-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 3

How Does The 'Granny Shot' Work In Investing?

Since the inception of the ‘Granny Shots’ portfolio methodology, we have beat the S&P 500 by 4,260 bps since inception. On a YTD basis, the S&P 500 has returned 9.4% while our Granny Shots portfolio has returned 34.1%, more than three-fold of what the broader index did. YTD Granny Shots is beating the S&P 500 by 2,540 bps.

Our ‘Granny Shots’ portfolio selects stocks by aligning our tactical 6-12 month stock portfolios with our thematic strategic portfolios, which have a horizon of 3-5 years. We have three of each. Based on our analysis, the more portfolios a stock is in, the better. We have four treasured stocks that we recommend to our subscribers that come across 4 categories. To understand ‘Granny Shots’ better, we will give you a little background on each of our themes for 2020.

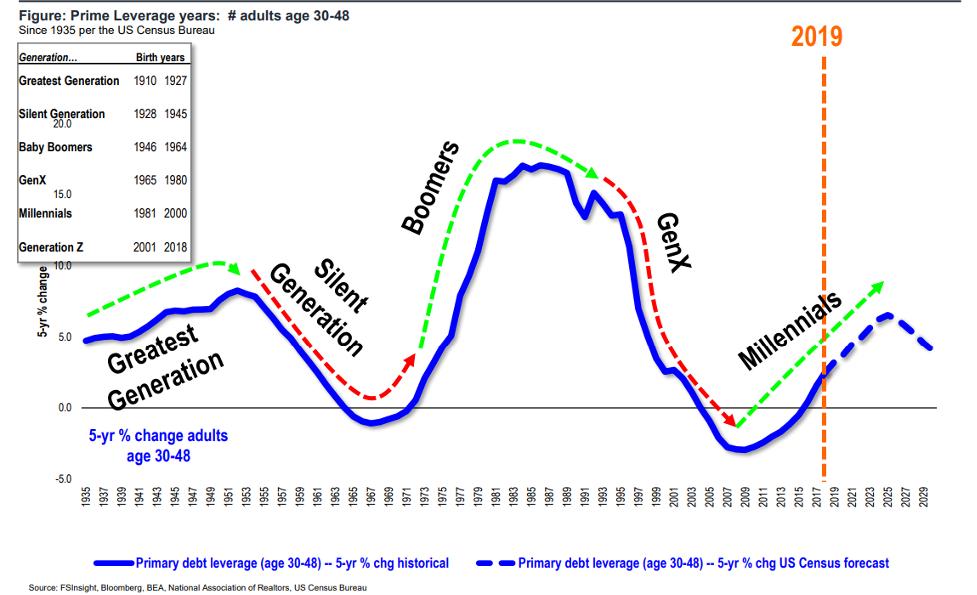

Millennial Prime Earning Years/Wealth Transfer From Baby Boomers

One of the key thematic investing strategies we are implementing over the next 3-5 years will be the enormous transfer of wealth from baby boomers to millennials and millennials entering their prime ‘leverage’ years. The millennial generation will be making the key purchases that drive cyclical economic expansion in a way that only a large generation replacing a smaller one can. In the United States, millennials significantly outnumber Gen-X. They will soon be buying houses, cars, and other core needs consumers spend on as they advance through their lifecycle on a scale rarely, if ever, seen.

This consumption will be fueled by the massive transfer of wealth from the Baby-Boomer generation through inheritance and other transfers to help support their progeny’s economic advancement and security. The vast majority of 75 trillion dollars in wealth held by boomers will eventually be passed to millennials. This wealth will be coming to them, let’s remember, in addition to their own earning power, which has the potential to be greater than any previous generation.

This will affect markets and the wider economy in profound ways, as massive generational shifts always do. We believe that generational effects on the stock market are amongst the least appreciated but also the most reliable and perennial drivers of markets and growth. The predictable patterns and needs of generations as they advance from one stage of life to another is a powerful economic force. Accordingly, millennials will also be the primary drivers of credit expansion. As millennials get more and more leveraged, they will begin to drive more GDP growth. Given that millennials are the most highly educated generation in history, their earning power should reflect this and opens the possibility that their days in the lifecycle limelight, so to speak, could lead to one of the most robust bull markets in history.

-

How to Pick Stocks? The birth of “Granny Shots”?

-

How We Apply 'Granny Shots' To The Stock Market?

-

How Does The 'Granny Shot' Work In Investing?

-

Impact on Technology, Digital transformation and Artificial Intelligence in the Stock Market

-

Impacts on Inflation and Portfolios

-

How to allocate and create Tactical Portfolios?

-

How to create Seasonality allocations and portfolios?

-

How Do Granny Shots Bring it all Together?

Related Guides

-

Series of 4~7 minutesLast updated4 months ago

Series of 4~7 minutesLast updated4 months agoWhy The Mysterious R-Star Should Be on Your Radar

Economists lose sleep over it. Central bankers get asked if we’re close to it. Most Americans don’t realize it, but their lives are quietly guided by it. The it here is the neutral rate of interest, also known as r-star or r*, which powers, penetrates, and binds all aspects of the economy.

-

Series of 4~13 minutesLast updated1 year ago

Series of 4~13 minutesLast updated1 year agoThe Federal Reserve: What it is and why we care about it

Overview of the history, structure, and market impact of the Federal Reserve