-

Research

-

Latest Research

-

Latest VideosFSI Pro FSI Macro FSI Crypto

- Tom Lee, CFA AC

-

First WordFSI Pro FSI Macro

-

Intraday WordFSI Pro FSI Macro

-

Macro Minute VideoFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- Mark L. Newton, CMT AC

-

Daily Technical StrategyFSI Pro FSI Macro

-

Live Technical Stock AnalysisFSI Pro FSI Macro

-

OutlooksFSI Pro FSI Macro

- L . Thomas Block

-

US PolicyFSI Pro FSI Macro

- Market Intelligence

-

Your Weekly RoadmapFSI Pro FSI Macro FSI Weekly

-

First to MarketFSI Pro FSI Macro

-

Signal From Noise

-

Earnings DailyFSI Pro FSI Macro FSI Weekly

-

Fed WatchFSI Pro FSI Macro

- Crypto Research

-

StrategyFSI Pro FSI Crypto

-

CommentsFSI Pro FSI Crypto

-

Funding FridaysFSI Pro FSI Crypto

-

Liquid VenturesFSI Pro FSI Crypto

-

Deep ResearchFSI Pro FSI Crypto

-

-

Webinars & More

- Webinars

-

Latest WebinarsFSI Pro FSI Macro FSI Crypto

-

Market OutlookFSI Pro FSI Macro FSI Crypto

-

Granny ShotsFSI Pro FSI Macro FSI Crypto

-

Technical StrategyFSI Pro FSI Macro FSI Crypto

-

CryptoFSI Pro FSI Macro FSI Crypto

-

Special GuestFSI Pro FSI Macro FSI Crypto

- Media Appearances

-

Latest Appearances

-

Tom Lee, CFA AC

-

Mark L. Newton, CMT AC

-

Sean Farrell AC

-

L . Thomas Block

-

⚡FlashInsights

-

Stock Lists

-

Latest Stock Lists

- Super and Sleeper Grannies

-

Stock ListFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- SMID Granny Shots

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

HistoricalFSI Pro FSI Macro

- Upticks

-

IntroFSI Pro FSI Macro

-

Stock ListFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

CommentaryFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

- Sector Allocation

-

IntroFSI Pro FSI Macro

-

Current OutlookFSI Pro FSI Macro

-

Prior OutlooksFSI Pro FSI Macro

-

PerformanceFSI Pro FSI Macro

-

SectorFSI Pro FSI Macro

-

ToolsFSI Pro FSI Macro

-

FAQFSI Pro FSI Macro

-

-

Crypto Picks

-

Latest Crypto Picks

- Crypto Core Strategy

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

Historical ChangesFSI Pro FSI Crypto

-

ToolsFSI Pro FSI Crypto

- Crypto Liquid Ventures

-

IntroFSI Pro FSI Crypto

-

StrategyFSI Pro FSI Crypto

-

PerformanceFSI Pro FSI Crypto

-

ReportsFSI Pro FSI Crypto

-

-

Tools

-

FSI Community

-

FSI Snapshot

-

Market Insights

-

FSI Academy

-

Book Recommedations

- Community Activities

-

Intro

-

Community Questions

-

Community Contests

-

Part 6

How to allocate and create Tactical Portfolios?

Our Tactical Portfolios are also an important tool we use to manage a bit more actively. We generally construct these with a 6 to 12 month time horizon in mind. We have three tactical portfolios consisting of our Style Tilt between Value and Growth, our Seasonality Measure, and our PMI Recovery Above/Below 50. We’ll discuss our thinking on each of these briefly.

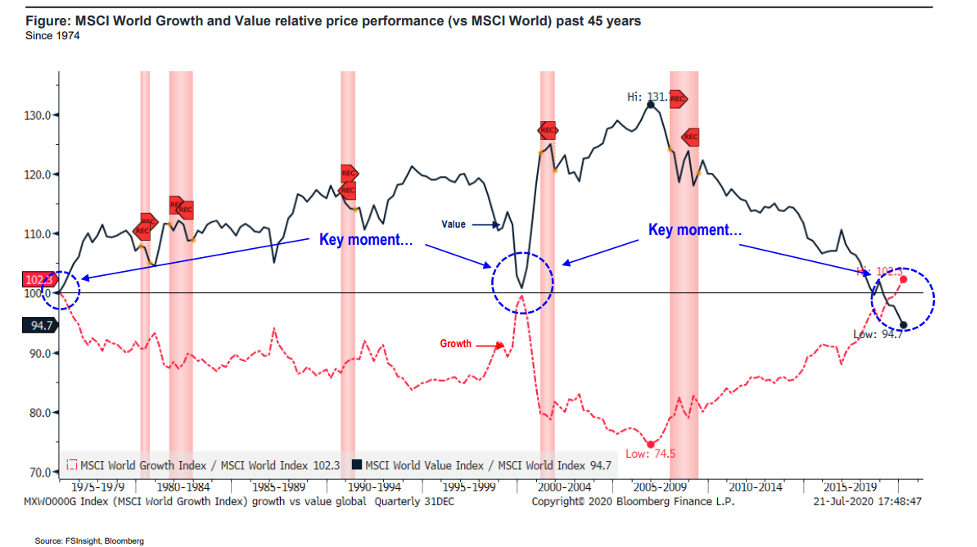

Based on many of our proprietary indicators, we see a golden age of Value dawning. While we still like many growth stocks, we do not believe these champions of the COVID-19 era will lead the averages to new and impressive highs. We believe pure value plays and value cyclicals will lead this move to new ATHs. We think that the market has rediscovered valuation risk in the wake of coronavirus. We recommend getting exposure to pure value stocks and value cyclicals, especially to take advantage of this changing dynamic. We believe that as the strength of the virus diminishes that much of the wall of money that has gone into the big tech stocks over the last 9 months will rapidly and violently shift to these two groups of stocks.

Many people tend to forget what is in the present value of a stock. Most equity analysts and economists use discounting future cash flows to arrive at the stock’s current value. What this means is that although current and near-term quarters should be weighted more than subsequent quarters because the cash-flow from these periods is more certain that even for a stock with a lower P/E ratio the future quarters are so many that they constitute a larger portion of present value than many investors realize. For example, if a stock has P/E ratio of 15 times earnings, then you should be discounting 60 quarters of future growth, and even though this quarter and next quarter might have severely depressed, or uncertain, results as a result of the virus, the following 58 likely will not. Obviously, the better the financial condition, balance sheet and management of the company the truer this is. In March, the market panic created many opportunities and beat down a lot of stocks that are undeniably undervalued by key fundamental metrics, particularly when incorporating discounted cash-flow analysis and proven survivability. We also like to follow the activity in adjacent markets like those for derivatives and debt to get a sense where the equities are going; developments in these areas are largely supportive of our portfolio theses.

-

How to Pick Stocks? The birth of “Granny Shots”?

-

How We Apply 'Granny Shots' To The Stock Market?

-

How Does The 'Granny Shot' Work In Investing?

-

Impact on Technology, Digital transformation and Artificial Intelligence in the Stock Market

-

Impacts on Inflation and Portfolios

-

How to allocate and create Tactical Portfolios?

-

How to create Seasonality allocations and portfolios?

-

How Do Granny Shots Bring it all Together?

Related Guides

-

Series of 4~7 minutesLast updated4 months ago

Series of 4~7 minutesLast updated4 months agoWhy The Mysterious R-Star Should Be on Your Radar

Economists lose sleep over it. Central bankers get asked if we’re close to it. Most Americans don’t realize it, but their lives are quietly guided by it. The it here is the neutral rate of interest, also known as r-star or r*, which powers, penetrates, and binds all aspects of the economy.

-

Series of 4~13 minutesLast updated1 year ago

Series of 4~13 minutesLast updated1 year agoThe Federal Reserve: What it is and why we care about it

Overview of the history, structure, and market impact of the Federal Reserve