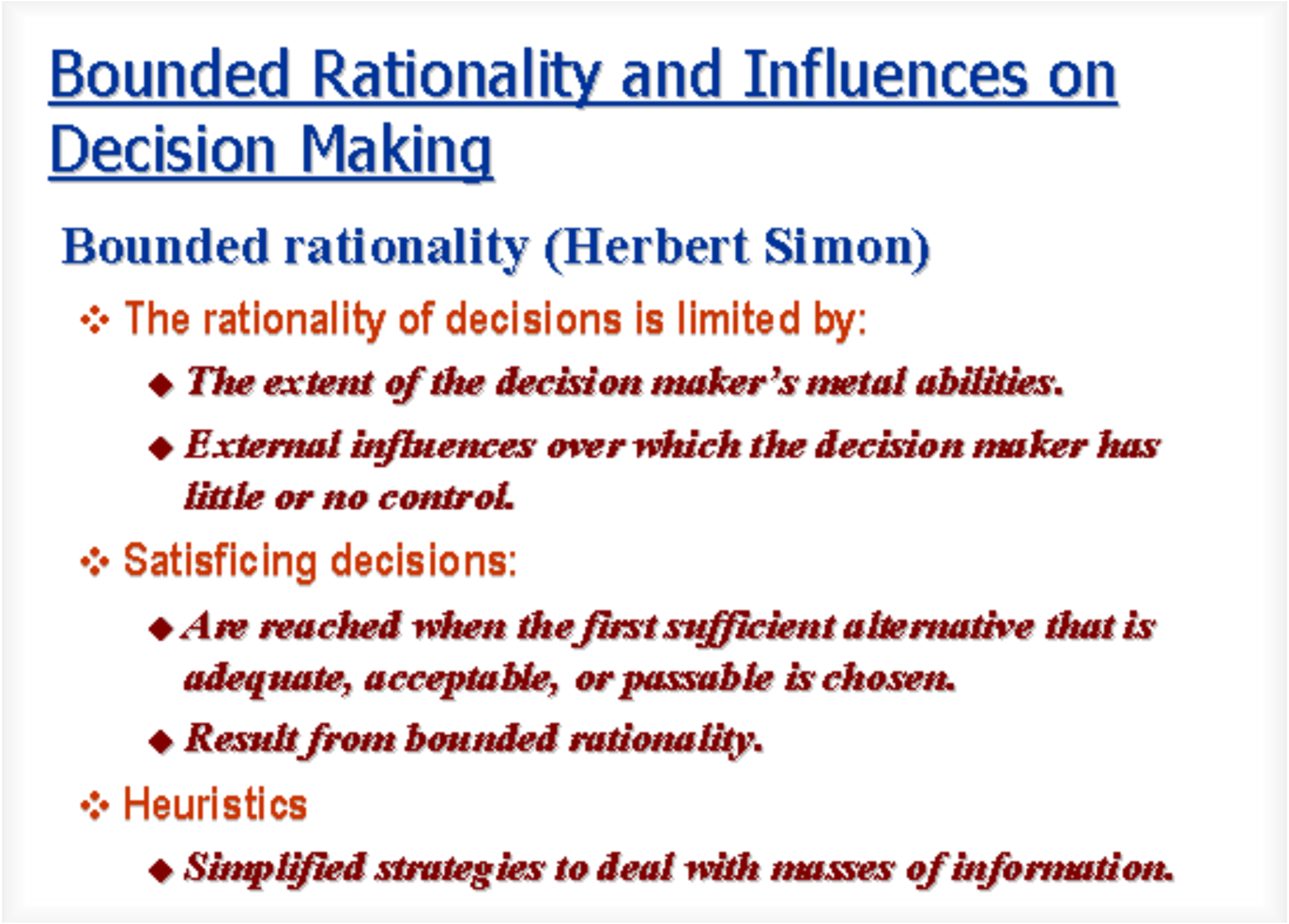

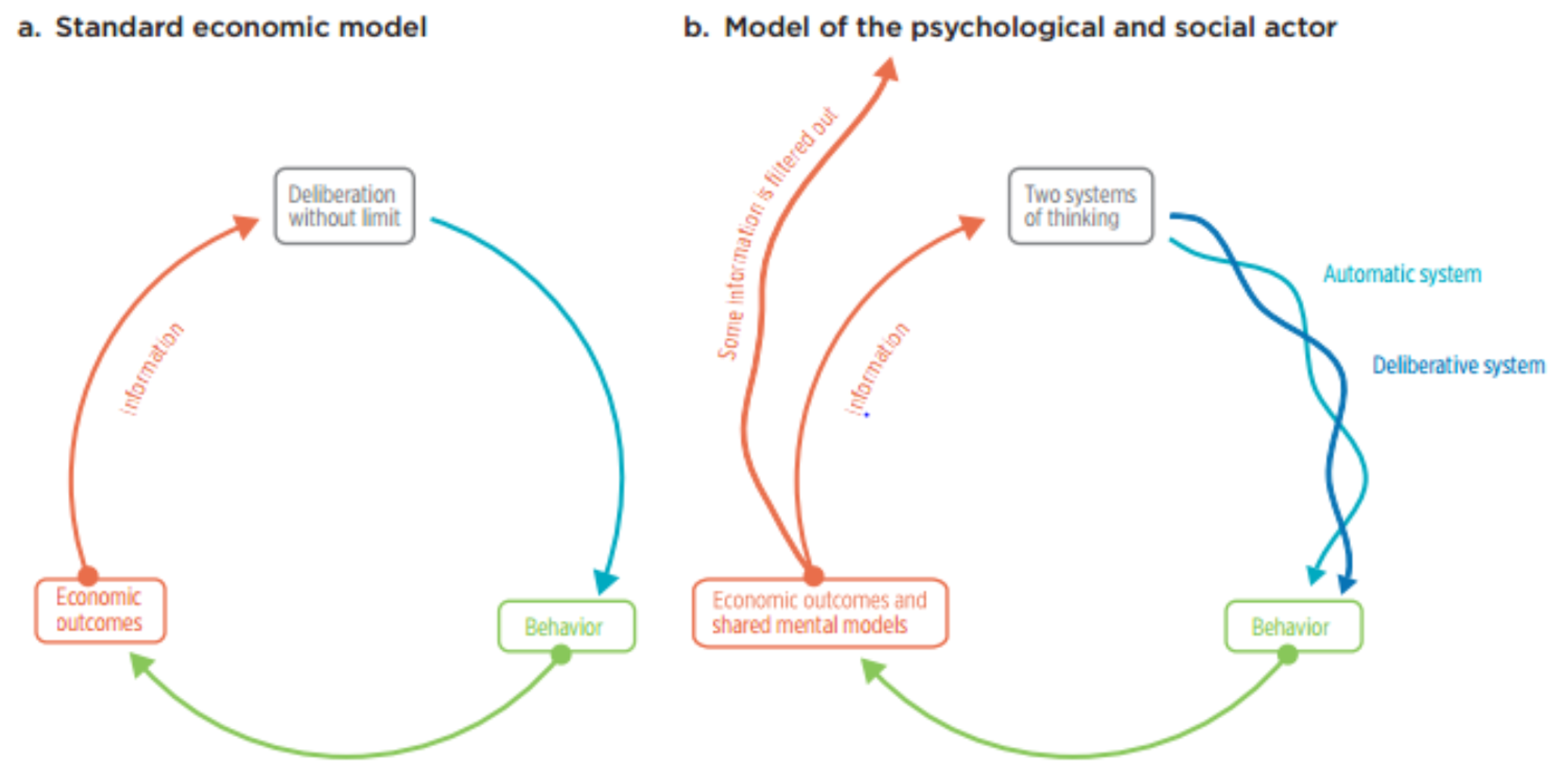

Bounded Rationality is a crucial concept for markets. Basically, contrary to economic theories that consider humans rational economic actors, this concept is concerned with the limits of human rationality. Rather than focusing on the rational aspects of human behavior bounded rationality focuses on our limitations in abilities, understanding, time and information that affects decisionmaking in investing. There are bounds to our collective rationality that can interact with herd behavior in ways that cause panic and forced liquidation. This is a perennial occurrence in markets.

In other words, when looking at the fundamentals of a stock, you’re only getting half the picture. You also must consider what the broader investing community will think about the stock in the future. There’s a reason people are afraid of crowds; they can be irrational and fickle. Understanding the crowd is crucial to beating the average return. The ideal candidate for a stock is one that may look somewhat homely today but which you are convinced will be an enchanting beauty in the future.

Those who had faith in Amazon ($AMZN) over the years can probably relate. The low-margin, struggling for profitability company was hated by many on Wall Street for years. Now, it’s titanic in stature. Twenty years ago, if you had seen that the future world would think of Amazon, despite its despised status on the Street – Barron’s infamously called it the company that would fail – you’re probably well off.

The Keynesian Beauty Contest: Picking Good Investments Involves Seeing “Beauty” Before The Crowd Does

“Successful investing is anticipating the anticipation of others.”-John Maynard Keynes

So, let’s use a straightforward example to illustrate a complicated concept. Sometimes, movies and pop culture jokes may contain more meaning than we initially imagined. In the 1999 coming-of-age romantic comedy, She’s All That, a popular jock played by Freddie Prinze Jr. engages in a cruel but illuminating bet with a high-school rival to see if he can transform one of the least desirable girls in school into the prom queen.

Though the movie might seem trivial, it illustrates the concept of bounded rationality that lies at the heart of the Keynesian Beauty Contest. A parody movie called Not Another Teen Movie targets the film as a perfect example of how irrational and subjective conceptions of beauty are and that someone is not actually transformed by taking their glasses off. Instead, our collective perceptions are. This is a profound insight with direct application to investing.

The Stock Market Is Like a Beauty Contest…

Have you ever had to judge a beauty contest? Sounds pretty easy, right? Just pick the prettiest girl and be on your way. If stock investing were this easy, many professionals would be out of the job – they’d be wildly wealthy. Let’s add one more variable and see how the complexity of your task exponentially increases: now, don’t pick whom you think is the prettiest girl; decide whom you believe all the others judging the contest will pick.

This is Keynes’s beauty contest, and it is a way to demonstrate the difficulty in pricing stocks. How much do you know about those judging the competition with you and their perceptions of beauty? How similar are they to you? Do they even like girls? Quite a few factors could influence that and make the correct answer very difficult to ascertain. To correctly guess which contestant would win, you would have to know quite a lot about the other judges and their aesthetic proclivities. That information is just as important as, if not more important than, the faces of the actual contestants themselves.

John Maynard Keynes devised this analogy to explain how investors value and pick stocks to buy. If it were as easy as simply choosing the companies with the best 10-K filings, then stock selection would be effortless. The problem is that investors must evaluate the inherent value of a stock and the willingness of the investing public to purchase it at a given price. Try as we may to use pure rationality to value financial assets; human emotion and passion have been part of financial markets since their inception. Despite many efforts to purify the market of this element, it has been a perennial driver of boom and bust.

It’s not a case of choosing those which, to the best of one’s judgment, are really the prettiest, nor even those which average opinion genuinely thinks the prettiest… We devote our intelligences to anticipating what average opinion expects the average opinion to be

-John Maynard Keynes

Related Guides

-

Series of 3~15 minutesLast updated1 year ago

Series of 3~15 minutesLast updated1 year agoInflation – What’s All the Fuss About?

A multi-part series about inflation and its impact on stock investors.

-

Series of 3~11 minutesLast updated3 years ago

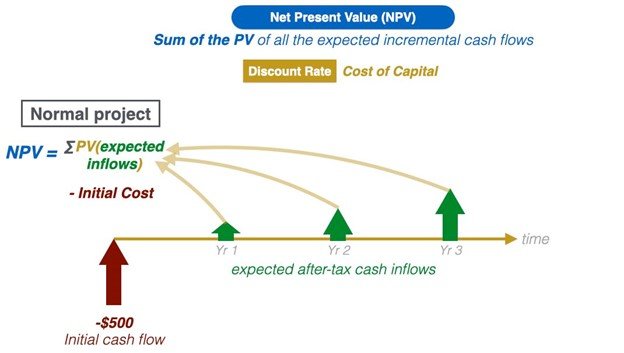

Series of 3~11 minutesLast updated3 years agoUnderstanding Net Present Value and The Basics of Discounted Cash Flow Models (DCF)

Acquaint yourself with the basics of net present value and discounted cash flow (DCF) models.

-

Series of 6~12 minutesLast updated3 years ago

Series of 6~12 minutesLast updated3 years agoIntroduction to Hedging

In this guide, we will cover the basics of hedging, what is hedging and what is the user for it.

-

Series of 8~27 minutesLast updated2 years ago

Series of 8~27 minutesLast updated2 years agoBitcoin Guide

Is it a good time to get in? How much should I invest?

-

Series of 5~21 minutesLast updated3 years ago

Series of 5~21 minutesLast updated3 years agoThe VIX Series

What is the VIX? What does it indicate? How can I use it to improve my strategies?