-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 7

How to create Seasonality allocations and portfolios?

Seasonality and economic cycles have obviously been dramatically impacted by the first-ever coordinated global shutdown of economies worldwide. This unprecedented action and associated changes in consumer behavior significantly altered what were once far more predictable consumption activity patterns. However, in some ways, COVID-19 has created its own type of “new seasonality”, and we pay careful attention to the companies that have been made winners in the new environment. We are currently seeing some strong beneficiaries of the viral economy in Tech Hardware, Household Product and Retail, Fertilizers, Homebuilders, Online Retail, and Electronics. We think the strongest players within these sub-industries are very attractive equities to own. From where some of the highest-flying stocks of the year are now, you have to remember to go up 50% would be a Herculean task given all the gains they have had this year. However, given where much of the worst-affected cyclicals are, a rise of 50% would simply bring them back to pre-COVID levels. We think that they will also reach these pre-COVID levels with better profitability and operating leverage than before. Not only that, they have proven that they can survive the worst-case scenario. This greater survivability will inevitably mean more robust valuations, which in our opinion are deserved.

We think new consumer trends regarding housing, which have remained resilient throughout much of the virus due to changing demand patterns and low rates, and de-urbanization will significantly benefit these sectors. As we always are looking through a multi-faceted lens, we also think that this ‘new seasonality’ as we call it, will also be accelerated by one of our strategic portfolio trends since millennials are responsible for many of the new home purchases.

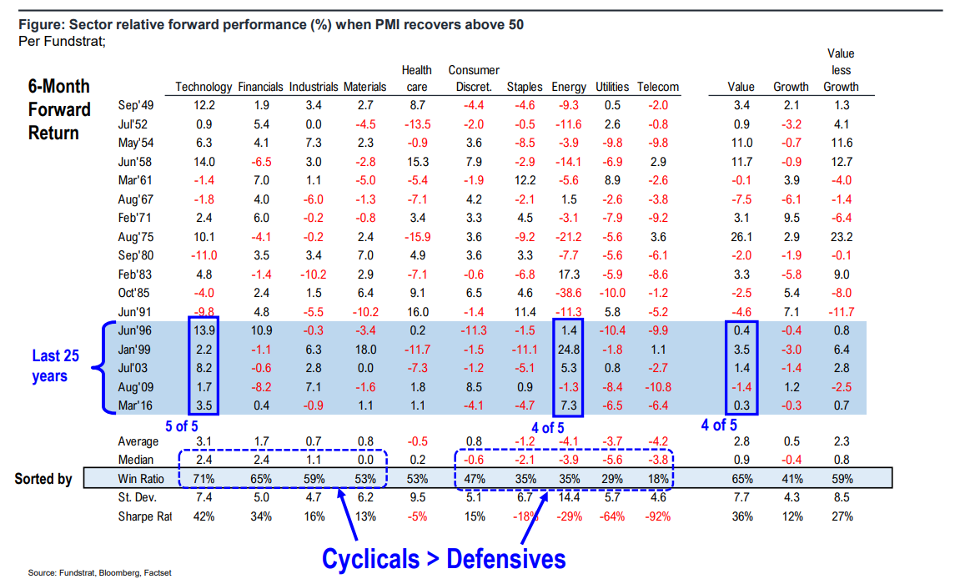

PMI Recovery- PMI Above 50

The Purchasing Managers Index is a simple but reliable indicator of how businesses feel about upcoming periods compared with current ones. If the PMI goes above 50, it indicates that managers in various industries feel more optimistic about their prospects than in the previous month. This often means that companies benefitting from the expansive side of economic cycles will do better than if the number were contracting (or was below 50). We have done some significant analysis of PMI and its correlations to various sectors comprising the S&P 500. We have looked at the data and determined that since 1949 every time the PMI goes above 50, there is a measurable outperformance by Cyclicals and Value. Even more interesting is a trend that we’ve noticed over the last 25 years that we believe will continue. The three groups that consistently outperform are Technology, Energy, and Value. While we are not constructive on Energy at this time given some idiosyncratic risks we see as unresolved, we are very bullish on Tech and Value due to PMI being above 50 since July. This is the final tactical portfolio trend we use to select our Granny Shots portfolio.

-

How to Pick Stocks? The birth of “Granny Shots”?

-

How We Apply 'Granny Shots' To The Stock Market?

-

How Does The 'Granny Shot' Work In Investing?

-

Impact on Technology, Digital transformation and Artificial Intelligence in the Stock Market

-

Impacts on Inflation and Portfolios

-

How to allocate and create Tactical Portfolios?

-

How to create Seasonality allocations and portfolios?

-

How Do Granny Shots Bring it all Together?

Related Guides

-

Series of 4~7 minutesLast updated3 months ago

Series of 4~7 minutesLast updated3 months agoWhy The Mysterious R-Star Should Be on Your Radar

Economists lose sleep over it. Central bankers get asked if we’re close to it. Most Americans don’t realize it, but their lives are quietly guided by it. The it here is the neutral rate of interest, also known as r-star or r*, which powers, penetrates, and binds all aspects of the economy.

-

Series of 4~13 minutesLast updated1 year ago

Series of 4~13 minutesLast updated1 year agoThe Federal Reserve: What it is and why we care about it

Overview of the history, structure, and market impact of the Federal Reserve