-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 2

How We Apply 'Granny Shots' To The Stock Market?

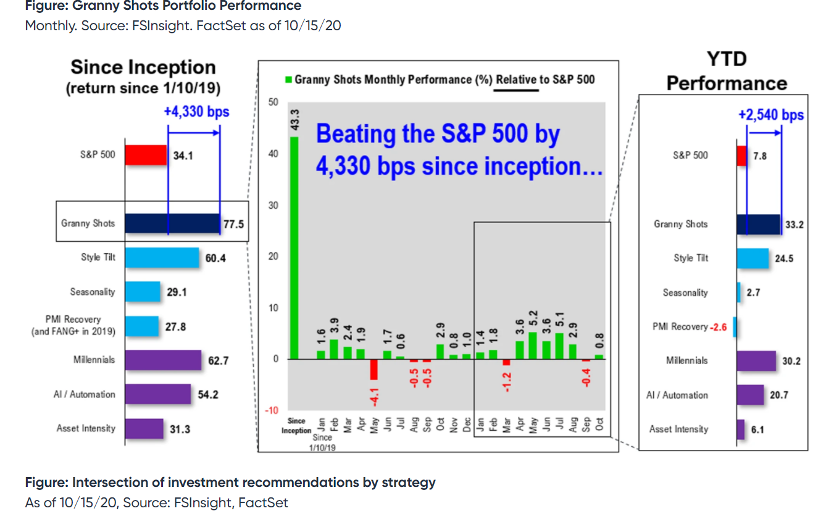

Wall Street is supposed to be full of smart people with smart ideas. Sometimes it is. Sometimes an idea’s complexity can be misidentified as credibility or the potential for prosperity. We think, particularly in the wake of the pandemic, some clear winners whose advantages and congruence with our key investing strategies open them to similar criticism to those taking the easier and more consistent ‘granny shots.’ We aren’t showboats though, we are trying to make our subscribers money. That’s why we recommend many relatively safe names to our subscribers because of the relatively straightforward intersection with at least two of our six active portfolios.

Some of these companies may be seen as ‘bland’ or ‘easy’ recommendations for stocks, and they may be relative to what some are buying, but since our inception, our ‘Granny Shots’ portfolio has significantly outperformed the S&P 500. So, as Rick Barry’s father told him, you can’t make fun of us because we’re making our shots. Though you will find names like AAPL and TSLA, you will also find less-known names that we believe are investable stocks that you will want to buy to own. This means we recommend these to be bought and held, not traded. To illustrate the spirit of our Granny Shots investing strategy, we’ll give a quote from both Rick Barry and his son, who uses his famous ‘granny shot’ to explain the wisdom of the strategy. The elder Rick Barry, always known for flare and directness, put it like this, ‘I don’t understand. I really truly can’t comprehend the aversion that people have to try something that could be very effective for them. After all, the ultimate goal is to make the high[est] percentage you can!’

The younger Barry, Canyon, put it a bit more subtle but perhaps makes an even more forceful point for our purposes of using their signature shot as an investing metaphor. “I think nowadays image is big. People are super into fashion, you know, how they look, kind of how they’re portrayed. But at the same time, is it macho shooting 40 percent from a line versus 80% from a line and your team winning six more games in the NBA season? To me, I think that’s more important than being macho or considered manly.” We couldn’t agree more with the sage young Gator.

Investing is about returns. An idea is not bad because its efficacy is widely acknowledged or the thesis isn’t about anything shiny and new. Granny Shot investing is about companies where the numbers keep showing up quarter after quarter and shareholders keep getting rewarded. Still, some investors show a definite prejudice against ‘crowded trades’ or investments they think are too obvious. They think they should have a more creative alternative than that when clients ask, but if they weren’t so worried about impressions maybe clients wouldn’t be asking in the first place. We would point to the returns and the earnings put up by some of the best tech stocks like AMZN, AAPL, and GOOG, all of which have been on our Granny Shots list for quite some time, so if you’re a retail investor who has been suffering from average or sub-par returns than try a straight play with some of our safest Granny Shots.

Like Rick Barry and the spirit of our investment selection product, we won’t make you take our word for it. We’ll just give you the numbers, and if you’re doing better than our conservative product, then don’t worry about considering a subscription. Though many of the names may be considered conservative or safe plays, it certainly doesn’t sound conservative that we’re beating the S&P by well over 20% on a YTD basis.

-

How to Pick Stocks? The birth of “Granny Shots”?

-

How We Apply 'Granny Shots' To The Stock Market?

-

How Does The 'Granny Shot' Work In Investing?

-

Impact on Technology, Digital transformation and Artificial Intelligence in the Stock Market

-

Impacts on Inflation and Portfolios

-

How to allocate and create Tactical Portfolios?

-

How to create Seasonality allocations and portfolios?

-

How Do Granny Shots Bring it all Together?

Related Guides

-

Series of 4~7 minutesLast updated4 months ago

Series of 4~7 minutesLast updated4 months agoWhy The Mysterious R-Star Should Be on Your Radar

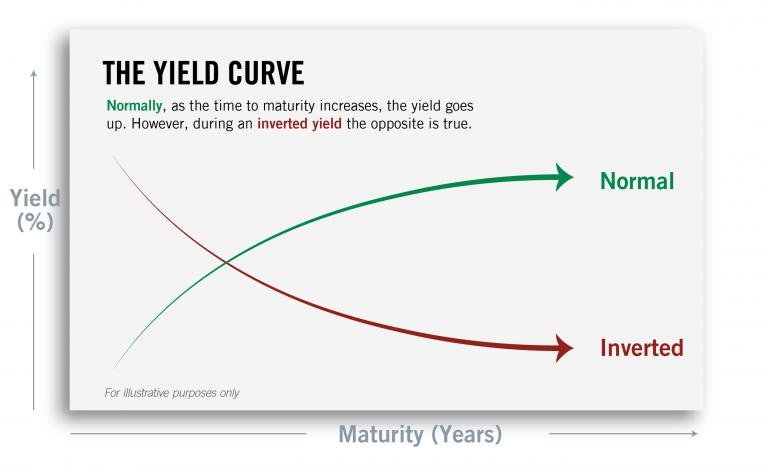

Economists lose sleep over it. Central bankers get asked if we’re close to it. Most Americans don’t realize it, but their lives are quietly guided by it. The it here is the neutral rate of interest, also known as r-star or r*, which powers, penetrates, and binds all aspects of the economy.

-

Series of 4~13 minutesLast updated1 year ago

Series of 4~13 minutesLast updated1 year agoThe Federal Reserve: What it is and why we care about it

Overview of the history, structure, and market impact of the Federal Reserve