US Equity trends have reached areas of resistance which likely make the road between now and mid-November a bit trickier, despite the ongoing bullish uptrend. I suspect that a near-term correction will happen starting between now and end of October that results in 5-7% correction in Stock indices into mid-November before the next leg higher gets underway. This should arguably represent a short-term correction only, not the start of a larger decline. Moreover, weakness into November should represent an attractive risk/reward opportunity for dip buying for US Stocks for a technical December rally into Year-end. At present, US stock indices are a bit “Over their Skiis”, and should require consolidation before this rally can continue. Both US Dollar and US Treasury yields could retreat as Stock indices pull back, and risk assets generally could face a consolidation phase which would prove constructive as a way to help sentiment and momentum reset a bit ahead of a rally into year-end. Overall, the correction that I suspected might start by 10/17 could very well be getting underway a few days early, and I suspect Equity indices are lower into mid-November before rebounding in December. Risk/reward seems poor in the short run, and SPX seems unlikely to exceed 6000 right away. Meanwhile, QQQ should find resistance at 503-505.

I believe that Stock indices could be at/near a peak that happens between now and end of month, which results in a 5-7% decline between now and mid-November. This might take the form of an initial peak this week, followed by a selloff next week. Thereafter, a bounce attempt happens into Oct 31-November 1 which could mark a Double-top for stock indices. (I say this as strong evidence pointed to this week from a time perspective, and then an additional period of inflection near the end of the month.)

Overall, the preponderance of the evidence still shows the broader US Stock market to be in good shape, with not many intermediate-term warnings. However, over the next 1-2 weeks, there looks to be an increasing likelihood of a short-term market peak which might materialize in October, leading to minor weakness into early to mid-November.

I had written about indices needing to undercut their 5 and 10- day moving averages (m.a.) for concern. While SPX has not, the QQQ has undercut its 5-day m.a., and I feel there’s enough proof based on different methods that it makes sense just to address this today and discuss the reasoning.

QQQ, as shown below, very well could be peaking out as of today, Tuesday, October 15th, and I suspect a pullback to test 475-477 initially, then after a bounce, a possible move down to 461 looks likely, with a maximum decline to 452. Thereafter, I expect QQQ to turn back higher towards new all-time highs.

With regards to SPX, I suspect that price retraces at least 38.2% of the rally from early August but very well could retrace 50% or 61.8% before bottoming and turning back higher in November. I do not suspect that August lows should be broken. Thus, while a move up to 5900 or slightly above is certainly possible, I’m skeptical that SPX will exceed 6000 into November and should likely retrace down to 5575, and/or 5500 area before bottoming.

Nasdaq QQQ Invesco ETF

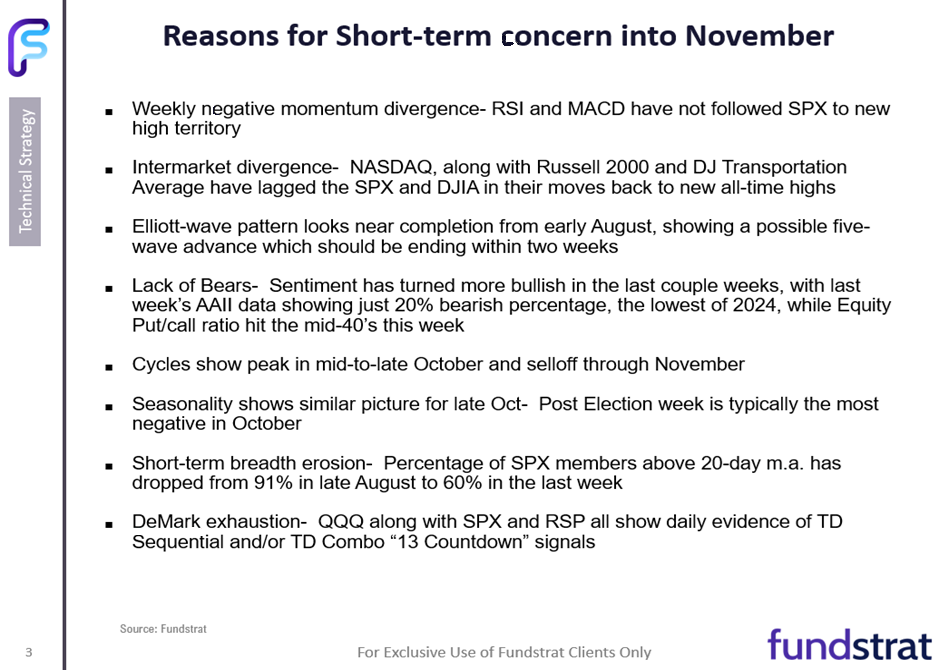

Bearish short-term technical Reasons for near-term concern

While the intermediate-term view remains quite positive for US indices, (and I expect higher prices from November into next Spring/Summer) there are short-term concerns that have cropped up which are worth mentioning.

These might allow for a short-term pullback in US Equity indices which could erase 5-7% off prices between now into mid-November.

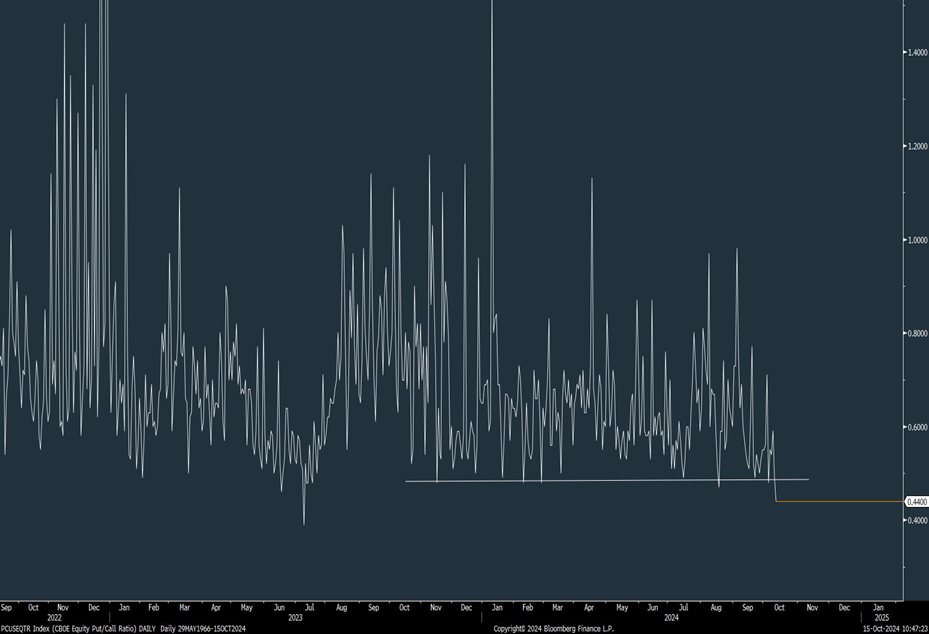

Equity Put/call ratio dropped to the mid-40’s this week

One aspect of Sentiment which I normally feel has a lot of importance is when the Equity put/call ratio shows a daily reading under 0.50 (meaning more than two call options are being traded for every put option).

While I typically utilize a 13-week moving average of the Equity Put/call ratio (being at extremes) as having importance for larger turns, the daily readings showing close to 1 within downtrends, or below 0.50 during uptrends can often signal a short-term extreme.

I detailed last week that the AAII sentiment poll having shown Bearish percentages at 20% (the lowest levels of the year) was alarming and a reason for concern.

Overall, while the 13-week m.a. of the Equity Put/call remains at neutral levels (indicating that intermediate-term conditions are not overly extreme) the daily Equity Put/call having dipped to the lowest levels of the year certainly does look to be significant.

I expect that recent investor bullishness being manifested in call buying likely at a level of twice what puts are being traded at should ultimately translate to Equities requiring some consolidation into November.

PCUSQTR Index

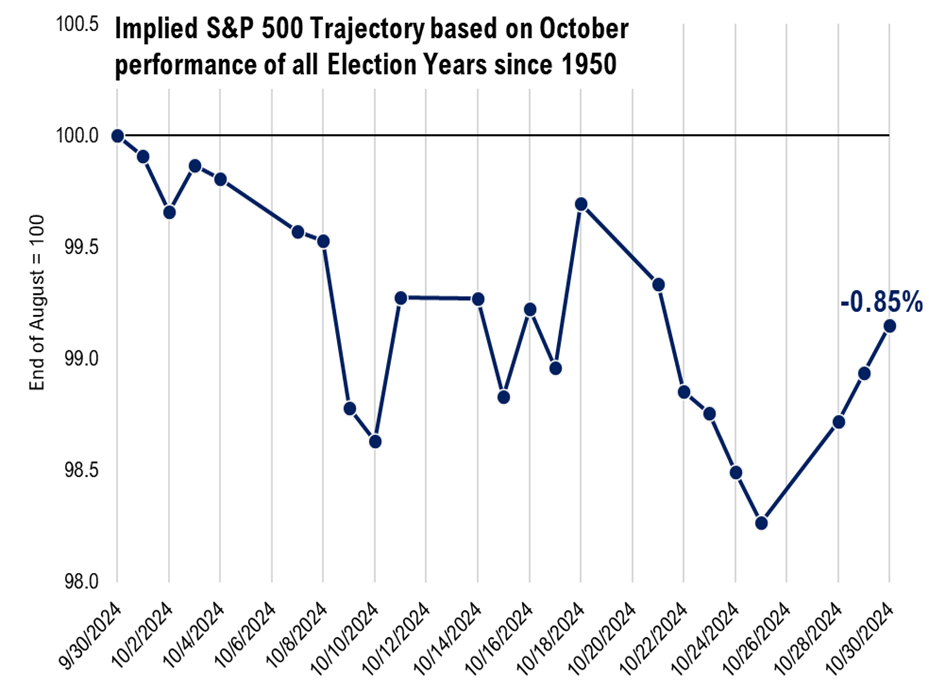

October seasonality should turn sharply bearish next week

This chart of Election year seasonality for October since 1950 shows that normal seasonality tends to be quite negative in the week following Expiration Friday, which is this Friday, 10/18/24.

I expect that this week likely ushers in a short-term peak for SPX, and then sells off into next week before a final week rebound attempt into 10/31-11/1.

Such a V-shaped move would fit in with the chart below and would also hit two of the key periods that looked important from a cyclical standpoint which I shared in Monday’s report (10/14/24).

Following a decline and bounce into late October, additional selling pressure is possible for November which would last into and likely after the US Election into mid-month possibly until some stabilization happens and a sharp rebound into end of year.

The intermediate-term cycles and intermediate-term trends and momentum all show that it’s still right to be long Equities at this time. Most of my concern deals with short-term issues only.

Upon a selloff into November, I suspect that near-term overbought conditions would be relieved and sentiment would get back to neutral levels which should make Equities attractive to buy dips for a December rally. However, in the short run, I wouldn’t be surprised if the balance of October played out similarly to the chart below.