A daily market update from FS Insight — what you need to know ahead of opening bell

“Young people can learn from my example that something can come from nothing. What I have become is the result of my hard efforts.” ~ Franz Joseph Haydn

Overnight

Bank of England Eases Up on Banks With Latest Capital Rules BBG

Atlanta Fed’s Bostic violated trading rules, US central bank watchdog says RT

U.S. crude oil stockpiles increased in latest week WSJ

Goldman’s Solomon Sees Case for a 50-Point Cut Due to Softening Signs BBG

SSGA and Galaxy Asset Management are launching three crypto-focused ETFs BBG

Bank dividends catapult Q2 global payouts to record highs RT

US holiday sales to grow at slowest pace since 2018, report says RT

Mexican legislature passes judicial overhaul that has rattled investors WSJ

European business confidence in China is at an all-time low, report says AP

Investors pulled $7.7B from Franklin Templeton amid co-CIO probe FT

OpenAI reportedly in talks to raise at $150B valuation TC

VW ends three-decade job security pact in Germany FT

Boeing strike threat looms as workers vote on contract RT

TD Bank ordered to pay $28 mln by US CFPB for misreporting consumer credit data RT

Norfolk Southern CEO Alan Shaw replaced by CFO after alleged affair with legal chief CNBC

India leads in crypto adoption for second straight year, report shows RT

GOP objections force Johnson to pull bill keeping government open WSJ

Heavy rain from Francine floods parts of New Orleans NYT

Tech billionaire completes first private spacewalk SMH

US man arrested for allegedly sparking California’s Line Fire BBC

US and UK discuss easing restrictions on Ukraine’s use of western weapons FT

UK to require £10 travel permits for EU and US citizens FT

D-Day veteran who helped liberate Bergen-Belsen dies at age 104 BBC

Chart of the Day

MARKET LEVELS

| Overnight |

| S&P Futures +10

point(s) (+0.2%

) Overnight range: -7 to +16 point(s) |

| APAC |

| Nikkei +3.41%

Topix +2.44% China SHCOMP -0.17% Hang Seng +0.77% Korea +2.34% Singapore +0.72% Australia +1.1% India +2.0% Taiwan +2.96% |

| Europe |

| Stoxx 50 +1.51%

Stoxx 600 +1.17% FTSE 100 +0.92% DAX +1.41% CAC 40 +1.03% Italy +1.26% IBEX +1.26% |

| FX |

| Dollar Index (DXY) +0.05%

to 101.73 EUR/USD +0.05% to 1.1017 GBP/USD +0.08% to 1.3054 USD/JPY +0.16% to 142.59 USD/CNY +0.02% to 7.1206 USD/CNH -0.01% to 7.1284 USD/CHF +0.28% to 0.8547 USD/CAD -0.02% to 1.3572 AUD/USD +0.03% to 0.6676 |

| Crypto |

| BTC +0.99%

to 58063.33 ETH +0.3% to 2355.11 XRP +0.58% to 0.5387 Cardano +3.89% to 0.3601 Solana +1.63% to 134.58 Avalanche +1.33% to 23.59 Dogecoin +0.39% to 0.1022 Chainlink +1.33% to 10.58 |

| Commodities and Others |

| VIX -0.28%

to 17.64 WTI Crude +1.56% to 68.36 Brent Crude +1.47% to 71.65 Nat Gas -0.93% to 2.25 RBOB Gas +1.28% to 1.921 Heating Oil +0.92% to 2.111 Gold +0.28% to 2518.76 Silver +0.45% to 28.8 Copper +1.91% to 4.161 |

| US Treasuries |

| 1M -2.4bps

to 5.0641% 3M -1.4bps to 4.9881% 6M -0.3bps to 4.7398% 12M -0.8bps to 4.11% 2Y +2.1bps to 3.6621% 5Y +2.0bps to 3.4642% 7Y +2.0bps to 3.5558% 10Y +1.9bps to 3.6721% 20Y +2.2bps to 4.0615% 30Y +2.2bps to 3.9882% |

| UST Term Structure |

| 2Y-3

M Spread widened 3.1bps to -133.9

bps 10Y-2 Y Spread narrowed 0.2bps to 0.8 bps 30Y-10 Y Spread widened 0.2bps to 31.2 bps |

| Yesterday's Recap |

| SPX +1.07%

SPX Eq Wt +0.05% NASDAQ 100 +2.17% NASDAQ Comp +2.17% Russell Midcap +0.36% R2k +0.31% R1k Value -0.11% R1k Growth +2.14% R2k Value -0.08% R2k Growth +0.69% FANG+ +2.57% Semis +5.16% Software +1.07% Biotech +0.82% Regional Banks -1.17% SPX GICS1 Sorted: Tech +3.25% Cons Disc +1.32% SPX +1.07% Comm Srvcs +1.03% Utes +0.34% Materials +0.27% Indu +0.21% REITs -0.23% Healthcare -0.25% Fin -0.39% Cons Staples -0.88% Energy -0.93% |

| USD HY OaS |

| All Sectors -5.1bp

to 391bp All Sectors ex-Energy -4.3bp to 361bp Cons Disc -3.7bp to 351bp Indu -4.4bp to 288bp Tech -3.1bp to 367bp Comm Srvcs -5.9bp to 632bp Materials -3.3bp to 372bp Energy -10.7bp to 345bp Fin Snr -5.1bp to 350bp Fin Sub -2.1bp to 249bp Cons Staples -4.3bp to 337bp Healthcare -3.0bp to 420bp Utes -8.1bp to 249bp * |

| Date | Time | Description | Estimate | Last |

|---|---|---|---|---|

| 9/12 | 8:30AM | Aug PPI m/m | 0.1 | 0.1 |

| 9/12 | 8:30AM | Aug Core PPI m/m | 0.2 | 0.0 |

| 9/13 | 8:30AM | Aug Import Price m/m | -0.2 | 0.1 |

| 9/13 | 10AM | Sep P UMich 1yr Inf Exp | 2.7 | 2.8 |

| 9/13 | 10AM | Sep P UMich Sentiment | 68.4 | 67.9 |

| 9/17 | 8:30AM | Aug Retail Sales m/m | -0.1 | 1.0 |

| 9/17 | 10AM | Sep Homebuilder Sentiment | 40.0 | 39.0 |

| 9/18 | 2PM | Sep 18 FOMC Decision | 5.25 | 5.5 |

| 9/18 | 4PM | Jul Net TIC Flows | n/a | 107.517 |

MORNING INSIGHT

Good morning!

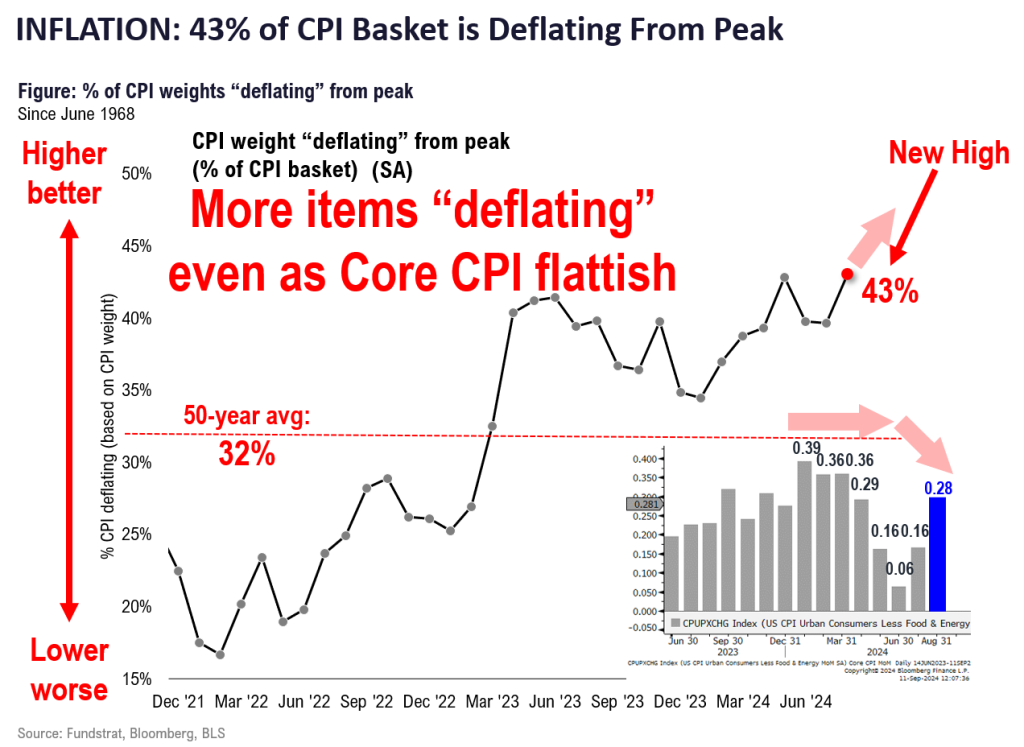

The August CPI release is better than it appears. Core CPI came in at +0.28% MoM, which is well above Street consensus of +0.20%. On the surface, this is 8bp (+0.08%) hotter, but this doesn’t change the fact that inflation is indeed cooling fast. That said, we are still in the bad eight weeks until Election Day.

Click HERE for more.

TECHNICAL

- Trends have shown improvement and possible Triangle pattern is being formed

- QQQ has outperformed SPY for three straight days as Growth has made a comeback

- Alternative Energy names outperformed sharply in Wednesday’s session

Click HERE for more.

CRYPTO

Following yesterday’s CPI release, crypto markets, along with other risk assets, initially sold off as the market digested the data. However, prices subsequently rebounded. As for the recent presidential debate, prediction markets indicated Harris as the clear winner, which coincided with a dip in Trump’s election odds and a subsequent decline in BTC’s price. However, it’s important to consider that broader market factors were also at play.

Click HERE for more.

First News

Food, glorious food. Although food prices are excluded from Core inflation metrics due to their inherent volatility, they are one of the main mechanisms through which the average American household perceives inflation (or lack thereof). And the issues that American households care about tend to find their way into American politics. (The grocery component in August headline CPI came in flat yesterday.)

At Tuesday night’s Presidential debate, food prices came up as former President Trump blamed the Biden/Harris administration for prices at the checkout counter. “People can’t go out and buy cereal or bacon or eggs or anything else,” he argued. Vice President Harris did not specifically address this assertion (she pivoted to an attack on the trade deficit during the Trump administration and his policies regarding China.)

Nevertheless, Harris has previously blamed “price gouging” for making groceries less affordable. Despite multiple plausible arguments against this claim, the Biden administration and French President Emmanuel Macron have both made similar assertions. Harris has yet to detail what she means when she proposes “the first-ever federal ban on corporate price gouging on food and groceries,” but her pledge brought to mind President Richard Nixon’s 90-day freeze on wages and prices in a similar effort to counter high prices in the early 1970s. (As followers of history and our work know, this price freeze was an abject failure – even if the general public responded favorably to his decision at first.)

It is in this context that the grocery chain Krogers (KR -1.09% ) reports its quarterly earnings today. Almost certain to be a topic of discussion during its subsequent earnings call will be its proposed merger with another grocery chain, Albertson’s (ACI N/A% ). The proposed $24.6 billion merger, approved by both companies’ boards in October 2022, included plans to pre-empt antitrust scrutiny by selling off 579 stores, eight distribution centers, and five private-label brands.

It didn’t work. The proposal has run up against stiff regulatory opposition – not just from the Federal Trade Commission and the Biden administration, but nine state attorneys general. The FTC has initiated an administrative proceeding to halt the merger, and Kroger’s effort to obtain an injunction against it is ongoing as of this writing. Opponents are arguing that the merger of the country’s second- and fourth-largest grocery chains would result in reduced competition and higher prices for consumers. They also claim that the merger is likely to result in some stores being closed, causing so-called “food deserts” – communities in which it is difficult or even impossible to buy fresh produce and meats.

Proponents of the merger argue that in fact the merger is necessary to prevent such undesirable outcomes. Traditional groceries – always a low-margin business – have been challenged in recent years by new entrants into industry like Walmart, Costco, Target, and Amazon (through its Whole Foods and Fresh chain of stores.) Advocates argue that the merger is needed to let Kroger better compete with these new competitors, and blocking it will cause more stores to close. Kroger’s also said that the merger would result in lower prices, promising – without providing details – to “lower grocery prices by $1 billion” after the merger. If the deal is completed, the resulting entity would own 5,000 grocery stores in 48 states.

Speaking of (not) eating. One of the stock ideas that has worked particularly well this year have been the so-called “Ozempic-related” stocks – Eli Lily (LLY 0.74% ) and Novo Nordisk (NVO -1.39% ). Demand for GLP-1-based drugs such as Eli Lilly’s Ozempic and Wegovy and Novo Nordisk’s Mounjaro and Zepbound surged so sharply this year that the Food and Drug Administration (FDA) started putting them on its drug shortage list in 2022.

This cleared the regulatory path for compounding pharmacies to circumvent patent protections and manufacture their own versions of these obesity drugs – and for small businesses such as medical spas and wellness centers to sell them to customers/patients. Hims & Hers Health (HIMS -2.43% ) shares surged when it announced plans to sell a compounded version of these medications at a lower price.

These compounded versions are not to be confused with outright fakes peddled by fraudsters via spam e-mails and dodgy websites. They contain GLP-1s as active ingredients, even if details of the formulations might differ.

Whether those details matter depends on who you ask. Unsurprisingly, Eli Lilly and Novo Nordisk have claimed that these compounded off-brand formulations could pose serious risks to patients, and they have filed dozens of lawsuits against compounding pharmacies arguing this point. They also assert that therefore, any claims that the compounded versions are as safe and effective as the brand-name originals constitute false advertising.

There is at least some truth to the claims. For example, the FDA admitted to having “received adverse event reports after patients used compounded semaglutide (the active ingredient in Ozempic and Wegovy). This includes cases in which compounders used “salt forms of semaglutide, including semaglutide sodium and semaglutide acetate” which are different from the base form of semaglutide used in the patented versions of the medications. The salt versions “have not been shown to be safe and effective,” the regulator noted.

Other adverse effects have been linked to overdoses. This is arguably more likely with compounded versions because they are typically sold in vials and sometimes require patients to measure out the doses into syringes and self-administer. In contrast, the branded versions have typically come in auto-injector pens that deliver pre-measured doses. (The slower process of filling these auto-injector pens is part of the reason for the shortages in the first place, and it is also partly why the branded versions are significantly more expensive. Eli Lilly recently announced it would sell lower-cost single-dose versions of Zepbound and Ozempic without the auto-injector pens.)

Both Eli Lilly and Novo Nordisk are working to increase production capacity, hoping to take their treatments off of the FDA’s Drug Shortage list. Yet if and when this happens, compounded versions of their medications might still be legally sold, albeit in much smaller quantities. Compounded versions of patent-protected medications if they are either customized by prescription for a specific patient, or if they are tweaked to provide another clinical benefit. As one example, some compounding pharmacies have floated the idea of combining the obesity treatment with Vitamin B6 or Vitamin B12 to help prevent the nausea that often accompanies GLP-1 treatments. (FT, ATL, Axios)